JHVEPhoto

Consumers are getting strapped, with the Personal Saving Rate down to the lowest level since 2005. The latest jobs report, though, actually showed that yearly hourly earnings are above the most recent Core PCE figure. Still, there’s no doubt that folks are spending down their excess savings. One restaurant could benefit from relatively less expensive food away from home, but the shares have a valuation premium.

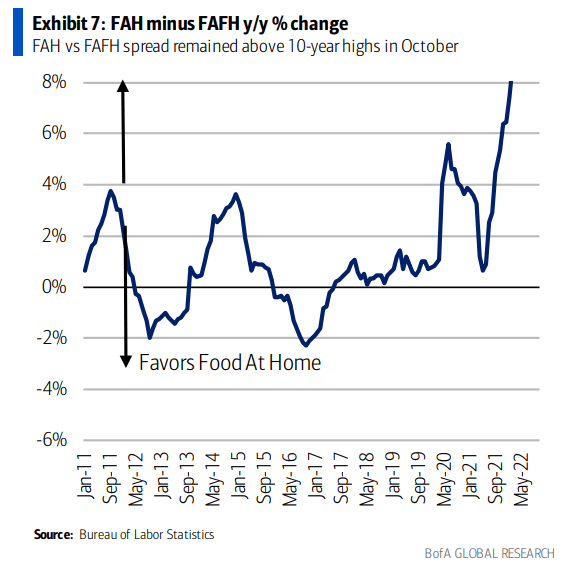

FAH-FAFH Spreads Favors Restaurants

BofA Global Research

According to Bank of America Global Research, Wendy’s (NASDAQ:WEN) is the third-largest hamburger quick-service restaurant chain. The company is trying to reinforce its historical brand positioning as a premium QSR brand through major remodels and product differentiation. Wendy’s is increasing its franchise mix and trying to restart unit growth in North America and internationally, where the brand has very little presence.

The Ohio-based $4.8 billion market cap Hotels, Restaurants, & Leisure industry company within the Consumer Discretionary sector trades at a high 26.2 trailing 12-month GAAP price-to-earnings ratio and pays a 2.2% dividend yield, according to The Wall Street Journal.

Recently, Wendy’s issued mixed Q3 results but mentioned that it had strong revenues from breakfast foods. Importantly, the management team reiterated FY 2022 guidance as the consumer, while strapped, might be trading down to Wendy’s low-cost fast food. Wendy’s remains a holding of activist investor and fund manager Nelson Peltz through Trian Fund Management. You can’t rule out a takeover of this name, either.

Downside risks include tough comps as the firm’s financials will roll off the launch of its breakfast lineup, which happened back in 2021. Also, significant international exposure is a question mark given tepid global GDP growth next year. Upside potential stems from improving high-margin breakfast sales, a lower US dollar, and possible M&A or strategic partnerships.

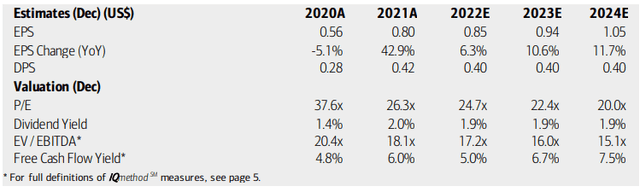

On valuation, analysts at BofA see earnings having risen at about the rate of inflation this year, but then rising nicely in 2023 and 2024. Dividends are expected to be flat near $0.40, though the latest payout announcement was for $0.125, implying a $0.50 forward annual yield. Wendy’s operating P/E still looks pricey even with 10% EPS growth, leading to a PEG near 2.0, while its EV/EBITDA ratio is high above 15. The restaurant chain generates significant free cash flow, though. Overall, the valuation looks a bit expensive when weighing all the evidence.

Wendy’s: Earnings, Valuation, Dividend Forecasts

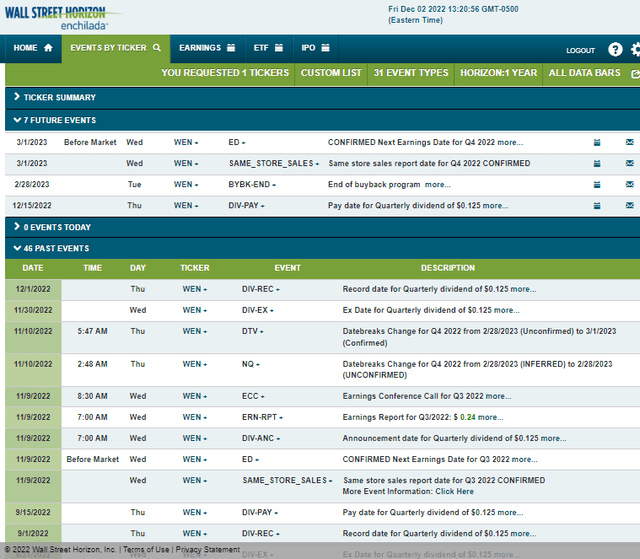

Looking ahead, corporate event data provided by Wall Street Horizon shows a confirmed Q4 2022 earnings date of Wednesday, March 1. Before that, the stock has a dividend pay date of December 15 and the firm’s share repurchase program ends on February 28, 2023.

Corporate Event Calendar

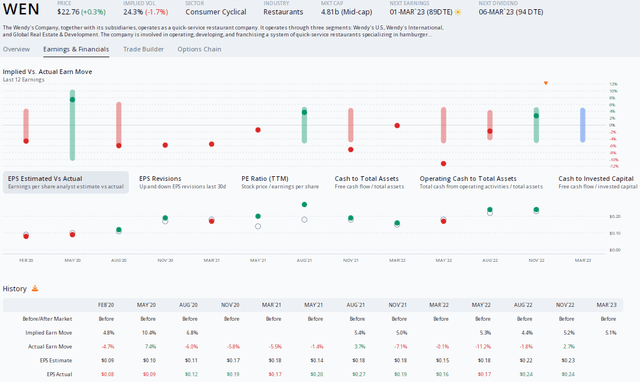

The Options Angle

Data from Options Research & Technology Services (ORATS) show an expected Q4 earnings-related stock price move of 5.1% using the nearest-expiring at-the-money straddle. So, thus far, there is little in the way of expected excess volatility in the cards.

WEN: Shares Rallied After Its Recent EPS Beat

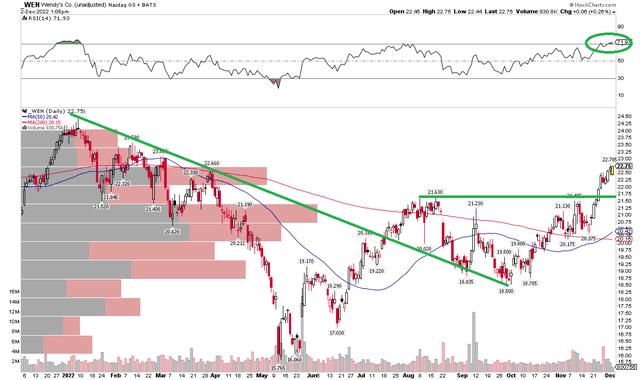

The Technical Take

WEN is a high relative strength chart in the last several months. Notice how shares broke above a key range just below $22 last month. That yields a bullish price objective to near $24.50 – which is important as that has been a historical point of profit-taking by the bulls. The stock paused there in late 2020, late 2021, and once again earlier this year. A breakout above $25 would likely lead to a test of the mid-2021 high above $29. For now, being long technically with a stop under $21 looks good on the charts.

WEN: Strong Momentum Confirms A Rising Stock Price, Targeting $24.50 to $25

The Bottom Line

I like Wendy’s technically, but the valuation is high. Long-term investors should wait for earnings to arrive so that the P/E hopefully retreats somewhat. Short-term traders looking at the charts should consider being long, however. This is one of the stocks that has a different taste based on one’s time horizon and style. That’s how it goes sometimes.

Be the first to comment