Douglas Rissing

On Wednesday, the Federal Open Market Committee (‘FOMC’) will share with the public its latest decision made on its current quantitative tightening (QT) program to fight rising inflation.

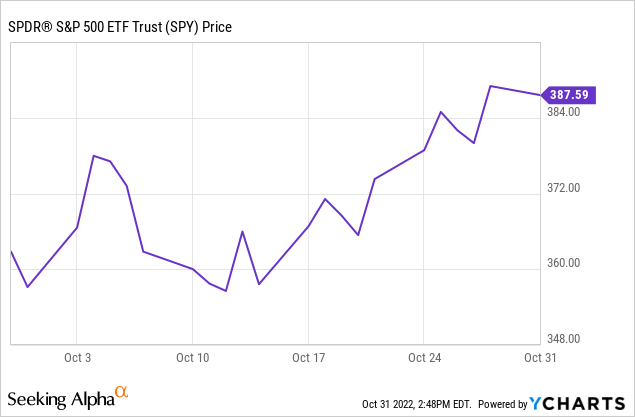

The general market expectation now is for the Fed to become less hawkish for the remainder of the year. To be more precise, the market has already priced in a 75bps rate hike for the November meeting but believes the Fed might be pausing on the December rate hike or at least giving any softening of language supporting the market bounce. That is likely why the S&P500 has rallied by almost 12% on pivot hopes since October 13, 2022. According to the latest JPMorgan statement, there is even 10% more room to the upside, if there is a less hawkish Fed or a more dovish Fed.

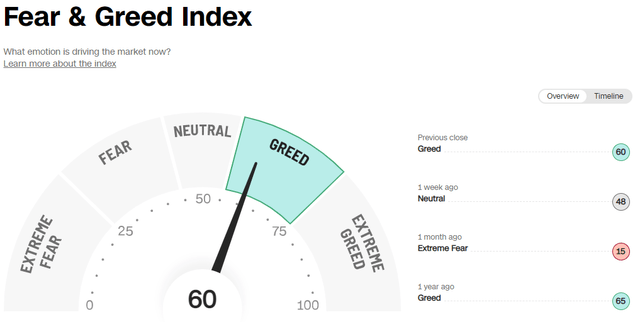

Because of that (bear) market rally, the sentiment has dramatically improved from very bearish (15) to bullish (60) within just one month.

All of the sudden, the narrative changed where traders are calling for a melt-up rally into the year-end, the so-called early on “Santa Claus” rally. The “buy-the-dip” (btd) mentality appears to have returned to the markets, all because of believing in the Fed pivot hope with the next meeting.

But are these market hopes justified by any means at all? Let’s dive into some key facts:

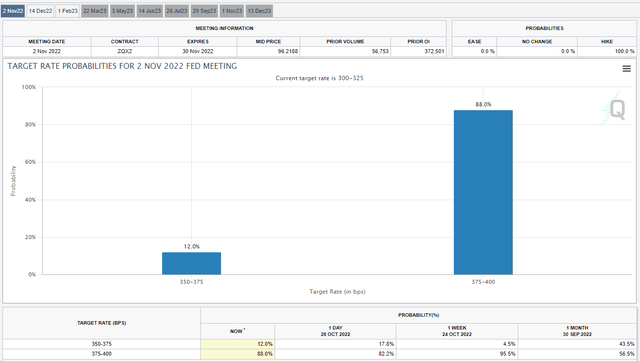

First, let’s have a close look at what interest rate hikes traders believe will happen on this and the next Fed meeting. According to the CME Fed watch tool, there is an 88% chance the Fed will raise rates by 75 bps in November 2022.

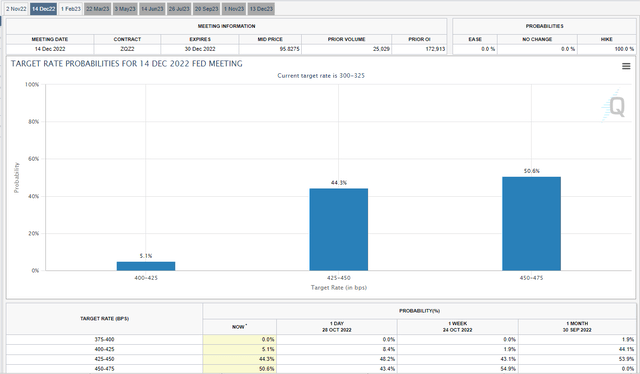

Almost 50% believe there is a chance of a 50 bps to 75 bps rate hike in December.

So that’s the general expectation. Any other outcome other than that could indeed boost the markets to the upside as JPMorgan expected. For example, the Fed could surprise the markets on the November rate hike just like the BoE recently did when it announced to raise rates only by 50 bps rather than 75 bps markets were expecting. The Fed could also surprise the markets in a positive way by targeting a lower-than-expected half of a percentage point for the December meeting.

However, there is also a good chance the markets could get it really wrong! Let me show you what I mean by that by putting together the pros and cons to evaluate the possible outcome of the upcoming Fed meeting on Wednesday.

1. Pro Rate Hike December – September Jobs Report

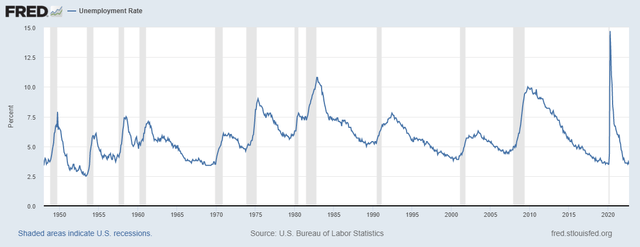

The unemployment rate came in hotter (3.5%) than expected (3.7%) – this contradicts clearly the Fed’s 4.5% self-set targeted unemployment rate. This is a clear negative for any dovish Fed hopes.

FRED Unemployment Rate (Fed St. Louis)

2. Pro Rate Hike December – September Inflation Reports

Core CPI came hotter in (6.6%) than expected (6.5%). Although we saw an improvement in the headline CPI, the Fed is usually watching more the core numbers more to strip out volatile food and energy prices.

Core PCE m/m rose (0.5%) in line with expectations (0.5%).

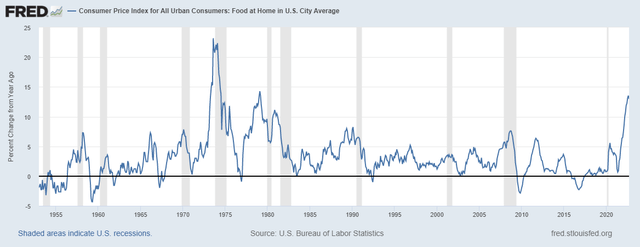

As an overall result, inflation stayed strong in September but somehow within expectations. Nevertheless, I believe the Fed is also looking into the food price CPI which is now sitting at 13% from a year ago…

3. Pro Rate Hike December – Q3/GDP Growth Report

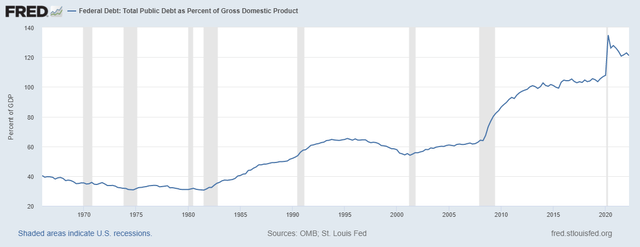

GDP came in hotter (2.6%) than expected (2.3%). This “positive” number is not confirming the recession in the US even though we got two negative GDP growth numbers before this one. Hence, this strengthens the Fed case to take on a hawkish stance to fight inflation, especially when the Debt/GDP exceeds 100 by far as you can see in the following chart.

FRED Debt to GDP (Fed St. Louis)

1. Anti Rate Hike December – MidTerm Elections 2022

Political pressure is coming out of the Democrats corner, who are likely going to lose the election. For example, Biden’s team needs a lower gas price to convince the average Americans to vote for Democrats. Biden also needs “good” news from Fed Chairman Powell. A stock market crash triggered by a very hawkish Fed would be making Biden and his Democrats in power look bad.

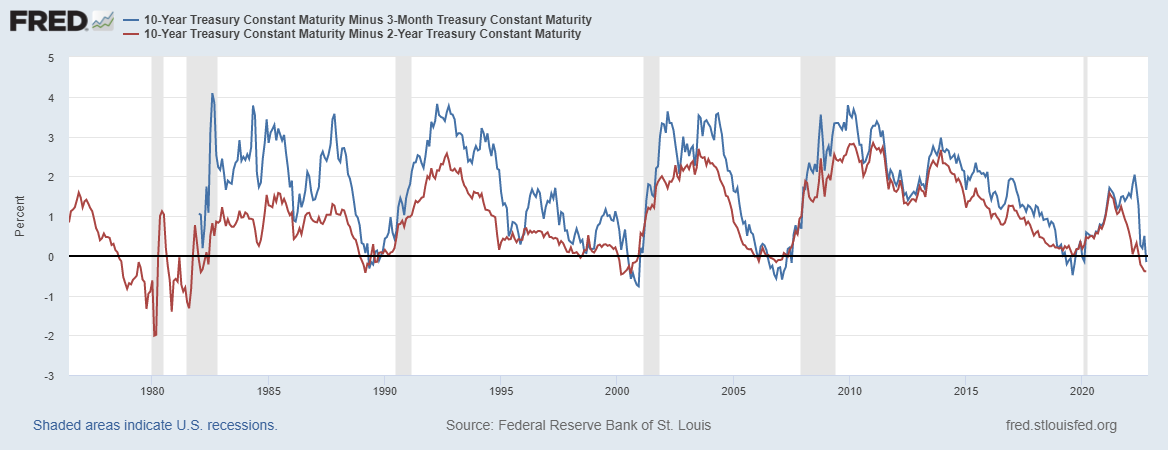

2. Anti Rate Hike December – Yield Curve Inversions

Campbell Harvey is using the yield curves to predict recessions. Two conditions need to be made to declare that we are in a recession.

-

10y/2y spread inversion needs to persist for at least three months = Met!

-

10y/3m spread needs to be inverted = Met!

FRED Yield Curves (Fed St. Louis)

As the Fed is following these yield curve spreads closely, we can assume that respective measurements will be soon followed to correct this distortion in the economy. In other words, it is likely the Fed will “pivot” rather sooner than later to adjust these distortions in the bond markets. In the past yield curve inversions, however, the Fed usually switched within 2-4 months from QT to QE after the two yield curves were inverted to fight stagnation. Consequently, we can expect the Fed pivot to take place between December 2022 and March 2023. Earlier so November 2022 is also a possibility but less likely as the yield curve inversions were just matching up.

3. Anti Rate Hike December – Upcoming US Holidays

We are entering the most impactful season of the year in the US, where it’s all about the consumer – the holiday season! Thanksgiving, Black Friday, Cyber Monday, Christmas and New Year Eve, all of these days are usually used to encourage US consumers to buy more stuff to push the GDP. The US consumer contributes up to 70% to the US GDP! If the Fed is going to raise rates in November and in December aggressively, it could discourage consumers to spend more money on stuff throughout the holidays.

Conclusion:

We have now reflected three pro-hawkish arguments vs three pro-dovish arguments. Although it might look like there is a good chance the Fed might surprise the markets in a positive way, we should consider things twice!

From an economic perspective, the Fed has no other chance other than keeping its hawkish stance if they really want to have a chance to fight inflation. From a political point of view, however, Washington wants to see the Fed to do everything possible to push the economy, especially with the upcoming Midterm elections and the holidays around the corner – the inflation fight is here, but only meant to bring down gasoline prices.

Probably this is why the markets believe there might be a dovish Fed as they believe the political pressure out of Washington is there.

But remember two things:

1. The Fed claims to be independent from congressional appropriations. If this is really the case, there should not be any political decisions made in the upcoming Fed meeting.

2. Fed Chairman Powell said multiple times over the last weeks that he aims to reduce inflation even at the risk of recession, “We must keep at it until the job is done“. Clearly, he is following the Paul Volcker 1980s playbook.

As of this, I believe the Fed will not be dovish enough as the markets are hoping for. This will ultimately send shock waves throughout the markets in the aftermath!

Be the first to comment