Khanchit Khirisutchalual

A Great Near-Term Prospect

WESCO International, Inc. (NYSE:WCC), a company that distributes electrical, industrial, and communications products, had a tremendous second-quarter run. Its momentum is set to continue until the next quarter, with the company setting record sales, margins, and EBITDA. WESCO also raised its targets, achievable if it capitalizes on strengthening the end-market demand through its cross-selling opportunities.

As the company is now a growth company, near and long-term strategies have been set in place to ensure momentum doesn’t fade quickly through debt reduction, integration activities, potential acquisitions, or returning capital to shareholders (where the company has approved a share repurchase back in June). The company’s broad portfolio of highly-marginalized products, along with a low valuation, compared to its peers, lead me to rate the stock as an attractive Buy.

Growth Through A Broad Portfolio

WESCO operates in three main segments, which are: the Electrical & Electronic Solutions (EES); Communications & Security Solutions (CSS); and Utility & Broadband Solutions (UBS) segments. The company serves 140,000 customers worldwide, and with over 1.5 million products, end-to-end supply chain services, and extensive digital capabilities, the company continues to provide innovative solutions to meet customer needs.

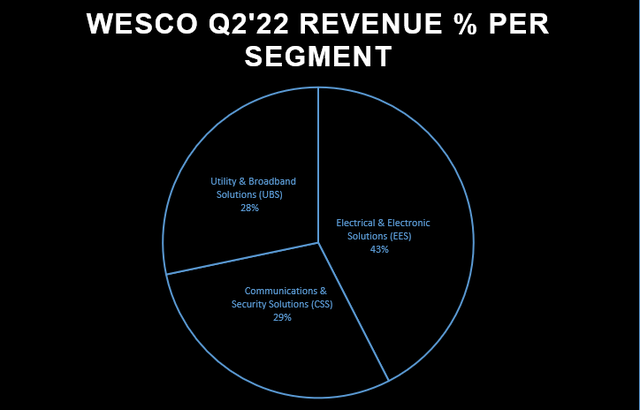

Data from WESCO’s Q2’22 Results – Chart by Author

The company achieved $5.48 billion in revenues in its second-quarter earnings release, resulting in an $888 million increase, or a 19.30% increase, in revenues year-over-year. This was led by EES, which accounted for 43% of WESCO’s Q2’22 results, followed by CSS at 29% and UBS at 28%. One of the primary growth drivers for revenue comes from the Anixter acquisition, which can be reflected by looking at the company’s Q2’20 (when the company successfully acquired Anixter) revenue results of $2.1 billion, compared to the company’s $4.14 billion revenue in the next quarter, resulting to a 93% sequential revenue growth.

With that being said, the company achieved a 13% CAGR ever since the Anixter acquisition, which helped improve its revenue mix. One of the main drivers for the EES segment is cross-selling and its Anixter acquisition. With the electrical services market growing at a 6% CAGR, the EES segment could remain the most significant part of WCC’s revenue.

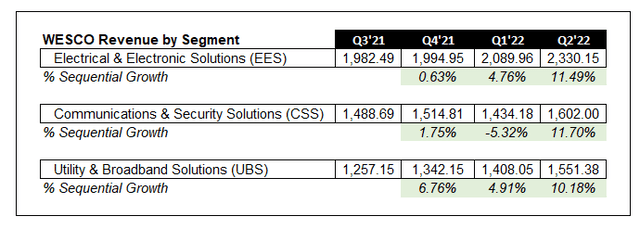

Data from WESCO’s Q2’22 Results – Chart by Author

Each WESCO segment featured a single-digit sequential growth in its 52-week period, with the company achieving record sales in a single quarter, bringing more value after the Anixter acquisition. Overall, it’s looking strong for WESCO. The momentum is entering growth territory as the company still managed to generate record sales for the past ten years despite supply chain challenges which increased backlog. As David Schulz, WESCO’s EVP & CFO, said:

“So we have been taking in inventory given the strong backlog, which are committed to orders, and we do have terms and conditions. So that inventory will be shipped to a customer. We have not seen any cancellations in the backlog. So we’re very confident in the quality of the inventory.”

This means that once supply chain constraints are addressed, the backlog will be cleared, and demand will be filled, which also means that sales could potentially increase. More demand equals more sales once backlog issues are addressed.

WESCO Compared to Industry Performance

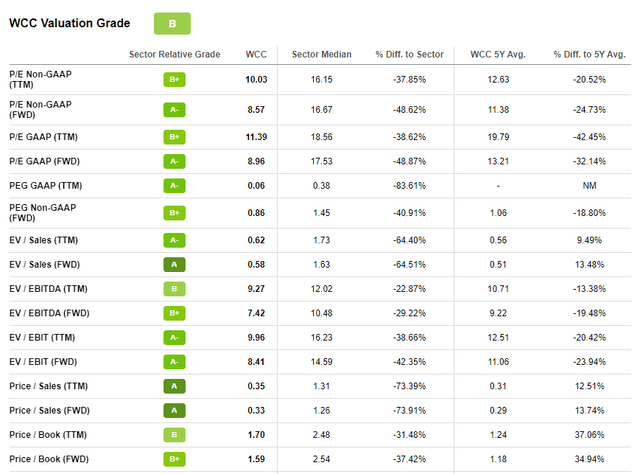

WESCO Valuation – Seeking Alpha

To further strengthen my claim on why I rate WESCO as a Buy, we have to look at the company’s recent performance through ratio and multiple analyses. Metrics such as WCC’s (TTM) P/E of 10.03, compared to the sector’s median of 16.15, take note that WCC is ranked 14 out of 618 in the Industrials sector. The company’s forward P/E is very cheap compared to the sector median of 16.67, which highly suggests that the stock is undervalued compared to the sector’s median. This pattern can also be seen with the company’s TTM EV/EBITDA multiple of 9.27 compared to the sector’s median of 12.02, which is also an undervaluation signal. Similarly, a lower Price/Sales ratio is ideal when choosing a stock, and it is what we get with WCC’s Forward P/S ratio of 0.33 compared to the sector median of 1.26, which, again, signifies undervaluation. With Seeking Alpha’s quant ratings, the WESCO receives a B valuation grade, which is pretty decent for a relatively cheap stock compared to its peers in different sectors.

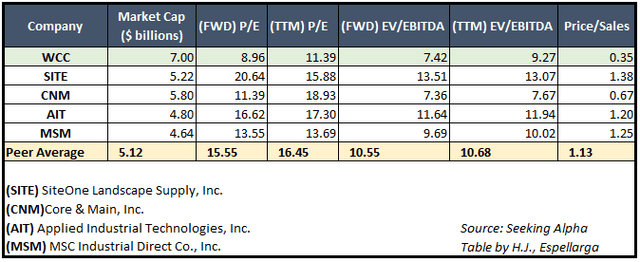

Data from Seeking Alpha – Table by Author

Speaking of different peers in the same sector, I’ve gathered four of WESCO’s peers to show a side-by-side comparison of where WCC’s at in the market. I compared WCC with peers like SiteOne Landscape Supply, Inc. (SITE), Core & Main, Inc. (CNM), Applied Industrial Technologies, Inc. (AIT), and MSC Industrial Direct Co., Inc. (MSM), which generally operates in the same sector and industry. On a peer level, WESCO is still valued lower than other companies, such as SITE, with a 20.64 forward P/E ratio, compared to the company’s forward P/E ratio of 8.96, which again shows signs of an undervaluation. With WCC’s forward EV/EBITDA multiple of 7.42, it still is lower than its peer’s average of 10.55, which signifies that it is cheap. At the end of the day, whether you compare its valuation metrics at a sector level or down to a peer level, WESCO still shows undervaluation under these TTM and forward multiples, strengthening my Buy rating.

WESCO Risks and Challenges

One of the weaknesses that turns me off about WESCO is that it has a relatively high debt/equity ratio of 1.35. To me, it’s relatively high, since the company would typically need to deleverage, and it will be a bit challenging since the company had less cash in 2021 compared to 2020. Because in 2020, the company had $449.14 million in cash and cash equivalents, while the company had $212.58 million in cash and cash equivalents in 2021 due to the use of $210 million in cash in Q4’21, including $100 million for inventory that led to a lower accounts payable balance, resulting in a cash draw of $100 million in the quarter. For short-term liquidity, the company has $7.6 billion in current assets while having $3.5 billion in current liabilities, which gives us a strong 2.12 current ratio and indicates no short-term liquidity issues.

Regarding long-term solvency concerns, management did mention that excess liquidity will prioritize debt reduction, integration activities, potential acquisitions, or returning capital to shareholders through their existing share repurchase authorization of $1 billion, which last was approved in June. I think that the company’s cash operating and financing activities are sufficient for the long-term debt that they currently have.

Other than the solvency risk, there are also supply chain disruptions, increasing backlog, and inventory issues that the company is currently working on. They need to invest more in inventory to ensure that demands are met and backlogs are cleared up. This is a risk because even if the company has momentum and is deemed a growth stock, its profitability can affect its near-term and long-term value. WESCO has a 21% TTM gross profit margin compared to the sector median’s 29% TTM gross profit margin, which the company has been sitting on for the past years since its 5-year gross profit margin has been around 19%, which is below the median. To ensure that the company maintains its value, it needs to show some profitability by reducing expenses and managing inventories better to meet demands rather than solely relying on cross-selling and top-line performance.

Final Take On WESCO

Overall, I believe that WESCO International’s broad portfolio will play a massive role if the company continues cross-selling products amongst different segments. With the company’s broad portfolio, it can continue cross-selling products and solutions while profoundly investing in a specific segment with a high CAGR to boost its growth capabilities further while solving triviality in profitability by increasing its margins through top-line growth or reduction in costs. The $1 billion approved share repurchase can also boost the stock. The company is valued far less than its peers in different sectors, showing signs of undervaluation.

With the company beating EPS estimates for the past four quarters, I believe WESCO International, Inc. currently has momentum on its way to growth. Although the company has some minor inventory and long-term solvency issues, the numbers don’t lie, and it’s looking like a Buy. I rate WESCO International stock as a buy by evaluating the valuation metrics with a close-up peer analysis.

Be the first to comment