luza studios/iStock Unreleased via Getty Images

Introduction

A month ago I published an article called “Activision Blizzard: What If The Microsoft Deal Fails?” The main thesis was all about Activision Blizzard, Inc. (ATVI) as an independent company given the uncertainty about the future of the acquisition.

This article will be a kind of continuation of the previous one, but here I will be discussing Microsoft Corporation (MSFT) without Activision in its gaming segment and, more importantly, what Microsoft will lose if the deal collapses.

Let’s not pretend there are no risks

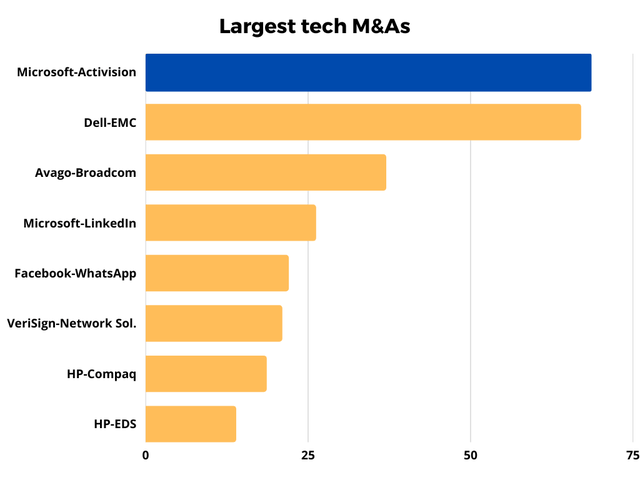

It is very important to understand that the success of closing such a deal can never be guaranteed. All because of the size of the acquisition.

I believe that this is the biggest tech acquisition we have ever seen. The only M&A close to Microsoft-Activision Blizzard was the Dell (DELL)-EMC Corp deal with a transaction value of $67 billion.

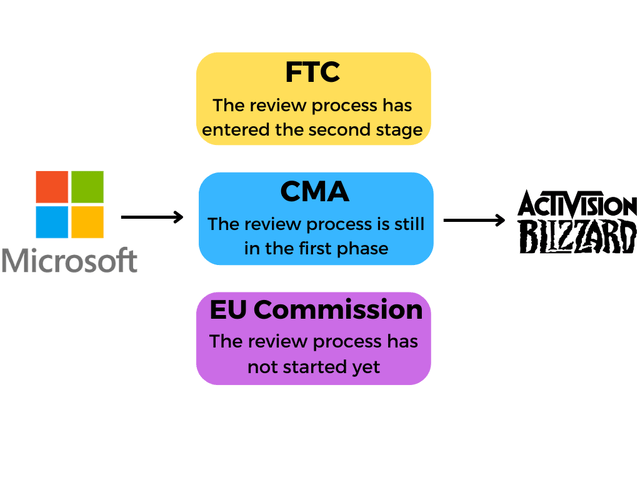

Thus, this takeover cannot but arouse interest from regulators. Microsoft needs approval from three regulators: FTC, CMA, and European Commission.

Microsoft can be asked very uncomfortable questions.

There likely will be concerns about the situation with the availability of Activision games on the competitors’ platforms, like Sony’s PlayStation. Some records show Microsoft saying that it has no plans to make these franchises exclusive since PlayStation users account for a large share of Activision’s revenue. However, I don’t think it’s all about short-term success as the platform war is still going and gaining momentum. New games in Microsoft’s gaming segment could follow the path of Bethesda’s projects (Redfall and Starfield will only be available on Xbox and Windows).

Microsoft could have gone the other way, such as providing early access to Activision Blizzard games. It may also raise questions from regulators. Exclusive content will help build a huge community for Xbox, and Microsoft won’t be able to resist this opportunity.

The bottom line is that regulators will act differently in this situation. All previous Microsoft deals went almost unhindered, and perhaps this time the regulators will decide to ruffle the nerves of the corporation and put forward their own conditions.

The metaverse

This acquisition will become one of the building blocks of Microsoft’s metaverse. The corporation releases its own Xbox consoles and has its own cloud platform and a VR headset project, so now it needs to create its own content and Activision Blizzard will help it with this.

Video games will play a central role in the metaverse as they already provide immersive 3D graphics and virtual reality experiences. Players can create content themselves, share it with others, interact and communicate in virtual space, use digital assets, and create digital copies of themselves.

Activision Blizzard, contrary to the opinion of many, is an excellent metaverse play. It’s not so much about the games themselves and their integration on modern platforms, but rather about the franchises and brands that the company owns. Users, trying to entertain themselves in the metaverse, will first of all turn to brands they already know, like Call of Duty, Overwatch, Diablo, and WarCraft.

The corporation lacks strong brands with huge local bases, ready to follow their favorite games anywhere, even in the metaverse. Considering that Microsoft already has Minecraft with 141 million active users, Activision Blizzard will automatically make the company the king of the metaverse, at least in the entertainment segment.

However, if the deal does not go through, then the idea of creating a metaverse in the form in which it is presented by Microsoft will evaporate. The company will lack unique content and will match other game companies with only a couple of their own game projects and nothing more.

A strong position in the gaming market

Video games are the largest, most popular, and fastest growing form of entertainment content, with a global audience of 3 billion, and through this transaction, Microsoft intends to participate in the growing gaming business.

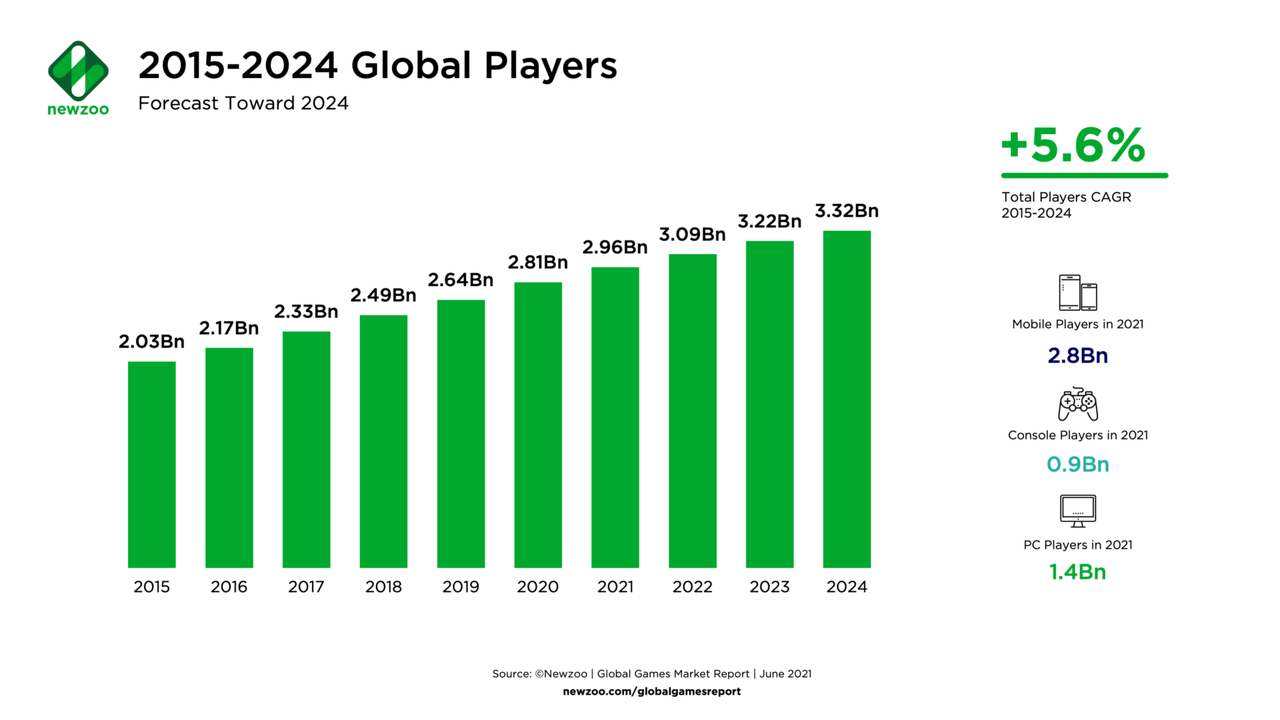

The global gaming market is projected to reach 3.32 billion users by 2024 and could grow to 4.5 billion by 2030 due to increased interest in immersive content, virtual worlds, and new experiences, according to Microsoft.

newzoo

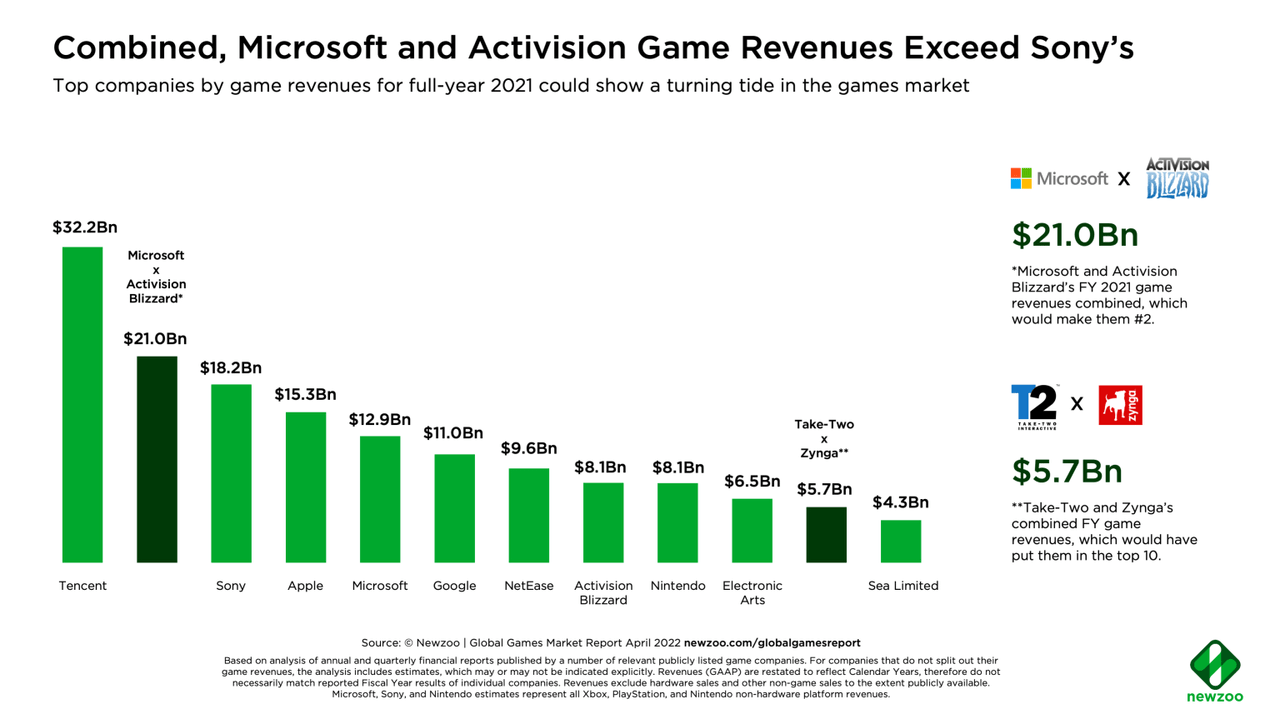

Based on revenue in 2021, Microsoft will overtake Sony Group (SONY, OTCPK:SNEJF) to become the world’s second largest gaming company, behind only Tencent (OTCPK:TCEHY, OTCPK:TCTZF).

newzoo

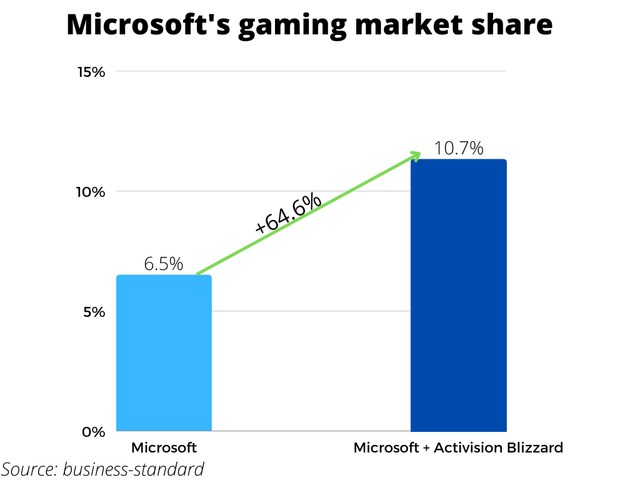

Microsoft is set to increase its share in the gaming market by 64.6% with Activision Blizzard in its gaming segment.

However, unlike Tencent, Microsoft will own franchises that will have a loyal customer base 10 years from now, not the games whose hype is likely to fade away in a year.

If the companies will end up going separate ways, then Microsoft will lose a huge market share in the first place, and more importantly, the resources necessary to further capture the market. Thus, Microsoft will be a few steps away from being completely defeated by Sony’s closest competitor in the platform and content war.

Call of Duty

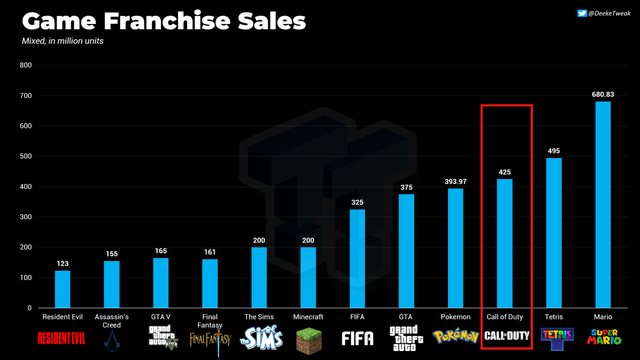

Call of Duty remains the main Activision Blizzard asset with over 425 copies sold. In a couple of years, Microsoft could pretty much own the second most popular franchise in the world.

Call of Duty has about 100 million active monthly users (as of the first quarter of 2022). At the same time, 42.1% of all users play on PlayStation, while only 25.6% play on Xbox. If Microsoft can pull at least 2.5% of all Call of Duty players from a competitive platform to its own, then this will increase the number of active Xbox users by 1 million.

The franchise will get a new round of development thanks to the resources of Microsoft, and Microsoft itself will receive an incredibly loyal 100 million players.

An absolutely ingenious move would be to make Call of Duty games free on Xbox Game Pass (video game subscription service). This will increase the number of active users and at the same time, make fans of the game think before buying a new PlayStation 5 instead of the Xbox Series X/S. Do not underestimate the Call of Duty factor. For the last 4 years, the games of this brand have been the best-selling games in the U.S.

Activision is clearly not squeezing the maximum out of the game. If the deal goes through, then Call of Duty will immediately join the Microsoft gaming ecosystem. However, if the deal slips out of the corporation’s hands, then Activision will have an incredibly strong audience, the potential of which will remain huge but will no longer be able to become something bigger.

Conclusions

Microsoft-Activision deal is definitely the most important corporate event of the year. The companies perfectly complement each other and the acquisition opens up new development paths for both.

I believe that the loss to Microsoft from the failure of this deal is huge, and I cannot imagine the conditions that regulators can put forward for the corporation to refuse the offer itself. If the deal is blocked, Microsoft will go to court and continue to fight for the company.

Microsoft’s incredible eagerness to take over Activision confirms that ATVI is a Buy, as it raises the likelihood of closing the deal.

Given that Microsoft will gain an incredible competitive advantage by purchasing Activision, I also rate MSFT as a Buy if the deal goes through.

Be the first to comment