Mario Tama

WM Technology (NASDAQ:MAPS) shares have been decimated over the past two years, falling 96%. Shares have fallen for good reasons, including:

1/ Massive overvaluation – MAPS shares were caught up in the tech/spac/cannabis bubble and were selling at an astronomical valuation (30x revenue) in early 2021.

2/ MAPS earned 64% of its revenue from California in 2021 (and 53% in 3Q22) and the California cannabis market is a mess. There is a reason very few multi-state operators (MSOs) do business in CA. While California legalized recreational marijuana use for adults in 2016, the state has done very little to combat illicit trade. When I say ‘illicit trade’ I’m not talking about a guy slinging weed out of his van behind the bowling alley. I’m talking about unlicensed retail locations which are indistinguishable from legitimate licensed operations (this article provides a great overview). Because unlicensed operators do not pay excise/state taxes, they operate at a competitive advantage versus legal operators and are able to undercut legal operators on price. This has hurt the financial health of the legitimate operators.

The impact on MAPS appeared in 3Q22 results where it took an impairment to accounts receivable and announced that it expects to take another impairment in 4Q22.

3/ MAPS has been accused of providing its marketing and marketplace services to illicit operators. I suspect that this is likely true given that MAPS investor presentations seem to suggest that it serves thousands of operators in California (but there are fewer than 1,500 licensed operators).

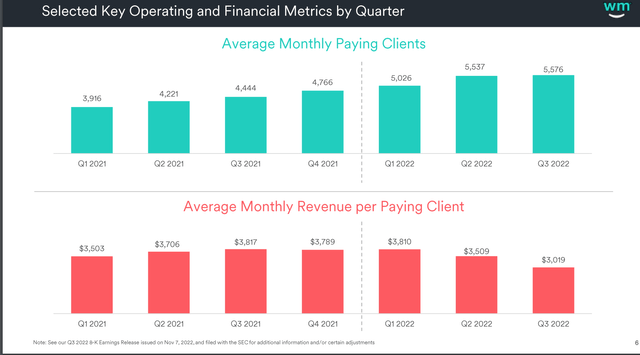

Customer Count & ARPU (Investor Presentation)

This could ultimately lead to adverse financial consequences including lost revenue (if it is forced to cut off serving unlicensed customers) as well as fines and/or other penalties.

4/ MAPS has made relatively little headway with the large cannabis multi-state operators (MSOs) which represent less than 5% of revenue. Frankly I’m not sure exactly why MAPS has made such little headway serving MSOs. If my suspicion that MAPS is serving the illicit market is correct, MSOs may be reticent to do business with a company that is willing to enable illicit operators to undercut legitimate operators.

5/ The CEO recently resigned and the company is in the midst of an executive search spearheaded by co-founder Doug Francis.

Given everything I just wrote, why do I own the stock?

First of all, I want to note that my position in MAPS is very small given the obvious risks highlighted above. Here are the things I like about the stock at today’s price of $1.20/share:

1/ Dominant position in online marketplace for cannabis in California with relatively limited competition. Online marketplaces tend to be great businesses as they require little capital, high margins (while current profitability is nil, looking back a few years MAPS achieved 25-30% EBITDA margins), and have relatively stable/growing revenue as they are a necessary marketing channel for customers.

2/ Strong balance sheet with net cash position of $34 million (15% of market capitalization). I believe that MAPS has sufficient financial strength to give it the opportunity to work through its problems.

3/ Very inexpensive with an enterprise value to sales ratio of 0.85x. This is an incredibly low ratio for a business with the potential for both high margins and significant growth (discussed below).

4/ Potential that MAPS figures (will almost certainly be a key objective for new management) out how to expand with MSOs and becomes a truly national business. It is no secret that more and more states are legalizing cannabis for adult use and that there is significant growth potential for legal sales. While ~60% of MAPS revenues come from CA (which represents only 20-25% of the legal market), there is tremendous potential for MAPS to expand beyond California.

Valuation

While I don’t think MAPS will ever achieve the same level of dominance nationally as it has in California, it is possible could MAPS double its revenue over the next 5 years (implies a 14% annual growth rate – MAPS more than doubled its revenue over the past four years) as

1/ MAPS continues to expand into new states

2/ MAPS cross sells products -in addition to the Weedmaps.com marketplace, MAPS sells a SAAS solution for dispensary operation

3/ potential rebound in California as troubled operators go bust and overall industry health improves.

Were it to get to $400 million in revenue (2x current level) at a 25% EBITDA margin, MAPS would be earning $100 million in EBITDA. Assuming a modest multiple of 10-12x, this implies shares would be worth $6-8 per share. This implies 5x return from today’s share price.

Conclusion

WM Technology is not for the faint of heart given the litany of issues facing the company (and the federally illegal status of cannabis in the US). That said, I’ve taken a small position in the stock as shares look to have considerable upside potential if things start moving in the right direction.

Be the first to comment