High Voltage Electric Power Lines At Sunset imaginima/iStock via Getty Images

Like most dividend growth investors, I am aiming to achieve financial independence and have the option of living off of my dividend income. This requires that I focus on purchasing only the best stocks for my portfolio.

One such stock that is a prominent holding in my portfolio is WEC Energy Group (NYSE:WEC) – the electric and natural gas utility based in my home state of Wisconsin. But I don’t have any intention of adding to my position in the stock soon.

Let’s review WEC Energy Group’s fundamentals and valuation to better understand why I am downgrading the stock from my previous buy rating to a hold rating.

Still A Top-Notch Dividend Growth Stock

WEC Energy Group’s 3-year dividend growth rate of 7.1% annually is among the highest in its industry. For context, this is much higher than the median industry 3-year DGR of 5.2%. Fortunately, I believe dividend growth on par with the 3-year DGR can be maintained.

WEC Energy Group’s 2.81% dividend yield is slightly below the utilities – regulated electric industry average of 2.91%. This is a surface-level metric that signals the dividend is safe.

WEC Energy Group produced $4.11 in diluted EPS in 2021 (page 1 of WEC Energy Group’s Q4 2021 earnings press release) while paying $2.71 in dividends per share during that time. This is equivalent to a diluted EPS payout ratio of 65.9%.

And based on WEC Energy Group’s guidance for this year, the payout ratio should remain well within the targeted range of 65% to 70%. Using the company’s midpoint diluted EPS guidance of $4.29 (according to page 2 of WEC Energy Group’s Q4 2021 earnings press release) and slated dividends per share of $2.91, WEC Energy Group’s diluted EPS payout ratio would be 67.5% in 2022.

This should give the stock flexibility to grow its dividend as fast as its earnings. And with analysts anticipating 7% annual earnings growth over the next five years, this gives me the confidence to reiterate my 7% annual dividend growth rate for the long haul.

The Company Had An Impressive Year

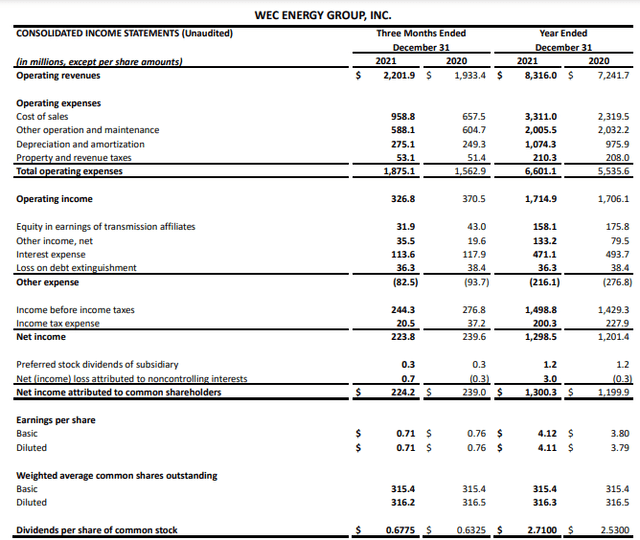

WEC Energy Group Q4 2021 Earnings Press Release

WEC Energy Group reported respectable financial results for the year ended 2021.

The company recorded $8.32 billion in operating revenue in 2021, which works out to a 14.8% year-over-year increase (details sourced from page 4 of WEC Energy Group’s Q4 2021 earnings press release).

Total deliveries of electricity were up 3% in 2021. Residential electricity use was down 0.6% year-over-year due to a return to the job site for some workers. But this was more than offset by a 4.4% increase in electricity consumption by small commercial and industrial customers and a 5.3% increase in consumption by large commercial customers (all info according to pages 1-2 of WEC Energy Group’s Q4 2021 earnings press release). The economic recovery that took place in 2021 was responsible for this bounceback in commercial and industrial electricity consumption.

WEC Energy Group’s diluted EPS increased by 8.4% year-over-year to $4.11 in 2021. This was the result of the company’s higher revenue base, which was partially offset by a 90-basis point reduction in its net margin to 15.6% in 2021 (data points per page 4 of WEC Energy Group’s Q4 2021 earnings press release).

Better yet, WEC Energy Group’s interest coverage ratio edged higher from 3.9 in 2020 ($1.92 billion in earnings before interest and taxes/$494 million in interest expenses) to 4.2 in 2021 ($1.97 billion in EBIT/$471 million in interest costs).

Overall, WEC Energy Group could be a great stock for investors to build wealth if purchased at the right valuation.

Risks To Consider:

At a glance, quality dividend growth stocks like WEC Energy Group may seem invincible. But they’re not. This isn’t meant to discount the merit of buying similar stocks. However, investors are more often successful when they know the risks of an investment ahead of time. That’s why I’ll be going over a couple of risks that are relevant to WEC Energy Group.

The first risk to the stock is one that all companies have increasingly acknowledged in the past few quarters, which is inflation. The March 2022 CPI reading of 8.5% was just ahead of the analyst expectation of 8.4% for the month.

WEC Energy Group has done a masterful job of steadily reducing its operating and maintenance expenses over the years (per slide 45 of WEC Energy Group’s April 2022 Investor Presentation). But in a business environment of accelerating inflation, there is the risk that the company may not be able to meaningfully lower its O&M. This could temporarily weigh on earnings growth.

As a result of surging inflation, the Federal Reserve will continue to gradually raise interest rates in the months ahead. If interest rate hikes don’t fall squarely within the Goldilocks zone (e.g., not too hawkish or too dovish), the economy could fall into a recession.

This could lead to a drop in energy consumption from its customers, which would harm WEC Energy Group’s operating and financial results for a period.

Recent Outperformance Has Led The Stock Too Far, Too Fast

It’s no secret that market volatility can lead stocks to aggressively move in either the undervalued or overvalued direction. WEC Energy Group has beat the S&P 500 index by 8% since the publication of my previous article.

Based on the two valuation models that I employ to gauge a stock’s fair value, this appears to have swung WEC Energy Group from undervalued to overvalued.

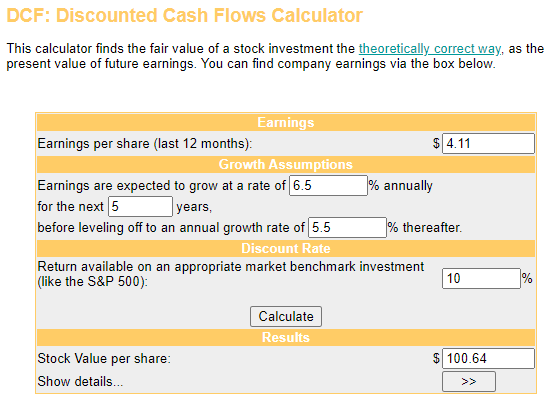

Money Chimp

The first valuation model that I’ll use to estimate the fair value of WEC Energy Group’s shares is the discounted cash flows model. This involves three inputs.

The first input into the DCF model is a stock’s previous twelve months of earnings. This amount is $4.11 in diluted EPS for WEC Energy Group.

The second input for the DCF model is growth assumptions. It’s crucial to make reasonable predictions as it pertains to the growth input.

Based on WEC Energy Group’s current fundamentals and past growth, I will use a 6.5% annual diluted EPS growth rate for the next five years. I’ll then factor in a slowdown to 5.5% in the years that follow.

The third input into the DCF model is the discount rate, which is simply the annual total return rate that an investor requires. I will use 10% since I believe that adequately rewards me for my efforts.

Using these inputs for the DCF model, I am left with a fair value of $100.64 a share. This indicates that shares of WEC Energy Group are trading at a 2.9% premium to fair value and pose a 2.8% downside from the current price of $103.59 a share (as of April 14, 2022).

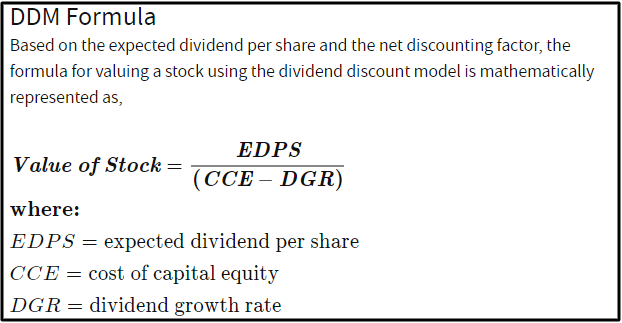

Investopedia

The second valuation model that I will utilize to arrive at a fair value for WEC Energy Group’s shares is the dividend discount model or DDM. This is also made up of three inputs.

The first input for the DDM is the expected dividend per share, which is another term for the annualized dividend per share. WEC Energy Group’s annualized dividend per share is currently $2.91.

The next input into the DDM is the cost of capital equity, which is the annual total return rate that an investor requires on their investments. I’ll again use 10% for this input.

The last input into the DDM is the DGR or annual dividend growth rate over the long run.

Unlike the first two inputs for the DDM that require basic data retrieval and subjectivity, accurately forecasting the annual dividend growth rate over the long term requires an investor to consider numerous variables: These include a stock’s payout ratios (and whether those payout ratios are positioned to contract, expand, or stay the same going forward), future annual earnings growth, industry fundamentals, and the state of a stock’s balance sheet.

As I previously indicated in the dividend section, I am maintaining my expectation of a 7% annual DGR.

Factoring these inputs into the DDM, I arrive at a fair value of $97.00 a share. This suggests that shares of WEC Energy Group are priced at a 6.8% premium to fair value and pose a 6.4% capital depreciation from the current share price.

When I average these two fair values together, I compute a fair value of $98.82 a share. This means that WEC Energy Group’s shares are trading at a 4.8% premium to fair value and pose a 4.6% downside from the current share price.

Summary: A Wonderful Stock For Your Watch List

WEC Energy Group has raised its payout to shareholders for nearly two decades. And given the stock’s high dividend growth rate, it isn’t just going through the motions to extend its dividend growth streak. Since WEC Energy Group’s payout ratio for 2022 is set to be in the middle of its long-term target, I’d be surprised if 7% annual dividend growth didn’t persist.

This is especially the case because WEC Energy Group had a remarkable 2021. Throw in the exceptional and improved interest coverage ratio and you have a fundamentally healthy stock.

But the stock looks to be more than fully valued at this point. Thus, I will be waiting for an increase in earnings, a share price decline, or a combination of the two before upgrading WEC Energy Group back to a buy rating.

Be the first to comment