MicroPixieStock/iStock via Getty Images

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on April 6th, 2022.

Western Asset Diversified Income Fund (NYSE:WDI) does exactly what the name would imply. They invest in a diversified pool of debt securities. They put a particular emphasis on being flexible and dynamic with their approach. That being said, that hasn’t resulted in them being able to deliver positive results since their launch.

On the other hand, it has been incredibly tough for any debt-related fund to be able to deliver results more recently. I believe that means WDI launching when it did is more of the problem rather than actually having some underlying issues with the fund. The main cause for fixed-income funds in this environment is higher interest rates. Those have been causing significant pressure. With the Fed expecting higher rates to come as inflation stays persistent, this will likely remain the main factor in keeping these types of funds down.

On top of this, recession fears have been increasing. This impacts these funds as many CEF funds invest in below-investment-grade types of debt. This is all on top of more geopolitical uncertainty after Russia’s invasion of Ukraine. Needless to say, a lot is working against fixed-income investments and just about every investment overall.

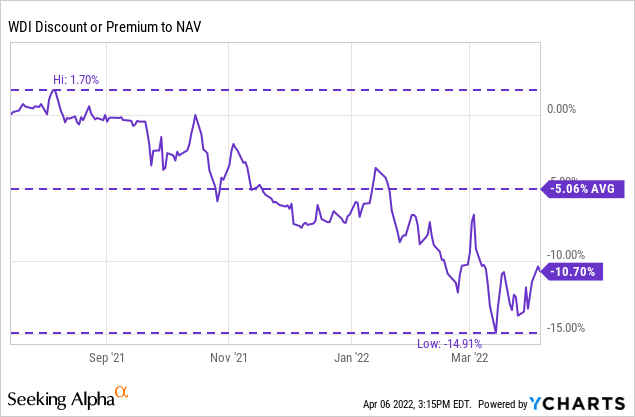

In more optimistic news, the fund’s discount has widened substantially. So that has certainly made the fund a more tempting option.

Western Asset has a long history of investing in the fixed-income space, being founded in 1971. It was purchased by Legg Mason in 1986. More recently, Legg Mason itself was bought out by Franklin Templeton (BEN) in 2020. Western Asset continues to remain in branding, but its website for closed-end funds has migrated over to conform with Franklin Templeton. That’s a change from the last time we took a look at WDI.

The Basics

- 1-Year Z-score: N/A

- Discount: 10.70%

- Distribution Yield: 8.49%

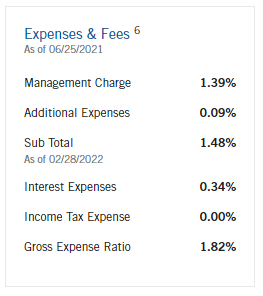

- Expense Ratio: 1.48%

- Leverage: 27.85%

- Managed Assets: $1.34 billion

- Structure: Term (anticipated liquidation date June 24th, 2033)

WDI’s objective is “to seek high current income. As a secondary investment objective, the fund will seek capital appreciation.” They will bring a “flexible and dynamic” approach. They anticipate doing this by “rotating sectors and securities in response to market conditions, focusing on what we believe are undervalued securities with attractive fundamentals.

For greater flexibility, they have no restrictions on investing in investment-grade or below investment grade. Meaning that they will span the credit quality spectrum, leading to a truly multi-sector bond fund with limited constraints. This can be a positive if they can successfully manage it. It leaves investors a bit more in the dark and more reliant on the management team to operate the fund.

The fund is sizeable, thanks in part to its nearly 28% in leverage. However, they were also able to raise quite a meaningful amount of assets in the first place for a CEF. The leverage is on the upper end of their expected 20 to 30% leverage target. The fund’s expense ratio comes to 1.48%; it comes up to 1.82% when including leverage expenses.

WDI Expenses Breakdown (Western Asset)

Their leverage is based on a variable rate benchmark. It is currently LIBOR “…but subject to transition to adjusted SOFR, or an alternative benchmark, upon the occurrence of certain benchmark transition events including the cessation of publication of LIBOR…”

That means that their expenses will rise as interest rates rise. This is pretty standard for most closed-end funds that utilize borrowings through a credit facility. They are currently borrowing $370 million but can ramp this up to a maximum amount of $400 million.

Performance – Attractive Discount

As I mentioned at the opening, this fund’s performance hasn’t been too spectacular since its launch. They launch in mid-2021, and they have been on a pretty consistent slide lower since. Due exactly to what we discussed above, and what I believe isn’t anything to do with this fund in particular but the current environment overall.

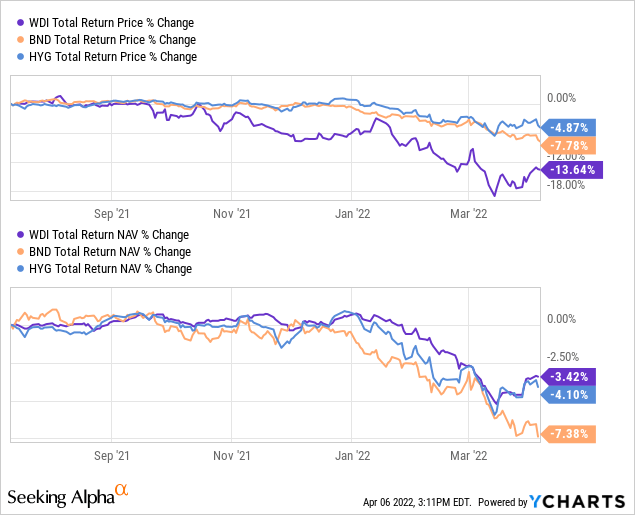

In fact, if we compare WDI to a couple of other passive bond-related ETFs, we can see that WDI has been performing fairly well. Below is the total return performance of price and NAV for WDI compared to Vanguard Total Bond Market Index Fund (BND) and iShares iBoxx $ High Yield Corporate Bond (HYG). I would keep in mind that WDI is leveraged, though, while these two other names are not. These are passively managed funds and not multi-sector bond funds the way that WDI is.

Ycharts

What we can see is how poor the total market price performance has been. That’s really what has opened up the most exciting part about WDI at this time. That is the double-digit discount that has appeared in WDI. To me, this makes a lot of sense that this is happening. Overall discounts are widening out in the CEF space, but investors are seeing this fund head lower and lower too.

Therefore, I believe investors are losing (or never had) confidence in a fund that is so new and not seeing spectacular results. However, as we can see above, the fund has been doing okay relative to other more passive and focused bond funds on a total NAV basis. This helps highlight the weakness of the asset overall.

We aren’t at the deepest discount the fund has traded at since it launched, but we aren’t necessarily too far away either.

Ycharts

Distribution – Appealing ~8.5% Rate

Another area that investors could be focused on is the distribution rate. As the fund has declined, we see the distribution yield on the fund tick higher. At this time, it comes to 8.49%. On a NAV basis, this comes to 7.59%. While that has moved higher since the fund’s launch, it isn’t necessarily overly aggressive either. They launched with a monthly $0.117 payout, and that is where it remains today.

Since it is a fixed-income fund, coverage isn’t necessarily based on the fund’s price or NAV. Although, at a certain point, if the distribution is causing too much erosion in the fund, it makes it harder and harder for the fund to achieve the income levels needed.

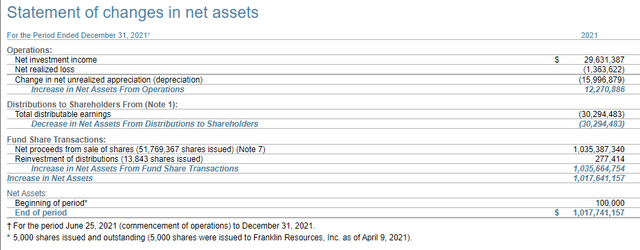

The net investment income plays a greater role in the predictability of the distribution in the future. At the end of 2021, they posted their Annual Report, and coverage was actually quite high. On the other hand, it is only for a shortened period, not a full 12 months. So this will be something we would want to keep an eye on going forward.

WDI Annual Report (Western Asset)

NII coverage during this period came to nearly 98% for this period. It makes it harder to predict where WDI will come out in the future. One of the reasons is that it is a newer fund. This was only an abbreviated reporting period. There was a time when they weren’t fully leveraged, though they also didn’t start paying a distribution until October. The other reason for this is because of how flexible they are. They can drastically change their portfolio, which would have a considerable impact on their NII generation.

For tax purposes, 2021 showed that the entire distribution as ordinary income. This is to be expected as a fixed-income fund. That would make it more appropriate for a tax-sheltered account.

WDI’s Portfolio

The managers were busy putting together their portfolio over 2021. However, they still reported a 19% portfolio turnover rate for the year. This means they were fairly busy selling and buying some positions too.

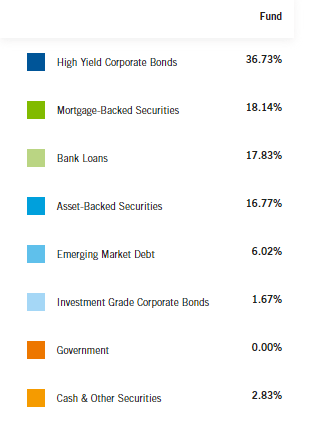

The current breakdown has the fund fairly aggressively overweight in high-yield bonds. This is then followed by MBS, bank loans and asset-backed securities. These weightings are as of December 31st, 2021.

WDI Asset Type (Western Asset)

The bank loans, in particular, I believe are interesting. These are primarily going to be floating rates, while the rest of these assets are generally fixed-rate securities. That puts the bank loan sleeve in a better position potentially in the portfolio in terms of how they respond to higher rates.

The average life is 5.41 years for the portfolio. The effective duration comes to 2.99 years. That isn’t overly elevated but is something to watch going forward. It is certainly higher than if it was a more pure-play senior loan fund. For some context here, Blackston Strategic Credit Fund (BGB) has a duration of 0.53 years. PIMCO Income Strategy II (PFN) has a duration of 3.71 years. So WDI comes somewhere in the middle of these two.

The higher the effective duration, the bigger the negative impact when it comes to rates increasing.

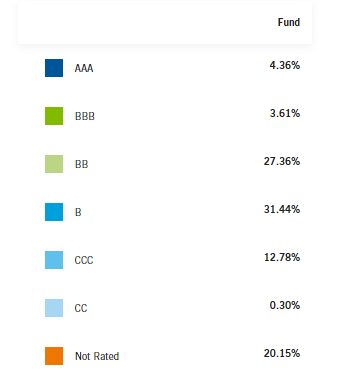

Looking at the credit quality breakdown for WDI, we see a fairly diverse weighting. Though a clear tilt towards below investment grade investments isn’t surprising given the overweight allocation to high yield bond funds. Bank loans are generally going to be below investment grade ratings as well.

WDI Credit Quality (Western Asset)

Taking a look at their top holdings at the end of February 2022, we see that WA Premier Institutional Government (WACXX) is in the most significant position.

WDI Top Holdings (Western Asset)

This was the largest position they had last time we covered the fund too. This is basically their cash position since it is a money market fund. It has come down substantially since September 30th, 2021 (our last look at the holdings.) That indicates that they have continued to put capital to work in positions that should provide a better chance of stronger returns. That’s generally what we want to see, not too much weighting in cash as we can do that in our own portfolios. CEFs should be primarily invested at all times.

From there, we see a fairly diverse group of holdings. There is no weighting in the fund that can substantially change the outcome of the fund on its own. That can be another fairly standard feature of multi-sector bond funds or just bond CEFs in general. They tend to invest in hundreds of positions, allowing the power of diversification to work its magic.

Conclusion

WDI appears to be off to a weak start as we take time to revisit this fund. In my opinion, though, it isn’t necessarily the fund that has anything wrong with it. It would appear that the timing of the launch was rather poor, coming to market as interest rates were set to rise and put pressure on fixed-income funds. At the same time, the fund’s discount has now widened substantially, making it a fairly attractive choice if one wanted to put some money to work. Going forward, I would want to continue to monitor the fund’s earnings to see if the distribution is being covered.

Be the first to comment