Thomas Barwick/DigitalVision via Getty Images

The Teucrium Wheat Fund (NYSEARCA:WEAT) provides an easy way to capture exposure to the commodity price performance of wheat through an exchange traded fund. The agricultural grain has been in the headlines considering the ongoing Russia-Ukraine war which has significant implications given the region is a major exporter. Indeed, the futures price of wheat briefly surged to an all-time high in Q1 based on fears of global supply chain disruptions. That said, the story over the last several months has been an ongoing correction lower based on a combination of macro factors including the U.S. Dollar strength, and a weaker global growth outlook.

Our call here is that the current level sets up a new tactical buying opportunity. The reality is that the geopolitical situation in Eastern Europe remains volatile which opens the door for new trade disruptions that can send prices higher. We’re also looking at several other fundamentals including tight supply conditions, and the potential for the US Dollar to pull back which can drive a return of positive momentum. In our view, the risks are tilted to the upside and long WEAT represents an attractive trade opportunity.

What is the WEAT ETF

WEAT technically holds a portfolio of wheat commodity futures trading on the Chicago Board of Trade exchange (CBOT). The strategy here is to invest approximately one-third of holdings between the second-to-expire contract, followed by the third to expire contract, and finally, the contract expiring in December following the expiration of the third-to-expire contract.

From a high-level perspective, wheat is one of the most important commodities as it relates to the food supply with the long-term demand growth outlook based on the increasing world population. The idea is that an expanding middle class particularly in emerging markets will further stretch wheat supplies through a higher consumption per capita. As it relates to agricultural commodities and wheat being an alternative investment, the idea here is that its price performance should have a low correlation to traditional asset classes like stocks and bonds, which adds to its quality as a portfolio diversifier.

Wheat Market Fundamentals

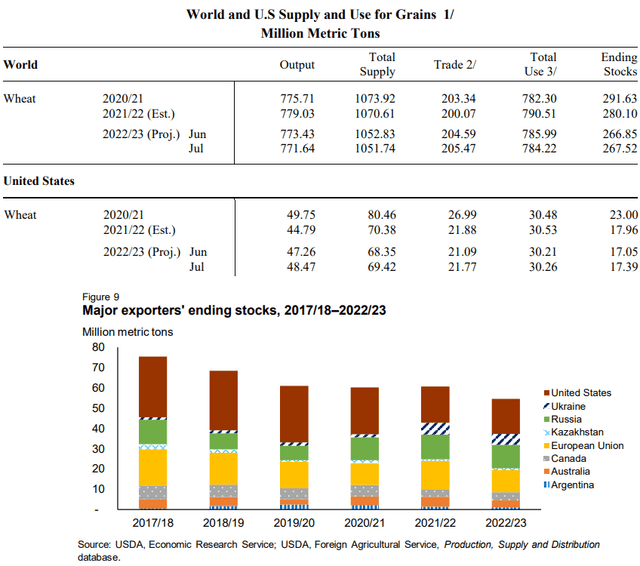

It’s recognized that global wheat supply conditions are tight through a trend of declining inventories over the last several years and otherwise soft output growth. According to data from the United States Department of Agriculture (USDA), ending stocks from major exporters are forecast to end the 2022/2023 season at the lowest level since 2016/2017.

One of the biggest uncertainties has been the output and trade between Russia and Ukraine. For context, Ukraine represented approximately 11% of total global wheat exports last year when it moved 18.8 million metric tonnes. Considering the ongoing war in the country and logistical challenges, that figure is forecasted to fall to 10 million metric tonnes this year. While other countries including Russia are making up for some of that gap, the result is an estimated 1.8% decrease in total world supply for the current year.

As it relates to the market price of wheat as a global commodity, the argument we make is that there is likely some downside risk to the supply forecasts as it relates to the reliability of data out of Ukraine. With best efforts to move as much product as possible, it is easy to imagine increased spillage and lost cargo for a variety of reasons. Major ports have been the scene of military confrontations.

On this point, a recent development was an export deal signed between Russia and Ukraine moderated by Turkey to ease what has been seen as a global food crisis. In essence, the treaty provides for safe passage of cargo vessels at Ukrainian Black Sea ports that had been subject to a blockade from Russian naval forces. Naturally, the move to ease tensions was seen as positive for improving trade conditions and explains some of the correction lower in the price of wheat and other commodities more recently.

Again, the issue here remains the volatile circumstances. Even on the day of the deal being signed, news reports covered a missile strike at the port of Odessa, casting doubts on how the pact will be implemented. Anyone betting that the market price of wheat continues to trend lower must be content with the possibility of a military escalation into Europe.

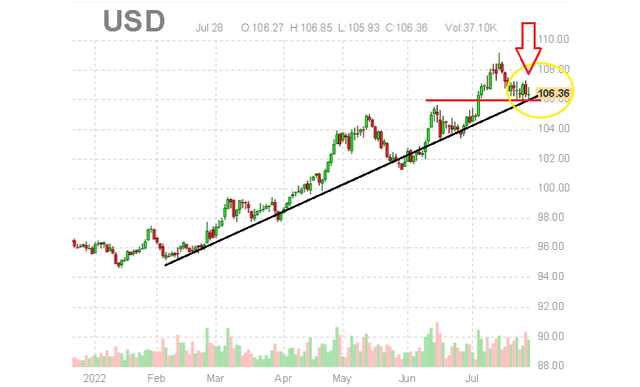

Taking a step back, there are other factors at play supporting a bullish outlook for higher wheat prices. One of the major headwinds against commodity prices in recent months has been the strength in the U.S. Dollar. A scenario where the Dollar loses momentum and reverses lower would generally be positive for commodities. In our opinion, the weaker than expected Q2 GDP data from the U.S. and falling bond yields are bearish trends for the Dollar as the Fed may ease up on its aggressive policy stance.

Wheat Price Forecast

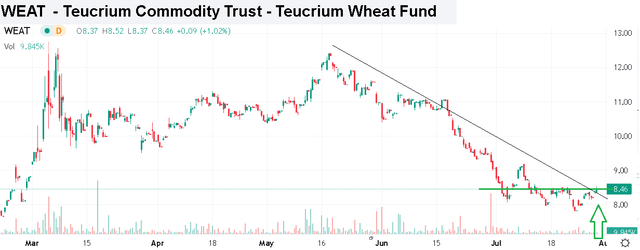

Putting it all together, it appears the selloff in wheat from its Q1 highs has gone too far with room for a rebound higher. From the futures price chart below, we highlight how wheat is testing a trendline that has been in place since early 2020. With the ability to hold this support, long positioning into a bullish outlook makes sense. From here, a retest of the psychologically important $1,000 per standard 5,000 bushels contract unit represents approximately 25% upside.

Our price target for wheat corresponds to approximately $10.50 in the WEAT ETF. We like the fund as a tactical trading instrument and see room for it to trend higher over the next few months. Traders can use the cycle low in WEAT at $7.91 as a stop level. In terms of risks, the monthly update from USDA regarding wheat supply and demand conditions is an important monitoring point. Significantly weaker global growth conditions with falling energy prices would also open the door for another leg lower in wheat prices.

Be the first to comment