JohnDWilliams/iStock via Getty Images

Who doesn’t want to own a company that’s increased its dividend for at least 50 consecutive years? Dividend kings are worth knowing about.

Clearly.

Last year, I read a Barron’s article by Lawrence C. Strauss that mentioned how there’s “no dividend kings index.” As one of the founders of Dividend Kings on Seeking Alpha’s Marketplace, I found that intriguing.

Perhaps I’ll make it happen – just as soon as I publish my first real estate investment trust (“REIT”)-focused index, which is coming soon. It seems like a fun endeavor regardless.

Profitable too. We all know how hard it is to create dividend-paying repeatability for a decade, much less five of them.

50 consecutive years is a very big deal, making these monarchs the crème de la crème of their categories… and helping them achieve superior shareholder returns.

Of course, past performance doesn’t guarantee a perfect present. So we still need to do our due diligence.

But there’s definitely a lot to explore here with some very buyable results.

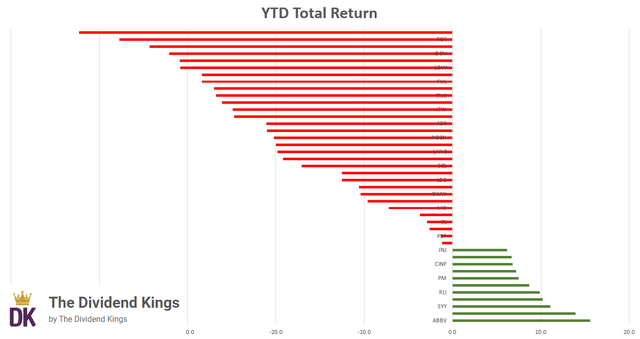

Year-to-date, the 42 dividend kings have returned -12%. Just 11 of them are in the green:

Dividend Kings

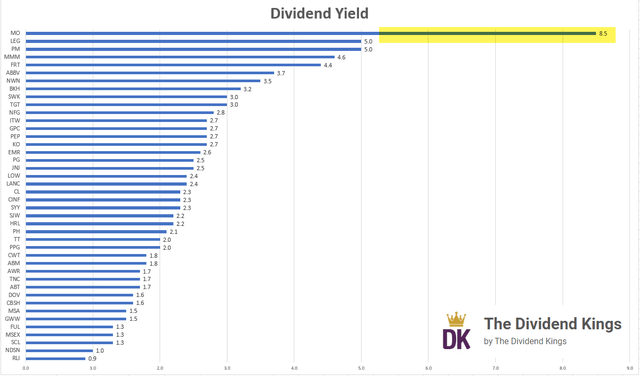

Their average yield is 2.6%, with Altria Group (MO) at 8.5% and RLI Corp. (RLI) at 0.89%.

Dividend Kings

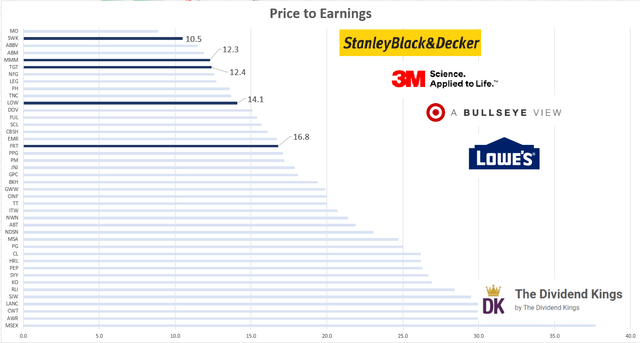

They have an average price-to-earnings (P/E) multiple of 19.9x. Federal Realty Investment Trust (FRT), for instance, trades at 16.8x price to funds from operations (P/FFO).

Its normal average is 22.5x, making for a 19% discount.

Knowing that, let’s look at the best four kings and the kingdoms they rule.

Meet Today’s Dividend Kings, Including Stanley Black & Decker

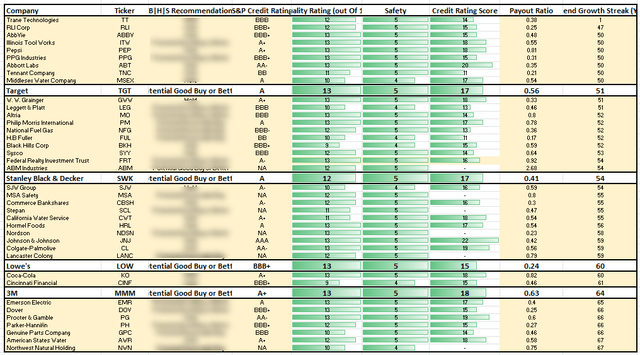

Dividend Kings

As shown above, our four dividend kings are:

- Stanley Black & Decker, Inc. (SWK)

- 3M Company (MMM)

- Target Corporation (TGT)

- Lowe’s Companies, Inc. (LOW).

Dividend Kings

Stanley Black & Decker, for its part, is a leading global diversified industrial. It’s amassed iconic brands and trusted products such as Stanley, DeWalt, Craftsman, Cub Cadet, Troy-Bilt, Lenox, and more.

In 2021, it generated consolidated annual revenues of $15.6 billion with approximately 60% from the U.S. Another 17% is from Europe 14% from emerging markets, and 5% from Canada.

Shares have returned -42% year-to-date thanks to deterioration in profitability and advanced accounting metrics. And Moody’s did downgrade SWK to a negative outlook on June 6, citing:

“… commodity inflation, higher supply chain costs to serve demand, and lower volumes, in addition to higher personnel expenses, transportation, and energy costs than in previous years.”

Now, SWK’s management team is increasing prices and reducing supply chain costs. And Moody’s explained it “must execute on its operating plan and exceed Moody’s expectations in order to maintain its Baa1 rating.”

Today though, SWK’s balance sheet is solid and getting stronger as it utilizes proceeds from asset sales to repay short-term debt of $5.1 billion. Meanwhile, free cash flow should be over $500 million in 2022 and $1 billion+ in 2023.

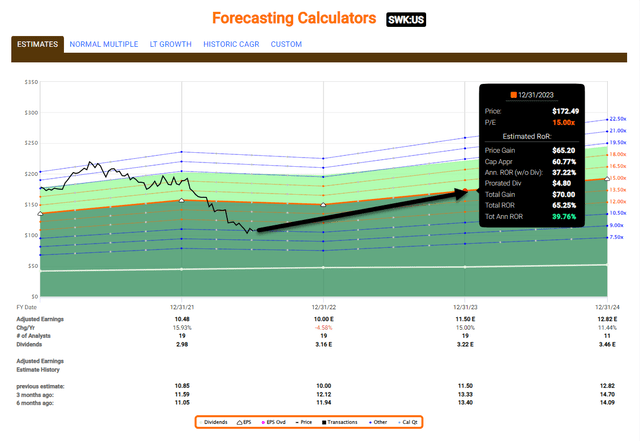

Analysts forecast 15% growth in 2023 and 11% growth in 2024. Plus, it’s extremely safe divided has a payout ratio of just 33% that should drop to around 26% over the next three years.

Shares trade at 10.5x earnings but could rise to 12.7x in 12 months for a 55% total return.

I’ll be adding SWK to my retirement portfolio this week. As shown below, I’m forecasting shares to return over 30% in the next 12 months – conservatively.

FAST Graphs

3M Corporation Could Be Your Ideal Dividend King

3M Corp. is a global technology company that makes:

- Safety and industrials

- Transportation and electronics

- Healthcare

- Consumer products.

Moreover, it’s a leading manufacturer in many of those markets.

Admittedly, as Dividend Sensei pointed out in a recent article, “litigation fears are an overhang on 3M’s stock.” That’s “responsible for the persistent price-to-value gap” but “ not likely to break MMM’s safe dividend thesis.”

Then there was Morningstar, which wrote:

“3M’s 2021 free cash flow was $5.6 billion and dividend cost was $3.35 billion, generating post-dividend free cash flow [of] $2.25 billion… 3M can cover a final legal bill of $66 billion over the next 30 years without putting the dividend at significant risk…”

S&P downgraded MMM in February 2020 at the start of the pandemic. The reason: legal liability risk and short-term leverage concerns.

As Dividend Sensi also pointed out, “MMM’s debt is drifting steadily lower. And its net debt is falling at 14% per year while its cash flows are growing at mid-single digits.”

In 2021, the company generated $34.5 billion in net sales. Generally accepted accounting practice (GAAP) operating income margins of 20.8%. And it paid over $3.4 billion in dividends while buying back over $2.2 billion in shares.

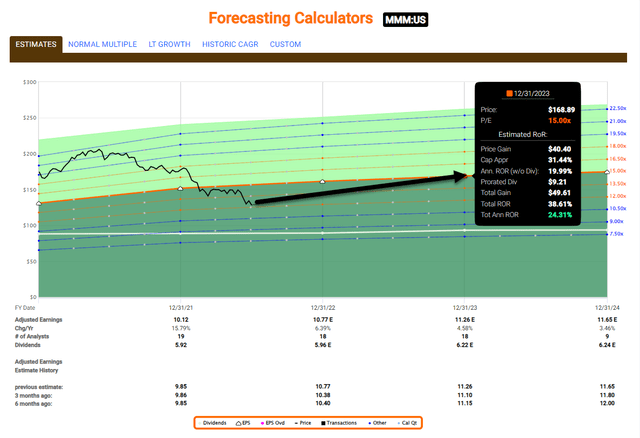

MMM trades at 12.3x compared to its norm of 20.2x, and its dividend yield is 4.6%. Analysts expect 5% growth in 2023 and 3% in 2024, and convert 97% of its net income into free cash flow.

3M’s post-dividend retained free cash flow for the next three years is about $7 billion… enough to pay off 41% of its debt or buy back 9% of shares at current valuations.

Analysts expect a 27% total return within a year, which requires it to trade at just 14x earnings. That makes it another pick for my retirement account.

FAST Graphs

On Target for More Kingly Dividend Growth

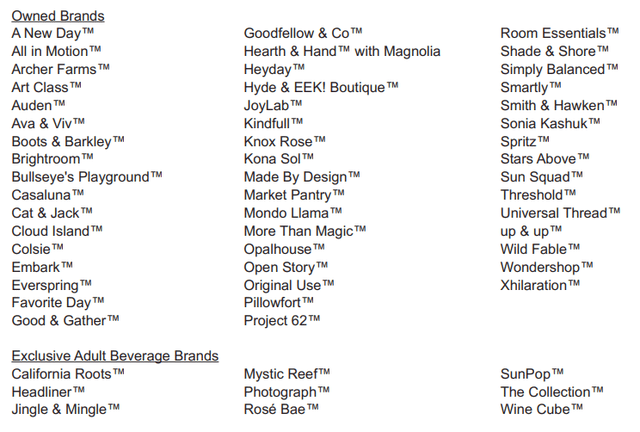

Retail giant Target sells a wide assortment of general merchandise and food items at its stores – most of which are larger than 170,000 square feet. Approximately one-third of 2021 sales were related to owned and exclusive brands such as:

(Source: 2021 Annual Report)

I plan to write an extensive sale-leaseback article this week. But for now, here’s some interesting information…

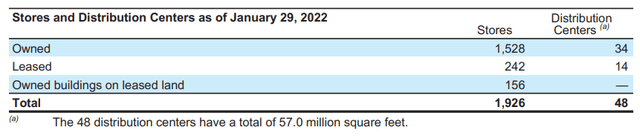

(Source: 2021 Annual Report)

As you can see, TGT owns most of its 1,528 real estate locations and 48 distribution centers. So, as an investor in TGT, I’m getting a terrific retailer PLUS a lot of real estate.

Before you get too excited, C-corps are no longer allowed to spin their real estate into REITs. Even so, there is material equity in those assets.

Now to be clear, we all know why Mr. Market doesn’t care for TGT. As Morningstar explains:

“The inflationary environment creates cost pressure while also introducing rapid mix shifts that complicate demand forecasting. The nature of the post-pandemic economy is opaque and could see customers shop Target’s higher-margin (non-grocery) categories to a greater or lesser extent than we expect, with profitability implications…

“We believe retail’s future is omnichannel, necessitating infrastructure investments that could prove difficult to scale, particularly as Amazon builds leverage and Walmart expands its digital presence. An acceleration of digitization (or slower-than-expected adoption) could affect Target’s results. Moreover, the reliability of fulfillment should differentiate retailers, with customers accustomed to Amazon’s generally dependable Prime delivery windows.”

That’s why shares are trading at 12.4x instead of their normal 15.7x. Yet TGT’s dividend yield is 3%, its payout ratio is just 28%… and it announced a 20% dividend hike for September to $1.08.

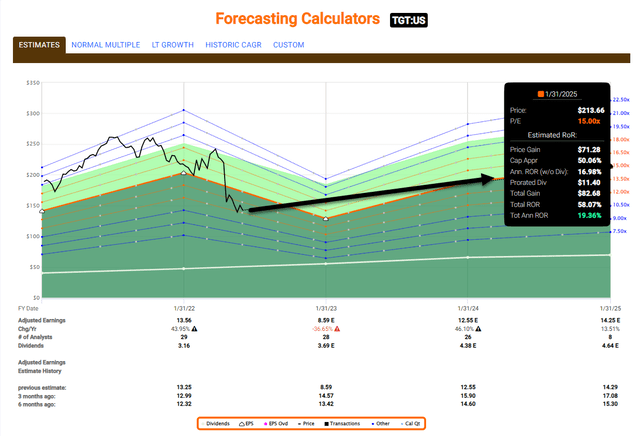

Analyst forecasts aren’t too rosy for 2023 at -37% EPS. But 2024 seems much better at 46%.

Personally, I began nibbling in late May. The bottom is still unclear; however, I see solid value unfolding – especially if it chooses to unlock the substantial value in its real estate.

I view TGT as a long-term play and plan to accumulate shares over the next five or so years. Nothing wrong here with nibbling!

(FAST Graphs)

A “Lowe-ly” Dividend King I Still Like the Look Of

Lowe’s is a Fortune® 50 company and the world’s second-largest home-improvement retailer. It operates 1,971 home improvement and hardware stores – 1,737 in the U.S. and 234 in Canada – representing approximately 208 million square feet of selling space.

In 2021, it generated total sales growth of 7.4% driven by comparable sales growth of 6.9%. That also led to greater operating productivity and a 36% increase in diluted EPS.

Also in 2021, LOW returned $15.1 billion to shareholders through share repurchases and dividends.

Admittedly, its Q1-22 results weren’t that impressive with earnings of $3.51. Meanwhile, net sales of $23.66 billion fell short of analyst’s estimates for $23.76 billion and last year’s $24.42 billion.

Same-store sales also declined by 4%, worse than analyst predictions of -2.5%… all of which management blamed on cooler weather conditions. As the CEO explained:

“… the past April was the coldest in over 20 years and one of the wettest in recent memory. But now spring has finally arrived, and we are seeing the anticipated improvement in our seasonal sales in the month of May.”

LOWs reaffirmed its full-year 2022 financial outlook with sales of $97 billion to $99 billion. This represents comparable sales of -1% to 1%. And its outlook for diluted EPS of $13.10-$13.60 remains intact too.

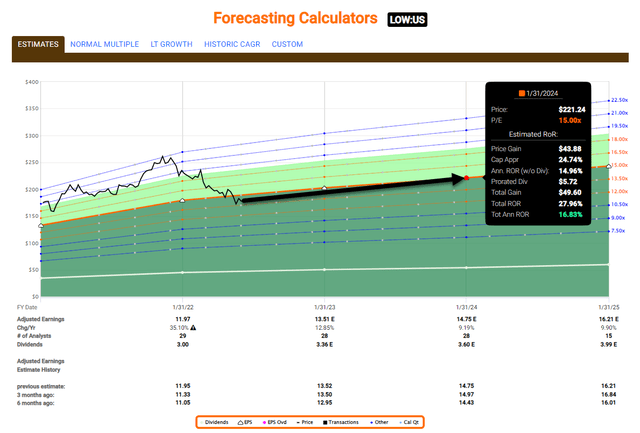

Analysts remain bullish about 2022, expecting 35% growth of 35% but just 13% for 2023. Shares trade at 14.1x against a normal19.9x, with a 2.4% dividend yield and a 35% payout ratio.

Like Target, I’m just nibbling on Lowe’s right now as supply chains thaw out and a recession likely unfolds.

Remember that most U.S. homeowners have more home equity in their homes that they can spend on home improvements. In the past, LOW has done well with this type of setup.

(FAST Graphs)

In Conclusion…

Although four of a kind isn’t the highest hand in poker, it’s still one of the best players can get – ranking under a straight flush and above a Full House.

Now, that doesn’t mean you should always shoot for this combination. In fact, I wouldn’t load up on all four kings right now.

At the same time, there’s clearly a margin of safety that exists. As Ben Graham observed:

“Paying out a dividend does not guarantee great results. But it does improve the return of the typical stock by yanking out at least some cash out of the manager’s hands before they squander it or squirrel it away.”

He added, “One of the most persuasive tests of high-quality is an uninterrupted record of dividend payments going back over many years.“

As always, thank you for reading and for the opportunity to be of service.

Now, who’s scooping up a few Dividend Kings?

Be the first to comment