Brycia James

Williams-Sonoma (NYSE:WSM) was a massive beneficiary of stay-at-home trends which saw revenue and operating profit increase 45% and 220%, respectively between 2019 and 2021. Shares responded accordingly, rising from $70 in 2019 to $223 in late 2021. However, a sharp rise in interest rates, a slowing economy and a downturn in the housing market has led to a retracing of gains with the stock falling 30% in 2022 and sitting 46% below their 52 week high. As we sit today, Williams-Sonoma trades at less than 7.5x trailing EPS as investors likely anticipate a significant decline in earnings as macro factors weigh.

Today I’ll review the pros and cons of an investment in Williams-Sonoma and attempt to estimate ‘normalized’ earnings per share.

Overview

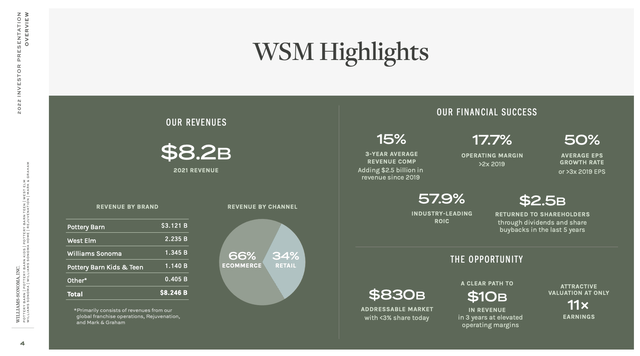

WSM is a leading home furnishings business that owns several well-known brands including William Sonoma, Pottery Barn, Rejuvenation, Mark & Graham, and West Elm. About 12% of WSM revenue (up from less than 5% three years ago) comes from its fast growing business-to-business sales where it sells furnishings for hotels and offices.

Overview (Williams Sonoma April 2022 Investor Presentation)

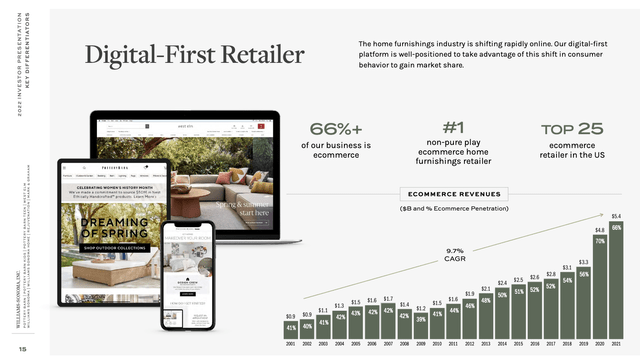

While WSM operates 546 stores, the company has seen a long-term increase in the percentage of sales coming from e-commerce, with e-commerce sales increasing to ~2/3 of total revenue.

eCommerce Growth (Investor Presentation)

While retailers have generally reported a stalling of e-commerce revenue in 2022 as consumers return to stores, in 2Q22, Williams-Sonoma saw continued growth in e-commerce revenue which represented 65% of total revenue.

Pros

1. WSM has continually increased market share in the highly fragmented US home furnishings market. The company has meaningful competitive advantages including:

A/ Its portfolio of well-known premium brands.

B/ Scaled e-commerce business – the vast majority of furniture makers/retailers are smaller players who simply cannot make the substantial investment required to succeed in e-commerce.

C/ Similarly, WSM’s scale affords it advantages in the procurement of materials.

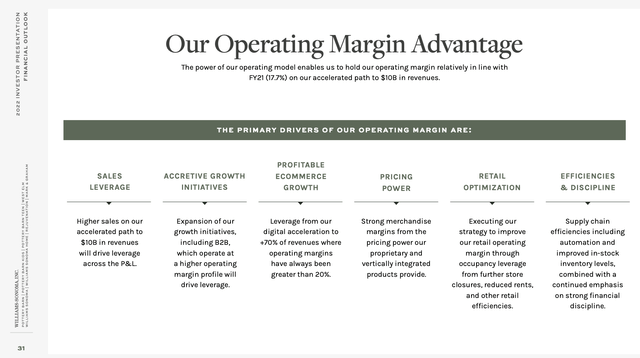

Operating Margins (Investor Presentation)

2. WSM caters to high income households which have shown more resilient spending patterns thus far in 2022.

3. WSM has significant momentum in its B2B business where it targets hotels and offices with a customized furnishings offering. Management believes this business can triple in size over the medium term. Further, the B2B segment has higher operating margins that the business-to-consumer segment.

Cons

1. Furniture sales are cyclical and dependent on overall macro and housing market trends. Though this has not yet shown up in WSM’s numbers, trends are deteriorating as the housing market has entered a downturn.

2. While WSM demonstrated significant positive operating leverage between 2019 and 2021 with operating margins more than doubling from sub-8% to over 16%, should sales turn negative, margins are likely to decline as fixed costs (stores, employees) prove stickier than revenue.

Valuation

My valuation assumes that there is some reversion of revenue and operating margins toward historical levels while taking into account continued growth in its B2B business segment.

I expect that revenue from the business to consumer segment will revert back to 2019 levels. While this may seem overly conservative, the overall housing and economic environment were strong in 2019. I do give the company credit for a step-change increase in B2B revenues and assume $600 million in incremental revenue.

In total this gets me to $6.5 billion in total revenue. I assume a 10% operating margin – while this is a far cry from the 16-17% margin levels achieved in 2020-today, it is an increase over the 7-9% levels achieved from 2014-2019. My assumption for higher operating margins is driven by continued success in the B2B segment.

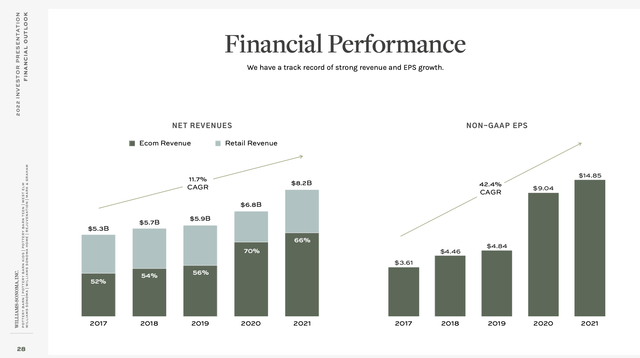

Overall this leads me to a normalized operating profit of $650 million which works out to $7.25 per share in normalized EPS. As you can see below, while my estimate is significantly (~50%) below current levels, it is significantly above pre-pandemic results (driven by B2B and lower share-count due to share repurchases).

Historical Financial Performance (Investor Presentation)

Balancing the company’s strong competitive position and favorable long-term prospects with the inherent cyclicality of the market in which it operates, I apply a 15x P/E multiple to normalized earnings. This gets me to an estimated fair value of $109, which is about 8% below the current price.

Conclusion

While I see Williams-Sonoma as a winner in the home furnishings market, I expect that earnings are likely to decline significantly. I see the shares as being slightly overvalued today. As a value investor, I would look to buy shares about 30% below my estimate of fair value or in the $75-80 range.

Be the first to comment