Michael M. Santiago/Getty Images News

Wells Fargo (NYSE:WFC) has been stuck in limbo for the past few years. Shares have looked cheap compared to other national banks.

However, many investors have been nervous about taking a position given the large liabilities the company potentially faced for its past illicit behavior, along with regulatory constraints on the bank. Throw in the fact that notable investors, including Warren Buffett, sold their stakes in WFC stock, and it’s not hard to see why shares haven’t performed well in recent times.

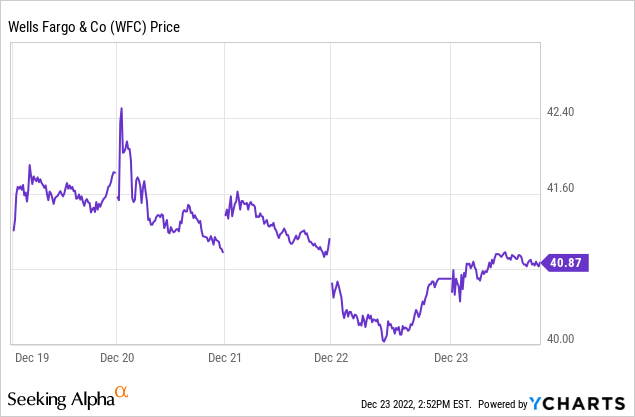

Against that backdrop, Tuesday brought a huge piece of news. The Consumer Financial Protection Bureau (CFPB) announced its regulatory action against Wells Fargo, hitting the bank with a total fine of $3.7 billion. On the surface, that sounds like a ton of money, and might be bad news for shareholders. However, shares were fairly muted in reaction, here’s the most recent five days of trading action in WFC stock:

As you can see, shares had a mixed trading session on Tuesday the 20th as traders digested the news, and as of this writing are down around 2% overall since the decision was announced.

And, as I’ll explain in a minute, that seems like a sensible reaction. If anything, I’d view this development as an incremental positive for Wells Fargo. In any case, despite the shocking $3.7 billion figure in the headline, this is far from a disaster for Wells. Let’s dig into the details.

A $3.7 Billion Fine

The CFPB assessed a $3.7 billion enforcement action against Wells Fargo. That’s broken down as follows:

- $1.3 billion in consumer redress related to auto loans.

- $500 million for affected deposit accounts including $205 million to remediate surprise overdraft fees.

- Nearly $200 million related to mortgage servicing accounts.

- $1.7 billion in penalties. This money goes to the CFPB’s victims relief fund.

It seems that Wells Fargo might have had been preparing for this sort of move as the company had put aside $2 billion in its third quarter results for future legal and remediation expenses. The $1.7 billion CFPB penalty comes on top of that, but Wells Fargo had already seemingly taken an advance accrual for the $2 billion remediation portion of this fine. There also was market chatter around a large potential CFPB settlement back in November.

Wells Fargo has a total of 3.8 billion shares outstanding. As a result the total fine works out to approximately $1 per share in expenses. The CFBP penalty portion of it works out to around 45 cents per share of added expense (ignoring tax consequences of the fine).

That alone should explain the significant lack of stock price volatility since the CFPB news hit. $3.7 billion is a huge amount of money in nominal terms, but at the absolute worst, it’s a $1/share hit to shareholder value on a stock currently trading for around $40 each. A $3.7 billion fine doesn’t really move the needle.

Light At The End Of The Tunnel

This is not the end of regulatory actions against Wells Fargo. There are several other outstanding issues that the bank must resolve before it once again has a clean slate. Adding to that, the head of the CFBP said that this was not the end of the agency’s work relating to Wells Fargo.

Regardless, some analysts have pointed to this settlement as being a turning point for Wells Fargo. Jefferies’ Ken Usdin, for example, called this a “sign of positive progress” for Wells Fargo. While this isn’t an all-clear for the bank, this settlement resolved several of the larger outstanding issues for Wells Fargo.

Arguably, the biggest remaining roadblock for Wells Fargo at this point is the asset cap. It’s important to remember that the asset cap is a penalty put in place by the Federal Reserve and is not directly tied to the CFBP’s regulatory actions. Even resolving things entirely with the CFPB wouldn’t necessarily be a direct catalyst to causing the Fed to change its stance. That said, making concrete progress with one regulator is likely to be an incremental positive toward changing broader sentiment toward Wells Fargo.

The asset cap is becoming an increasingly large problem as inflation causes overall monetary numbers to rise. Wells Fargo should be taking in significantly more assets now and growing its operations in this much more favorable interest rate environment. Instead, Wells Fargo is stuck in the penalty box heading into 2023.

To sum up, Wells Fargo’s regulatory troubles aren’t over by any means. However, this is another solid step toward getting out of this dark period of the bank.

Underlying Earnings Are Strong And Trending Upward

Another measure of the relative importance of this fine is simply to look at Wells Fargo’s earnings.

In just Q3 of this year alone, Wells Fargo earned $3.5 billion of net income. The total CFBP settlement, by contrast, was $3.7 billion, or just about one quarter’s worth of profits.

Q3 was hardly an anomaly, either, as the company had earned $3.1 billion in net income in Q2 of 2022 as well. Wells Fargo has a tremendous amount of recurring earnings power, even while it is saddled with regulatory constraints, high overhead and legal expenses, and a mixed business environment.

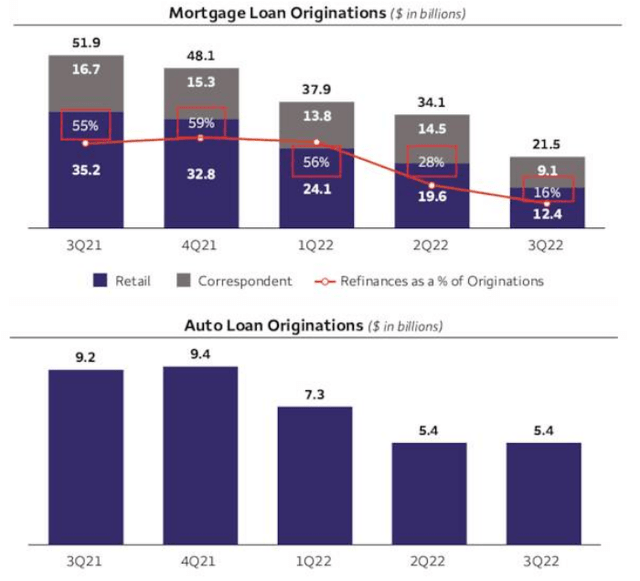

As a reminder, Wells Fargo has a large mortgage banking business, which will presumably be under pressure for the foreseeable future given the slump we’re now seeing in the housing market. Auto loans also have dropped significantly as economic conditions have softened:

Loan originations (Earnings presentation)

And the investment banking business is likely to see slower results as well, given the bear market and resultant closing of the IPO window and other such financial transactions.

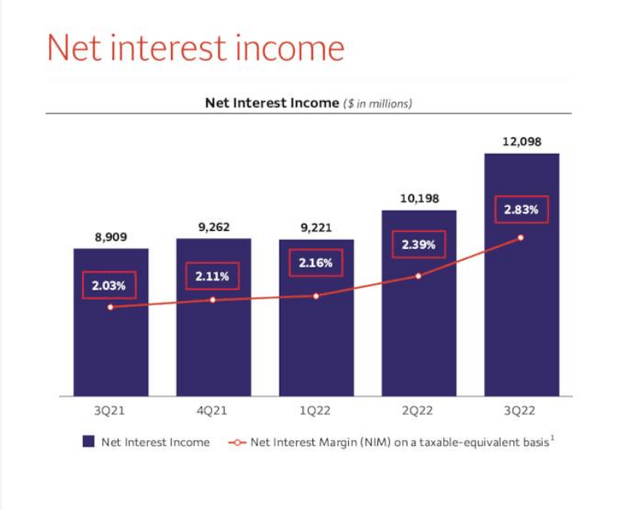

Despite those negative factors, Wells Fargo’s earnings are trending upward. Because, overshadowing all those factors, the firm’s core net interest income is absolutely exploding higher right now:

Wells Fargo net income (Corporate Presentation)

After being steady at around $9 billion per quarter, net interest income jumped to $10.2 billion in Q2 and a massive $12.1 billion in Q3.

This is primarily due to rising interest rates. Wells Fargo saw its net interest margin “NIM” explode from 2.0% in Q3 of last year to 2.8% this year. Adding 80 basis points of additional profit margin on Wells Fargo’s massive loan book is a game-changer. With the Fed continuing to raise rates for the time being, NIM should at least stabilize in the current range, if not continue to rise modestly heading into 2023.

If I had to point out a negative, it’d be that Wells Fargo isn’t buying back a material amount of stock at the moment. Despite the firm’s rising profitability and its capital adequacy ratio well above the regulatory requirement, Wells Fargo is sitting on its excess capital.

I get there is economic uncertainty right now, and that the bank is continuing to deal with its remaining legal and regulatory concerns. Still, Wells Fargo is enjoying a sharply improving earnings picture, and yet its share price isn’t that far above its 52-week lows. I’d love to see a share repurchase program to soak up some of Wells’ cheap outstanding stock here around 10x forward earnings.

WFC Stock Bottom Line

It’s never reassuring to hear that a company you’ve invested in has gotten hit with a multi-billion dollar fine. Investors are frustrated with Wells Fargo, and I totally understand why.

That said, it was clear for some time that the CFPB would be hitting Wells Fargo with a sizable regulatory enforcement action. This sort of headline, while unpleasant, was a necessary step in restoring Wells Fargo’s reputation and ability to operate freely going forward.

And investors shouldn’t lose sight of the bank’s forward prospects. It’s important that Wells Fargo clear up all remaining liabilities from its past misbehavior. However, there’s new management, a new business strategy, and rapidly increasing interest income amid a much more favorable outlook for the bank. All this speaks to a share price which should rise dramatically above the current $40 level over the next couple of years.

Be the first to comment