David Ramos

When Nokia Oyj (NYSE:NOK; OTCPK:NOKBF) reported third quarter results, investors sold the stock. NOK shares lost around 7% after the market opened. The report contrasts with Nokia’s Q2/2022 earnings smasher. What did shareholders dislike in the results?

Third Quarter 2022 Results Beat Estimates

Nokia reported revenue growing by 16% from last year to EUR6.2 billion. Its non-GAAP earnings per share beat estimates by a penny. Strong demand lifted the firm’s mobile networks revenue by 12% Y/Y, thanks to easing supply constraints. In contrast, revenue from Nokia’s Cloud and Network Services fell. It rebalanced its portfolio by re-weighting its efforts toward more profitable deals. Overall, operating margins topped 10.5%, down slightly from last year.

Nokia Technologies posted weaker results due to the negative timing of contract renewals. Investors are overreacting, instead of waiting for the company to realize a stronger performance in future quarters.

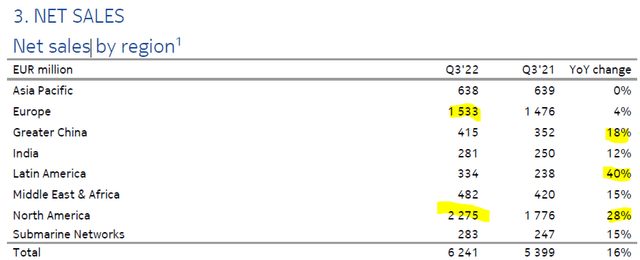

Overall, net sales grew on a YOY basis in Greater China, Latin America, and North America. In future quarters, Nokia sales in China may accelerate. The company achieved strong growth despite Covid-related lockdowns throughout the second quarter.

Europe is a major contributor to net sales. In the next two quarters, strong inflationary pressures from rising energy costs may slow Nokia’s sales. Fortunately, North America is the biggest contributor to net sales. This would offset its weaker performance in other regions.

Opportunity

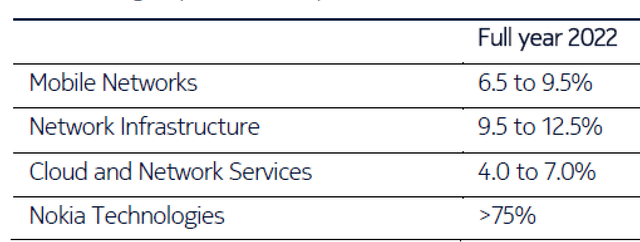

Nokia expects the full year 2022 net sales in the range of EUR23.9 billion to EUR25.1 billion. It expects constant currency addressable market growth of 5% in each of the Mobile Networks, Network Infrastructure, and Cloud and Network Services divisions. In addition, the company expects operating margin to be the strongest in Network Infrastructure:

Nokia Technologies will benefit from stable operating profits for the rest of the year. It still has outstanding deals to close. This could lift its long-term profitability forecast. Unfortunately, the free cash performance from Nokia Technologies is EUR450 million lower than its operating profits. Since it received prepayments from licensees in previous years, free cash flow (“FCF”) will slow.

Weak Outlook Explained

On the conference call, CFO Marco Wiren said that a less favorable regional mix will hurt its Mobile Networks margin. It is waiting for license litigations to be resolved before it updates its 2022 guidance. Until it resolves those outstanding renewals, it is guiding for EBIT margins in the range of 11% to 13.5%.

Nokia is not issuing guidance for 2023. It will wait for better visibility in the various regions, and only then will it update investors in the fourth quarter report.

After the post-earnings stock drop, investors are worried Nokia’s customers might report unfavorable contract renewal terms. Their terms vary from three to 10 years. Again, shareholders will need to wait until next quarter to get an updated outlook for the next fiscal year.

CEO Pekka Lundmark said that Mobile Networks are ramping up in India. However, in North America, customers may normalize capital expenditure spending. As a result, Nokia will need to rely more on emerging markets for gross margin expansion.

5G Slowdown Explained

CEO Lundmark said that Nokia benefited from the strong 3G Core Networks worldwide. As that market slows, the 5G core market is growing. Currently, network traffic volumes on the 5G network will come later. Investors will need to wait for 5G network usage to increase. Until that happens, Nokia investors will not increase their allocation in the stock.

Nokia held discussions with network operators to help them realize the full benefits of 5G. This effort takes time to translate to higher 5G equipment sales.

Risks

The strong U.S. dollar will have a EUR50-150 million impact on expenses for 2022. In addition to slower FCF growth, the Board of Directors will not likely raise its dividend. When it held its Annual General Meeting on April 5, 2022, it authorized a maximum distribution of EUR0.08 per share.

Nokia’s negligible dividend yield of 0.9% will not attract income investors. Those seeking yield should instead consider Cisco Systems (CSCO), whose $1.52 a share dividend yields 3.63%. Conversely, Ericsson’s (ERIC) poor results should deter investors from buying it for a dividend.

On its conference call, Chief Financial Officer Carl Mellander said that supply chain costs hurt its Network gross margin. In addition, the company is in the early stage of winning large-scale contracts.

Operating expenses grew at a faster rate, hurting top-line results. The company had double salary increases in the quarter. In the fourth quarter, expect normal annual salary inflation.

Stock Grade and Your Takeaway

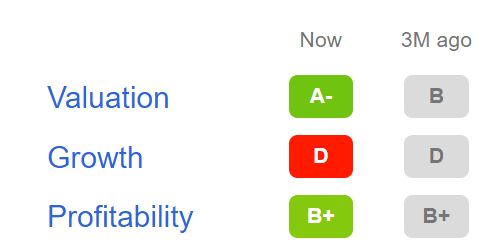

Nokia’s falling share price increased the stock’s valuation grade to an A-.

SA Premium

The company has strong relative profits, while the weak growth grade will deter investors from buying shares. In this weak economic client, investors want guarantees of future growth. This does not exist. Hardware network sales typically weaken during a downturn. The stock is trading lower after the report to price in the expected slowdown.

In the last five years, NOK stock traded in a range of around $4.00 to over $6.00. Long-term investors should expect the stock to hover near the five-year low. It will bounce back if the company updates investors with stronger licensing and equipment revenue guidance.

Be the first to comment