Pollyana Ventura/E+ via Getty Images

Gogo Inc. (NASDAQ:GOGO) reported excellent Q3 numbers earlier this month. Nobody wrote about this fast-growing $2.2 billion in-flight internet service provider’s emerging rebound story. I agree with the buy rating that Seeking Alpha has for Gogo. My core thesis is that the -23.89% 6-month price performance of GOGO is an opportune buy-in window for a rebound bet. GOGO trades at less than $16, well below its 52-week high of $23.69.

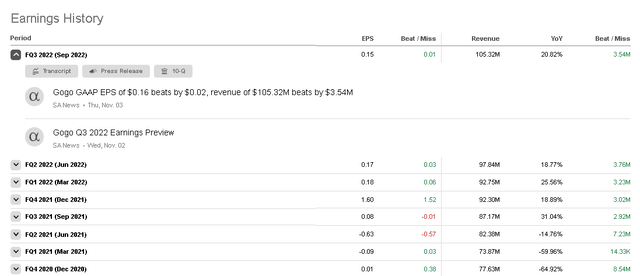

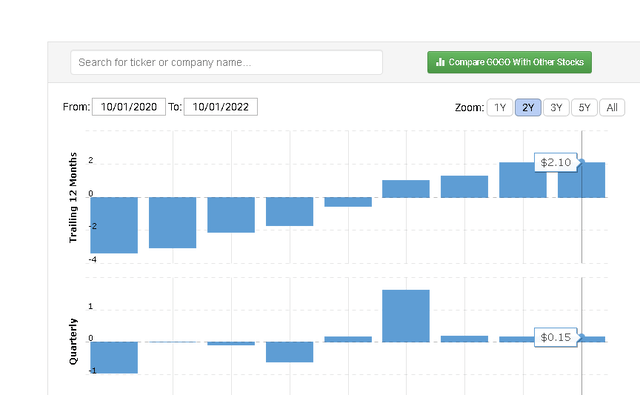

There’s an emerging bounce-higher momentum for GOGO after its excellent Q3 performance. The +10.14% 1-month rally for GOGO is largely thanks to its Q3 GAAP EPS of $0.16 (beats by $0.02) and Q3 revenue of $105.32 million (beats by $3.54 million and is +20.82% Y/Y). Gogo has beaten quarterly revenue estimates for the past eight quarters.

Gogo has beaten EPS for the past four consecutive quarters. The statistical record of rising growing top line and bottom line numbers might just encourage more investors to rally around GOGO. We do not need to be expert linear regression analysts to say that Gogo will most probably beat Q4 estimates of $0.15 EPS and revenue of $107.29 million.

If my Q4 prediction proves true, the average $20.40 price target of Wall Street analysts for GOGO might just happen by January or February next year. Since I am not a professional, my PT for GOGO is only 22x forward P/E multiplied by $0.88 EPS for fiscal year 2023, and we get $19.36. I know my 22x forward P/E multiple is higher than my usual template of 20x forward P/E for growth stocks.

The Emotional Technical Barometers Are Positive

I cannot call GOGO a GARP stock. I am only happy to report that GOGO has a short-term bullish trade signal called Stochastic OverBought Buried. It means the fast stochastic of GOGO is above 80 and has been above 80 for the fast five trading days. The fast stochastic score of GOGO is currently 85.38.

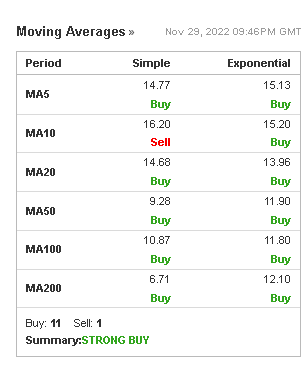

The Relative Strength Index score of GOGO is already bullish at 58.73. If you like Simple Moving Average or Exponential Moving Average to make technical decisions, they are both endorsing GOGO as a buy.

Investing.com

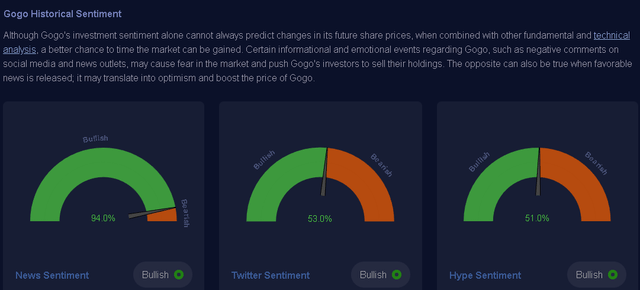

The internet and social media are now also important barometers to gauge the general public’s perception of a particular stock. The sentiment analysis result is also bullish for GOGO. There’s no recent news or information leak that could derail GOGO’s upward momentum.

Author Account of Motek Moyen @Macroaxis.com

Improving Growth Story

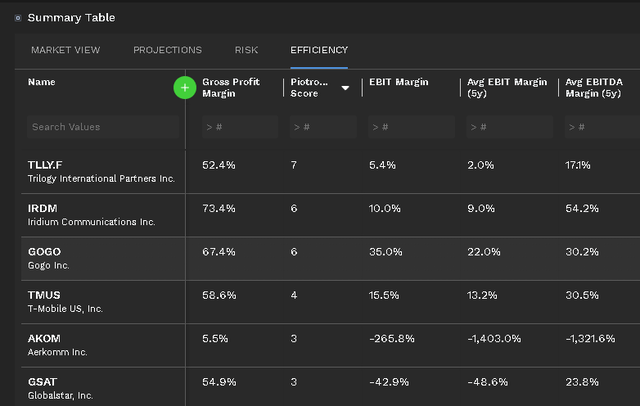

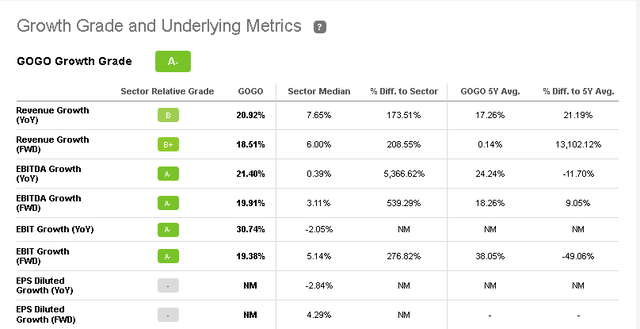

I am justifying my 22x forward P/E by pointing out that Gogo Inc boasts a net income margin of 72.93% and a TTM revenue CAGR of 20.92%. I cannot fully comprehend why Gogo touts a higher net income margin than its gross margin of 67.43%. I cross-referenced Seeking Alpha Quant’s margins for GOGO on Finviz, they are the same.

Gogo is outpacing the average 7.65% growth rate of the Communication Services sector. This feat is good enough reason to invest in this company.

Gogo Inc is still profitable while delivering a 20.92% TTM sales growth. The management is not sacrificing margins to grow its Business Aviation business. The chart above is why Gogo is a legit growth stock that happens to have a sweetheart partnership with Luxembourg-based Intelsat.

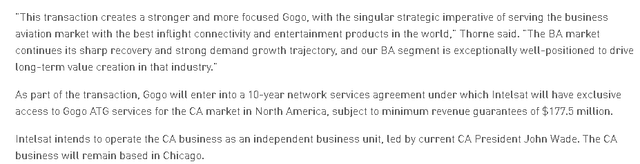

The $400 million sale of the Commercial Aviation to Intelsat in 2020 obviously helped GOGO become profitable for the past two years.

I do not have access to the exact terms between Gogo Inc and Intelsat. I checked and found out that Commercial Aviation is still being marketed through gogoair.com. As per the original 2020 announcement, the $400 million deal was bundled with a 10-year contract services agreement with Intelsat. Here’s the screenshot illustrating just how beneficial the deal was for GOGO. That guaranteed minimum revenue of $177.5 million for giving Intelsat exclusive access to Gogo ATG services in North America is commendable.

It only matters to me that the partnership was great for the bottom line and balance sheet of Gogo. The Piotroski F-score of GOGO is 6, denoting it as efficient and a good value investment.

Premium Account of Motek Moyen at Finbox.io

High profitability is important because it will eventually help Gogo Inc. pare down its $787.64 million debt. This is the most obvious downside risk for GOGO. Its debt load is much higher than its TTM cash & investments of $177.52 million. The side effect of this disparity is probably why GOGO only has a TTM levered free cash flow of $1.8 million.

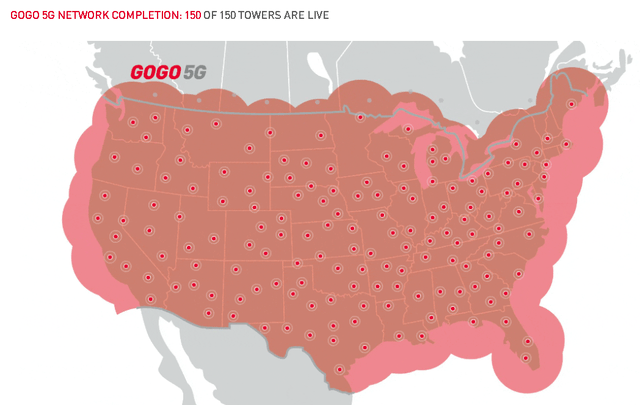

Gogo’s management can focus on its remaining Business Aviation in-flight internet service to generate better profitability. The Gogo 5G network for Business Aviation is now complete for business aircrafts operating in the U.S.A. There’s a good probability that these completed 150 5G towers could help deliver my $19.36 price target for GOGO.

My Verdict

You need to heed the buy recommendation that Seeking Alpha has for Gogo Inc. The partnership with Intelsat is doing wonders for GOGO’s bottom line and topline numbers. The emotional technical indicators are bullish for GOGO. This week is a suitable time to accumulate more GOGO shares.

The in-flight internet/Wi-Fi business is growing at a 17.14% CAGR and it will be worth $14.31 billion by 2027. The 150 tower strong Gogo 5G network in the United States should help GOGO maintain or even improve its 20.7% TTM revenue CAGR.

Be the first to comment