Khanchit Khirisutchalual/iStock via Getty Images

Intro

Wix.com (NASDAQ:WIX) has fallen over 60% since the beginning of 2022 as growth has been gradually slowing in the post-pandemic world. Investors sold off Wix’s stock in large numbers after disappointing forecasts made by management. In addition, this drop came along with the broader macroeconomic headwinds that are plaguing all tech growth stocks.

However, despite short-term macroeconomic challenges, Wix’s sound fundamentals and a path toward profitability make it an excellent “buy the dip” opportunity.

Company Overview

Wix’s main source of revenue revolves around charging customers a monthly subscription in order to get access to its website builder. Its other services complement its main service by providing customers with logos, domain registrations, and CRM tools.

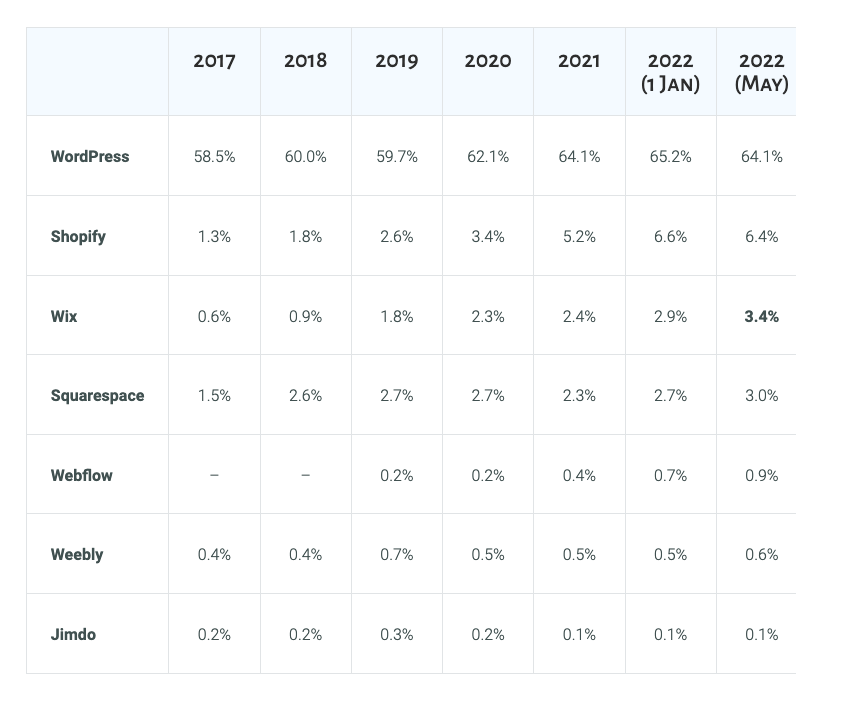

People use Wix for its combination of power and ease of use. Providing customers with powerful features to create industry-class websites while making them accessible to the average person. It operates in the website builder market, which Wix estimates to be worth $62 billion. However, combined with its expansions—serving e-commerce and creative agencies—its TAM is now $211 billion. In regards to market share, Wix holds 3.4% of the market, behind WordPress (64.1%) and Shopify (SHOP) (6.4%). However, in the simple website builders category (with the likes of Squarespace (SQSP), Weebly, and GoDaddy (GDDY)), it dominates with approximately 45% market share. Altogether, this means Wix is one of the market leaders. In addition, its growth from only having 0.6% of the market in 2017 makes it one of the fastest-growing platforms in the market.

ToolTester

Rough Earnings

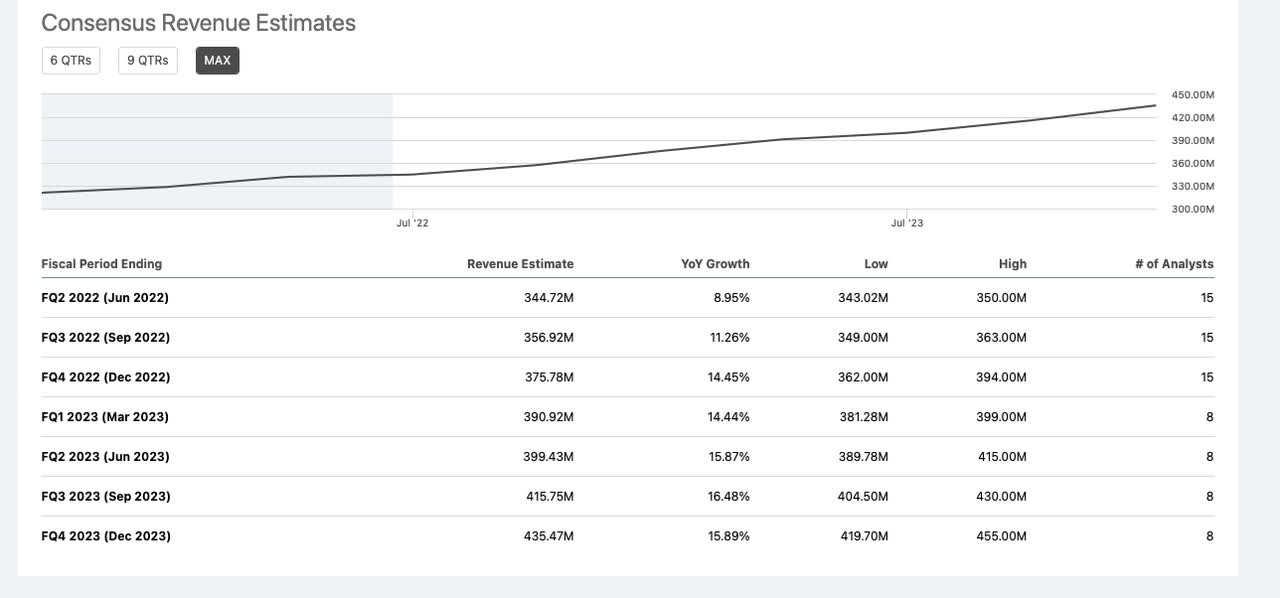

In Q1 2022, Wix reported $341.6M in revenue, a growth of about 14% YoY. Although revenue beat estimates by $1.13M, it had an EPS of -$0.72, which missed the estimate of $0.11. Wix is also cutting estimates for FY 2022: revenue growth of 10-13% YoY instead of the Wall St consensus of 14.39% YoY. A few factors are plaguing Wix’s growth, from the slowing growth that e-commerce is experiencing due to reopenings as well as the embargo on Russia and the sudden increase in the dollar’s value.

Sound Fundamentals

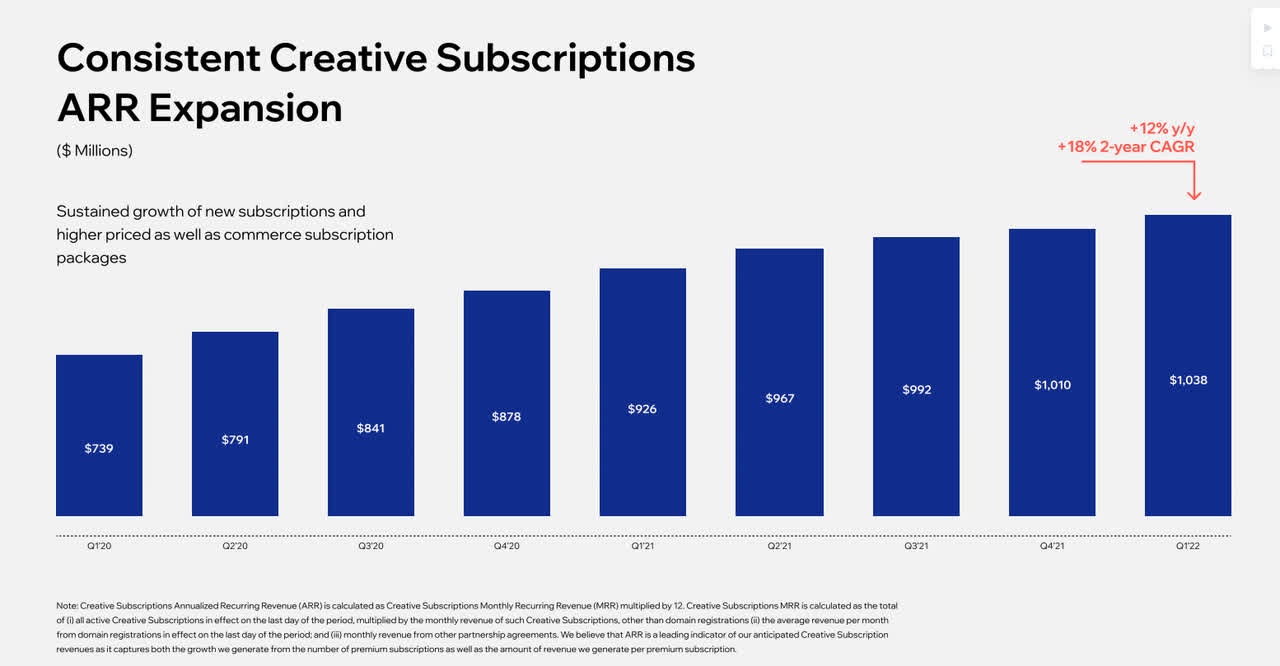

However, on a fundamental level, Wix’s subscription model is still going strong. Management reports that retention, conversion, and cancellation rates are remaining consistent. Wix’s ARR (Annualized Recurring Revenue) for creative subscriptions is still up 12% YoY and increased slightly from last quarter.

Wix

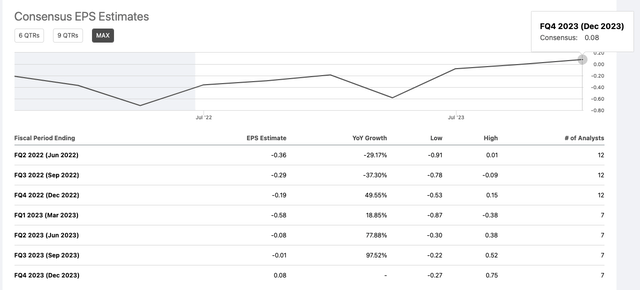

Even better, improved margins are expected across the board. Creative subscription margins are supposed to improve on the high end of the guidance range and business solutions gross margin will improve in either scenario. In addition, Wix is set to profit from their past investments. Though cash flow is currently negative, management is highly anticipating positive free cash flow this year and forecasting 5 points of free cash flow margin expansion every single year. From these efforts by management, analysts predict that Wix can become profitable as early as Q4 2023.

Seeking Alpha

Stock Buybacks

Wix announced a $500 million share buyback plan back in April and received court approval for it last month. This is coming off the $200 million buyback program Wix completed last year. Despite the estimated low-double-digit growth, the buyback program signals management’s confidence in the growth of Wix’s topline and its ability to meet expectations of free cash flow margins towards profitability.

With its market cap at just $3.47 billion, a $500 million purchase is significant and signals that management thinks the stock is cheap.

Valuation

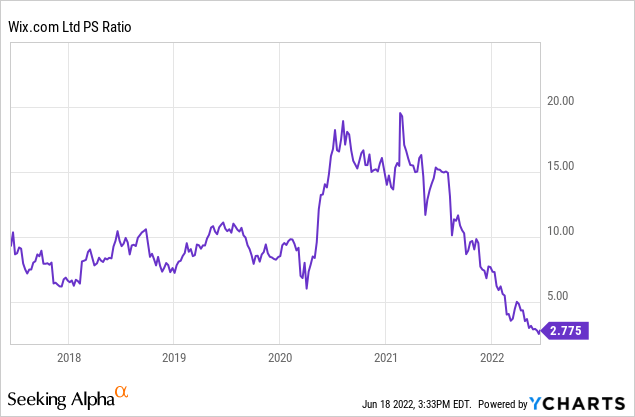

Despite Wix’s continued success, its P/S ratio currently stands at a meager 2.7x. Taking into context Wix’s historical P/S ratio, its current ratio is incredibly low and reflects the hasty selling by investors that don’t account for its fundamentals. With revenue still expected to grow at double-digits and massive improvements in free cash flow margins, Wix is undervalued by the market and a great buy opportunity.

Seeking Alpha

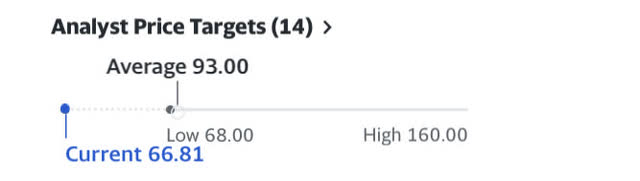

Finally, data provided by Yahoo Finance shows that the stock is currently undervalued by over 14 analysts—with a significant amount of the ratings issued after the earnings call and taking into account the massive decline in value.

Yahoo Finance

Risk

Wix suffers mainly from competitive risks. Currently, they are expanding to tailored solutions for businesses, as seen with Wix Stores, Wix Hotels, and Wix Bookings. Expanding to these areas would help Wix generate additional revenue and improve margins (because they take a cut of every sale made by the merchants). At the same time, current market leaders such as Shopify hold such a strong grip that it could make these initiatives futile. In its core business of website building, it faces heavy competition as it gets increasingly more difficult to differentiate its product offerings. Finally, the effect of a recession could have a greater impact on Wix’s products than management previously expected.

Conclusion

Despite the company expecting more conservative growth, Wix’s product offering in a growing and essential industry, its solid business fundamentals with a clear path towards profitability, and its attractive valuation make it a “buy” even amidst market fears.

Be the first to comment