MadamLead

Utilities Were Not Hit by The Bearish Sentiment in The US Stock Market

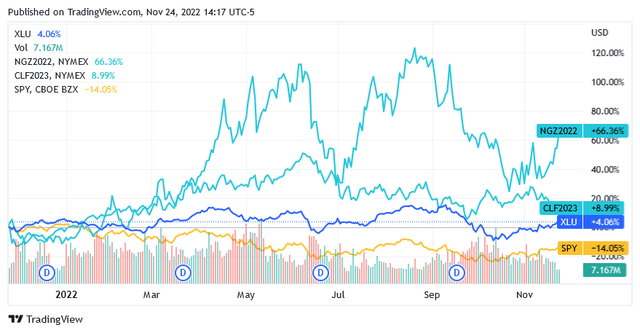

Rising natural gas (NGZ2022) and crude oil (CLF2023) prices helped the Utilities Select Sector SPDR Fund (XLU), the proxy index for US-listed utility stocks, to improve its share price performance over the past year and outperform the US stock market, as shown in the chart below. The SPDR S&P 500 (SPY) is a proxy index for the U.S. stock market.

Fossil fuels, which are expected to become more expensive than they are today, will continue to fuel the upbeat mood among utilities.

Analysts are forecasting that crude oil WTI futures – January 23 (CLF2023) will rise about 21% over the next 12 months from current levels and natural gas futures – December 22 (NGZ2022) will rise about 14%.

Pampa Energía S.A.

To seize the moment in the utility companies, investors should consider holding shares in Pampa Energía S.A. (NYSE:PAM) as the company’s operations demonstrate a strong commitment to delivering good results in conjunction with rising fossil fuel prices.

About Pampa Energía S.A. in the Utilities Sector

Headquartered in Buenos Aires, Argentina, Pampa Energía S.A. is an integrated energy company that operates through the following three businesses.

The first business area deals with power generation and transmission in Argentina.

The second business area concerns the exploration and production of oil and gas.

The third business area includes the distribution of petrochemicals.

Power Generation and Transmission in Argentina

In addition to hydroelectric power plants and wind turbines, the company can use the dynamics of thermal generation plants in combination with open gas turbines to generate electricity.

The company is capable of generating nearly 5,000 megawatts of electricity, which is transmitted throughout Argentina’s territory via its 21,500 km high-voltage power grid.

Pampa Energía S.A. should account for about 15% of the total installed electricity capacity of Argentina, while its electricity transmission grid should also be relevant in the Latin American country according to this electricity grid data about Argentina.

The Exploration and Production of Oil and Gas

Pampa is Argentina’s leading gas and oil exploration and production company, and its operations are concentrated in the country’s major mineral basins.

Specifically, Pampa Energía’s upstream assets consist of mineral interests in 13 production blocks and 5 prospects in known fields in Argentina, including the prolific mining districts of Comodoro Rivadavia [Chubut Province] and Neuquén [Plaza Huincul].

Pampa Energía accounts for 8% of Argentina’s total acreage devoted to energy minerals.

Pampa produces natural gas and crude oil from all proven reserves located entirely within Argentina, representing 157 million barrels of oil at the end of 2021. Natural gas accounted for 92% of these total mineral resources and oil fields for 8%. Plus, the resources were 61% developed and the remainder of 39% undeveloped.

The company is currently producing approximately 5,000 barrels of oil on a daily production basis combined with approximately 316 million cubic feet of natural gas.

The Sale of Petrochemicals

The company owns several industrial plants in the province of Santa Fe that produce a wide range of petrochemical products that, thanks to the existing logistics and export infrastructures, serve domestic and international markets.

The complex produces 50,000 tons of liquefied gas and 155,000 tons of aromatics for the modern petrochemical industry, and 290,000 tons of gasoline and refined products.

It also produces 160,000 tons of styrene and 55,000 tons of SBR [styrene butadiene rubber], as well as 180,000 tons of ethylbenzene and 31,000 tons of ethylene for the plastics markets.

Sky-High Energy Prices Led to Impressive Third-quarter 2022 Results

The strong positive relationship between the company’s business and energy and fossil fuel prices led to impressive financial results for the third quarter of 2022.

For the third quarter of 2022, Pampa Energía S.A. announced that total revenue was $507 million, a 17% increase over revenue for the same quarter last year. Sales exceeded most analysts’ expectations, as their average forecast was $496.8 million.

Sales benefited from the peak natural gas season combined with price increases in petrochemicals.

During the quarter, Pampa Energía S.A. reduced power generation following the termination of two power purchase agreements [PPAs] for the Loma De La Lata thermal power plant and the Piquirenda thermal power plant.

However, headwinds were more than offset by higher hydrocarbon and petrochemical sales volumes and prices.

Pampa Energía S.A. generated 3,767 gigawatt-hours in the third quarter of 2022, compared to 4,512 gigawatt-hours in the third quarter of 2021, or 17% lower year-on-year, resulting in a 22% year-on-year decline in gross margin in the power generation and transmission segment to $24.2 per megawatt-hour.

Hydrocarbon production grew 19% year-on-year to 68,500 barrels of oil equivalent per day in Q3 2022 from 57,400 barrels of oil equivalent per day in Q3 2021.

The total production of Pampa Energía S.A. was 92% gas in both years, which means that the margin of the hydrocarbon segment will depend heavily on the expected significant further improvement in gas prices.

The portfolio’s high exposure to natural gas markets will offset the lower energy production, as the price of electricity is generally pegged to the price of gas.

In terms of prices, the average price realized from the sale of one million British Thermal Units [MBTU] of gas in the third quarter of 2022 increased by 9% year-on-year to $4.8. The average price realized from the sale of a barrel of crude oil in the third quarter of 2022 rose 14% year-on-year to $70.2.

In terms of its petrochemicals business, the company reported a good level of profitability despite a 7% year-on-year decrease in sales volume to 120,000 tons in the third quarter of 2022. The growth stemmed from a 34% YoY increase in the average realized price of $1,496 per ton of petrochemicals sold in Q3 2022.

Bullish fossil fuel markets boosting petrochemicals will continue to be an inseparable link in the coming months.

Adjusted EBITDA of $246 million reported by total operations for the third quarter of 2022 was marginally lower by 5% year-on-year primarily due to the reduction in power generation.

The shareholders of Pampa Energía S.A. however, benefited from a whopping 35% improvement of the attributable profit to $176 million, despite tighter tax rates imposed by the government in the energy and utility industries.

Pampa Energía Q3 GAAP earnings were $3.23 per American Depositary Receipt [ADR], beating analysts’ median forecast by $2.48.

The Financial Condition

Pampa Energía’s financial position appears to be robust, although net debt increased slightly to $927 million as of September 30, 2022, from $865 million as of December 31, 2021.

However, the net leverage ratio [debt-to-EBITDA] of 1.3x is significantly better than the industry median of 4.49x.

The debt to EBITDA ratio measures a company’s ability to repay the debt it had to take on to fund its operations. Because oil, gas, and utilities are typically massively indebted businesses, this ratio is useful as it determines how long it takes annual EBITDA to pay off the outstanding debt. Usually, a ratio above 3 raises a red flag.

Additionally, Pampa Energía has an Interest Coverage Ratio of 2.61x, meaning that the company can easily afford the debt in terms of interest expense to be paid, as a minimum ratio of 1.5 is generally considered reasonable by investors.

This ratio is calculated as a 12-month operating income of $534.4 million as of September 30, 2022, divided by a 12-month total interest expense of $204.7 million as of September 30, 2022.

There Is Still Room For Improvement In the Price of ADRs

The ADRs are trading at $26.70 per unit as of this writing, giving a market cap of $2.91 billion and a 52-week range of $16.35 to $27.95.

The ADRs are well above the long-term trend of the 200-day simple moving average line of $23.06.

The ADR price is high compared to recent market valuations, but this does not trigger a sale.

It makes sense to continue holding ADRs of this stock for the following reasons.

Comparing the third quarter of 2022 to the third quarter of 2021, natural gas futures – December 22 (NGZ2022) are up 83% and WTI crude oil futures – January 23 (CLF2023) are up 30%.

As a result, not only have Pampa Energía’s quarterly sales and profits increased, but so did ADRs year over year. The stock market value improved 44% from the median price of $16.45 in the third quarter of 2021 to the median price of $23.59 in the same quarter of 2022.

Furthermore, Pampa Energía S.A. outperformed the SPDR S&P 500 as this benchmark index for the US stock market fell 10% in Q3 2022 compared to Q3 2021.

Therefore, a stake in Pampa Energía S.A. helped retail investors achieve the following dual objective.

To mitigate the negative impact on portfolio value stemming from declining sentiment in US equity markets and the impact of galloping inflation on the currency’s purchasing power.

Expensive energy bills caused the prices of goods and services to rise quickly as companies had to cover operating costs, but also significantly improved Pampa Energía’s sales and profits, resulting in a sharp rise in the price of the ADRs.

While this was happening, the Federal Reserve’s rate hike, aimed at calming runaway inflation, sparked a major sell-off in US stock markets, particularly US-listed tech stocks. This is because investors were weighing the prospect of a recession or had lower present values due to the application of greater discount rates to estimated future cash flows.

Some investors were also buoyed by the opportunity to lock in higher coupons on bonds or were attracted by a stronger US dollar.

Looking ahead, there is no reason why the same theme should not be continued, so that Pampa Energía S.A. could still outperform the stock market.

The Federal Reserve is likely to continue raising interest rates in an attempt to lower annual inflation from 7.7% in October [the target is 2%], although this could slow the pace. The war in Ukraine, global geopolitical tensions and OPEC’s reluctance to send more barrels of oil will put upward pressure on spot prices for natural gas and oil.

Going forward, fossil fuels are expected to become more expensive, which combined with strong operating activities will support the positive sentiment the market has for Pampa Energía S.A.

Analysts’ Estimates of Earnings and Sales

Analysts estimate a 9.15% drop in EPADR to $4.05 in 2022, but a 77.88% hike to $7.20 in 2023.

Analysts estimate a 22.32% growth in revenue to $1.63 billion in 2022 and a 16.01% jump to $1.89 billion in 2023.

Conclusion

Holding this stock is a hedge against headwinds from the ongoing bearish sentiment in the US market. Plus, a position in Pampa Energía S.A. still implies the potential for good returns.

This stock should climb price levels.

Be the first to comment