We Are

Matterport’s (NASDAQ:MTTR) revenue for its last reported earnings quarter was down 3.5%, gross margins had declined by 70 basis points, and cash burn from operations was up 28.6% sequentially. The company is uniquely exposed to the falling US real estate market as its primary customers remain real estate agents looking to create higher quality and more interactive listings. Matterport develops and retails advanced hardware and software used to capture the built environment, creating a digital twin. This has meant its total addressable market has been tied at the hips to real estate activity. Indeed, the company experienced a boom during the pandemic not just from the obvious stay-at-home orders, but from the greater viscosity of property transactions as people sought to take advantage of new WFH freedoms.

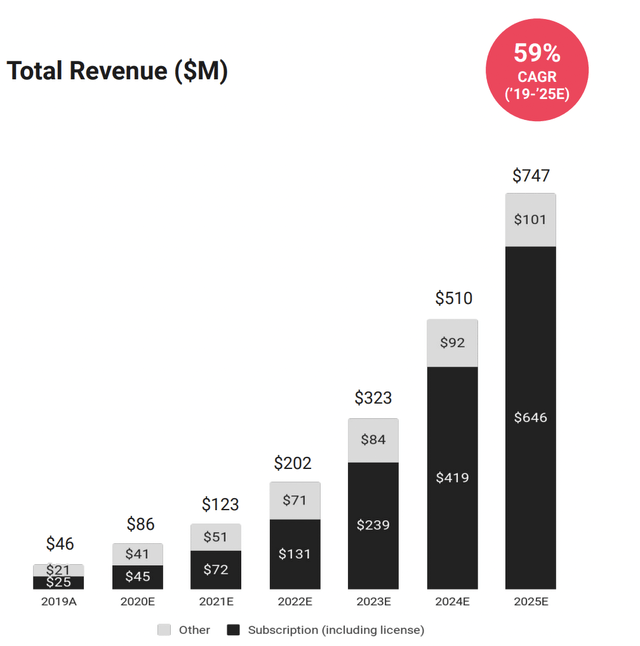

Matterport’s management previously stated that they were targeting every building in every country in the world. The company guided for material revenue growth on the back of this and a rising $240 billion TAM that would be inclusive of everything from hotels, construction, and the metaverse. This saw the company forecast revenues of $123 million for its fiscal 2021 and $202 million for fiscal 2022 when it went public.

With year-to-date revenue at $57 million, broadly in line with the same year-ago comps, there is no obvious pathway where Matterport achieves its target for revenue of $202 million. The company would essentially have to grow third and fourth quarter revenue by nearly 170% against a trajectory that is already in decline.

Matterport’s Near-Term Future Is Uncertain As The Housing Market Becomes Dislocated

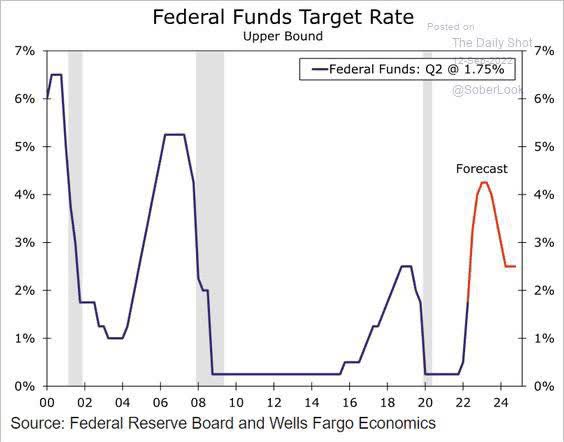

US real estate is collapsing as high inflation has turned the Fed hawkish and interest rates increase to new highs. The current Fed funds rate stands at between 3% and 3.25% with the rates expected to be hiked by another 75 basis points at the November Federal Open Market Committee meeting. This would further increase mortgage financing costs and apply more pressure on a national housing market already collapsing.

Federal Reserve Board

Further, the near-term outlook for the US economy remains poor with a recession expected in 2023. The toxic and somewhat rare combination of negative economic growth, high inflation, and rising interest rates would further accelerate the trend of collapsing housing sentiment and give further legs to the pullback in house prices.

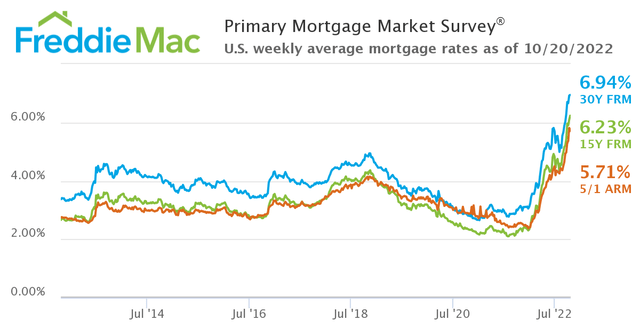

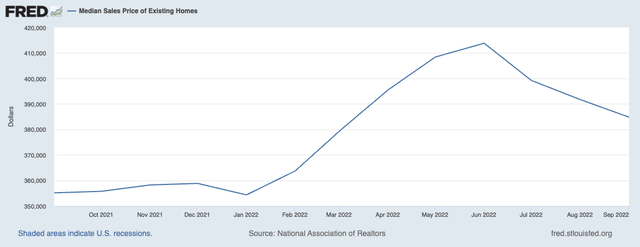

Freddie Mac’s primary mortgage market survey has placed the 30-year fixed mortgage rate at 6.94%, significantly up from a year ago when rates hovered just above 3%. Fannie Mae’s Home Purchase Sentiment Index has also dropped to its lowest level since 2011 when it reached 60.8 in September, its seventh consecutive month-on-month decline. Critically, as mortgages become more unaffordable buying and selling will slow down materially. Increasingly higher mortgage rates are pushing the market into an acute state of shock as stasis grips some markets from the Midwest to New England. The median sales price of existing homes is dropping, down 7% from a recent peak of $413,800 to $383,800.

Homeowners who locked in record-low rates on their mortgages from years ago are likely to sit on those for longer so they are unlikely to move homes whilst already falling real wages will work to reduce the ability of individuals to save for a deposit. Overall, the macro backdrop for Matterport’s core market is in decline and the company’s revenue growth reflects this.

Could the metaverse help?

The Metaverse As A Hedge Against A Physical Real Estate Collapse

According to McKinsey, the first five months of 2022 has seen more than $120 billion invested in developing the metaverse, more than 2x the amount spent for all of 2021. The market is seen to be a secular growth space with Facebook pivoting last year to Meta Platforms (META) to reflect its ambition to capture what some expect will be the evolution of the internet. A new way for millions around the world to live, work and play.

Whilst the company’s management did not give specific updates on their metaverse strategy at their last earnings call for their fiscal 2022 second quarter, their strategy still essentially condenses down to the core focus on a digital transformation of the built world and how essential this is for creating a viable metaverse at scale. But with the adoption of Meta’s inaugural Horizon Worlds declining some analysts are stating the early estimates about the growth of the new iteration of the internet might have been overhyped.

The company’s near-term earnings are likely to show continued weakness on the back of real estate transactions collapsing and the subsequent reduction in real estate activity. This will see revenue for fiscal 2022 likely come in at just over half of guidance to place Matterport on the list of deSPACs who overpromised and underdelivered. The common shares are still to avoid.

Be the first to comment