piranka

Author’s note: This article was released to CEF/ETF Income Laboratory members on November 23, 2022. Please check latest data before investing.

The Weekly Closed-End Fund Roundup will be put out at the start of each week to summarize recent price movements in closed-end fund [CEF] sectors in the last week, as well as to highlight recently concluded or upcoming corporate actions on CEFs, such as tender offers. Data is taken from the close of Friday, November 18th, 2022.

Weekly performance roundup

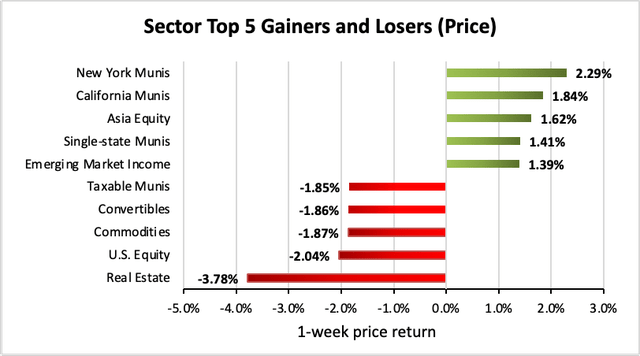

Global equity markets soared on weaker than expected US CPI (inflation) numbers. 7 out of 23 sectors were positive on price (down from 22 last week) and the average price return was -0.55% (down from +3.56% last week). The lead gainer was New York Munis (+2.29%) while Real Estate lagged (-3.78%).

Income Lab

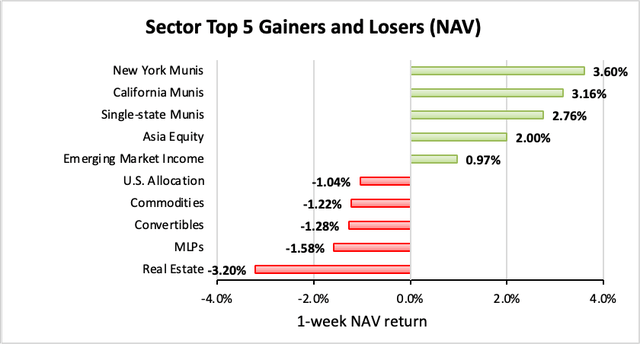

11 out of 23 sectors were positive on NAV (down from 22 last week), while the average NAV return was +0.11% (down from +3.59% last week). The top sector by NAV was New York Munis (+3.69%) while the weakest sector by NAV was Real Estate (-3.20%).

Income Lab

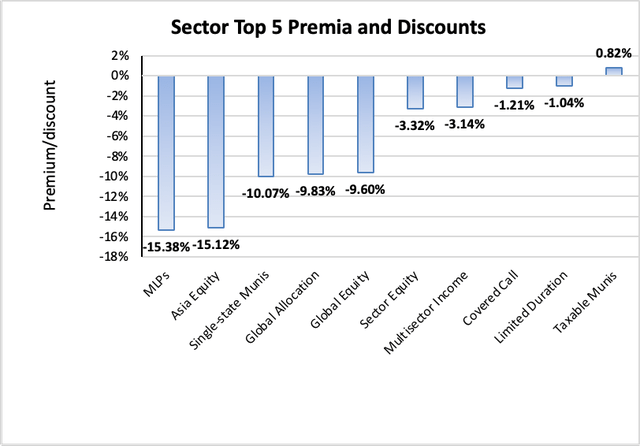

The sector with the highest premium was Taxable Munis (+0.82%), while the sector with the widest discount is MLPs (-15.38%). The average sector discount is -6.51% (down from -5.88% last week).

Income Lab

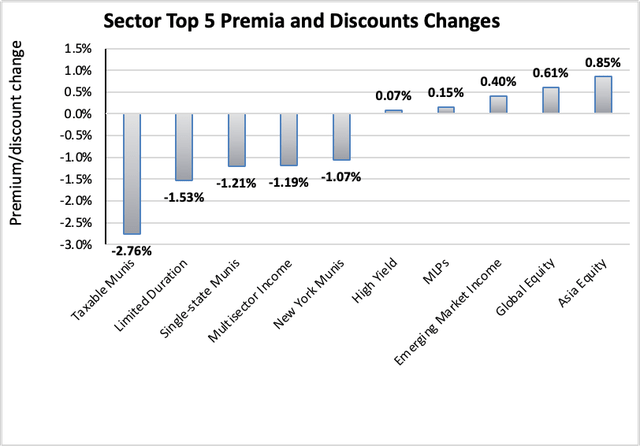

The sector with the highest premium/discount increase was Asia Equity (+0.85%), while Taxable Munis (-2.76%) showed the lowest premium/discount decline. The average change in premium/discount was -0.51% (down from +0.19% last week).

Income Lab

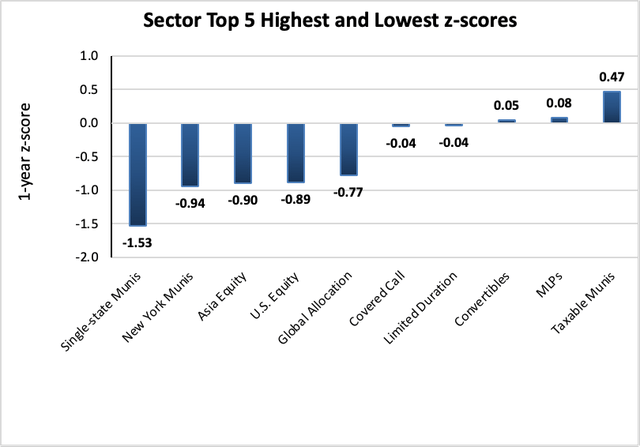

The sector with the highest average 1-year z-score is Taxable Munis (+0.47), while the sector with the lowest average 1-year z-score is Single-state Munis (-1.53). The average z-score is -0.47 (down from -0.33 last week).

Income Lab

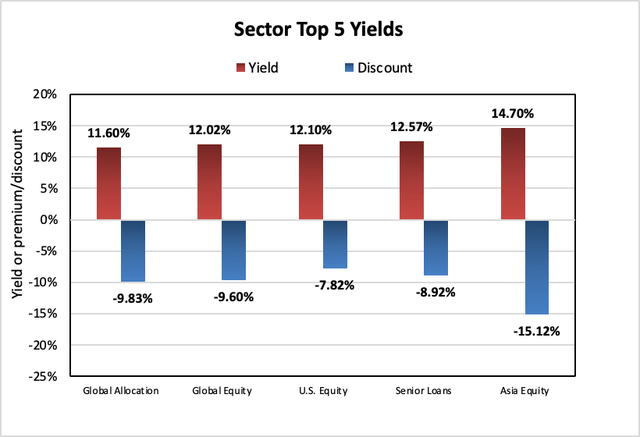

The sectors with the highest yields are Asia Equity (14.70%), Senior Loans (12.57%), and U.S. Equity (12.10%). Discounts are included for comparison. The average sector yield is 8.88% (up from 8.81% last week).

Income Lab

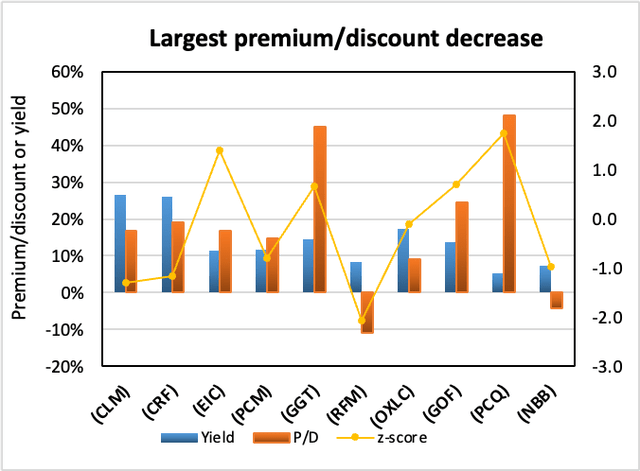

Individual CEFs that have undergone a significant decrease in premium/discount value over the past week, coupled optionally with an increasing NAV trend, a negative z-score, and/or are trading at a discount, are potential buy candidates.

| Fund | Ticker | P/D decrease | Yield | P/D | z-score | Price change | NAV change |

| Cornerstone Strategic Value | (CLM) | -11.55% | 26.46% | 16.82% | -1.3 | -7.03% | 5.88% |

| Cornerstone Total Return Fund | (CRF) | -10.28% | 25.91% | 19.20% | -1.2 | -5.19% | 6.14% |

| Eagle Point Income Co Inc | (EIC) | -8.95% | 11.31% | 16.75% | 1.4 | -7.82% | 0.00% |

| PCM Fund | (PCM) | -8.23% | 11.72% | 14.87% | -0.8 | -6.83% | -0.14% |

| Gabelli Multi-media | (GGT) | -5.94% | 14.38% | 45.02% | 0.7 | -0.97% | 1.93% |

| RiverNorth Flexible Municipal Income | (RFM) | -5.11% | 8.24% | -10.79% | -2.1 | -3.44% | 2.12% |

| Oxford Lane Capital Corp | (OXLC) | -4.89% | 17.27% | 9.00% | -0.1 | -5.79% | 0.00% |

| Guggenheim Strategic Opp Fund | (GOF) | -4.53% | 13.81% | 24.57% | 0.7 | -4.35% | -0.86% |

| PIMCO CA Municipal Income | (PCQ) | -4.42% | 5.13% | 48.20% | 1.7 | -0.72% | 3.96% |

| Nuveen Taxable Municipal Income | (NBB) | -4.33% | 7.21% | -4.29% | -1.0 | -3.15% | 1.26% |

Income Lab

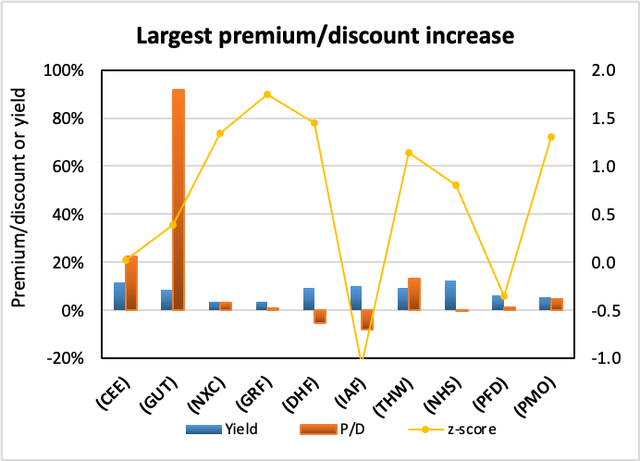

Conversely, individual CEFs that have undergone a significant increase in premium/discount value in the past week, coupled optionally with a decreasing NAV trend, a positive z-score, and/or are trading at a premium, are potential sell candidates.

| Fund | Ticker | P/D increase | Yield | P/D | z-score | Price change | NAV change |

| The Central and Eastern Europe Fund | (CEE) | 13.36% | 11.67% | 22.31% | 0.0 | 13.47% | -0.30% |

| Gabelli Utility Trust | (GUT) | 6.60% | 8.72% | 91.64% | 0.4 | 1.03% | -2.45% |

| Nuveen CA Select Tax Free Income | (NXC) | 6.11% | 3.61% | 3.17% | 1.3 | 8.04% | 1.65% |

| Eagle Capital Growth | (GRF) | 5.74% | 3.76% | 0.92% | 1.8 | 8.01% | 5.86% |

| BNY Mellon High Yield Strategies Fund | (DHF) | 5.69% | 9.37% | -5.20% | 1.5 | 7.24% | 0.81% |

| Aberdeen Australia Equity Fund Inc | (IAF) | 4.87% | 10.28% | -8.07% | -1.1 | 3.95% | -1.55% |

| Tekla World Healthcare Fund | (THW) | 4.68% | 9.49% | 13.11% | 1.1 | 3.84% | -0.46% |

| Neuberger Berman High Yield Strategies | (NHS) | 4.27% | 12.58% | -0.23% | 0.8 | 4.10% | -0.35% |

| Flaherty & Crumrine Preferred Income | (PFD) | 4.24% | 6.35% | 1.32% | -0.4 | 4.54% | 0.18% |

| Putnam Muni Opportunities | (PMO) | 4.03% | 5.59% | 4.88% | 1.3 | 7.55% | 3.43% |

Income Lab

Recent corporate actions

These are from the past month. Any new news in the past week has a bolded date:

November 10, 2022 | RiverNorth Opportunities Fund, Inc. Announces Final Results of Rights Offering.

November 9, 2022 | Macquarie Global Infrastructure Total Return Fund Inc. announces results of the special stockholder meeting relating to the proposed reorganization with abrdn Global Infrastructure Income Fund.

November 9, 2022 | Delaware Ivy High Income Opportunities Fund Announces Results of the Special Shareholder Meeting Relating to the Proposed Reorganization With abrdn Income Credit Strategies Fund.

November 9, 2022 | abrdn U.S. Closed-End Funds Announce Results of Special Shareholder Meetings Relating to Proposed Reorganizations with Delaware Management Company-Advised Closed-End Funds.

November 7, 2022 | Tortoise Announces Final Results of Tender Offers for its Closed-End Funds.

November 3, 2022 | Virtus Convertible & Income Fund, Virtus Convertible & Income Fund II Announce Final Results of ARPS Tender Offers.

Upcoming corporate actions

These are from the past month. Any new news in the past week has a bolded date:

November 9, 2022 | Eaton Vance Closed-End Funds Announce Proposed Merger.

October 28, 2022 | Delaware Investments National Municipal Income Fund Announces Additional Information Related to Its Self-Tender Offer for up to Fifty Percent of Its Common Shares.

September 20, 2022 | First Trust/abrdn Emerging Opportunity Fund Announces Approval of Liquidation.

August 11, 2022 | Abrdn’s U.S. Closed-End Funds Announce Special Shareholder Meetings Relating to Proposed Acquisition of Assets of Four Delaware Management Company-Advised Closed-End Funds.

Recent activist or other CEF news

These are from the past month. Any new news in the past week has a bolded date:

November 9, 2022 | abrdn Global Infrastructure Income Fund Announces Adjournment of Special Shareholder Meeting Relating to Proposed Acquisition of Assets of Macquarie Global Infrastructure Total Return Fund Inc.

October 21, 2022 | The Cushing® NextGen Infrastructure Income Fund Announces Name Change.

October 5, 2022 | BlackRock Closed-End Fund Share Repurchase Program Update.

————————————

Distribution changes announced this month

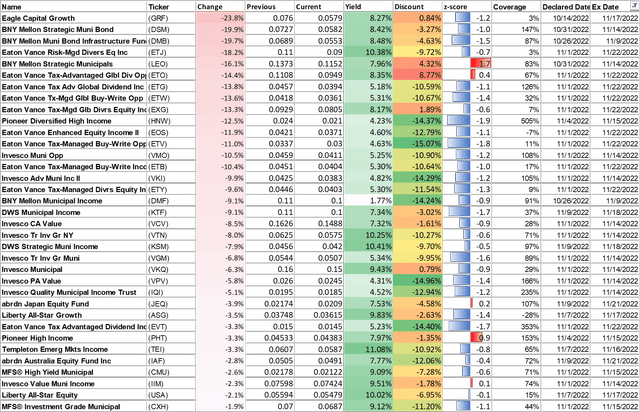

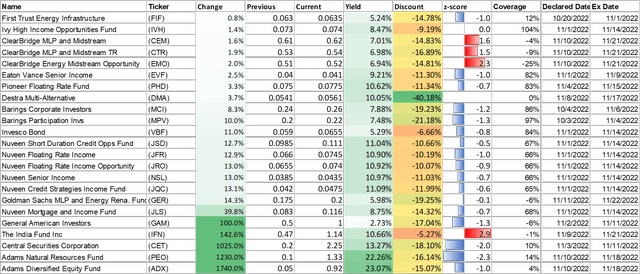

These are sorted in ascending order of distribution change percentage. Funds with distribution changes announced this month are included. =I’ve also added monthly/quarterly information as well as yield, coverage (after the boost/cut), discount and 1-year z-score information. I’ve separated the funds into two sub-categories, cutters and boosters.

Cutters

Income Lab

Boosters

Income Lab

Be the first to comment