Joe Raedle/Getty Images News

Wendy’s (NASDAQ:WEN) is a massive fast food chain which is known for its famous hamburgers, fries, and its signature Frosty. The company is one of the largest and most successful fast food restaurant chains in the world and has the fundamentals to back it up. Wendy’s has growing fundamentals, most notably with revenue and gross profit seeing immense growth over recent years. The balance sheet is a little troubling, as debt is growing and nearing $3 billion. However, the company generates free cash flow effectively and pays an impressive dividend yield. Wendy’s had a strong 1Q22 in terms of unit growth, but slightly fell below expectations and is falling behind its competitors in global sales growth. If a recession does come, the fast-food industry is set to do much better than sit-down restaurants, and Wendy’s has cheap and respected deals on its menu which will thrive. Trian Fund Management is the largest shareholder of Wendy’s and is interested in potentially acquiring the entire company at a premium, which would provide value to investors. However, WEN stock has dropped greatly this year and it is likely that momentum will keep on dropping the share price. Investors should wait for a margin of safety, which is why I value WEN as a Hold.

Wendy’s Has Strong Fundamentals But A Tricky Balance Sheet

Wendy’s has very strong fundamentals which help to prove the success that the chain has been posting over recent years. Revenue grew from $1.44 billion to $1.90 billion over the past 6 years, as the company has put an emphasis on expanding the chain globally over recent years. Nearly 7,000 Wendy’s restaurants are now opened throughout the United States and 29 countries. From 2016 to 2021 gross profit has also seen a climb, as it grew from $690.72 million to $1.27 billion. EBIT has been moving up and down over this same 6-year span, but has generally increased as it has risen from $314.78 million to $349.04 million over this period.

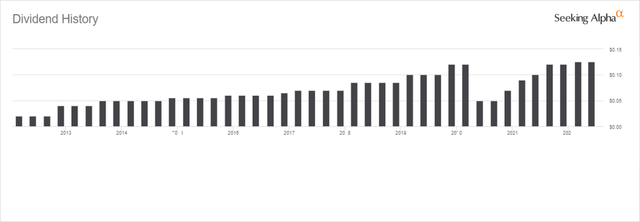

The balance sheet has also been trending upward over the past 6 years. Cash has increased from $198.24 million to $249.44 million over the past 6 years. The company’s current ratio is 2.6, with plenty of assets to cover liabilities. Total debt has been increasing from 2016 to 2021 as it has jumped from $2.51 billion to $2.96 billion. This could be unnerving, but is not too concerning as the company has proven to be able to translate EBIT into free cash flow, and has a strong and healthy balance sheet in other regards. Wendy’s Net Debt/EBITDA ratio currently sits at 7.6, which is also quite high and reflects the company’s large scale of total debt. Retained earnings has increased from -$290.86 million to $344.20 million over the past 6 years, which is why the company has decided to generally increase its dividends. Dividends trended upward for years before the COVID-19 pandemic, but has since dropped and is currently working back up to pre-pandemic levels. The company currently pays a $0.50 dividend, which equates to a 2.64% yield at the time of writing this article.

Wendy’s Dividend History (Seeking Alpha)

Wendy’s is now looking to boost its balance sheet even further, which the company recently began taking steps to do so. CEO Todd Penegor believes that Wendy’s strengthened its balance sheet in 1Q22 with the completion of its successful $500 million debt raise transaction.

From 2016 to 2021, Wendy’s increased its cash from operating activities from $193.83 million to $345.77 million. Capex has decreased from $150.02 million to $77.98 million. Therefore, the company’s free cash flow is increasing, which is attributed to its cash from operations being on the rise and its capex being on the decline. The trend is that the company has been paying debt, but Wendy’s has issued a large amount of debt in 2021 at $116 million.

First Quarter Indicates Growth While Missing Expectations

Wendy’s recently reported one of the best quarters in its history, particularly in terms of expansion. Over 90 new restaurants opened up and the company is on its way to achieving its net unit growth of 5%-6% a year. However, Wendy’s did not meet expectations in the first quarter and are lagging behind its top competitors in global sales. Revenue grew by 6.2% in 1Q22, but the company still fell below revenue expectations by over $9 million. EPS for the quarter fell right behind expectations, as it reached $0.17 per share which was 1 cent below estimates. The decreased profit over the quarter could be boiled down to greater general and administrative expenses over the quarter. Wendy’s has recently placed a high priority on its international markets, but the company lagged behind its top competitors in global sales over 1Q21. Wendy’s global sales grew by 2.4% in the first quarter, which is heading in the right direction, but still falling behind competition. McDonald’s (MCD) reported an 11.8% increase in global sales and Burger King (QSR) grew by 10.3%. Wendy’s is certainly expanding its global presence, but should look to close the gap between its competition to make the most out of its international chains.

A Recession Would Not Be The Worst Thing For Wendy’s

A recession can very well be coming, which would not be the worst thing for Wendy’s. Obtaining cheap food is very important for many during a recession, which is why Wendy’s can greatly benefit from consumers looking for inexpensive options. Wendy’s great deals such as the ‘Four for $4’ and the ‘Biggie Bag’ will be in high demand during a possible recession, as people will looking to save money anywhere they can.

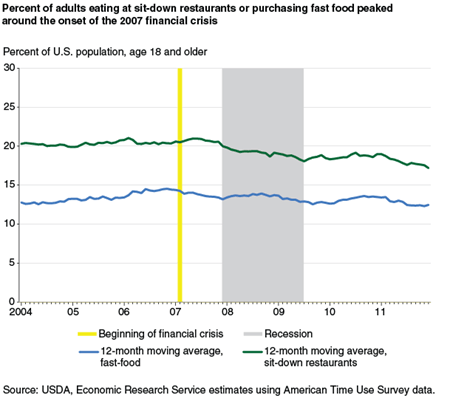

Adults Eating At Sit-Down Restaurants vs. Fast Food During Great Recession (USDA)

The percent of adults eating fast food was pretty steady and did not drop by much during the Great Recession, while sit-down restaurants suffered a much greater decline. If another recession does come, it is likely that there will be a similar trend, as people will look to eat at cheap fast-food restaurants like Wendy’s to save money. This is why Wendy’s is recession-resistant, and should be able to survive a possible upcoming recession.

An Activist Investment Firm Is Looking To Provide Value to Shareholders

Trian Fund Management, an activist investment firm, is the largest shareholder of Wendy’s through owning over 19% of WEN shares. The firm is also exploring its options to fully takeover the fast-food chain. In the firm’s SEC filing, it stated its interest in exploring and evaluating a potential transaction to enhance shareholder value. A full acquisition of Wendy’s would come at a premium and would bring great value to investors. Equity research experts like Mike Kalinowski believe that an acquisition is likely and could come at $23 to $25 a share. This would be big news for investors to take advantage of between a 21% and 31% premium.

Valuation

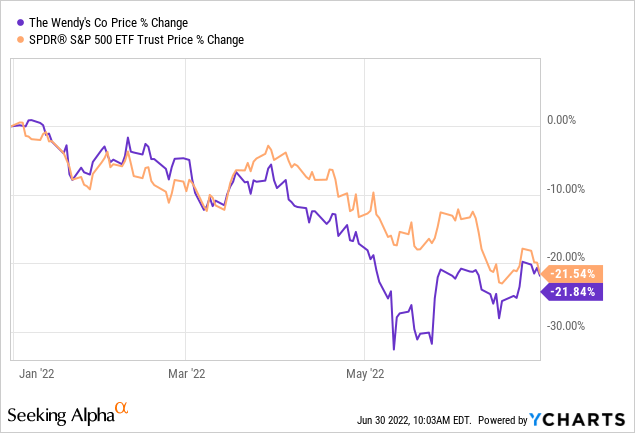

The share price is just underperforming the market, but it is not a significant rate to be worried about. Since the share price is down so much, investors may be interested in jumping into the stock. However, momentum could bring the stock down even further.

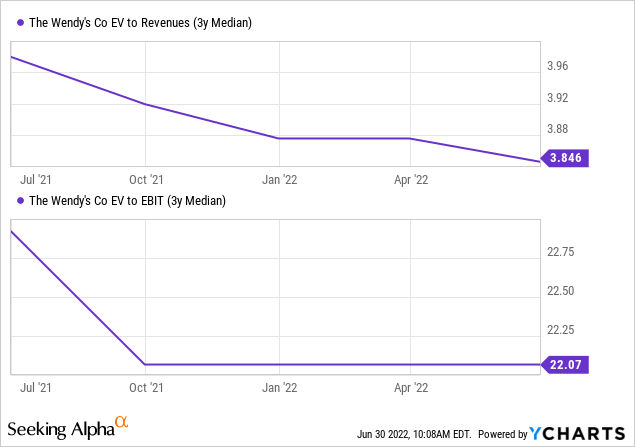

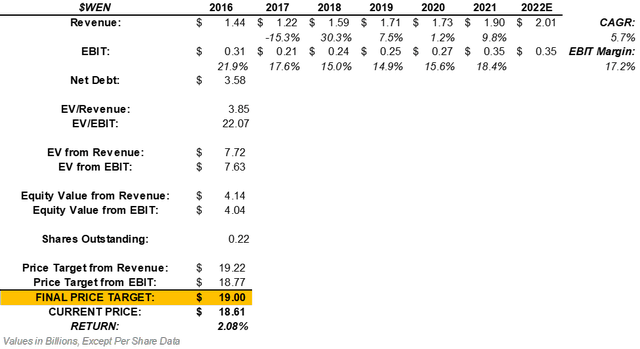

The last 6 years saw Wendy’s increase its revenue from $1.44 billion to $1.90 billion. This designates at CAGR of 5.7% which can be applied into the company’s next fiscal year. This forecasts the company to generate $2.01 billion in revenue in 2022. On top of that, Wendy’s has seen an average EBIT margin of 17.2%. Multiplying this margin by the estimated revenue of $2.01 billion will project the company to produce $350 million in EBIT in the upcoming fiscal year. After multiplying these projections by its current EV/Revenue and EV/EBIT multiples, we can come to the company’s expected enterprise value.

After adjusting the company’s estimated enterprise values for net debt, we can find Wendy’s projected equity value from revenue and EBIT. Dividing the equity values by the current number of shares outstanding and averaging the price targets bring us to a final price target of $19.00. This means that WEN stock could return an upside of 2.08%.

Valuation of WEN stock (Created By Author)

The Takeaway For Investors

Wendy’s has great fundamentals with a strong income statement and cash flow statement; however, the balance sheet is not the strongest, with a significant amount of debt. The company believes it has strengthened its balance sheet this quarter with a $500 million debt raise transaction. Wendy’s also had strong unit growth in 1Q22, but failed to meet expectations as it lagged behind competitors, especially in global sales growth. Wendy’s is recession-resistant as it has cheap items and fast food is a much more popular choice during market downturns over sit-down restaurants. Trian Fund Management owns over 19% of WEN shares and may be looking to acquire the whole company at a premium, which would give value to investors. WEN share price has dropped considerably this year, and momentum could mean that the stock will continue to do so. Investors should halt for a margin of safety before getting into WEN, as buying at the right price is crucial. Therefore, I will apply a Hold rating to WEN stock.

Be the first to comment