Darren415

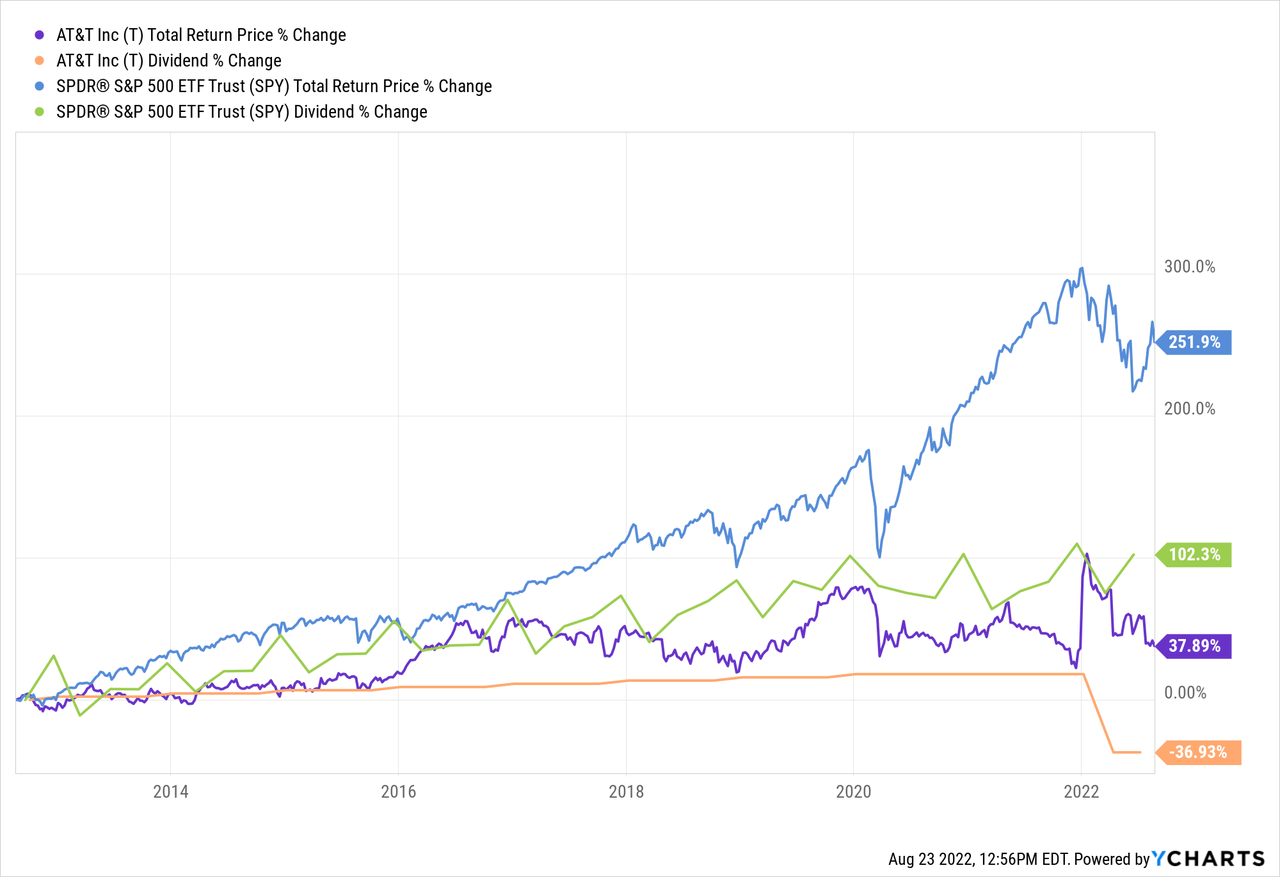

When it comes to the telecommunications space, there is no stock that is more popular than AT&T (NYSE:T). This is largely due to the fact that it is a household name with a large market share across the telecommunications space and for many years was a reliable dividend grower that also paid out a high current yield. As a result, it was a popular and effective bond proxy income stock for retirees. However, over the past decade, management has developed a track record for destroying shareholder value which led to it recently cutting its dividend. As a result, many retirees have decided that it can no longer be trusted to reliably grow its large dividend and is therefore no longer their income stock of choice.

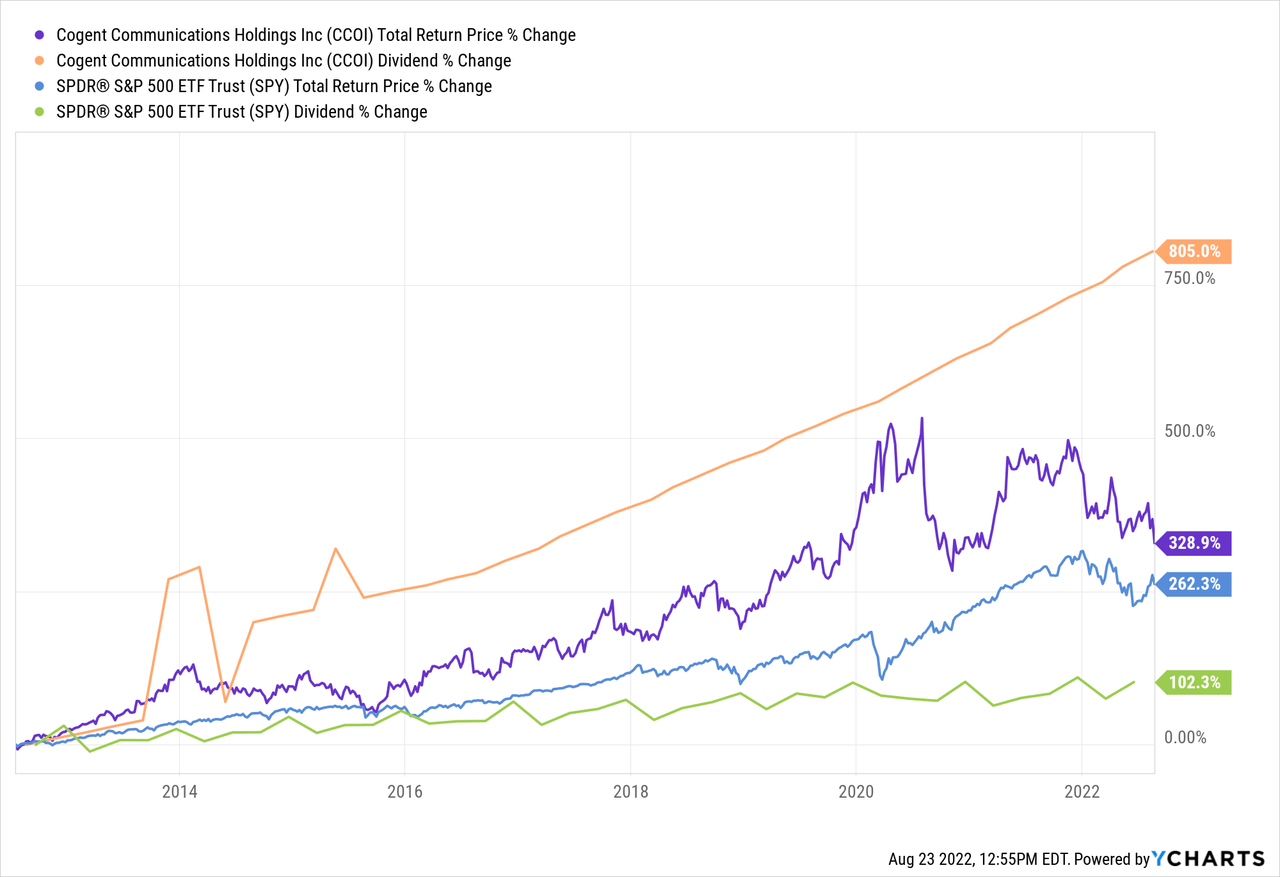

Meanwhile, there is a much smaller and less well known telecommunications stock called Cogent Communications (NASDAQ:CCOI) that we like much more at High Yield Investor. It has generated strong long-term returns for shareholders while growing its dividend aggressively over that time period.

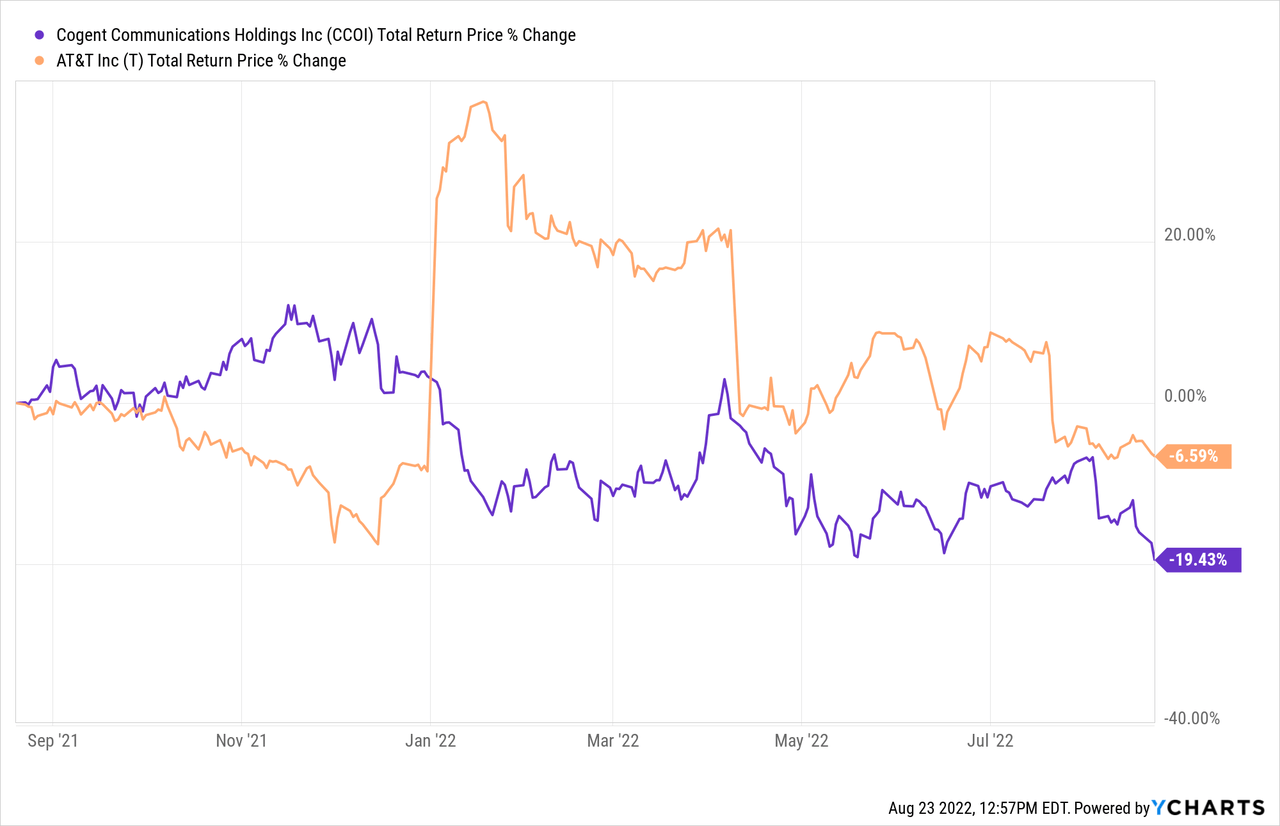

While CCOI has clearly crushed T’s performance in terms of both total returns and dividend per share growth, both stocks have generated poor returns on a trailing twelve month basis:

In this article, we will share why we believe that CCOI is the more attractive telecommunications investment at the moment.

#1. Cogent Communications Has Much Stronger Growth Potential Than AT&T

The first reason why we believe that Cogent Communications will outperform AT&T moving forward is that its business model lends itself to much greater growth than AT&T’s. For example, over the past five years Cogent Communications has grown its revenue at a 5.7% CAGR and its EBITDA at an 8.6% CAGR. As a result, its dividend per share has grown at a 16% CAGR over that time span.

In contrast, over the past five years AT&T has grown its revenue at an anemic 0.6% CAGR and its EBITDA has actually declined at a 0.4% CAGR over that time span. Meanwhile, its dividend only grew at a 1.5% CAGR during that period before being slashed this year.

Moving forward, though it does appear that Cogent’s growth rate is slowing, we expect its growth rate to continue significantly outpacing AT&T’s. Over the next four years, analysts project that Cogent will grow its revenue at a 6.3% annualized rate and that the dividend will grow at a 9.6% annualized rate. In contrast, analysts think AT&T will only achieve a 0.3% annualized revenue growth rate and that the dividend will only grow at a 0.4% annualized rate through 2026. The effects of such consistently high differences in rates of compounding are irrefutable.

#2. More Attractive Relative Valuation

Cogent’s vastly superior growth profile becomes even more attractive when you take into account the evaluation factors for both businesses. Cogent’s forward dividend yield is 6.6% whereas AT&T’s is 6.2%. Based on consensus analyst estimates for 2026, Cogent will be yielding 9.3% on current cost whereas AT&T will be yielding 6.3% on current cost. Given that Cogent’s five year average dividend yield is 4.6% and AT&T’s five year average dividend yield is 6.6%, it would appear that Cogent has meaningfully superior upside potential relative to AT&T in the coming years.

Another valuation metric that we can look at is the enterprise value to EBITDA ratio. Cogent currently trades at 15 times its EBITDA, which stands at a meaningful discount to its five-year average of 16.15 times. In contrast, AT&T traded 7.3 times its EBITDA, which is roughly in-line with its five-year average of 7.26 times EBITDA.

Based on these metrics and their sharply contrasting growth track records and growth outlooks, Cogent appears to be a growth at a reasonable price investment whereas AT&T appears to be a fairly valued very slow-growing stalwart.

#3. Vastly Superior Management

Last but not least, we have a lot more confidence placing our bets with Cogent’s management than with AT&T’s. First and foremost, this is due to the respective track records which have shown that Cogent has beaten the S&P 500 in terms of total returns while also generating phenomenal dividend growth. This reflects both a competent and shareholder friendly approach to management. On top of that, we know from conversations with the company that they run a very lean operation with an intense focus on what they do and on maximizing their ability to continue growing their dividend. In a conversation with their CFO, we were told:

We are highly focused. We have one business. What we do is we basically sell bidirectional internet service. That’s what we do, and we do it exceedingly well…we’ve reduced our costs of goods sold per bit in the last five fiscal years by over 22% per year. We’re a company that wants to drive margins and reduce costs and gain market share by delivering more value and lower prices.

Also, our commitment to not only paying a substantial dividend, but consistently growing that dividend each quarter, really forces us to create real discipline. Right? You can’t just increase that dividend every year. The power of that compounded dividend forces us to remain focused on cutting costs and improving efficiencies. Nobody has a secretary at Cogent. My CEO flies coach out to Singapore. It is not a frivolous company that does dumb acquisitions or stuff that doesn’t make sense. It is a well-run company and it’s also a pretty simple story. I was a banker for a long time. I’ve met with many companies and candidly it’s an incredibly well-run company. The interests of shareholders and the management team are highly aligned. The largest individual shareholder is the Founder and CEO and our compensation is almost all in stock. So, we have every interest in making sure the stock performs and the dividend gets paid, which is really important.

In contrast, AT&T’s management has failed to deliver repeatedly. Between making overpriced and overleveraged acquisitions that resulted in massive write-downs and impairments to the business, a severe dividend cut, and ultimately substantial total return underperformance. Even after streamlining the business and deleveraging the balance sheet with the recent spinoff of the media business, T’s business is still capital intensive, very slow growth, and the company remains far more complex and cumbersome than CCOI’s business. Without any clear vision or credibility from management and given the track record that warrants anything but trust, there is little to nothing that compels us to bet on T’s management right now.

Investor Takeaway

Both T and CCOI offer attractive current dividend yields and appear attractively priced on the surface after weak stock price performance over the past year. However, in our view T is actually not that cheap, lacks compelling growth potential, and its management is subpar and untrustworthy. In contrast, CCOI looks discounted according to several metrics, is expected to regain its strong growth momentum in the coming years, and its management is proven and fully aligned with shareholders.

As a result, it is a no-brainer decision for us. CCOI is our top pick in the telecommunications space and we rate it a Strong Buy. T, meanwhile, is a Hold in our view.

Be the first to comment