MCCAIG/E+ via Getty Images

Co-produced with “Hidden Opportunities”

Did you know that if the Dow loses 300 points or more on two consecutive trading days and the sun rises in the East on the third day, it is an indication that the U.S. economy may face a recession in the next 15 years?

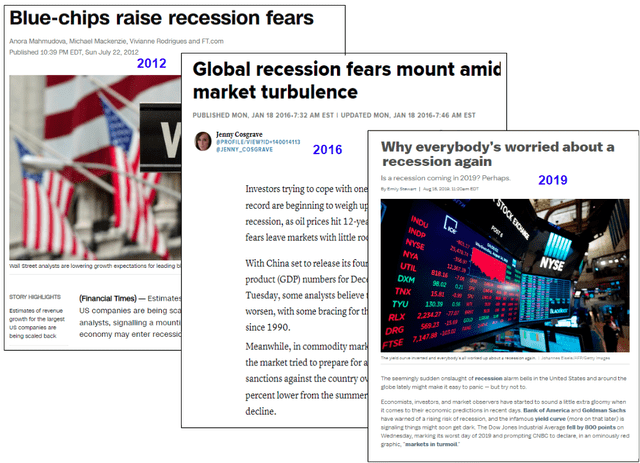

Sorry, I had to begin with a dash of humor. But all kidding aside, every day, we hear more voices express concerns about a potential recession. The bigger the individual (or firm) making the possible projection, the more significant the impact on daily stock prices. Truth be told, we see and hear such news every few years.

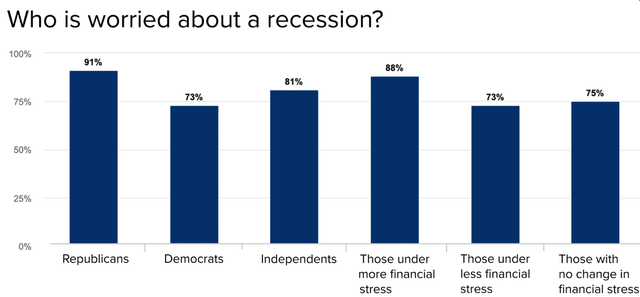

Fear sells effectively. Analysts are always busy searching for signs that might predict a downturn and portray a compelling thesis. As a result, we have a volatile market, and everyone, including the average Joe and Jane, is freaking out. (Source: CNBC)

If you fear every call for a recession and liquidate your equity positions, you will never be a successful investor. All this panic, words of caution, and proactiveness from major institutions are making me bullish about the market’s near-term prospects. Keep reading to find out why.

This Fearful Market Is Making Me Bullish

I’ll tell you a story.

When I first learned to ride a bicycle, my dad insisted on safety. So, I wore a helmet, knee pads, gloves, elbow and shin guards, and closed-toe shoes. My first bicycle had rear mirrors and training wheels. I made frequent stops and was aware of my surroundings at all times. I grew even more cautious when the training wheels were off and never crashed or seriously injured myself.

As years went by, I grew more confident with my riding skills and didn’t bother wearing the helmet and other protective gear. I became less and less cautious, and one night, my bike slipped, and I fell and gained some new scars that had me re-evaluating my confidence.

As years went by, I grew more confident with my riding skills and didn’t bother wearing the helmet and other protective gear. I became less and less cautious, and one night, my bike slipped in a puddle of water and left deep scars that I still have.

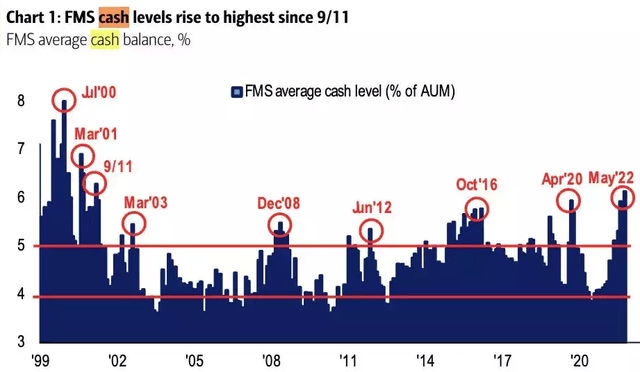

Today’s market conditions remind me of my bike riding experience. Investors are highly cautious, and hedge funds have accumulated the highest cash position since 9/11.

BofA Global Fund Manager Survey

It is interesting to note that the same was true in April 2020 and October 2016. Cash is trash, and every professional investor knows it. Institutions have to deploy the capital somewhere (and do it soon), and the U.S. remains the investment oasis of the world. Excess cash on the sidelines is a bullish sign for the equities market. The funds will make their way back into the market, starting with recession-proof and defensive sectors and then propagating to other industries. Notably, even the 9/11 tragedy used as the reference for hedge fund cash balance in the past 20+ years didn’t push the U.S. economy into a recession.

Let hedge funds do their usual dance; I will heed the words of my investment gurus.

Nobody can predict interest rates, the future direction of the economy or the stock market. Dismiss all such forecasts and concentrate on what’s actually happening to the companies in which you’ve invested. – Peter Lynch

Not Every Bear Market Results In A Recession

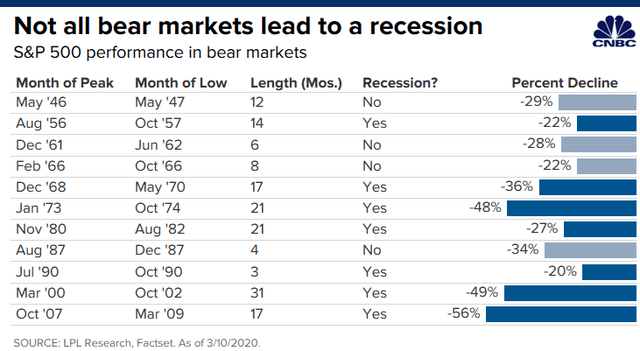

Five out of the last 12 bear markets (including March 2020, which isn’t shown in the image below) were followed by no economic recession.

That puts recession possibilities at 58%, an “F” Grade by U.S. academic grading standards. Is that good enough for you to be fearful?

Everyone Loves Statistical Analysis. Here Is One To Make You Feel Better:

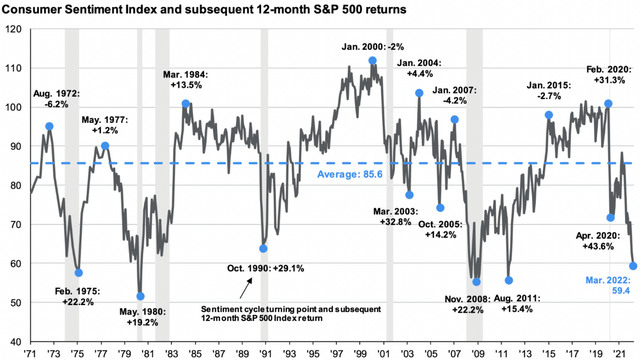

University of Michigan periodically surveys consumers and generates a consumer sentiment index metric. Every time this consumer sentiment index drops below its 50-year average, the S&P has rallied over 20% (on average) in the next 12 months.

The consumer sentiment stood at 58 towards the end of May. Do I take this as a bullish sign for the markets? It doesn’t matter. Please keep reading to understand why my method of investing doesn’t fear bear markets.

Staying In Cash To Invest Later? Think Again.

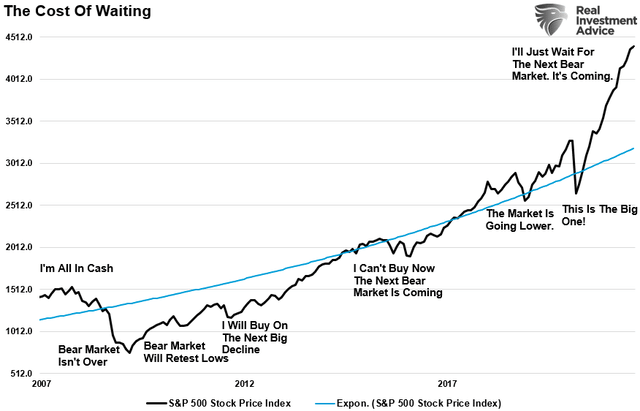

There is no shortage of news alerts warning us about economic hurricanes. Trading forums are filled with messages from traders claiming to be 70-90% in cash. This is causing ordinary investors to feel they missed the optimal time to liquidate, but most wonder if it would be wise to liquidate now, preserve what they have, and buy when the market bottoms.

You may go ahead and sell, but remember that no one will notify you that the market has bottomed and that a new bull run begins. This was true during the dot-com bubble, the great financial crisis, and even as recent as March 2020. There was so much pessimism on the streets that everyone called it a “dead cat bounce.” The truth is, the average investor who is shaken out of their equity position during a bear market will most likely miss the optimal opportunity to buy and is well-positioned to stay uninvested through a substantial rally.

Today people who hold cash equivalents feel comfortable. They shouldn’t. They have opted for a terrible long-term asset, one that pays virtually nothing and is certain to depreciate in value. – Warren Buffett in 2008

Instead of selling now and staring at stock charts and trading forums like a hawk, I feel much better knowing my money stays invested in dividend-paying, quality assets that have the ability to withstand economic hurricanes.

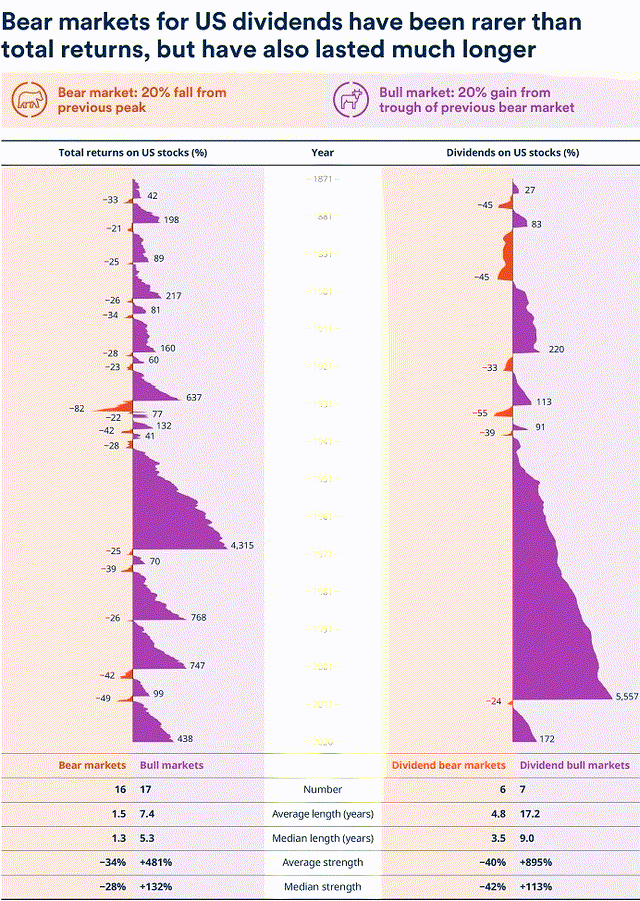

At HDO, we believe in the income method of investing. We invest in assets that pay us cash today and have the ability to pay us cash during difficult times. While past performance isn’t indicative of the future, the concept of returning excess profits to investors through dividends is a robust one. This is why in the past 149 years, there have been only six bear markets that affected dividend payments (compared with 16 bear markets for total returns).

As with all equities, dividend stocks may lose some value during a downturn, but as long as they continue producing income, why would I sell and wait for some songbird to sing the arrival of a new bull market?

Shutterstock

Conclusion

Recessions are inevitable. It is part of the economic cycle. No matter how strong the economy is, there will be rapid growth phases, slowdowns, and recessions. No one can accurately predict when each stage will happen. These phases are often confirmed after we have been through several months of it.

Today, every prominent analyst provides their opinion about a “likely” recession and spreading fear, not unlike in past years. Remember, these analysts don’t work for you and maintain no obligation to tell you when the coast is clear to begin buying equities. The income method is built to withstand uncertainty. Instead of worrying about things that no one can effectively predict, I am buying dividend stocks hand over fist. It is easy because they are cheaper now, and I get paid to wait for the tide to turn.

The interest rate curves, the Fed dot plot projections, or the underwear index (I was surprised by this one too) – stop finding excuses to stay on the sidelines, fearing a recession. These fears will always exist. Your hasty actions are more likely to cause harm than good. But looking at Mr. Market’s proactiveness today, I am very bullish about the safety of the U.S. markets. I’ll start getting worried about a downturn when everyone decides one isn’t coming.

Be the first to comment