dreamnikon

The current situation at Wheeler Real Estate Investment Trust (NASDAQ:WHLR) merits further consideration by investors willing to stomach some volatility and fully apprised of the risks. A brief summary follows:

The Players

-

Jon Wheeler – namesake of the business – was ousted after two ugly proxy battles.

-

Joseph Stillwell – at the helm after winning his second proxy attempt. He had the initial misfortune of gaining control as Covid lockdowns began.

-

Steamboat Capital Partners – owns portions of the WHLR capital stack, and has sued over treatment of preferred shareholders.

-

Cedar Reality Trust (NYSE:CDR) – winding down REIT that has agreed to sell WHLR a portfolio of properties for $130m cash and the assumption of CDR preferred shares. The sale is expected to close in the coming 2-4 weeks.

Legacy WHLR Overview

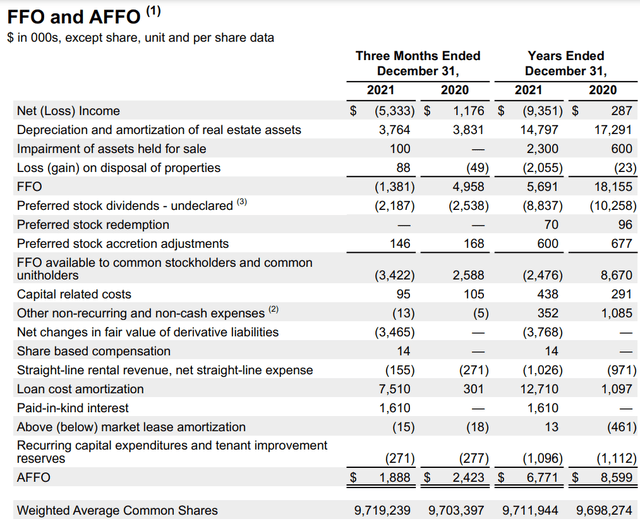

The legacy business had the following results in FY21:

-

$41.7m NOI, $6.8m Adjusted Funds from Operations (AFFO)

-

Cap structure summary and new CDR acquisition pieces: $130m KeyBank bridge loan to WHLR, CDR B/C preferred ($161m face)

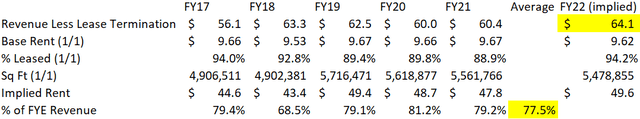

Base rent has averaged ~77.5% of WHLR revenues over the past five fiscal years, and with 94% of properties rented at $9.62 for FY21, I therefore estimate Wheeler will earn ~$64m of FY22 revenue vs $60.4m in FY21. Support below:

Author calculations from WHLR 10-K’s

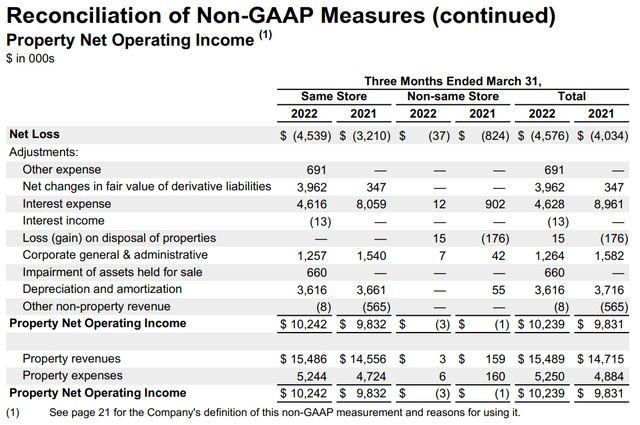

Q1-22 results were $15.5m of revenue (vs $14.7 in Q1-21), $10.2m NOI (vs $9.8m), and $2.3m of AFFO (vs $1.2m), so results appear on track.

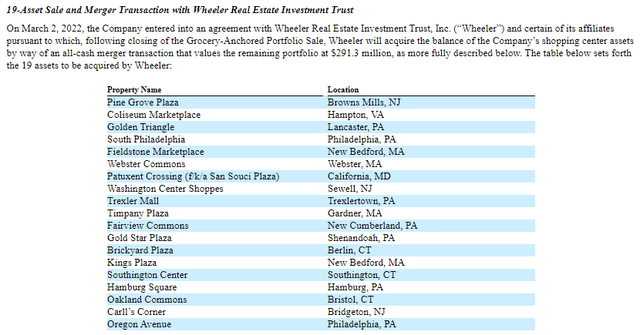

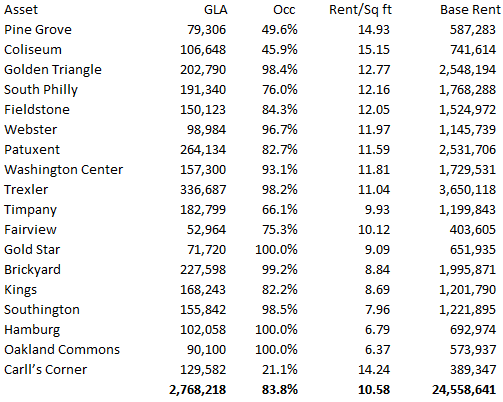

CDR Acquisition Overview

CDR Transaction Proxy Author summary from CDR FY21 10-K

New WHLR Pro-Forma

So how does this transaction change the complexion of Wheeler? Prior to the deal, WHLR has 5.5m leasable square feet with $9.62 average base rent. The acquisition will increase their square footage by around 50% and add slightly higher rents on a lower occupancy base. The CDR properties included in the transaction were about 28% of total CDR base rents and 38% of square footage. This equates to ~$36m of FY22 revenues on the acquired properties (28% of CDR’s $127.6m FY21 total revenues) and doesn’t assume any new leases for FY22.

The pro-forma combined cashflow could look something like this:

-

$33m property operations ($13m from CDR’s 28% of operating expenses, $20m run rate for WHLR)

-

$10m corporate overhead (~$6m run rate for WHLR, assume $4m increase from CDR, some could be non-cash and synergies could improve this number)

-

$23m cash interest expense (5% estimate on $452m pro-forma debt below)

-

$10m Capex ($28m total FY21 for CDR of which 28% is ~$8m, $1.1m for WHLR for “recurring Capex” in FY21)

-

No Taxes

-

$24m cashflow from operations

This is enough to service dividends on all the current preferred issues that would exist after the CDR transaction.

The Capital Structure (Post-CDR Transaction)

Below, I’ve taken the WHLR 10-Q from Q1-22, added the $130m KeyBank facility and CDR preferred, adjusted for the two recent refinancing agreements (JANAF – $56.5 to $60m, various – ~$65m to $75m), increased WHLRP outstanding from WHLRL dividend, and we’re left with the post-transaction capital stack:

|

Cap Structure (Pro-Forma Recent Refinancing and CDR Transaction) |

# Outstanding (k) |

Market Value/Share |

Face Value |

Trading Value |

|

WHLR Debt/Mortgages |

—– |

—– |

$452 |

$452 |

|

WHLR Convert (NASDAQ:WHLRL) |

1,320 |

$28.00 |

$33 |

$37 |

|

WHLR D’s (NASDAQ:WHLRD) |

3,152 |

$13.00 |

$105 |

$41 |

|

WHLR B’s (NASDAQ:WHLRP) |

~2,350 |

$5.00 |

$59 |

$12 |

|

WHLR A’s (Do not trade, assume par) |

—— |

——- |

$1 |

$1 |

|

CDR B’s (CDR PRB) |

1,391 |

$8.50 |

$35 |

$12 |

|

CDR C’s (CDR PRC) |

4,991 |

$6.50 |

$125 |

$32 |

|

WHLR Warrants (Assume worthless) |

1,558 |

—— |

$9 |

$0 |

|

WHLR Common |

9,723 |

$2.50 |

$24 |

$24 |

|

Restricted & Non-Restricted Cash |

—— |

—— |

$50 |

$50 |

|

Total |

$793 |

$561 |

||

|

Pro-Forma NOI Less Overhead |

$57 |

$57 |

||

|

Cap Rate |

7.2% |

10.2% |

(Source: WHLR filings and Author Calculations)

Given the above, WHLR could tender half the face value of preferred shares at the prevailing prices, significantly reducing the all-in cost of taking the business private and removing some of the dilution overhang impending for fall of 2023 from the WHLRD’s. Additionally, if the CDR preferred shares are tendered at the above prices, the implied price of the $19m of CDR NOI (confirmed in merger docs) would be under $175m, about a 12% cap rate. Completing such a deal would be tremendously accretive to WHLR.

Potential Outcomes

Stillwell & team appear to be down about 75% on their investment, not a great outcome after two years and all their efforts. He owns about 80% of the WHLRL notes he created, and we expect those notes to accrue the most value going forward, absent a successful lawsuit by Steamboat. Key considerations:

-

CDR preferred shares will be attached to the Cedar subsidiary post-close and are not convertible into WHLR common stock. Shares are priced with the expectation that dividends will be turned off post-close, though there should be enough cash flow to continue paying. Preferred shares hold minimal rights compared to debt and Stillwell has no ownership interest in CDR preferred shares, so there is risk these securities are neglected.

-

WHLRP’s trade at 20 cents on the dollar after cumulative dividends were stripped in 2021. The shares can convert to common stock at $40/share, so WHLR would need to increase more than 10x for this right to become relevant. A future tender for this issue seems quite likely while they trade at a depressed value.

-

WHLRD’s cannot have their dividends stripped without a majority vote by D holders, a risk that appears minimal unless Stillwell acquires 2/3 of the outstanding D shares. Holders have the right to force conversion in September 2023 for their face value + accrued dividends in VWAP common stock. These shares trade at 33 cents on the dollar vs their conversion value, suggesting the market expects an adverse event similar to what happened with the WHLRP’s.

-

WHLRL’s are the notes created by Stillwell, which bear 7% interest payable in preferred shares and with conversion rights into common stock at $6.25 or at 55% of the lowest price obtained by WHLRDs in their conversions. So far, discounted B and D shares have been issued as dividend payments, and the eventual conversion price will likely be highly accretive, hence the notes trade significantly above par.

I strongly anticipate WHLR will attempt to tender some of the preferred or open a buyback authorization for the issues after the CDR deal has closed. Prior WHLRD buybacks were executed at higher prices, and the shares have only accrued additional dividends since. There is a conversion cliff in 2023 from the WHLRDs and then WHLRLs, which will likely leave the common stock price under pressure, and the lack of alignment with Management on the CDR preferred shares makes them less attractive at this juncture. We expect the WHLRLs will come out on top, with a low conversion price into common shares after receiving many discounted preferred shares as dividends. We expect after the capital structure is simplified and the conversion pressures resolved, the collection of properties will be sold at a much higher price than currently implied by the market value of outstanding securities.

Risks

-

The decision to remove accrued dividends from the WHLRP shares appears to have been legal under the issue’s terms and serves as a reminder to carefully approach any WHLR issue.

-

WHLRL notes make it possible for Management to pay themselves interested with heavily discounted parts of the WHLR capital stack.

-

Significant litigation outstanding against WHLR could result in material changes to the above scenarios.

-

Loss of significant tenants could impair WHLR’s ability to generate meaningful earnings or realize substantial value on a future sale.

-

One-time Capex requirements for newly acquired CDR properties could be material.

-

Rising rates may impact cap rates for these properties, though with recent refinancing deals in place, there is minimal exposure to interest rates going forward.

- CDR preferred shares are being priced by the market like they will not continue paying dividends post-transaction.

Conclusion

Despite the perception that the acquired CDR assets are low quality, this transaction has the potential to transform WHLR and provide the necessary cashflow to solve their complex capital structure. Nevertheless, an investment in the WHLR or CDR capital stack requires a significant amount of game theory to determine the most likely outcome. The timeline is a bit murky, and depending on the interim moves value may not accrue as anticipated. For now, the safest bet seems to be aligning oneself with Management via the WHLRL’s and waiting for more clarity. WHLR and CDR preferred holders may get tendered at a premium in the near future, but holders should carefully consider risks that their fortunes are unexpectedly adjusted.

Be the first to comment