tupungato

While a case could be made that it’s always important for a company to be growing in order to be considered a great investment prospect, continued expected growth is all but necessary for most companies during these difficult economic times. Anything less than that can lead to a material downside in terms of share price. But sadly, even modest growth may not be enough for a high-quality company that’s trading at a low multiple to see a meaningful upside. Such has been the case with Winnebago Industries (NYSE:WGO), an enterprise that focuses on the production and sale of recreational vehicles and other related products and services. Recently, the financial trajectory of the company has been promising and shares are trading at levels that many should consider attractive. Though not the cheapest player in its space, the company does seem to warrant some nice upside potential. But even so, shares have recently underperformed the market because of concerns of what the future might hold. Despite this weakness, I still do believe the company represents a compelling opportunity for investors. And as such, I’ve decided to keep the ‘buy’ rating I assigned the firm earlier this year.

Steady progress

Back in July of this year, I wrote an article that took a rather favorable view of Winnebago Industries. In that article, I talked about how well the company had done, from a fundamental perspective, in recent history. In particular, I found the nice increase in revenue and profitability to be encouraging. Simultaneously, I found myself intrigued with how cheap shares were, since you often expect an enterprise that’s growing at a reasonable clip and that is trading on the cheap to be trading at a rather lofty multiple. Given how the data looked, I had no problem in my prior article rating the company a ‘buy’ to reflect my view that shares should outperform the broader market for the foreseeable future. Since then, the company has done alright but has failed to live up to my own expectations. While the S&P 500 has been up by 2.7%, shares of Winnebago Industries have generated an upside of 2.1%.

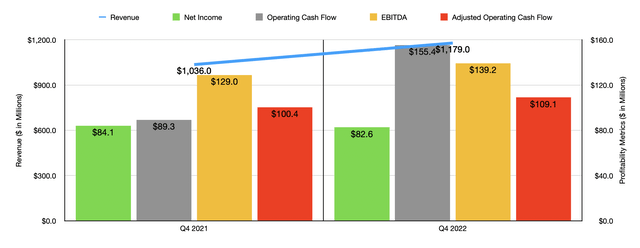

Even though Winnebago Industries may be underperforming the market slightly, this is not to say that the fundamental condition of the company looks anything less than appealing. To see what I mean, we should touch on the data reported for the company’s fourth quarter of its 2022 fiscal year. This is the only quarter for which we now have data that we didn’t have when I wrote about it previously. During that time, sales came in at $1.18 billion. That’s 13.8% higher than the $1.04 billion reported the same time last year. Actual organic growth during this time was 4.3%, while the rest of the growth can be attributed to the company’s acquisition of Barletta. Although the company benefited from higher pricing, it did see a decline in the number of units sold under its Towable segment.

This rise in sales brought with it mixed profitability. On the negative side, net income came in at $82.6 million. That was down slightly from the $84.1 million reported the same time last year. Higher material and component costs, as well as other related factors, negatively impacted the company’s gross profit margin. Naturally, you would think that this would have translated into weaker results when it comes to other profitability metrics. But in this case, you would be mistaken. Operating cash flow of $155.4 million dwarfed the $89.3 million reported the same time last year. Even if we adjust for changes in working capital, we would have seen an improvement from $100.4 million to $109.1 million. And over that same window of time, we also saw EBITDA increase from $129 million to $139.2 million. Thanks to these robust cash flows, management felt emboldened to buy back additional stock. During the final quarter alone, they repurchased $80.1 million worth of shares, completely tapping out the $200 million share buyback program they had in place. And in celebration of that, the company also announced a new $350 million share buyback plan aimed at rewarding shareholders further.

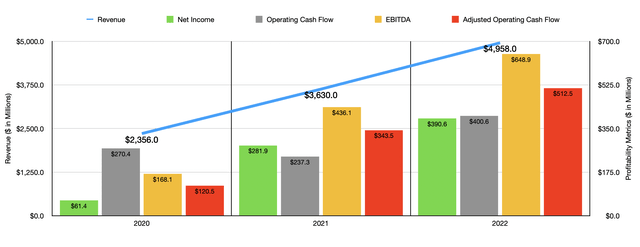

Thanks to these results in the final quarter, the 2022 fiscal year came in quite strong. Revenue of $4.96 billion represented a significant improvement over the $3.63 billion reported in 2021. Net income grew from $281.9 million to $390.6 million. We also saw operating cash flow rise from $237.3 million to $400.6 million, while the adjusted figure for this jumped from $343.5 million to $400.6 million. Also rising year over year was EBITDA, with the metric expanding from $436.1 million to $648.9 million. Investors may be worried about the future, especially the impact that economic conditions might have on the demand for recreational vehicles. But according to management, they are still on track to generate $5.50 billion in revenue annually by 2025. 15% of this revenue is slated to be unrelated to recreational vehicles, while 10% coming from North America will involve the pontoon market. The company is also hoping that this rise will bring its EBITDA up to $715 million. That would translate to an annualized increase over the 2022 fiscal year of 3.3%. Considering the softness expected in this market moving forward, that should be considered promising.

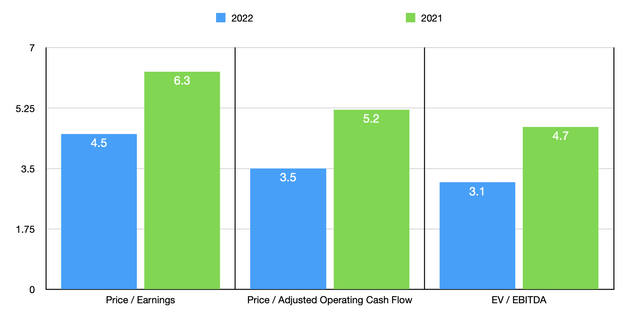

Using the data from 2022, I calculated that the company is trading at a forward price-to-earnings multiple of 4.5. The price to adjusted operating cash flow multiple was 3.5, while the EV to EBITDA multiple should come in at 3.1. By comparison, using the data from 2021, these multiples would be 6.3, 5.2, and 4.7, respectively. Also, as part of my analysis, I compared the company to five similar firms. And on a price-to-earnings basis, these companies ranged from a low of 1.8 to a high of 126.7. Two of the five firms were cheaper than Winnebago Industries. Using the price to operating cash flow approach, the range is from 1.7 to 11.4, with only one of the five companies being cheaper than our target. And finally, using the EV to EBITDA approach, the range should be from 3.4 to 18.8. In this case, our prospect is the cheapest of the group.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| Winnebago Industries | 4.5 | 3.5 | 3.1 |

| Lazydays Holdings (LAZY) | 1.8 | 1.7 | 3.8 |

| THOR Industries (THO) | 4.4 | 5.0 | 3.4 |

| LCI Industries (LCII) | 5.4 | 7.5 | 4.5 |

| Camping World Holdings (CWH) | 6.1 | 11.4 | 4.8 |

| REV Group (REVG) | 126.7 | 7.4 | 18.8 |

Takeaway

In the recreational vehicle space, we may very well have to deal with a great amount of uncertainty in the near term. But as management pointed out when it comes to multiyear guidance, the picture for the industry should be favorable in the long run. Add on top of this how well Winnebago Industries is doing right now, and factor in how cheap shares are, and I do believe that it still warrants a very solid ‘buy’ rating at this time.

Be the first to comment