gesrey

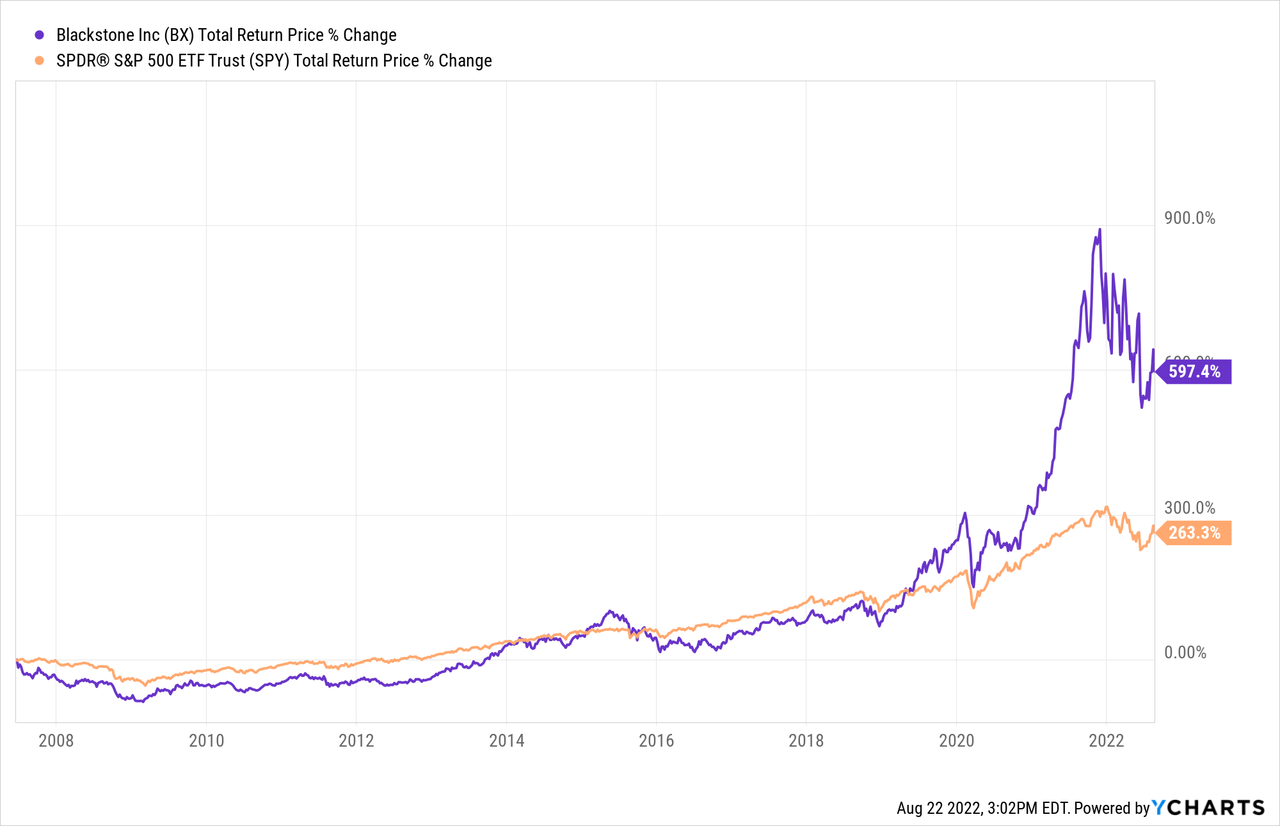

Blackstone (NYSE:BX) has a phenomenal track record of creating shareholder wealth. Since going public, it has delivered total returns that have crushed those generated by the S&P 500 (SPY):

That said, we currently favor another alternative asset manager to BX: Blue Owl Capital (NYSE:OWL) is a young, but large and growing member of the alternative asset management sector that we believe offers investors a very attractive combination of value, growth, and cash flow stability. In this article, we discuss why we believe OWL is a better buy than BX at the moment.

#1. Black Owl Has More Permanent Capital Than Blackstone

BX certainly has its strengths, including incredible economies of scale and business network advantages that come with being the largest alternative asset manager in the world with nearly $1 trillion in assets under management. As a result, it is better able to fundraise which in turn enables it to grow shareholder value at a rapid pace.

However, OWL still has considerable scale with well over $100 billion in assets under management, including a very strong leading position in the direct lending space with 56.8 billion assets under management in that sector. Furthermore, it owns a dominant position in the general partner solutions private equity business with $45.7 billion in assets under management. As a result, it has had and likely will continue to have enormous success fundraising in both sectors.

Where OWL really sets itself apart from Blackstone however, is in the vast amount of permanent capital it has managed to raise. At the moment, over 80% of its total assets under management is permanent capital. This equates to roughly 3 times the percentage of permanent capital that Blackstone has. Why is this such a big deal? Well, permanent capital means that OWL will never have to raise that capital again and instead will be able to generate a permanent fee stream from it through its various funds. This is also a big advantage because OWL does not have to worry about short to medium-term performance in order to get clients to reinvest those funds with the company. Instead, that money can be invested purely with a very long-term perspective, which almost always results in superior performance over time.

Another unique work with the structure that OWL employees is that it does not accrue any carried interest on its balance sheet. This stands in stark contrast to what is employed by Blackstone, as a large percentage of its income during economic expansions comes from carried interest on its various funds. As a result, when you combine the extremely high percentage of permanent capital with the lack of carried interest, you end up with a much more stable earnings stream for OWL that you do with a company like Blackstone, particularly in an economic downturn.

Given that it appears increasingly likely that we are headed for recession, assuming we are not already in one, the current macroenvironment seems to favor OWL over Blackstone.

#2. OWL Is Better Positioned Than BX For Rising Interest Rates

Another reason why we like OWL more than Blackstone right now is because it is better positioned to benefit from rising interest rates than Blackstone is. While Blackstone is primarily invested in private equity and real estate, both of which tend to suffer from rising interest rates, OWL is invested primarily in floating interest rate senior secured debt. As a result, when interest rates rise, OWL’s earnings stream rises with them. Meanwhile, given the senior secured nature of its debt in the company’s careful underwriting practices, debt delinquencies are likely to remain low even as interest rates rise further from here. As management stated on its latest earnings call:

I think people should be anxious about markets, but not just now. I mean that is to say our business in direct lending is built for exactly this environment. So we performed very well during strong times as we have for the past many years, but our — we really shine in times like this, this is what we’re built for, senior secured loans against very large companies, very high-quality, world-class businesses with world-class sponsors, floating rate exposure. So this is really the market we’re built for. So I wouldn’t say that anxiety is misplaced, it’s a very uncertain world out there. I would say probably investors should be kind of anxious but because you’re anxious is the reason you go to direct lending, you say, I want to be senior secured I want to be at the top of the capital structure. I want to be protected from interest rate changes. And I want to do that with people that do vigorous underwriting, deeply in origination, work with the best sponsors and work with the best company.

So I think our particular position in the market for specifically because that’s really our strike zone, which are the best companies best sponsors, that’s really our strike zone. That’s a particularly strong place to be. Really important point to note for this audience is what we all care tremendously about the performance of our portfolio and presumably, I think shows our since assumption performance was 5 basis points annualized loss rates. Remember, for the shareholders, people on this call it doesn’t matter really at all. That is to say we are an entirely fee-based business, right. 100% of our revenues are fee based. So unlike anybody else in the marketplace where there’s carry heavily embedded in their alt structures, we don’t have that carry component, we’re fee-based. So we care a lot about credit quality, and we’re — fair to say one of the best at it. But for you all as shareholders, to be clear, it actually doesn’t affect the results.

Effectively what management was saying is that they believe their loans are built to do well in the current stagflationary environment and that even if credit quality begins to deteriorate somewhat, OWL shareholders are well insulated from those impacts given that the fee stream is pretty stable and not dependent on carried interest. While we are not convinced that OWL is as recession-proof as management seems to imply (for example, calling the counterparties in their direct lending portfolio as “very large companies, very high-quality, world-class businesses” seems like a bit of a stretch to us given that their loans are at high interest rates and mostly senior-secured), we do agree that the business model is certainly on the lower end of the risk spectrum.

As a result, we expect OWL to generate stronger earnings growth in the current environment both from its current earnings stream as well as from accelerated fundraising as more institutional investors look for opportunities to benefit from rising interest rates without going too far out on the risk spectrum. This was clearly evident in OWL’s second-quarter results. Fee related earnings increased 52% year-over-year and 15% sequentially. Assets under management also increased by 91% year-over-year and 16.8% sequentially. Fee-paying assets under management increased by 81% year-over-year and 18.1% sequentially. Permanent capital increased by 68% year-over-year and 11.6% sequentially. The direct lending business was the fastest growing of OWL’s three business segments despite already being its largest, as it saw its assets under management grow by a stunning 26.8% sequentially.

#3. Much Cheaper Valuation

Finally, there is the issue of valuation. Blackstone currently trades at around 30 times their annualized fee related earnings net of carried interest and posted ~45% year-over-year fee related earnings per share growth in the second quarter. Meanwhile, OWL trades at around 20 times annualized fee related earnings and grew its fee related earnings per share by ~45% year-over-year in the second quarter. Given that OWL’s earnings stream is more conservative by nature given the much higher percentage of permanent capital and has a more bullish near-term outlook due to its favorable exposure to rising interest rates, it appears that OWL is considerably cheaper right now.

OWL looks even more attractively priced when considering that OWL plans on growing its dividend from its current $0.44 annualized pace to $1 per share within just a few years. By paying out a reliable quarterly dividend that would constitute a near 9% yield on current cost within a few years, OWL is more attractive as a dividend growth stock than BX is, given that BX pays out a variable dividend and is not expected to grow its dividend to such a high yield on current cost in such a short period of time.

Investor Takeaway

While we certainly like Blackstone and expect it to generate satisfactory if not impressive total returns for shareholders well into the future, we simply cannot ignore the unique advantages afforded by an investment in OWL in the current environment. Between its more defensive positioning, positive exposure to rising interest rates, and compellingly cheaper valuation that we made evident to us during our recent conversation with the company, we rate it a Strong Buy, whereas we view BX as a weak Buy at the moment.

Be the first to comment