gremlin/E+ via Getty Images

The Everything Storm

Investors this year have gotten absolutely hammered in a severe market rout that has spared few sectors. The blood-red colors in this stock map show the depth and expanse of the carnage, with only energy and health care sectors being bright spots of profitability.

Market Map 2022 – Sea of Red (finviz)

The cause? The Fed has finally started zealously tightening rates, reversing 14 years of easing. The results are what you see in the chart above.

You see a lot of this has to do with zombies…

Beware The Zombies

Zombies are real. At least where they relate to corporate entities. As defined by the Fed, zombie firms are “nonviable firms with low growth prospects that survive on cheap credit”.

Quite a few articles have mentioned the proliferation of zombie companies, whose very presence put a heavy drag on the dynamism of the US economy. But it’s hard to find quantifiable facts.

The Federal Reserve itself took the subject seriously enough to publish a study on this a year ago, acknowledging the problem and analyzing its impact.

Source: U.S. Zombie Firms: How Many and How Consequential?

The study attempted to establish “a panoramic view of the prevalence of zombie firms in the U.S. economy”.

Their conclusion at the time was that the prevalence of zombie firms, around 9% of the public companies and 5% of private firms, was “not an important feature of the U.S. economy, so far”.

These companies “did not benefit disproportionally from the improvement in credit market conditions resulting from the unprecedented fiscal and monetary support following the outbreak of the COVID-19 pandemic.”

However, the study also concluded : “it is too early to dismiss concerns that the current economic conditions may be breeding new zombie firms. The COVID-19 pandemic is an economic shock of unprecedented magnitude, and while its potential scarring effects on the economy are difficult to predict, it may severely damage some sectors of the economy, turning many firms into zombies.”

In a humorous aside, some Fed critics at the time likened publication of this study on the Fed site to appointing the fox to guard the chickens. After all the presence of zombie firms is a direct consequence of ZIRP (Zero Interest Rate Policies) and Quantitative Easing measures (QE1, QE2, etc.). How likely is the Fed to find its own policies bad?

Did The Zombies Multiply Today?

I give the Fed credit for at least giving the topic credence and backing it up with a thorough set of statistics. That said, that Fed study was written 1 year ago when the cost of lending was about 1.25% lower. A lot can happen in a year.

So have zombies multiplied? Are they now threatening to overwhelm the economy?

It would be very revealing to see the same detailed Fed study run today. Since I don’t have the time or resources to do that, but am keen to know the answer, I decided to do a back-of-the envelope approximation.

I took a statistical dive using the Altman Z-score. This tool was invented by NYU Stern Finance Professor Edward Altman in 1968 to measure corporate health and test the likelihood of bankruptcy.

The Altman Z-score (see Wikipedia formula) has become the preferred tool for investors and bankers to evaluate corporate credit risk. We won’t dive into the finer details here, but it works like this:

- a score below 0 signals the company is facing impending bankruptcy

- a score above 3 shows little chance of insolvency

To give you a perspective, in 2007 a median Z-score of 1.81 let Altman to predict that a major stock market collapse was likely to hit the US stock market. He was right.

Altman later clarified that he believed a score below 0 indicated an individual firm’s likelihood of impending bankruptcy, as opposed to 1.81 for the overall index.

So what’s today’s global Altman Z-score? None of the data tools to which I subscribe gave me access to that number for current year, so again I had to approximate it.

I have two tools for doing that, Seeking Alpha’s great stock screener, and another great one offered by Gurufocus, a subscription service. Each has a very different set of data they draw from and frankly, I’m not sure which is the more better of the two. Gurufocus’ dataset is more than 6 times larger, but is it more accurate?

Sometime the perfect is the enemy of the good, when it comes to statistics. I’ll keep it simple and give you both.

| Source | Data Universe | > 3 | < 3 and > 1.81 | < 1.81 and > 0 | < 0 | Safe | Ok | Shaky | High Risk |

| Seeking Alpha | 10,694 | 6,239 | 1,833 | 999 | 1,623 | 58.3% | 17.1% | 9.3% | 15.17% |

| Guru focus | 64,066 | 27,528 | 18,943 | 13,264 | 4,331 | 42.9% | 29.5% | 20.7% | 8.3% |

I checked how many companies were below the 2008 median figure, and how many were above.

Regardless of datasets, we get similar results for the percentage above and below the median value of 1.81

- 62-65% have a Z-score higher than 1.8, (safe and ok firms)

- 24-29% have a Z-score below 1.8, (shaky or high risk or bankruptcy)

So the median is still a bit better than in 2007 – which ended up in the Great Financial Crisis of 2008- but not by much.

We get a bigger discrepancy in the percentages that are highly likely to go bankrupt. These are the zombie firms. The number ranges from 8.3% to 15%.

Remember, based on Altman’s own judgement, companies in the last category were almost certain to go bankrupt over the next few years.

So the picture is pretty bleak. We see around a quarter of the companies in the US on very tenuous footing and roughly one out of 10 likely to go bankrupt.

Do Zombies Provoke A Crash?

A prevalence of zombies does not necessarily lead to a stock market crash. Instead, if allowed to spread, it inevitably leads to a moribund economy of little to no growth. By desperately selling goods and services at close to zero profits, zombie companies prevent healthier companies from increasing profit margins, while they compete with those healthy companies for scarce labor and capital.

Low profit margins, in turn, disincentivize healthy companies from investing in new capital, technology and inventions, since profits are comparably lower. So the overall effect is to hold back an economy’s future growth.

Killing off the zombies would actually ultimately be good for the economy in the long run, while admittedly painful in the short term. Back when Schumpeter was revolutionizing economic theory, zombies weren’t really a thing. But he would have recognized a zombie firm on first sight.

What do zombie companies survive on? Cheap interest rates, and quantitative easing. Stop those and the zombies die.

Zombies and The FED – An Early Romance

Since around 2008, during the Global Financial Crisis, the powers that be decided desperate times called for desperate actions. So they invented Quantitative Easing, Helicopter Money, and Modern Monetary Theory.

Bottom line. They printed money.

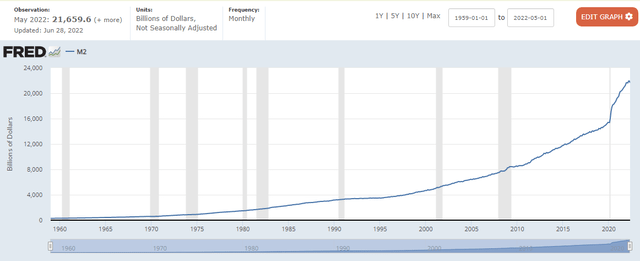

Growth of M2 (fred.stlouisfed.org)

The result, the money supply (as measured by M2) went from around $7 trillion in 2008 to today’s $22 trillion, as the Fed responded to the Global Financial Crisis. Which meant plenty of free money for zombie companies to gorge on. No profits? No problem! They just borrowed at ridiculously low rates, and they proliferated.

You could say the FED was the zombies’ best friend.

Inflation – The New Kid in Town

For a long time, on the surface, everything seemed fine. But beneath the surface rot was spreading. Investors just held their noses against the stench while riding the seemingly unending stock market boom.

Fed critics pointed to numerous spurts of inflationary pressures throughout 2021, but the Fed proclaimed these rises as “transient”, a result of supply change imbalances caused by the Covid epidemic that would soon work itself out.

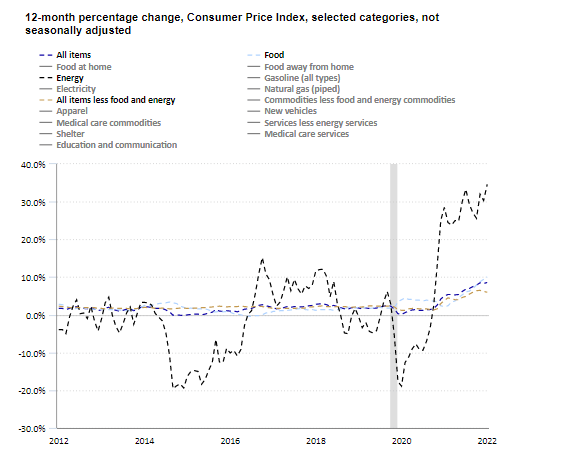

And then came the day of reckoning. After years of seemingly dormant inflation, prices exploded upwards. By early June 2022, the May numbers on inflation jumped to 8.6%, the biggest rise in 40 years Shelter shelter, food and gas were the biggest contributors.

Many economists believe even these high rates have been artificially suppressed to disguise the real damage and that real inflation is already in the mid-teens. If you want to dig into that line of thinking, be sure check out the data at Shadowstats.

American workers, now have had to face $5 and $6 dollar gas prices, soaring food prices and double digit increases in housing costs. For many Americans, this inflation burst instantly vaporized all of the hard-fought wage gains of the last year, and for some, of the last several years.

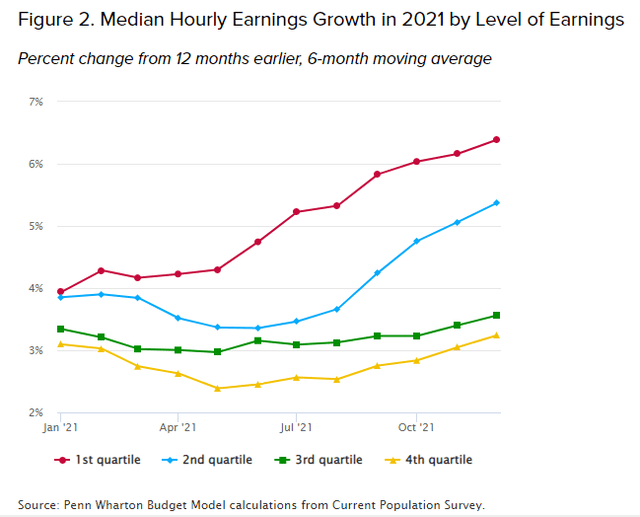

Consumer Price Inflation Explodes in 2022 (U.S. Bureau of Labor Statistics) Wage growth has trailed inflation (wharton.upenn.edu)

The lowest income earners (1st and 2nd quartiles) are lagging recent inflation numbers by around 4 to 5 percent. These are the people who have the least abilities to cope.

The American voter mood is ugly, ranging from considerable worry to out-and-out fury. For better or worse, the American voters want to see action. The want inflation halted at least by … yesterday.

Democrats in government, meanwhile, have come to realize that their chances of maintaining power in the midterm elections in November 2022 ride almost entirely on how seriously they are seen to be combating inflation.

President Biden has since announced his full confidence in the Fed’s ability and willingness to prioritize combatting inflation , a not so subtle push to tighten policy now or face his wrath.

Meanwhile, Biden has washed his hands of any responsibility for the inflation and placed the blame for it – and its future evolution – purely in the Fed’s lap. (Everyone knows the massive fiscal stimulation under first Trump and then Biden had nothing to do with it. It will be interesting to see if voters buy this story in November.)

Bottom line: the Fed has two reasons to raise interest rates: 1) to get the President and Congress off their backs and 2) because they don’t want to be written down in the history books as the Fed that provoked the next great inflationary cycle.

On the Fed board of directors, the last of the doves have caved to the new reality: inflation has become the number one threat to the US economy. They have recently vowed that they would slay it with a series of interest rate hikes – accompanied by a faster halt to quantitative easing measures.

Inflationary Risks – That Was Then This Is Now

Until now, the Fed consensus had been that the combined forces of a steadily aging US population, rapid technological improvements and global decentralization would keep inflation low for decades. So other than political pressure, what changed the Fed’s thinking?

The Fed has recently seen the rapid rebirth of unionization among American workers. and feared how much wage earners might start to price in the sudden spurt of inflation into present and future wage demands. Meanwhile, the Fed has observed how businesses are repolishing their long-forgotten skills in raising prices to offset higher supply costs.

A second factor is that the Fed has come to realize that the war in Ukraine could drag on for a long time, exacerbating oil shortages, food shortages and supply chain disruptions.

Third, the Fed cannot have ignored the increasingly obvious end of global centralization in trade and manufacturing. This trend which persisted for decades and was hugely deflationary, has been reversed – many say permanently – by Covid and the war in Ukraine.

Governments worldwide are now scrambling to secure critical economic resources, be they energy-related (oil, natural gas, lithium) or technology-related (high-end computer chips). So governments are erecting trade barriers, favoring domestic industries with preferential subsidies and tax cuts and limiting new trade agreements only to their most trusted allies.

These measures – while arguably sensible from a national security perspective – will certainly come at much higher cost.

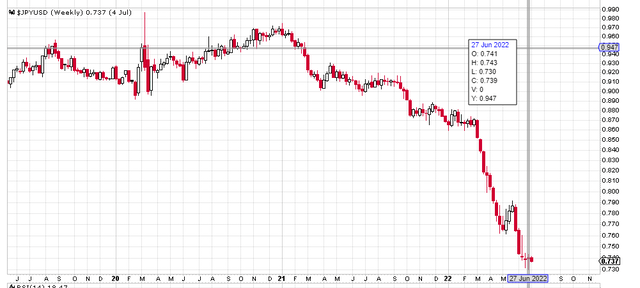

Fourth, central bankers at the Fed realize that Japan has not yet joined other central banks in tightening interest rates.

But his discrepancy has led to a dramatic drop in the Japanese yen against all currencies.

historic drop of Japanese Yen (stockcharts.com)

Now, the historic drop in the yen’s value makes it increasingly likely that the Japanese central bank will be forced to match those tightening policies.

Until now, this had propped up the dollar, lowering US inflation while raising global commodity prices.

A reversal of these policies could cause an equally strong reversal of the dollar vis-a-vis the yen, good for the rest of the world but bad for US inflation.

Killing Off The Zombies

Whether it was from internal conviction or political expediency, in May of this year the Fed flipped the switch from a very gradual tightening to an accelerated one, while hastening the end of Quantitative Easing policies. The Fed increased interest rates by 75 basis points in June, from the more timid 25 basis point reductions it had previously initiated.

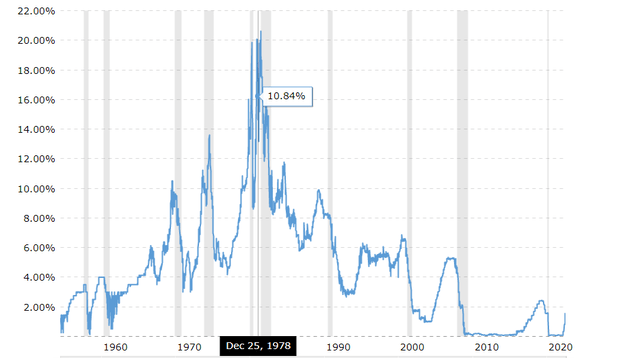

In fact, in his recent speeches Mr Powell has even started to take on the mantel of Paul Volker, the FED chairman who famously increased interest rates to 20% in 1980 to finally break the back of the 70’s stagflation.

History of Interest Rates (longtermtrends.net)

The Fed now announced it would resolutely act to combat inflation in a series of monthly interest rate hikes until the high inflation was quashed. The actual hikes that would come and their frequency – were left understandably vague to permit flexibility.

The speed and severity of these upcoming hikes has been the subject of much debate among economists and investors.

What is crystal clear is that this new tightening – if it is resolutely enforced – will put an end to the zombies. Without cheap money, they cannot survive. Unprofitable companies, unable to raise new debt, will shrivel and collapse.

Higher job losses cause a direct drop in wage inflation, as the number of candidates for any open position rises. Meanwhile, laid-off workers reduce their spending on goods and services. This in turn reduces corporate profits, which causes stocks to fall.

Meanwhile, higher interest rates reduce the affordability of home purchases, which translates into lower house prices.

And in a kind of triple whammy, higher interest rates drop the value of existing bonds, reducing the value of bond portfolios.

So stocks and bonds fall in value, and house prices decline. This wealth destruction causes economic participants to save more and spend less to rebuild their decimated portfolios.

Can We Spare The Good Guys?

The $64 trillion dollar question – of course – is can the Fed manage a soft landing? Can it reduce inflation just enough to slow inflation to the Fed’s preferred 2 percent level without sending the economy into a severe recession?

I will try to answer that here.

First let’s make one thing abundantly clear: the global economic environment today precludes anything close to a Volkerish tightening.

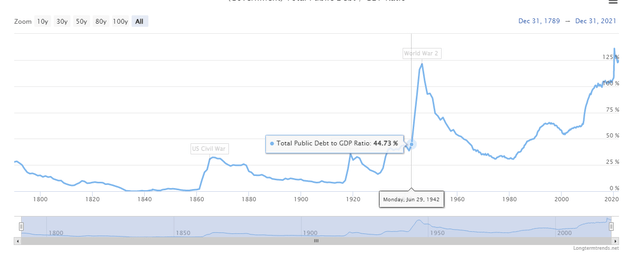

Take a look at US debt. It was around 27% of GDP in 1980, today is four times higher at 127%.

History of US debt to GDP (longtermtrends.net)

My conclusion is that an interest rates increase of much more than 4% would bankrupt the US government over just a short period. Here’s how I come to that conclusion.

Take a look at the stats on the wonderful US debt clock site if you have a strong stomach. You’ll quickly see that if we raise rates by 4% we’d increase government spending by $1.2 trillion. This would wipe out half the money allocated to Social Security, Medicare and Medicaid or it would eclipse the entirety of our national defense expenditures.

Think we can do without those? Obviously not. So where would the money come from?

Borrowing?

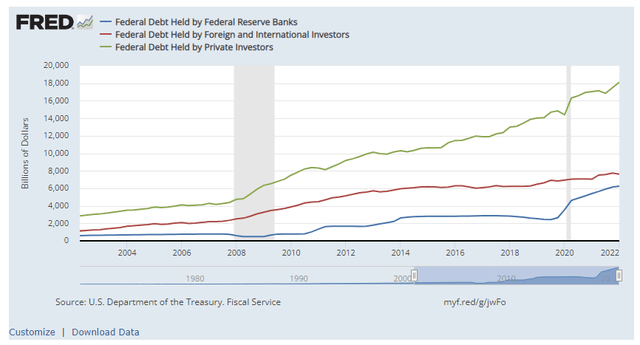

Look at the chart showing sourcing of US treasuries.

US treasury sales by source (fred.stlouisfed.org)

Since 2008, in the massive expansion of the Federal balance sheet, only $5 trillion of new treasury issuance has come from foreign sources, while the Fed has added up an additional $18 trillion through the miracle of QE. What happens when the Fed can’t print money anymore?

And the foreign central banks’ proclivity for Treasuries has taken a massive beating in the last months of the Ukraine war. Who wants to be in Treasuries – even if rates are bumped up to 5 or 6 percent – when inflation is running in double digits? Especially when the US has demonstrated that it is willing and able to weaponize its control of the global banking system. (The US recently pressured Switzerland – a historically neutral safe haven – to freeze Russian foreign reserves as a consequence of Russia’s invasion of Ukraine.)

Not to mention that the biggest potential lender, China , is not exactly on our good side right now. In an escalation over the issue of Taiwanese sovereignty, China’s leadership has to be concerned the US might withhold or dishonor its treasury obligations to China. Which may be why has China massively reduced its US bond purchases in recent years.

If the US government can’t borrow the money to pay for higher interest rate obligations and the Fed is precluded from printing due to inflation, what’s left? Well, the US government could reign in its expenses. Oh wait.. we can’t eliminate our biggest expenses: Medicare, Medicaid, Social Security and defense. That’s political suicide.

As for the other budget items, when was the last time we shrunk the government by 50%? You just have to go back about 246 years. Think hard. Can’t recall? My point is made.

That’s why a 3 to 4 percent increase is an upper cap on any interest rate increases. Beyond that, you’re looking at a collapse of the US monetary system. Sounds crazy, I know, but work out the numbers.

The Tough Choice – Recession or Permanent Stagnation

So to combat inflation, the Fed must raise interest rates and stop money printing. Both of these will cause the economy to suffer, bond prices and stocks to drop, and housing to tank. Or it must abandon its attempt to fight surging inflation, at the risk of returning to the stagflation of the 70’s -a period of dismal growth, eroding living standards and high inflation.

We already saw the collateral damage of a 1.75% increase. Couldn’t the Fed just stop now?

A handful of economists think that’s exactly what will happen, or what should happen.

But I don’t think that will happen. This Fed – for better or worse – has found true religion, and it will take it’s rediscovered inflation-busting duties more seriously than its vow to maintain a low rate of unemployment.

Moreover, the Fed has egg all over its face at the slowness of its initial response to signs of impending inflation. To reverse again, at the first signs of pain, would be frankly just downright embarrassing. If there’s one thing powerful people hate, it’s being ridiculed.

And despite what many people think, Fed bankers are people. They suffer from pride, as all of us do, and nobody likes to admit they are wrong, especially twice in just a matter of a few months.

Furthermore, they’re susceptible to the public mood, which is clamoring for strong anti-inflationary measures.

Look at it from the Fed’s perspective. If the Fed gives the public what it is clamoring for and we get a bad recession, the Fed can always say: “See. I told you it was transitory. You didn’t believe me. You wanted a tightening. Now live with it.”

If stocks and housing drop but we get only a mild recession and inflation is suppressed, to 80% of Americans they can proudly say: “Hey check it out. You may still have to moonlight for Uber now that your jobs gone to part-time status, but at least you can pay for food and rent and your gas bill is lower. Elon? Warren? Really sorry about that billion-dollar hit to your net worth. Couldn’t be avoided. “

On the other hand, if they suddenly ease again and inflation rekindles, they’d be stuck admitting: “Oops. We loosened again. Inflation’s now 20%. You can’t pay for food or gas or rent or buy a house, but at least your portfolio’s recovered. Stocks are up 20%. And just look at all the new billionaires.”

Taking all those considerations in, I expect the Fed will raise interest rates until the back of inflation is definitively broken. Until most of the zombies are slain.

That means, in this economy, at least another 1 to 2 percent rise in rates. At that point, either real estate or stocks, or both together, will plummet.

I don’t expect these rate increases to be gradual, drawn out over 6 months to a year. Rather, they will be dished out in rapid succession, in order to quash rising inflation expectations. I predict they will have occurred before the November elections.

Collateral Damage from The Zombie War

If I’m right, and we see a further 1-2% increase in rates, how bad will this be for markets, real estate and the economy overall?

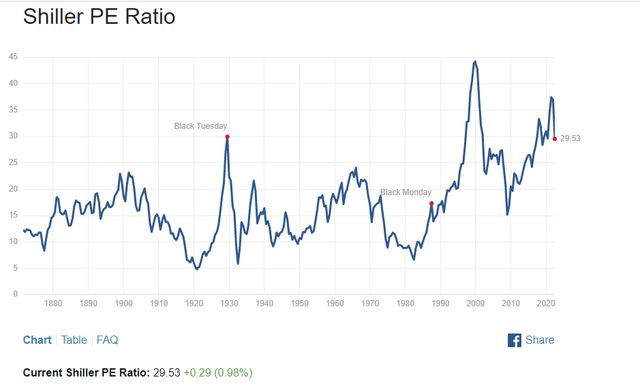

To judge the impact on stocks, let’s take a look at today’s PE compared to history.

The graph below is of Yale Professor Robert Schilling’s Cyclically Adjusted PE Ratio, known at the CAPE Ratio: This is a price-earnings ratio that uses an average inflation-adjusted earnings from the previous 10 years, in order to smooth out individual years’ impact on the ratio.

Historic CAPE ratio (multpl.com)

As you see, today we’re at a CAPE RATIO of 29.55.

Two things are of note:

- This ratio today is higher than in the 1929 stock market crash

- It’s the 2nd highest level it’s been at in the last 40 years

This just means stocks are way overpriced. It doesn’t necessarily mean they will crash tomorrow, but given my expectation of a quick 75 basis point July increase, and another in August, sooner is more likely than later.

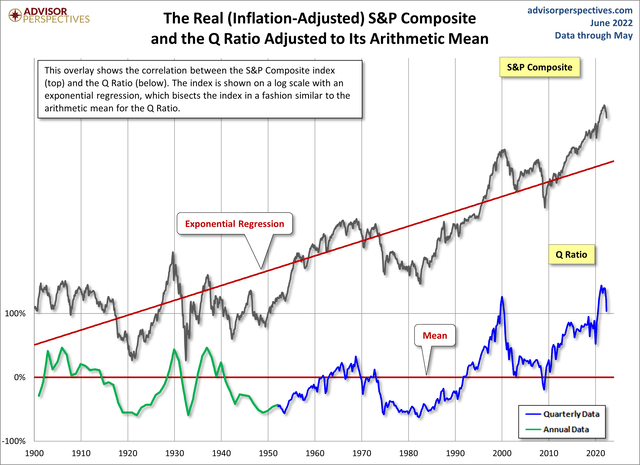

Let’s look for confirmation with another useful tool: the Q-Ratio. The Q Ratio is a popular statistical tool used to estimate the fair value of the stock market. It was developed by Nobel Laureate James Tobin.

The Q Ratio is the total price of the market divided by the replacement cost of all its companies.

How does it work?

- when the Q ratio is exceptionally high, the market is being euphoric and overpricing stocks.

- When it’s too pessimistic, and the market is in a severe downturn.

- In periods of severe recessions, the q value is between -30% and -50%.

As you see in the graph below, despite its recent big downturn, the market has a ways to go before the bottom is in. Even though the 24% drop seems severe, that rise is inconsequential compared to the rises that preceded it.

The Q Ratio Since 1900 (advisorperspectives)

The Q Ratio has very far to fall before it reverts to the mean. And remember, it inevitably does so by overshooting the mean to the downside. So for those who think the damage is done, we got to say: “History says you’re still being very euphoric. Stocks have to come down a lot more.”.

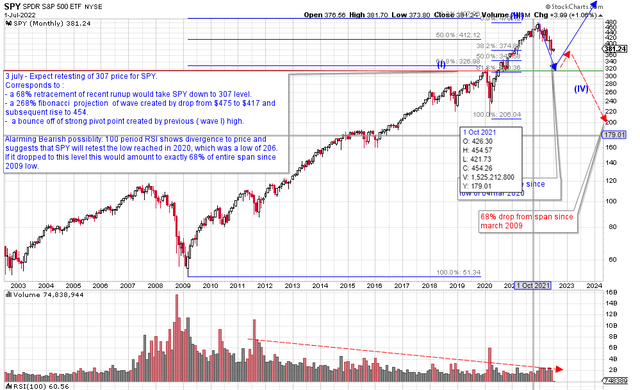

Technical chartists know that in severe drops, it is very common to see reversions of a trend on the order of 68%. In the graph below of SPY, the ETF composed of the S&P 500 STOCKS, I see a high likelihood of retesting the September 2021 $312 low, which would be a 68% retracement of the rise SPY made since that March 2021 low.

Right now that’s my best guess for the severity of the drop, 18% lower than today’s price.

However, the charts also give some support for a 68% drop of the entire rise since 2008! This would take SPY down to the lows of March 2020, at $212. That would represent another 35% drop from today’s price.

Which will it be? That depends on the zombies. How many are there really out there. And how will the Fed fight them?

SPY long term prognosis (tradejolt.com)

What about real estate?

So far the Fed’s cumulative 1.75% rate hikes have sent mortgage rates from lows of around 2% to more than 5.5%. For the average home costing around $440,000 in the US, , this doubled mortgage payment rates for homeowners who are financing. That’s about 80% of all home buyers. This is already squeezing home buyers badly. But since home owners are desperate to get in before rates go up even more, housing prices have not slowed. But housing sales have.

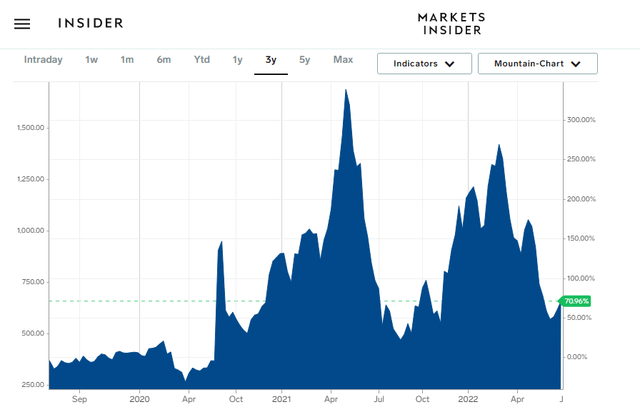

More telling: lumber prices – representing future homes built – are dropping sharply, dropping 70% off last year’s highs. This is one of the first things to slump when new housing starts slow.

Lumber price boom collapsing (business insider)

And many major mortgage companies have recently announced layoffs of around 20% of their staff. You usually don’t fire staff when you’re expecting a boom of new house purchases.

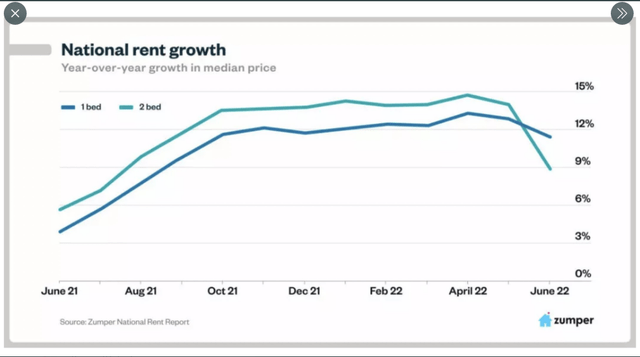

And if you glance at housing prices or rental rates, you’ll notice that the pace of growth, the rate of the rise, is starting to fade.

Rising rents slowing down (Zumper National Rent Report)

Taken together, I interpret these as ominous early signs of an impending collapse in housing.

My back of the envelope analysis is that each 1% rise in interest rates would decrease the affordability of that average mortgage by about 8%. This is assuming a 20% down payment. So I expect housing prices to drop in the 15% to 20% range on a 2% rise in rates.

The worse effects is that on long term bonds. Many people forget the duration effect on bond prices, though it’s completely logical. 20 year treasury bonds have dropped severely by 37% on just the 1.75% rate hikes we’ve had. But a duration of 20 on those bonds makes that completely logical. So another 40% drop is to be expected on a 2% rise in rates.

Finally, and probably most importantly to most Americans, is the effect on the economy. I’ll frankly admit that this is not my area of expertise, involving a multitude of esoteric and difficult to obtain metrics.

But I would expect the combined impact to be similar to the 2008 crash, where GDP shrank by 2.3% in 2009, before recovering by an equal amount in 2010, due to heavy stimulation.

I do not expect a repeat of the 1929 crash, when the US economy suffered a combined 29% drop over the 4 years of the Great Depression.

I do hate zombies, though.

Protecting Your Portfolio

What can be done to protect your portfolio? A number of strategies come to mind, but perhaps the simplest is to short TLT, the I-shares ETF that tracks 20 Year Treasury Bonds. This will cost you around 3% a year in interest payments (yep you owe the interest coupon if you short the ETF).

I put the likelihood of at least 2 interest hikes as very high. Better than 90%, in my view. You could make anywhere from 20% to 40% on any amount you short. So depending on how long it takes for TLT to drop, you’d still clear 17% to 37% on your short wager.

What’s the risk? That investors are so fearful of a crash that they flee to bonds (highly likely) sending TLT up and not down. And that they choose to use long term bonds to hedge this risk.

The latter, in my view, is not likely. Smart bond investors know how much TLT loses on every interest rate hike, whereas short term treasuries will offer safety from the storm without being susceptible to huge duration risk.

A long position in TLT is essentially a belief that despite everything, long term deflation will set in and stocks will permanently offer no growth. It’s a belief that getting a 3 to 5 percent return on your money over the next 20 years is the best you can hope for in a zero growth world. I believe a small minority investors hold this view.

For my own accounts, I’m using a combination of calendar and broken-wing put strategies on TLT and SPY. While complicated, these limit your risk if you’re wrong to what you stake, while offering between 4 and 17 times your stake if you’re right.

If you’re going to use options, make sure you give yourself enough time for this gloomy scenario to play out. I’d say at least 6 months to a year.

Good luck to everyone, but not the zombies!

Be the first to comment