Smith Collection/Gado/Archive Photos via Getty Images

Investment Thesis

Williams-Sonoma (NYSE:WSM), as an established luxury consumer brand, has had a strong performance and an effective operational model. However, its current liabilities have continued to outgrow its current assets, which leaves little room for error for its sales and revenue to slow down without impacting its cash flow. We see a rebalance of risk and growth ahead for the company.

Company Overview

Williams-Sonoma, founded in 1956, is a retailer that mainly sells French-style-inspired cookware, utensils, kitchen appliances and home decor and furnishings. The company has eight distinct brands: Pottery Barn, Williams Sonoma California, Williams-Sonoma Home, West Elm, Rejuvenation and Mark & Graham.

Strength

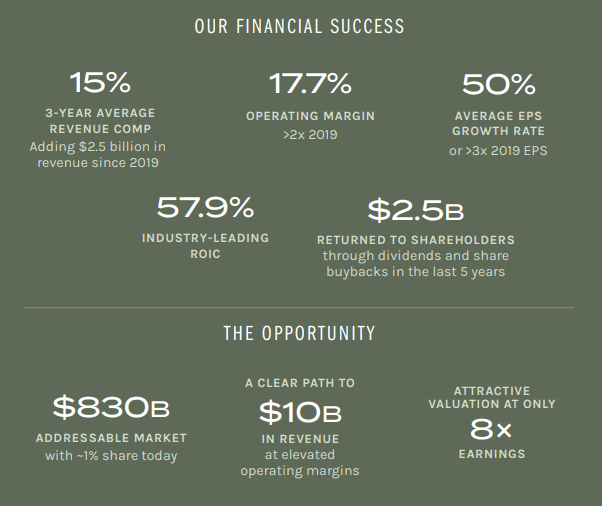

Williams-Sonoma has successfully built a luxury home furnishing and kitchenware brand in the middle-class consumer base. It shows in its financial numbers with strong potential opportunities ahead.

WSM Financial Metrics (WSM Q3 Presentation)

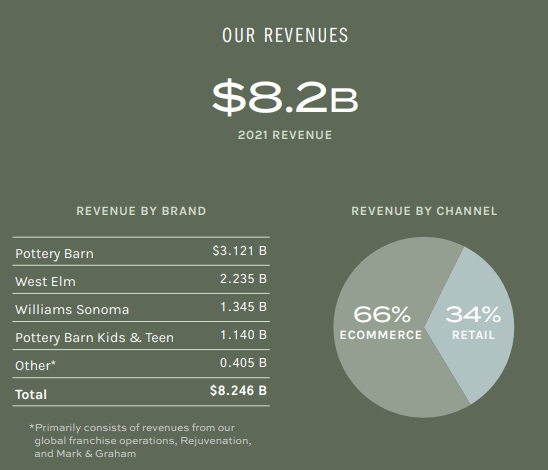

Through its revenue breakdown, we can see it the largest revenue came from Pottery Barn. If including Pottery Barn Kids & Teen, it accounted for 51.6% of its total revenue.

WSM Revenue Breakdown (WSM Q3 Presentation)

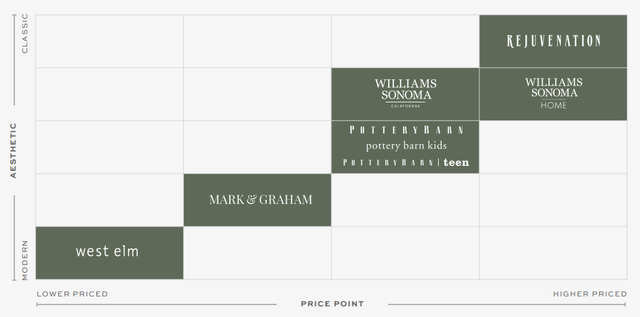

This brand is right in the middle in terms of price point v.s. aesthetic. The success of this brand shows Williams-Sonoma’s broad appeal in its targeted consumer base, which could give it more resilience in facing a slump in consumer sentiment.

WSM Axis of Aesthetic vs Price Point (WSM Q3 Presentation)

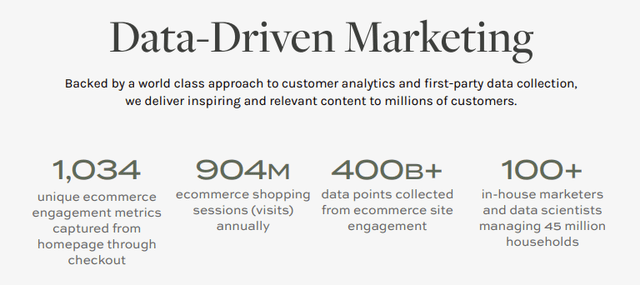

Also from the revenue breakdown, we see that it has over 66% came from e-commerce. This is important because its digital marketing platform directly came down to the bottom line. What we find most relevant in the current market environment is its lean and effective operation. With its data-driven approach, the company created a modular personalized marketing campaign facing 45 million households.

WSM Data Driven Marketing (WSM Q3 Presentation)

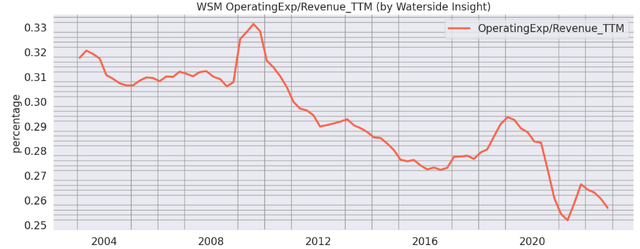

The company runs an “in-house design, digital-first channel strategy” operating model. Its data-driven e-commerce approach has contributed to sustainably and effectively bringing down its operational cost. In the recent quarter, its operating expenses as a percentage of revenue have dropped to their lowest level on a TTM basis.

WSM Operating Expenses over Revenue (Calculated and Charted by Waterside Insight with data from the company)

In essence, this broad-based appeal and the lean operational expenses are critical in surviving a market downturn.

Weakness/Risks

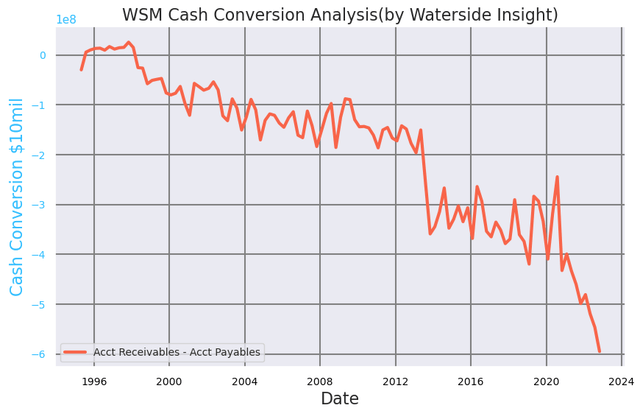

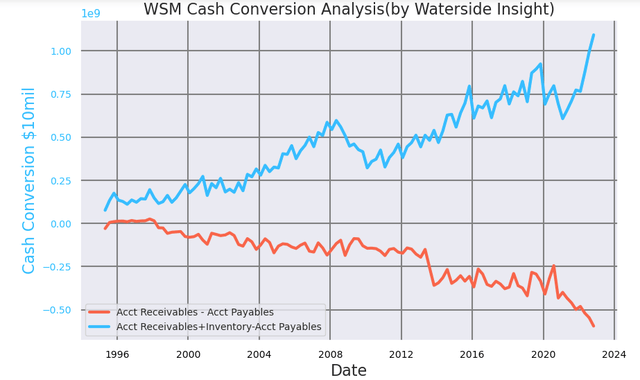

Williams-Sonoma’s cash conversion pace has dropped rapidly in recent quarters to the lowest point on record. Williams-Sonoma always had more payables than receivables, but the level had held steady from 2013 to 2020 within a range. That range has been broken to the downside in the past year or so and sped up the negative trend to its lowest point.

WSM Cash Conversion Analysis I (Calculated and Charted by Waterside Insight with data from the company)

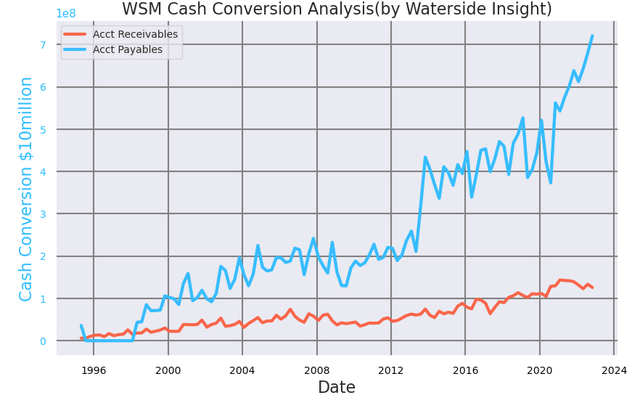

Parsing through the data, we can see the account receivables haven’t changed all that much except for a slight dip lately, but the account payables have soared by more than 50% compared with the range they used to be in.

WSM Cash Conversion Analysis II (Calculated and Charted by Waterside Insight with data from the company)

The company is also running a large inventory. Adding inventory brings the net operating working capital to a soaring upward trend.

WSM Cash Conversion Analysis III (Calculated and Charted by Waterside Insight with data from the company)

Its inventory turnover rate was at 4.1x by the end of 2021, but on a TTM basis, it had come down to about 3.8X by Q3 last year. The company’s net operating working capital hinges on its inventory turnover to stay liquid and positive.

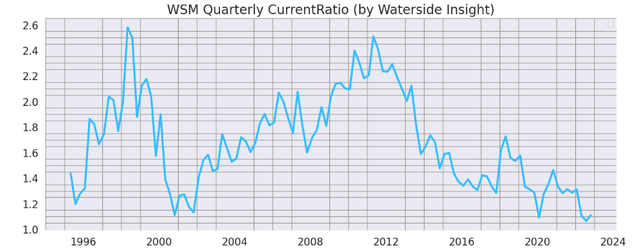

The divergence between the two seems to have always been there, and it didn’t stop its stock price from climbing. Does it matter this time? We think so. Because this time around, its current ratio has taken a hit to a new historic low.

WSM Current Ratio (Calculated and Charted by Waterside Insight with data from the company)

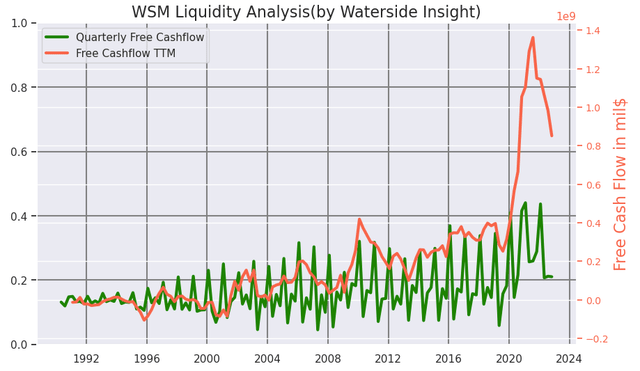

This downward trend has put pressure on its free cash flow on a TTM basis. We think this will continue to trend lower in the next few quarters. Bills still got to be paid. Historically, these payables didn’t seem to come down easily. If sales slow down, the adverse effect on cash flow will be much more noticeable.

WSM Liquidity Analysis (Calculated and Charted by Waterside Insight with data from the company)

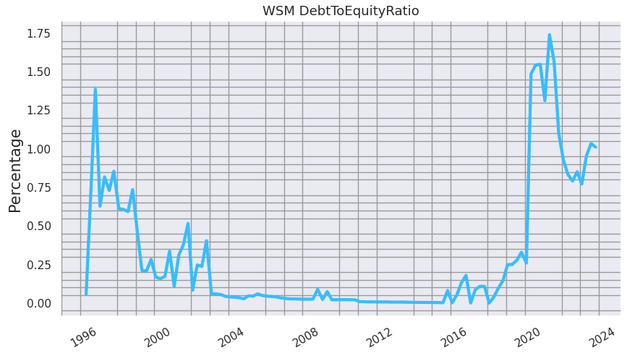

What else got to be paid? Its interest expenses and debt payments. To put it in context, its debt-to-equity ratio is also at a high level historically. It has two of the unsecured letters of credit reimbursement facilities totaling $30 million maturing on August 19, 2023.

WSM Debt To Equity Ratio (Calculated and Charted by Waterside Insight with data from the company)

This wouldn’t be a huge problem so long its sales and revenue keep climbing at the current pace. But that is really priced to perfection in a market with slumping consumer sentiment. In other words, Williams-Sonoma cannot afford to slow down any bit of its sales and revenue growth if it wants to avoid a large negative impact on its cash flow and earnings. We don’t think the combination of all these factors is fully priced into its stock values.

Last but not least, we want to come back to the potential of the home furnishing market. It is a highly fragmented market by nature. The total market has huge potential, but it also has large variables and persistent trends among consumers that prefer personalizing and localizing their home furnishing fitted to the geographical settings, and that may not conform to certain standards. Williams-Sonoma has been around for over 70 years but still only has about a 1% market share. We see both potential and limitations ahead for its future growth.

Financial Overview

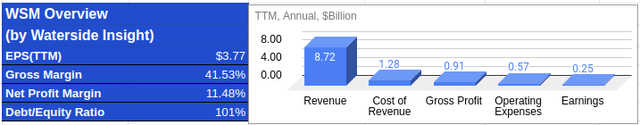

WSM Financial Overview (Calculated and Charted by Waterside Insight with data from the company)

Valuation

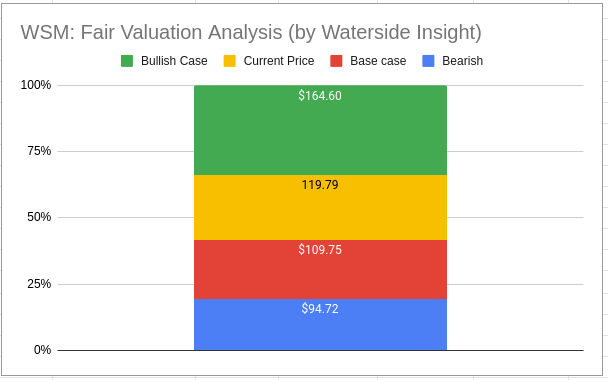

We take into account all the analysis above and use our proprietary models to assess the fair valuation of Williams-Sonoma, with a ten-year projection ahead. What we find is in our bullish case, should the company be able to continue its upward sales trend, keeping expenses low, and use all the extra cash to refloat its liquidity ratio, without much bumps ahead, it is valued at $164. 60. In our bearish case, where the sales slow down for two fiscal years while the cash flow growth stays flat on average, it is valued at $94.72. In our base case, the company experiences slow sales in the looming recession, and makes efforts to bring down its short-term liabilities with a consistent average cash flow growth rate; it is valued at $109.75, a bit below its current market prices.

WSM Fair Valuation Analysis (Calculated and Charted by Waterside Insight)

Conclusion

Williams-Sonoma has a strong, broad-based appeal to its targeted consumers and has effective expense control. They benefit both its top line and bottom line. However, its current liabilities have accumulated to a new high recently, which takes an expectation of perfect sales growth to maintain its current cash flow trend. We acknowledge its potential in the long term but also think there are risks ahead that the market isn’t fully priced in currently. We recommend a hold at this time.

Be the first to comment