everythingpossible

A Quick Take On Wipro Limited

Wipro (NYSE:WIT) reported its FQ3 2023 financial results on January 13, 2022, missing revenue estimates and matching EPS estimates.

The firm provides a wide array of digital transformation consulting, outsourced business services and IT products in India and worldwide.

A 2023 recession is widely expected by many economists and market participants, so I’m not optimistic that the firm is going to be able to produce a significant upside catalyst despite recent bookings success.

Accordingly, I’m on Hold for WIT in the near term.

Wipro Overview

Bengaluru, India-based Wipro was founded to provide various IT consulting services, business outsourcing services and IT products globally.

The firm is headed by Chief Executive Officer Thierry Delaporte, who was previously Chief Operating Officer of Capgemini and currently lives in Paris, France.

The company’s primary offerings include:

-

IT consulting

-

Business process outsourcing

-

Product engineering & design

-

Government services

-

Other services

The company has more than 250,000 employees located on six continents.

Wipro’s Market & Competition

According to a 2021 market research report by 360 Market Updates, the global market for digital transformation strategy consulting was an estimated $58.2 billion in 2019 and is forecast to reach $143 billion by 2025.

This represents a forecast CAGR of 16.2% from 2020 to 2025.

The main drivers for this expected growth are a large transition from on-premises, legacy systems to cloud-based environments with complex architectures.

Also, the COVID-19 pandemic has likely pulled forward significant demand to modernize enterprise systems resulting in increased growth prospects for digital transformation consultancies.

Major competitive or other industry participants include:

-

Endava

-

Globant

-

EPAM Systems

-

Accenture

-

Capgemini

-

Cognizant Technology Solutions

-

Tata Consultancy

-

Ideo

-

McKinsey & Company

-

The Omnicom Group

-

Sapient

-

WPP

-

Others

Wipro’s Recent Financial Performance

-

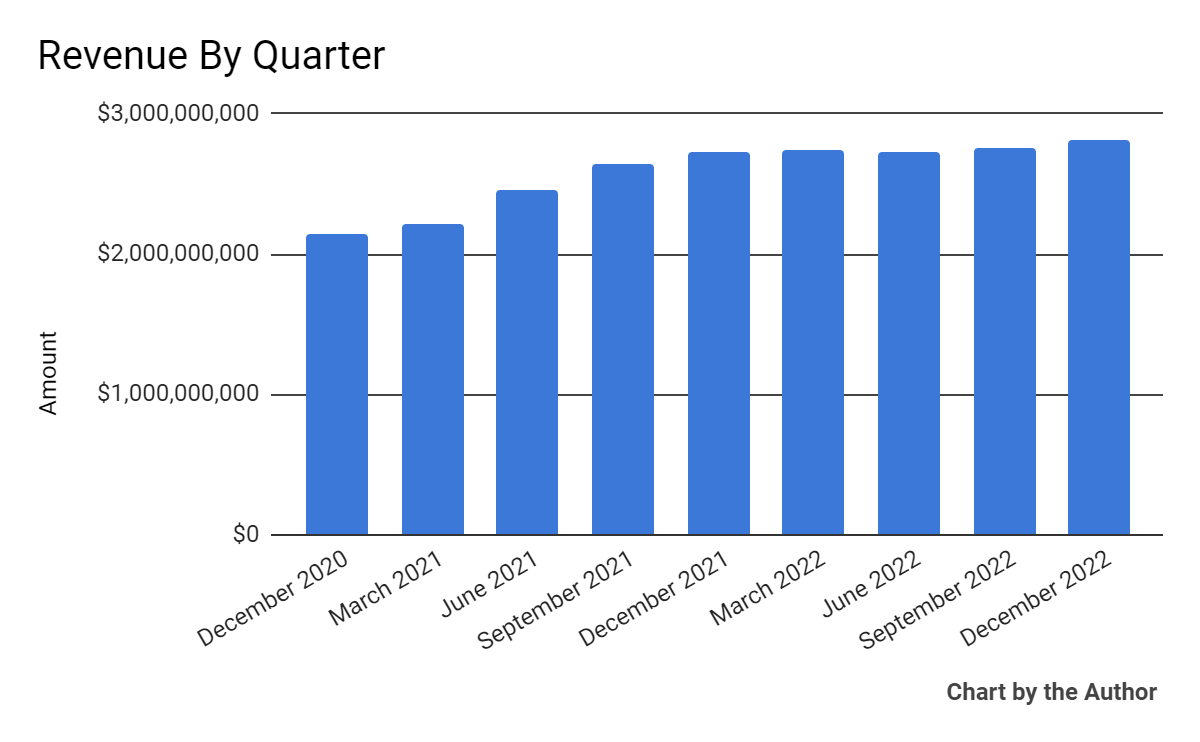

Total revenue by quarter has plateaued in recent quarters, as the chart shows here:

9 Quarter Total Revenue (Seeking Alpha)

-

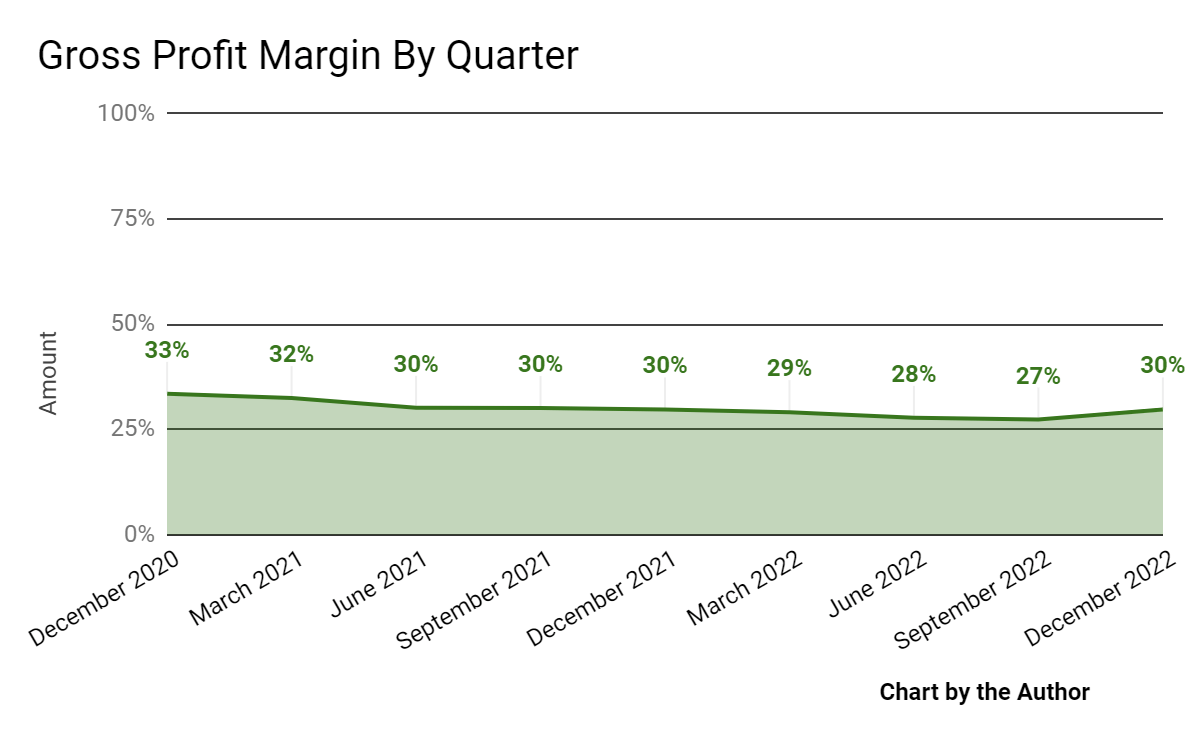

Gross profit margin by quarter has trended lower in recent quarters, although the most recent quarter matched its year-over-year result:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

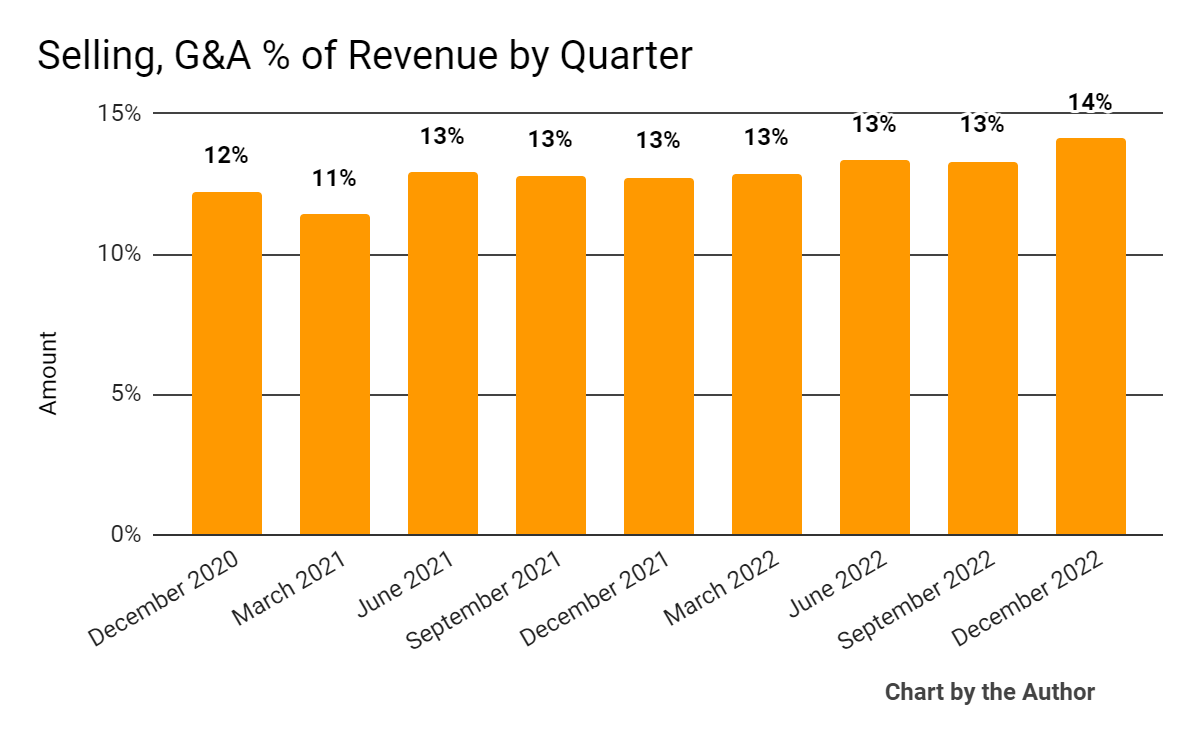

Selling, G&A expenses as a percentage of total revenue by quarter have trended higher in its most recent quarter:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

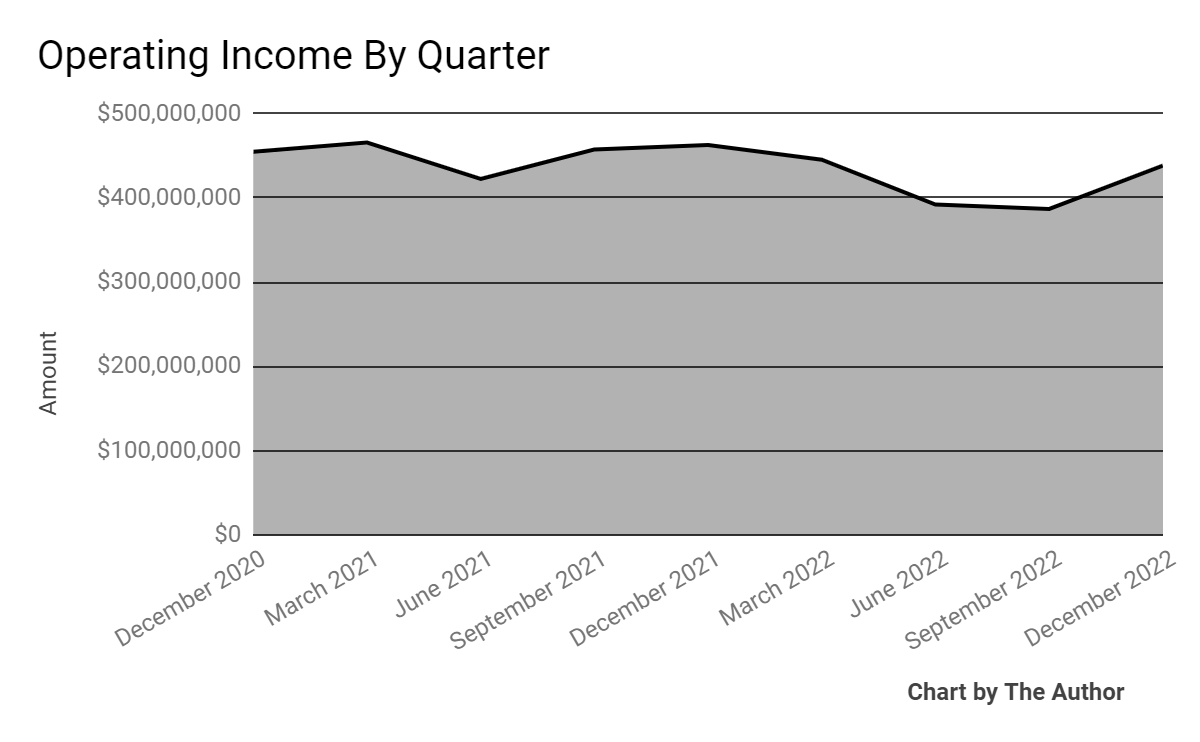

Operating income by quarter has trended lower in recent reporting periods:

9 Quarter Operating Income (Seeking Alpha)

-

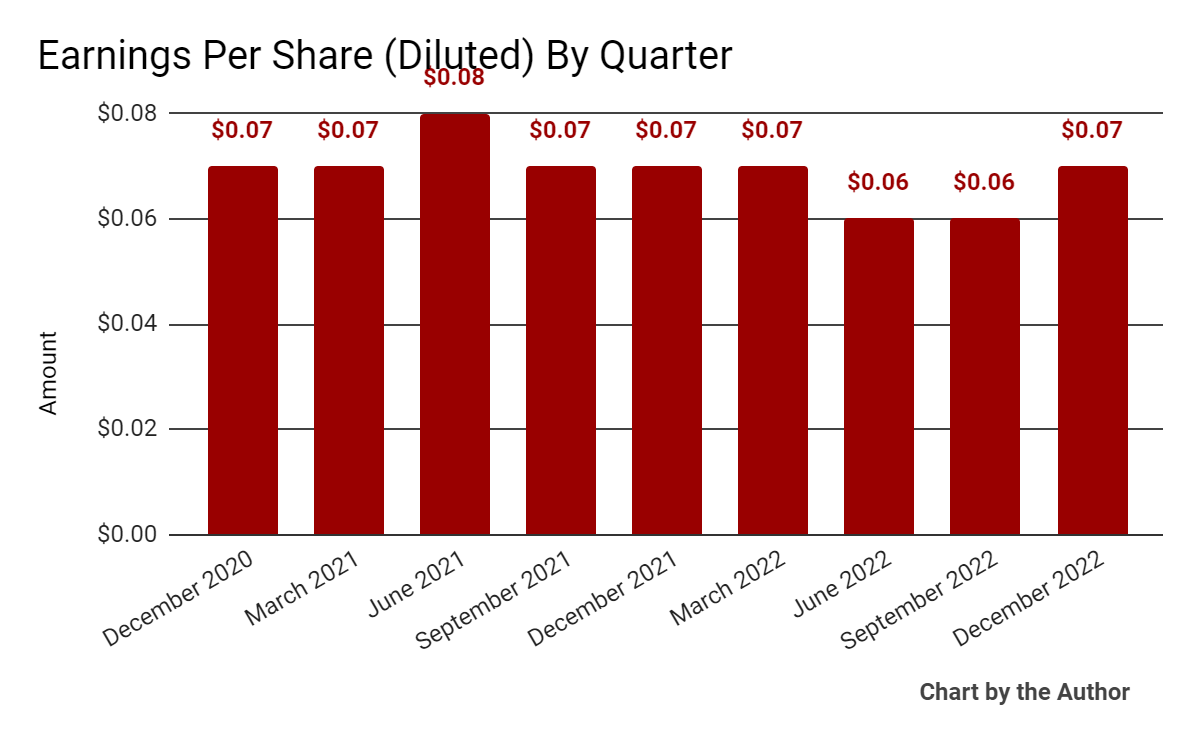

Earnings per share (Diluted) have trended lower in certain recent quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is IFRS)

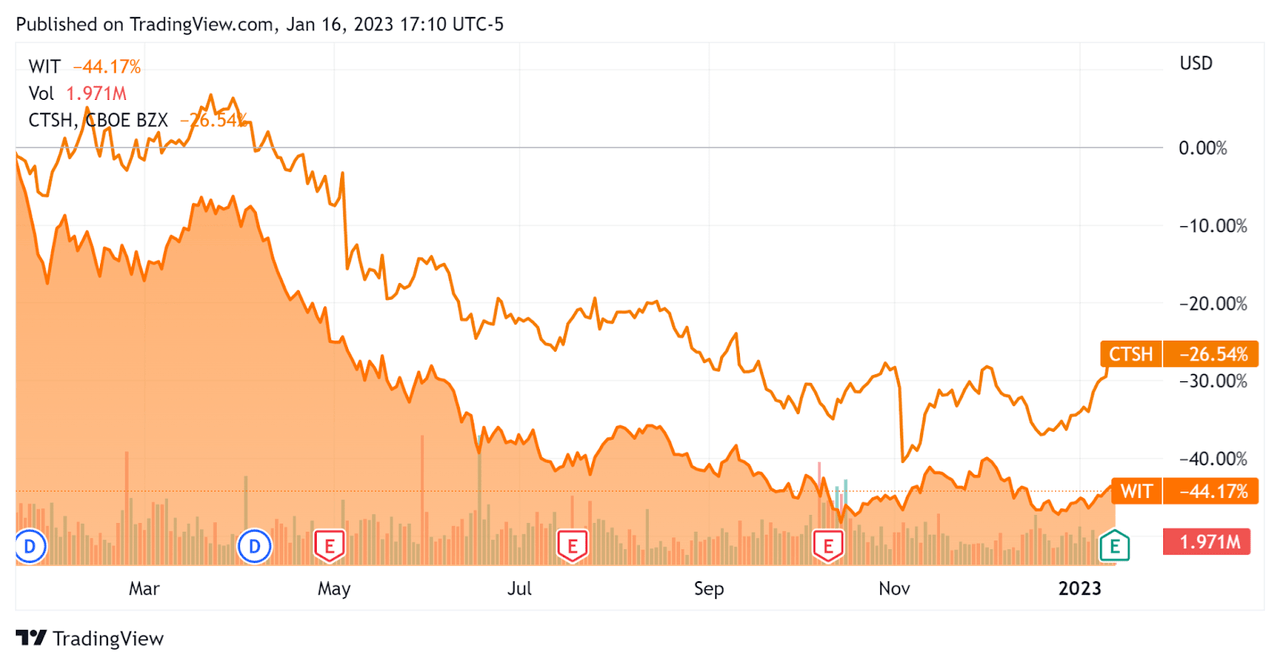

In the past 12 months, WIT’s stock price has fallen 44.2% vs. that of Cognizant Technology Solutions’ drop of around 26.5%, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For Wipro

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

2.3 |

|

Enterprise Value / EBITDA |

12.9 |

|

Revenue Growth Rate |

18.4% |

|

Net Income Margin |

12.9% |

|

IFRS EBITDA % |

17.6% |

|

Market Capitalization |

$26,529,579,000 |

|

Enterprise Value |

$24,122,042,400 |

|

Operating Cash Flow |

$1,264,794,880 |

|

Earnings Per Share (Fully Diluted) |

$0.26 |

(Source – Seeking Alpha)

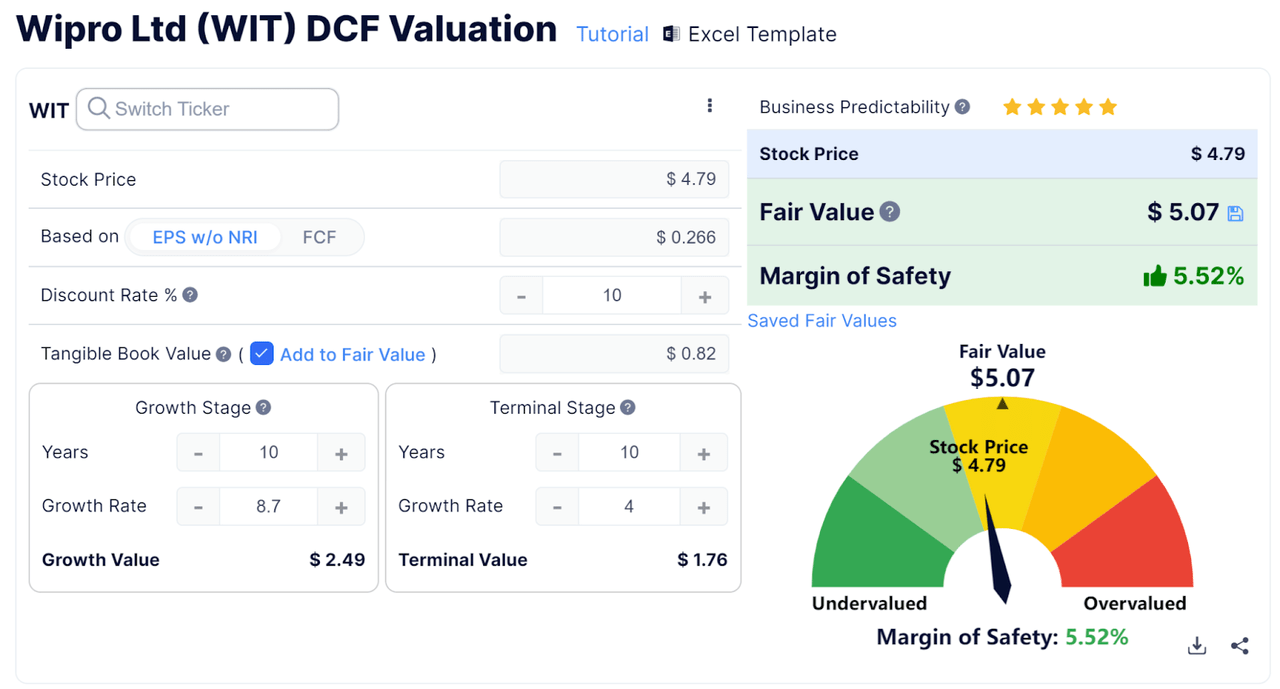

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Wipro Discounted Cash Flow Calculation (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $5.07 versus the current price of $4.79, indicating they are potentially currently more or less fully valued, with the given earnings, growth, and discount rate assumptions of the DCF.

As another valuation reference, a relevant partial public comparable would be Cognizant Technology Solutions (CTSH); shown below is a comparison of their primary valuation metrics:

|

Metric [TTM] |

Cognizant Technology |

Wipro Limited |

Variance |

|

Enterprise Value / Sales |

1.6 |

2.3 |

37.8% |

|

Enterprise Value / EBITDA |

8.9 |

12.9 |

44.2% |

|

Revenue Growth Rate |

8.1% |

18.4% |

126.5% |

|

Net Income Margin |

12.1% |

12.9% |

6.4% |

|

Operating Cash Flow |

$2,690,000,000 |

$1,264,794,880 |

-53.0% |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

Wipro’s most recent IFRS Rule of 40 calculation was 36% as of FQ3 2023, so the firm has performed well in this regard, per the table below:

|

Rule of 40 – IFRS |

Calculation |

|

Recent Rev. Growth % |

18.4% |

|

GAAP EBITDA % |

17.6% |

|

Total |

36.0% |

(Source – Seeking Alpha)

Commentary On Wipro

In its last earnings call (Source – Seeking Alpha), covering FQ3 2023’s results, management highlighted signing 11 large contracts with a total value of more than $1 billion.

The company also produced its highest-ever bookings in total contract value and continued lower attrition in employees.

However, the company is seeing greater challenges in certain verticals, most notably technology customers, and this is not specific to Wipro since other consulting firms are reporting the same headwinds.

As to its financial results, revenue rose 3% year-over-year on an as-reported basis, but would have grown 10.4% on a constant currency basis, indicating significant foreign exchange headwinds due to the strong US dollar.

The firm’s Rule of 40 results has been reasonably good even though the firm is not strictly a software company, with balanced revenue growth and operating profit contributing to a good figure for this metric despite the firm’s large size.

For the balance sheet, the firm finished the quarter with $4.58 billion in cash, equivalents and short-term investments and $1.9 billion in total debt.

During the quarter, operating cash flow was $526 million, an increase of 44.7% year-over-year.

Looking ahead, for the full fiscal year 2023, management expects revenue growth to be 11.75% in constant currency terms at the midpoint of the range.

Regarding valuation, my discounted cash flow calculation indicates WIT may be fully valued given current assumptions.

Also, compared to Cognizant, Wipro is being valued at higher multiples, which is not unreasonable given its faster growth and slightly higher net income margin.

The primary risk to the company’s outlook is a macroeconomic slowdown affecting project ramp speed and slowing revenue recognition and reducing discretionary spending from clients.

A potential upside catalyst to the stock could include a falling US dollar if interest rate hikes slow or pause in the quarters ahead.

This would likely reduce forex headwinds and possibly reduce the prospect of a deep recession.

However, a 2023 recession is widely expected by many economists and market participants, so I’m not optimistic that the firm is going to be able to produce a significant upside catalyst.

Be the first to comment