to_csa/iStock Unreleased via Getty Images

Investment Thesis: Wizz Air could see further revenue growth from here. However, higher fuel costs and persistently high long-term debt could mean little upside for the stock until signs of a recovery in operating profit emerge.

Wizz Air Holdings (OTCPK:WZZAF) has seen an encouraging rebound in revenue as passenger numbers have picked up strongly since the COVID-19 pandemic.

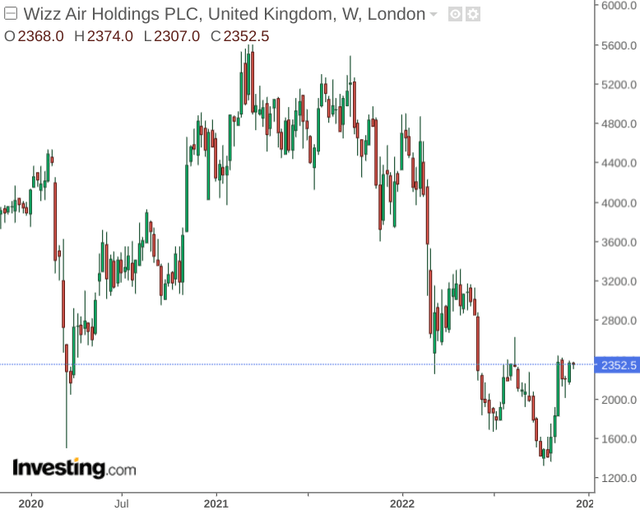

However, while the initial rebound in the stock was encouraging – price has now reverted to near lows seen during the March 2020 crash:

The purpose of this article is to assess whether Wizz Air has the potential to see a longer-term rebound from here.

Performance

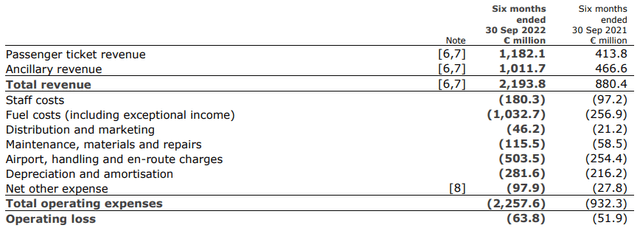

When looking at H1 (six months to September 2022) results for the company, we can see that while revenues have grown strongly – the sharp increase in operating expenses has meant that the company’s operating loss has still grown over the period:

Wizz Air Holdings Press Release: Results For The Six Months To 30 September 2022

In terms of the company’s balance sheet, we can see that the quick ratio has decreased significantly from March 2021 to September 2022, and a ratio below 1 means that the company is in a less favourable position to service its current liabilities using existing liquid assets:

| March 2021 | March 2022 | September 2022 | |

| Total current assets | 1657.2 | 1572.5 | 2012.6 |

| Inventories | 53.7 | 70.9 | 128.7 |

| Total current liabilities | 1224.1 | 1373.7 | 2057.9 |

| Quick ratio | 1.31 | 1.09 | 0.92 |

Source: Figures sourced from Wizz Air Holdings Annual Report and Accounts 2022 and H1 F23 Results. Figures provided in € millions except the quick ratio. Quick ratio calculated by author as total current assets less inventories all over total current liabilities.

Additionally, non-current (or longer-term) borrowings to total assets are up from 65% in March to 68% in September:

| March 2022 | September 2022 | |

| Non-current borrowings | 3525.3 | 4469 |

| Total assets | 5356.1 | 6484.2 |

| Non-current borrowings to total assets ratio | 65.82% | 68.92% |

Source: Figures sourced from Wizz Air Holdings Annual Report and Accounts 2022 and H1 F23 Results. Figures provided in € millions except the non-current borrowings to total assets ratio. Non-current borrowings to total assets ratio calculated by author.

From this standpoint, it is evident that while Wizz Air has seen strong revenue growth – higher operating expenses have not allowed the company to return to profitability, while the company’s short-term cash position has been worsening and long-term debt levels remain high.

Looking Forward

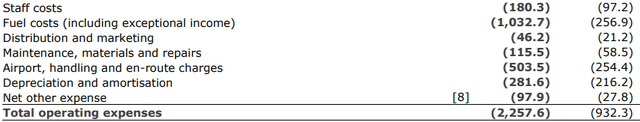

When looking at the contributors to higher operating expenses, we can see that fuel costs are by far the most significant – accounting for nearly half of total operating expenses as of September 2022.

Wizz Air Holdings Press Release: Results For The Six Months To 30 September 2022

Going forward, a significant factor in whether Wizz Air can see renewed upside from here will the degree to which revenue growth can potentially outpace the rise in operating expenses, and the trajectory for fuel costs from here.

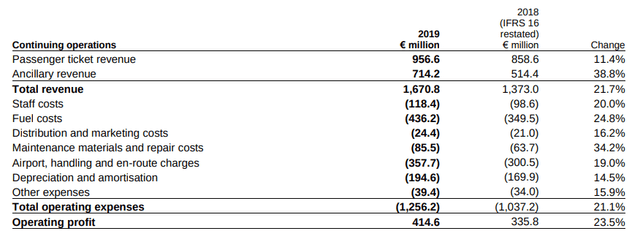

It is encouraging that the total revenue we saw for the six months ended September 2022 was significantly higher than that seen for the six months ended September 2019. Moreover, we can see that given fuel costs were significantly lower during this period, the company saw a strong increase in operating profit at the time:

Wizz Air Holdings Press Release: Results For The Six Months To 30 September 2019

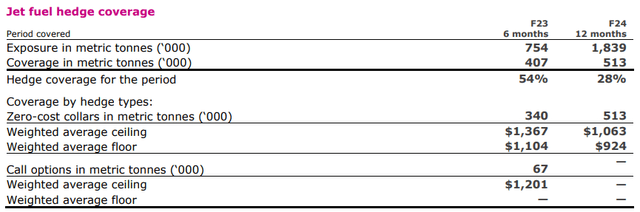

Of course, Wizz Air is not the only company having to bear higher fuel costs. For instance, easyJet (OTCQX:EJTTF) is expecting that there could be a potential 50 percent increase in fuel costs next year and Wizz Air itself could conceivably see higher fuel prices as the company’s ability to hedge against spot prices decreases going forward. For instance, we can see that hedge coverage will fall from 54% of consumption from F23 to 28% for F24:

Wizz Air Holdings Press Release: Results For The Six Months To 30 September 2022

From this standpoint, revenue will need to see strong growth to counteract the effects of reduced hedging and higher fuel costs – it is unclear as of yet whether this can be achieved.

Conclusion

To conclude, Wizz Air Holdings has seen encouraging revenue growth. However, high fuel costs and a lower hedge coverage for fuel consumption going forward means further price rises could be ahead.

While Wizz Air could see further revenue growth from here – I take the view that higher fuel costs and persistently high long-term debt could mean that the stock sees little upside until clear signs of a recovery in operating profit emerge.

Be the first to comment