SeanPavonePhoto/iStock via Getty Images

The telecommunications sector is highly competitive. Telecom operators have and will continue to spend hundreds of billions of dollars every year just to satisfy customer demand. All of this while achieving very limited growth due to the fierce price competition in the sector.

Therefore, it should not be a surprise to investors that the US telecom sector has greatly underperformed the S&P 500. Yet the stability of its cash-flows and the reliability of its dividends make it a very appealing sector for income-focused investors.

The situation in South Korea is no different. The telecom market is dominated by three major players: KT Corporation ADR (NYSE:KT), SK Telecom (SKM), and LG Uplus (OTCPK:LGUPF). Although these companies have also underperformed the S&P500, they have all experienced stable and increasing profitability, and KT is positioned to deliver outstanding returns in the next few years.

In this article, I will compare the performance and valuation of AT&T (T), Verizon (VZ), and KT, assess the benefits and risks of diversifying with KT, and present my investment thesis on KT.

Total Return Comparison

When comparing the total return of these 3 companies to the S&P 500, it is immediately clear that they have not been good investments during the last 10 years. They may have provided safe and stable dividends, but this has come at the expense of significantly lower returns.

We can also see that after 10 years of terrible returns, KT has started to outperform this year and has provided greater returns than Verizon and AT&T in the past 3 years. I will go further into the reasons for this outperformance and my expectation of its continuation later in the article.

| Company | 1-Year | 3-Year | 5-Year | 10-Year |

| S&P 500 | 15.57% | 67.44% | 107.97% | 288.73% |

| Verizon | -5.98% | -2.23% | 27.21% | 85.54% |

| AT&T | -15.70% | -5.31% | -19.81% | 42.49% |

| KT Corporation (ADR) | 24.67% | 20.27% | -5.38% | 12.56% |

Fundamentals Comparison

As we can see, the three companies are trading at very cheap valuations compared to the market. Nonetheless, KT is trading at a very sizable discount compared to both AT&T and Verizon while also having significantly lower leverage, giving it higher flexibility to return money to shareholders and invest in new profitable ventures.

I do have to mention that AT&T’s key ratios, leverage, and dividend yield will change after their spin-off of Warner Bros Discovery (WBD) in April, with an expected dividend yield of ~6% on the remaining company and no expected dividend from WBD.

| Company | EV/EBITDA | EV/EBIT | FCF Yield | Net Debt/EBITDA | Dividend Yield |

| Verizon | 7.51x | 11.16x | 9.01% | 2.8x | 5.02% |

| AT&T | 6.69x | 11.26x | 16.06% | 3.22x | 8.92% |

| KT Corporation | 2.31x | 7.87x | 18.60% | 0.99x | 5.57% |

Benefits and Risks of Diversifying with KT

Following are the major elements that you should consider when analyzing the benefits and risks of adding KT to your portfolio.

Regulatory factors

The telecom industry is one of the most regulated industries in the world due to its critical importance. Investing in KT will effectively diversify our regulatory risk between the US and Korea.

In the US, regulation of the industry has not been high, with the main risk concentrated around spectrum auctions and prices. Regulation could become more restrictive with the expansion of 5G and fiber, but it is unlikely.

In South Korea, regulation has been considerably restrictive. As a major player, KT mobile rates changes are required to be accepted by the Ministry of Science and ICT (MSIT). The MSIT also forces KT to give discounts to low-income subscribers and subscribers that do not want to accept mobile phones offered with subscription plans. These regulations have limited Average Revenue Per User (ARPU) growth in recent years. The continuation of these regulations or expansion to other services could severely impact KT’s operating profit.

Economic factors

Despite the fact that the telecom industry is more resilient to economic downturns than most industries, it is still negatively affected by them. It is true that the US economy has an enormous impact on the worldwide economy, but we can still benefit from diversifying our investments internationally.

South Korea’s economy has been extraordinarily resilient after the 1997 Asian financial crisis. Since the crisis, it has only had one year of negative GDP growth, 2020, and even then it was only -0.9%. In addition, it’s not experiencing high inflation like the US and Europe and its debt levels are very manageable, with a debt to GDP of 47% and a Fitch credit rating of AA-.

Political risk

Political risk in South Korea is low and mainly driven by the long-standing tensions with North Korea. There are also some existing bilateral tensions with Japan and China that have affected its economy in the past and could continue to affect it.

Currency risk

Investing in KT will inevitably expose us to movements in the exchange rate of the Won. Although the Won has had very low volatility since the financial crisis of 2008, its price against the dollar went down by almost 8% last year. Currency movements like this could happen again and severely impact our position.

AT&T and Verizon Future Prospects

Verizon

In 2021, Verizon made massive investments to secure its future growth:

- It acquired Tracfone, the largest prepaid mobile virtual network operator (MVNO), for $6.9 billion to reinforce its prepaid and “value-oriented” business. This will lead to significant synergies as all Tracfone customers move to Verizon’s network.

- It spent $52.9 billion to acquire an average of 161 MHz of C-band spectrum, effectively doubling its mid-band holdings, which will be crucial for the expansion of its 5G network.

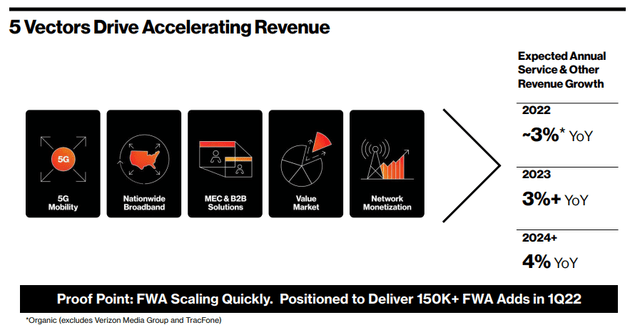

These investments greatly increased the leverage of Verizon, and the company will have to continue investing large amounts in its 5G network. On the other hand, these investments are not expected to lead to significant growth, with Verizon forecasting 4% growth annual revenue growth from 2024 and similar adjusted EBITDA growth.

Verizon Investor Day 2022 Presentation

AT&T

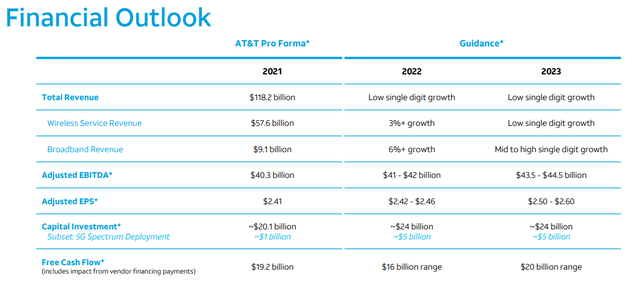

After the spin-off of WBD is completed, AT&T will be in a very similar position to Verizon, investing heavily in 5G and fiber expansion to achieve not-so-great growth. AT&T is currently forecasting low single-digit revenue growth and slightly faster EBITDA growth.

KT Corporation

KT was founded in 1981 as a fully state-owned firm and is South Korea’s first telecommunications company. It was privatized in 2002 and since then it has expanded greatly, launching and acquiring new businesses in other sectors such as media, cloud services, financial services, and real estate.

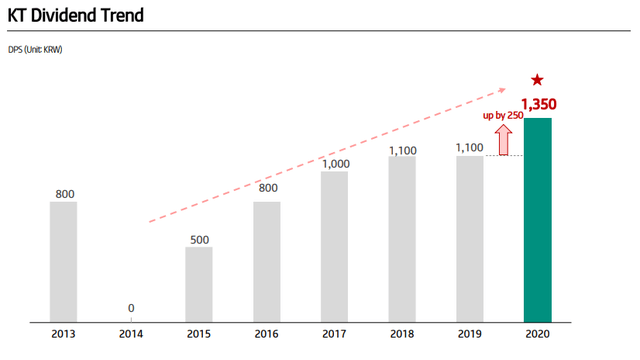

Since the change of CEO and reorganization of the company in 2014, KT has disposed of non-core businesses, reduced net debt, and achieved significant EBITDA growth. The company has also implemented a dividend payout ratio of 50% of adjusted net income, which has led to a fast-growing dividend, with a declared dividend of 1950 KRW (5.57% yield) per share for 2021, a 41.5% YoY increase.

KT Dividend Trend (KT Feb 2021 IR Presentation)

The company is forecasting revenue growth of ~4.5% and operating income growth for 2022, which will lead to an increasing dividend on a share price that has remained mostly flat for the last 10 years. In contrast to Verizon and AT&T, KT’s peak investment years for 5G and fiber are behind them.

I do have to mention that a sizable part of the jump in profitability in 2021 is due to non-recurring valuation gains in some of KT’s holdings and therefore it is highly likely that net income will go down in 2022 (The valuation metrics used in the article are adjusted to take this into account). However, the dividend of 1950 KRW was set using adjusted net income and is expected to grow in 2022. For reference, the reported EPS was 5747 KRW while the dividend is set at 50% of adjusted net income, so the adjusted EPS was around 3900 KRW.

| In Won, billions | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Sales | 23,790 | 23,811 | 23,422 | 22,281 | 22,744 | 23,387 | 23,460 | 24,342 | 23,917 | 24,898 |

| Gross Profit | 10,524 | 5,811 | 4,854 | 5,474 | 5,650 | 5,801 | 6,568 | 6,541 | 6,503 | 7,190 |

| EBITDA | 4,482 | 4,406 | 3,413 | 4,618 | 4,785 | 4,740 | 4,522 | 4,764 | 4,767 | 5,252 |

| EBIT | 1,214 | 839 | -363 | 1,279 | 1,440 | 1,375 | 1,240 | 1,125 | 1,133 | 1,644 |

| Net Income | 1,087 | -162 | -1,055 | 411 | 711 | 477 | 688 | 619 | 658 | 1,357 |

| Net Debt | 9,165 | 9,001 | 10,649 | 5,939 | 4,500 | 3,776 | 2,950 | 4,884 | 4,628 | 5,423 |

Like many Korean major companies, KT owns and operates many different businesses and subsidiaries that operate in unrelated industries. Because of this, making an accurate valuation of the company is somewhat complicated. In the case of KT, its businesses can be segmented into 6 major areas:

Telecom for Consumers

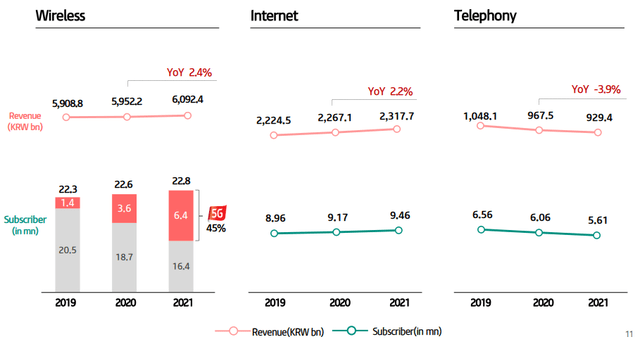

The Telco B2C unit is the biggest, making up ~60% of the service revenues of KT (without taking into account its subsidiaries). It has experienced very small revenue growth, with a 3-year CAGR of only 0.9%. Limited ARPU growth due to fierce price competition, regulation, and the secular decline in demand for fixed-line telephony have caused this unit to underperform.

Revenue and ARPU growth are expected to accelerate in the next few years thanks to the rise in 5G subscribers, but I do not expect this unit to grow at a higher rate than 3%. The growth prospects for this unit are similar to those of AT&T and Verizon, growing at/below GDP growth.

KT Telco B2C (KT Feb 2022 IR Presentation)

Telecom for Businesses

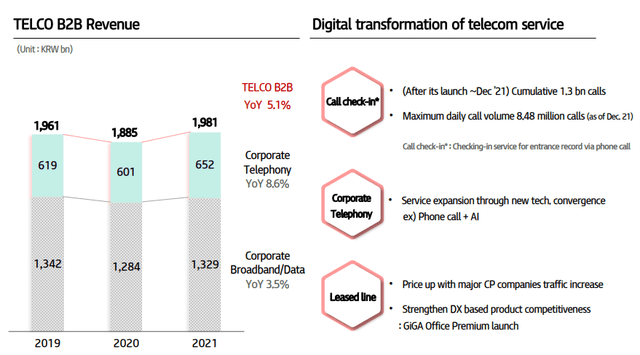

The Telco B2B unit has also underperformed, with a 3-year CAGR of just 0.5%. Although this underperformance can be attributed to a small decline in revenues in 2020 due to Covid, my long-term expectations for this unit are the same as the Telco B2C, growing at/below GDP growth.

KT Telco B2B (KT Feb 2022 IR Presentation)

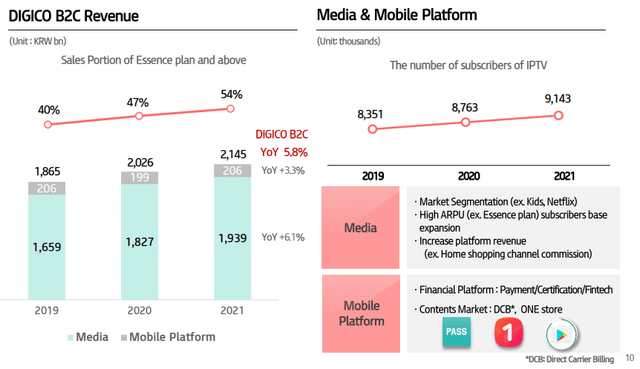

Digital Services for Consumers

The Digico B2C unit has grown at a fast pace, achieving a 3-year CAGR of 7.2%. KT IPTV subscribers have experienced significant growth due to increasing consumer demand for streaming media and bundling promotions.

KT currently has a market share of 35.9% of the Pay TV market in Korea, giving it a major stronghold against international competitors. Apart from its own Pay TV service, it also offers the most popular international streaming services such as Disney+ and Netflix.

KT Digico B2C (KT Feb 2022 IR Presentation)

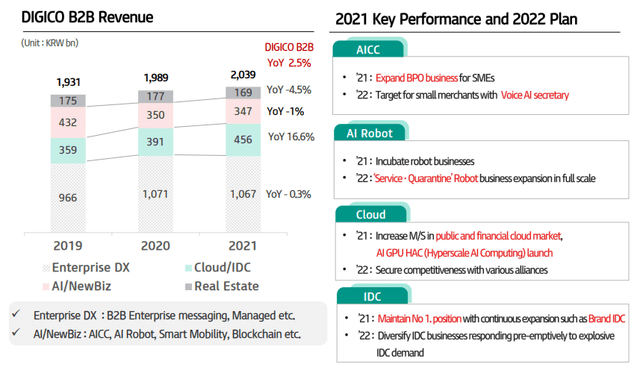

Digital Services for Businesses

The Digico B2B unit had a 3-year CAGR of 2.7%. KT is the biggest cloud services and digital transformation (DX) provider among local companies in Korea, competing mainly with Amazon (AMZN) and Microsoft (MSFT).

Even though the growth of this unit has been lackluster, it is expected to accelerate, especially after KT’s investment and partnership with Shinhan Financial Group (SHG), one of South Korea’s largest financial groups.

This unit also includes the rental income from investment properties held by the parent company but does not include the results of its real estate subsidiary KT Estate.

KT Digico B2B (KT Feb 2022 IR Presentation)

Finance

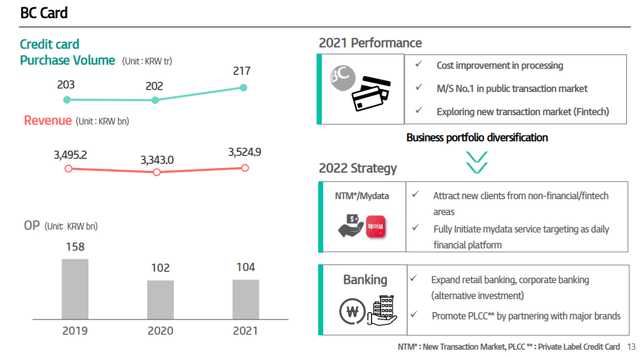

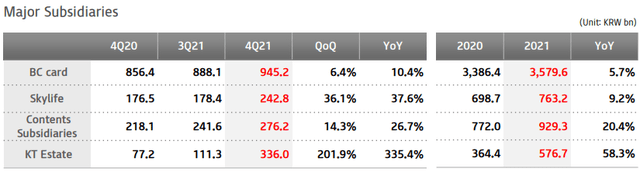

KT currently holds a 69.5% stake in BC Card, South Korea’s largest payment processing company. BC Card’s earnings and revenues have been significantly impacted by the pandemic and heavy competition from Shinhan Card, Hyundai (HYMTF) Card, and Samsung (OTC:SSNLF) Card.

In addition, BC Card is subject to significant regulatory risk. The Korean Financial Services Commission (FSC) and Financial Supervisory Service (FSS) announce periodic guidelines every three years for card processing fees. In November 2018, the FSC and FSS announced guidelines reducing credit card processing fees paid by merchants from a range of 2.05% to 2.17% to a range of 1.4% to 1.95%, which heavily impacted BC Card’s revenues and profits.

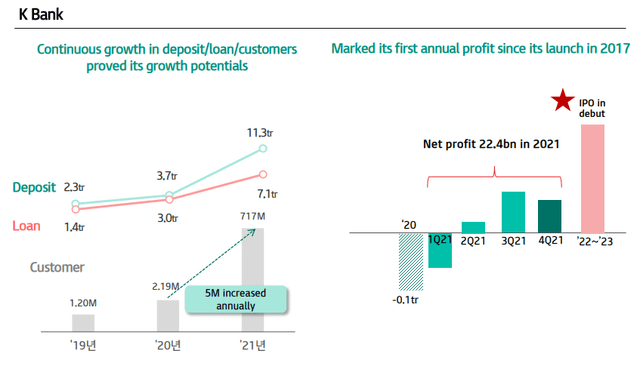

BC Card (KT Feb 2022 IR Presentation)

BC Card has a 33.7% stake in K Bank, one of the only three online banks in South Korea which has experienced exceptional growth. K Bank is expected to IPO in 2023, and it was valued at $6.9 billion by Morgan Stanley (MS) in August 2021. At this valuation, KT’s effective stake (23.42%) would be worth ~$1.6 billion, ~24% of its current market capitalization. This IPO could be a significant catalyst for the value of KT’s shares and potentially unlock capital to return to shareholders.

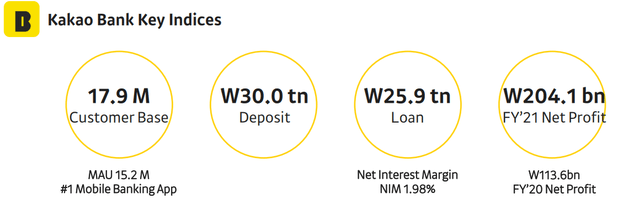

In comparison, Kakao Bank, K Bank’s biggest rival, is currently valued at $20 billion after its IPO last year. It is also around 3 times larger than K Bank, which makes the valuation of $6.9 billion seem a bit optimistic now but realistic by the time of its IPO.

Kakao Bank 2021 Results (Kakao Corp 2021 IR Presentation)

K Bank (KT Feb 2022 IR Presentation)

Others

Apart from BC Card, KT separately reports results for three other major subsidiaries:

KT Skylife

KT Skylife is 50.3% owned by KT. It offers satellite TV services and had a 3-year CAGR of 3.2% with similarly rising profits. In September 2021, it acquired Hyundai HCN for 515 billion Won ($420 million). In 2021, Skylife was just 4% of KT’s consolidated operating profit.

Contents Subsidiaries

This segment is made up of three subsidiaries:

Nasmedia, 44% owned by KT, provides a variety of services for advertising agencies, online media companies, and their clients. It had a 3-year CAGR of 5.14% and was 2% of KT’s consolidated operating profit in 2021.

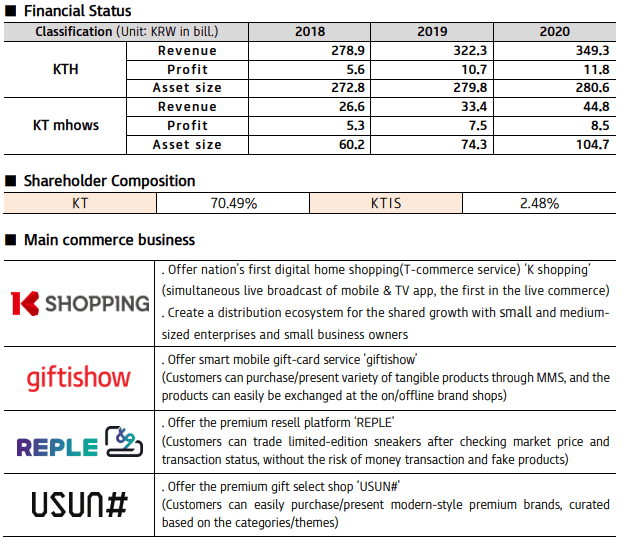

The recently created KT alpha, of which KT directly owns 70.5%. KT alpha was created last year by the merger of KTH (South Korea’s first Television-commerce service) and KT mhows (the No. 1 mobile coupon provider in the B2B market).

Although KT alpha is a small part of its overall business, it is expected to triple its Gross Merchandise Value (GMV) by 2025 (from KRW 1.4 trillion in 2020 to KRW 5 trillion), as it launches a commerce solution platform business and expands its Direct 2 Consumer (D2C) business.

KT alpha (KT IR Newsletter “KTH merges with KT mhows to establish kt alpha”)

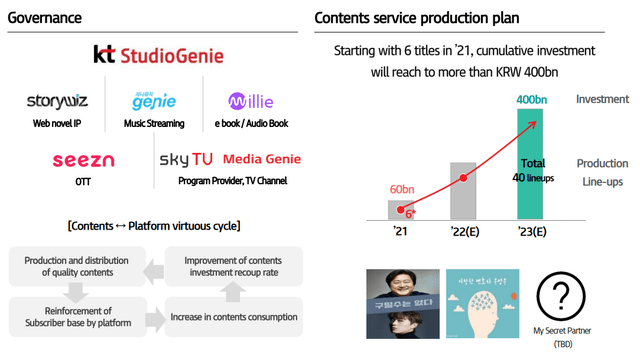

The recently created KT Studio Genie, 90% owned by KT, was created by combining many of the media platforms and content production companies that KT owns. It recently received a valuation of 1 trillion Won ($820 million) after selling a 10% stake to CJ ENM, a leading media company in Korea.

KT Studio Genie (KT Feb 2022 IR Presentation )

KT Estate

KT Estate is 100% owned by KT. It engages in the planning, development, sale, and leasing of residential complexes and commercial buildings. The revenues and profits of this business are very volatile due to their nature.

In 2021, it posted an unusually high profit of 213 billion Won due to a major sale. However, its average operating profit from 2018 to 2020 was just 38 billion Won, around 3% of KT consolidated profit.

Conclusion

KT Corporation offers an especially appealing value proposition to telecom investors that want to enhance their returns, reduce their exposure to the US, and have the risk tolerance to diversify internationally.

KT’s cheap valuation, superior growth profile, and rapidly increasing dividend make KT a strong buy. There is a high likelihood that KT’s valuation multiples will expand as its dividend yield grows and K Bank approaches its planned IPO in 2023. At a very achievable 3.5x EV/EBITDA multiple, the ADR shares would trade at $23.74, almost 70% higher than the current price of $14.23.

Be the first to comment