Mario Arango/E+ via Getty Images

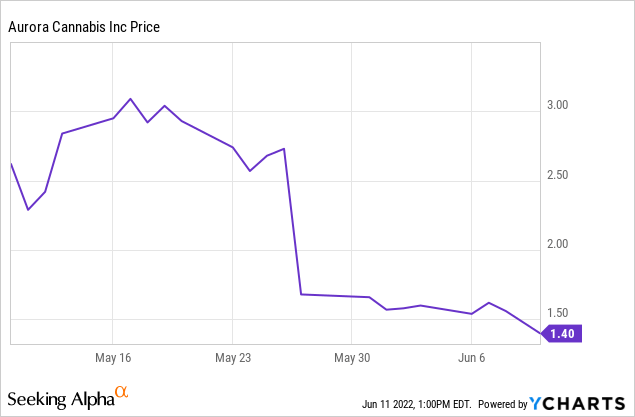

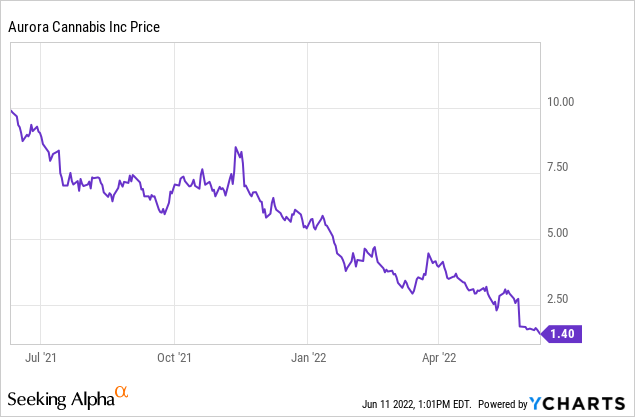

Aurora Cannabis Inc. (NASDAQ:ACB) is crashing again. The cannabis sectors have been in a downtrend for quite a while, but ACB’s crash is something different. The magnitude of this recent crash is quite extreme, even considering its own history of stock price implosions.

This recent fall occurred due to an expensive equity raise at the end of May. ACB remains committed to reducing its operating cost structure and achieving a positive adjusted EBITDA run-rate, but there remains the risk of disappointment and needing another capital raise. The Canadian cannabis sector has long had a history of cash-guzzling operations coupled with the promise of improved margins, and ACB is an example of the associated destruction of shareholder capital.

ACB Stock Key Metrics

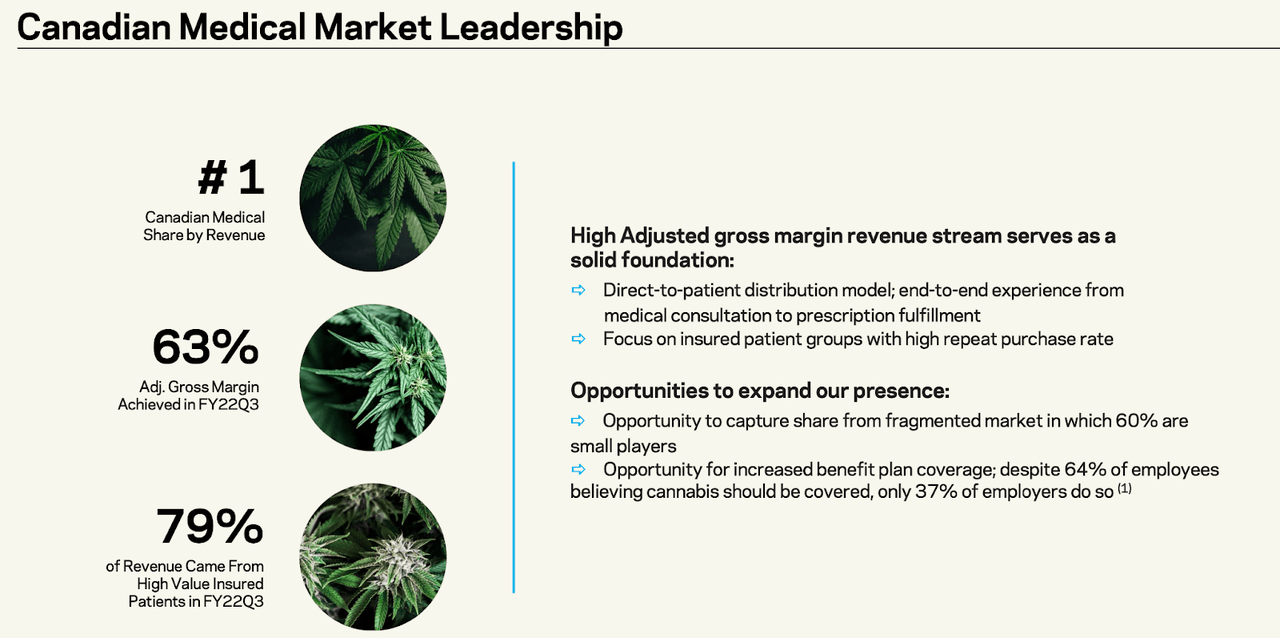

ACB differentiates itself as being the top operator in the Canadian medical market. That is a curious distinction considering that Canada has already legalized adult-use sales for many years, which has led to the medical market declining consistently ever since. ACB was able to achieve a 63% adjusted gross profit from Canadian medical sales in the latest quarter.

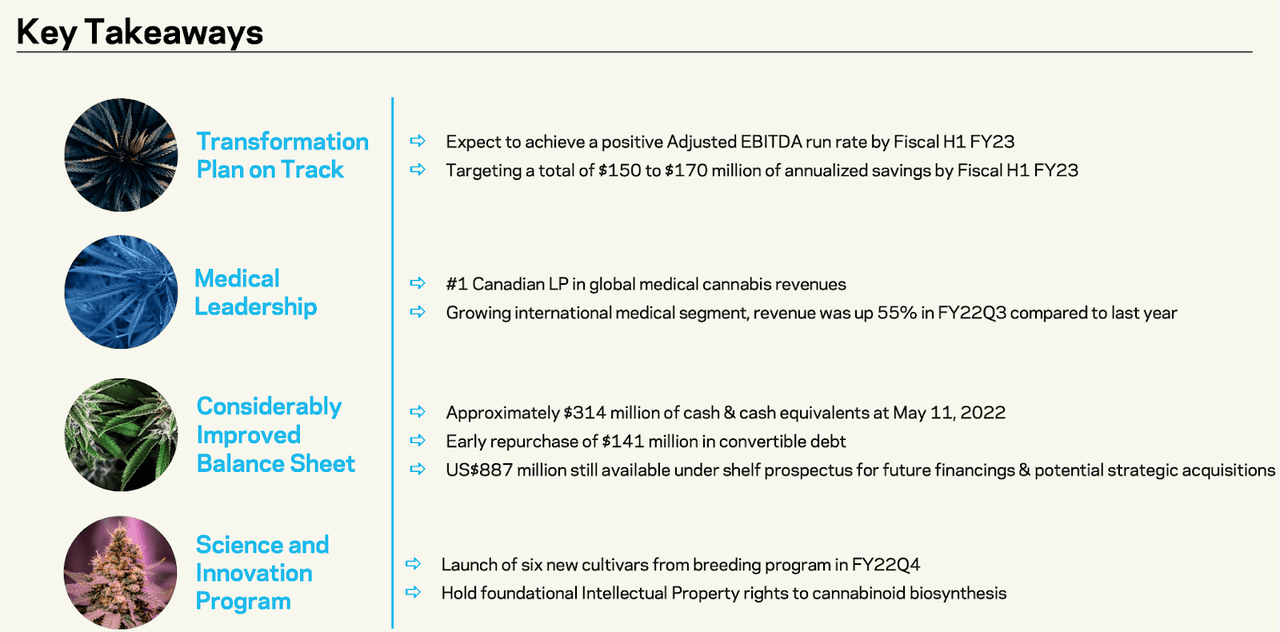

2022 Investor Presentation

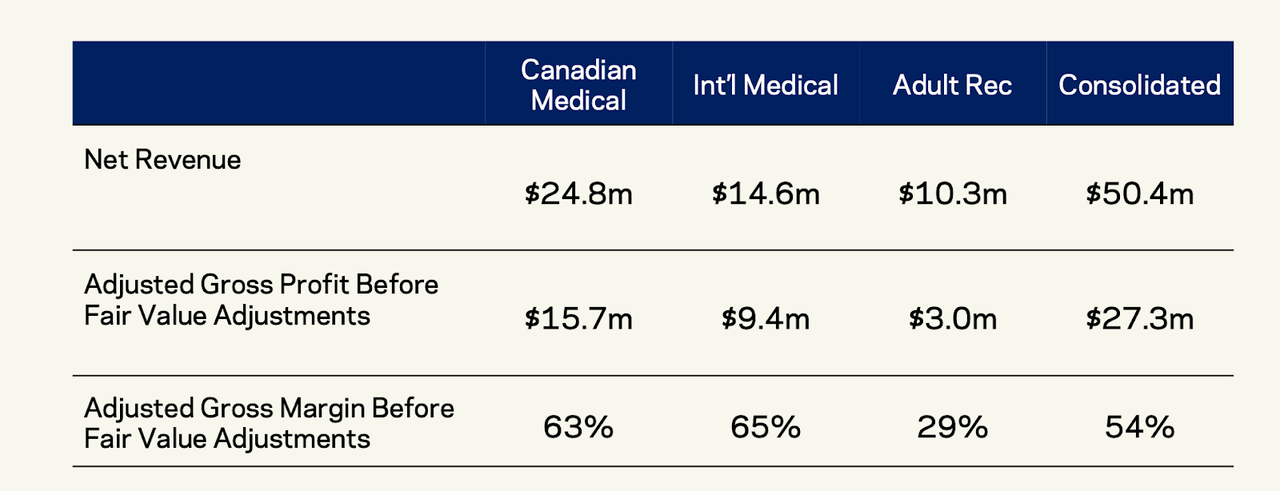

Below, we can see a breakdown of their various business segments. ACB has generated solid gross margins on medical sales, which make up 80% of overall sales.

2022 Investor Presentation

A quick note: “adjusted gross profit” refers to the gross profit prior to accounting for the closure of facilities, which would lead to a write-down of inventory. Like many Canadian peers, ACB has been closing down facilities due to the actual demand falling far short of projected demand.

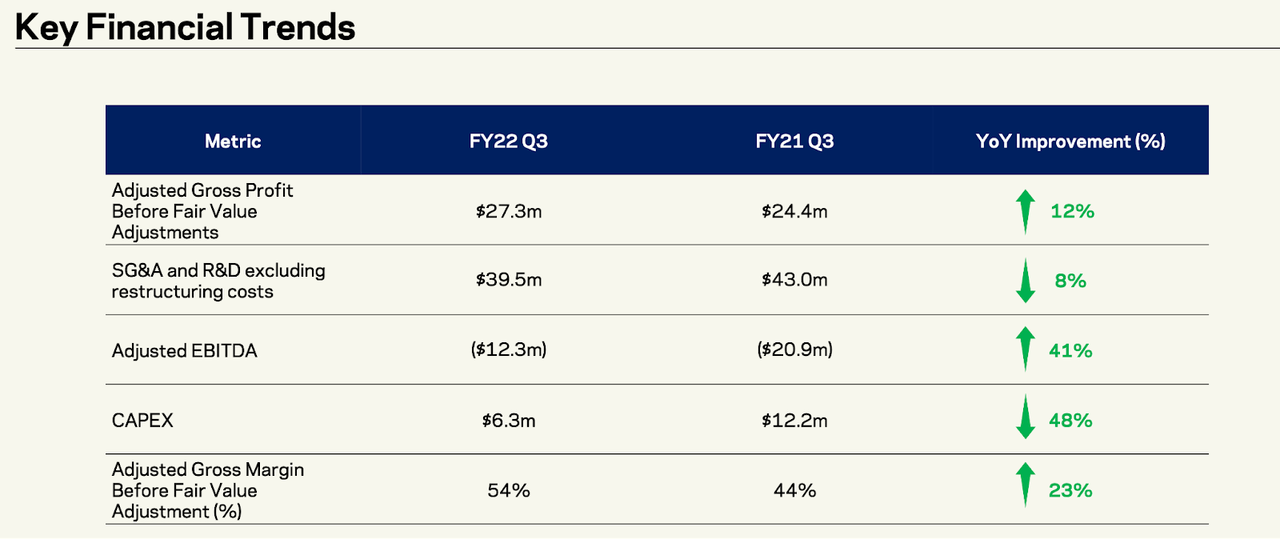

ACB has also been making progress on improving its fixed cost structure.

2022 Investor Presentation

ACB did see net revenues decline by 9% in the quarter due to price pressures across the portfolio. While the reported net loss was $1 billion, this included $923 million in impairment expenses. I estimate that excluding such non-cash losses, ACB generated a $58.7 million loss in the quarter.

Why Did Aurora Cannabis Crash In May?

It is not uncommon to see ACB stock decline, but there was a sudden crash at the end of May.

This crash occurred because the company raised $172.5 million in an expensive bought offering. This offering involved selling 70.4 million units for $2.45 per unit, with each unit including a 36-month warrant (exercise price of $3.20).

That capital raise appeared to take some shareholders by surprise, as the company exited the quarter with $430 million in cash versus $334 million in debt. I note that subsequent to the quarter, the company repurchased $128 million of those convertible notes. These convertible notes carry an interest rate of 5.5% (the conversion price is too high to care about), making one wonder if raising cash through this bought deal offering to repurchase those notes was such a good use of capital – there is a clear implication regarding management’s view of the stock price valuation.

The 54% crash in May is small when considering that the company actually traded above $10 per share 1 year ago.

In fact, the stock has fallen 78% over just the past 8 months since I covered the name and recommended focusing on the US operators.

In connection with the bought deal, ACB noted the following:

As a result of the capital raised from this Offering, the Company now anticipates no further use of the previously announced at-the-market (ATM) facility in the near term, of which approximately US$186 million remains outstanding.

That may sound bullish, but one mustn’t forget that ACB stated the following just 1 year prior:

“Following this repayment, we continue to have a substantial cash position and the financial flexibility needed to fund current operations and execute our business plan. Further, to maximize our strategic opportunities including within the U.S., we have an at-the-market equity program to issue and sell up to US$300 million of common shares. We are not expecting to access the ATM Program without an accretive use of proceeds”

The above verbiage seemed to imply that the company had rightsized its balance sheet and was positioned to be on the offense. Clearly, that has not materialized for shareholders.

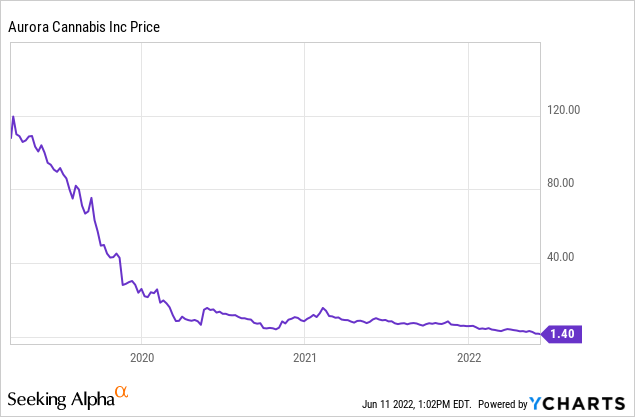

This is a company which has a vicious history of diluting shareholders. The company previously issued $666 million in stock in 2021 and $575.5 million of stock in 2020 – for reference, the current market cap is $436 million. Those capital raises were necessary due to the company having taken sizable amounts of debt in 2019. The stock is down an astounding 99% since just a few years ago.

If one was thinking that the recent 86% decline over the past year must imply value in the name, then they may be disappointed as history has shown that there is always 100% downside.

Is ACB Stock Undervalued Now?

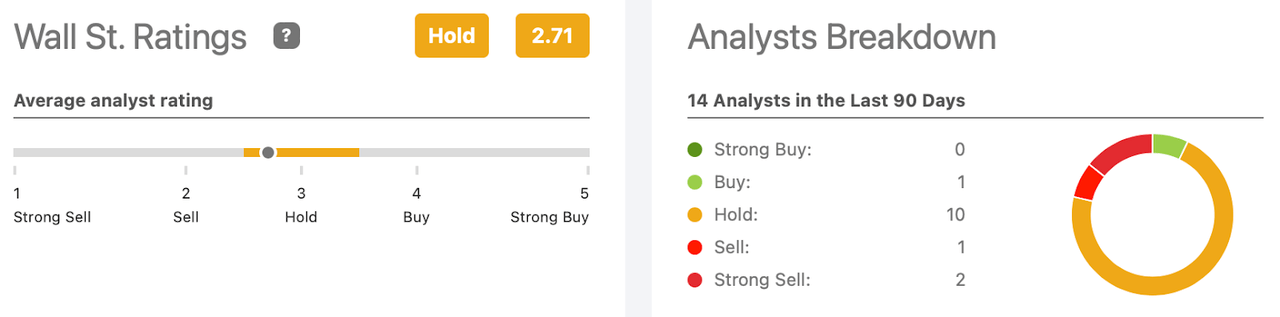

Wall Street analysts remain skeptical even in light of the crashing stock price, with an average rating of 2.71 out of 5.

Seeking Alpha

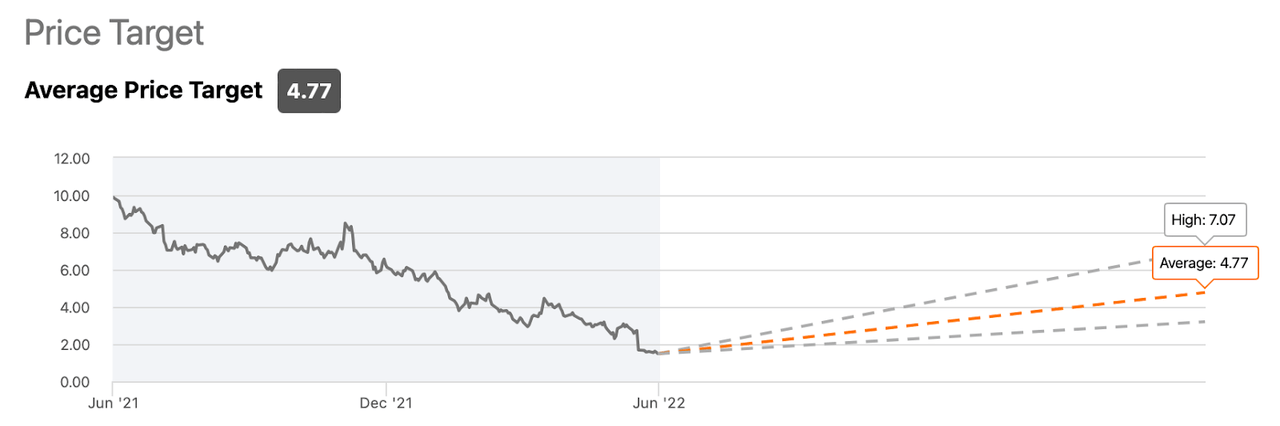

The average price target of $4.77 per share implies 244% upside, but I expect these price targets to be adjusted lower as analysts digest the dilution from the recent bought deal offering.

Seeking Alpha

Is Aurora Cannabis Expected To Recover?

ACB management has guided for positive adjusted EBITDA by the first half of fiscal 2023. For reference, the most recent quarter was the third quarter of fiscal 2022, so positive adjusted EBITDA is expected within 3 quarters.

2022 Investor Presentation

In relation to other Canadian operators, ACB has greater exposure to the medical markets. I am skeptical regarding this exposure, as the Canadian medical market should continue declining long term, and it is hard to have confidence in the long term viability of the international medical sales, as I expect those countries to eventually want to produce cannabis on their own.

Is ACB Stock A Buy, Sell, or Hold?

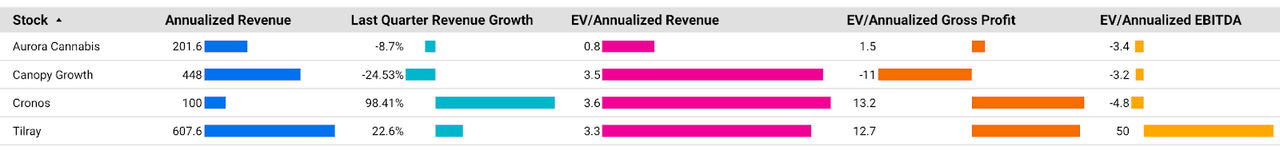

Still though, the stock might have fallen enough to attract some value investors. ACB is trading at a material discount to Canadian peers.

Cannabis Growth Portfolio

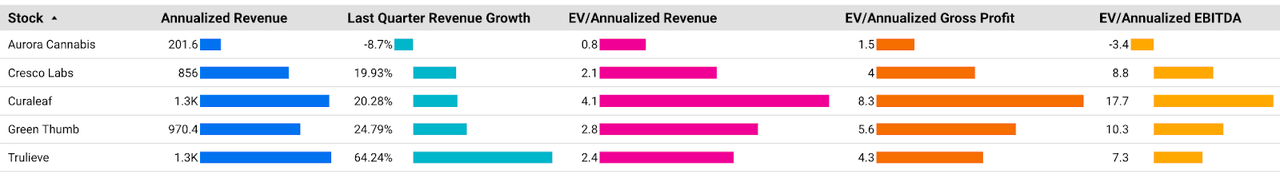

The above numbers do not yet reflect the associated dilution from the bought deal transaction, which increased shares outstanding by around 63%. Even taking into account the dilution, ACB is still trading at a notable discount on the basis of revenues. There appears to be fear that ACB has greater risk of further dilution later on, but the company actually has one of the stronger balance sheets among peers. Cronos (CRON) has just under $1 billion of net cash, Canopy Growth (CGC) has a $100 million net debt position, and Tilray (TLRY) has the weakest balance sheet with $500 million of net debt. Perhaps the main issue is that the other names are more geared towards a recovery in the Canadian adult-use market, as I view the growth potential of ACB’s medical sales to be limited. If one wanted exposure to Canadian names, then ACB is buyable due to its outsized discount to peers. But I’d argue that one should instead look south of the border at US peers. We can see below that ACB trades at a 50% discount to the top US operators – but that discount is arguably warranted considering that US operators are generating robust EBITDA margins.

Cannabis Growth Portfolio

Due to the U.S. names trading very cheaply with strong fundamentals, I have positioned the Cannabis Growth Portfolio to focus on U.S. names with no exposure to Canadian operators. Perhaps ACB is a buy for those looking for direct momentum exposure, though I caution that long term holding periods have proven nothing short of disastrous for shareholders.

Be the first to comment