jetcityimage

The Gates Foundation loves this stock

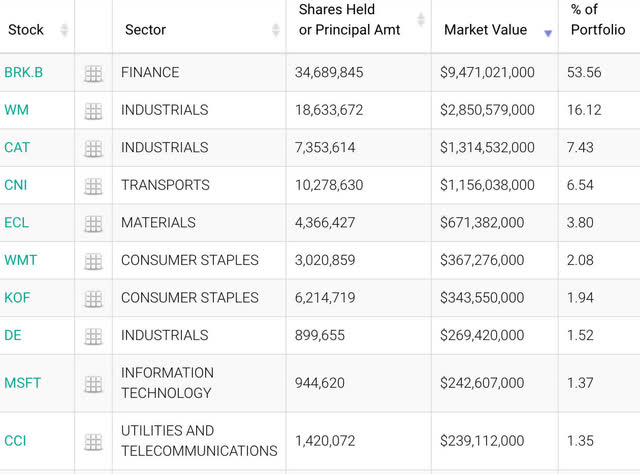

Waste Management, Inc. (NYSE:WM) is a holding that has been prominently featured in the Bill & Melinda Gates Foundation SEC Form 13F filings for years. The stock currently occupies the number 2 spot under Berkshire Hathaway (BRK.B, BRK.A).

Many investors know the close relationship between Bill Gates and Warren Buffett. It might be logical to assume that the large Berkshire Hathaway holding is due to Gates loving Buffett’s philosophy, but it’s actually the other way around. The majority of the shares under management were donations from Buffett himself as a charitable donation. The fund then from time to time sells a portion of the Berkshire holding to redeploy into other positions.

Bill & Melinda Gates Foundation (whalewisdom.com)

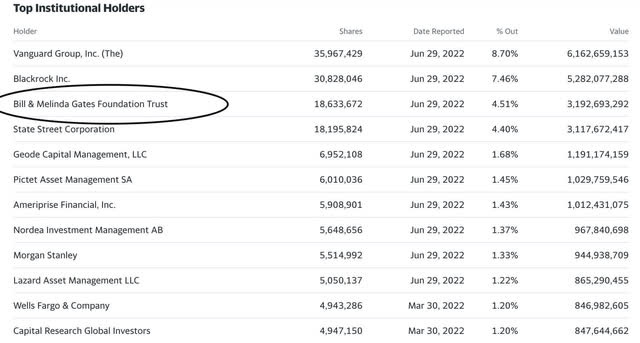

At a nearly $3 Billion position, the Bill & Melinda Gates Foundation is one of the largest holders of Waste Management stock, including institutions. It’s a rarity to find a stock that is held by a hedge fund, trust, or foundation in larger amounts than financial institutions, especially when that company is a member of the S&P 500.

Top WM Institutional Holders (Yahoo Finance)

Waste Management stock has traded at a very high price to earnings multiple for many years. We will examine what fair value this stock might trade at on an EBITDA basis and establish a fair multiple. This stock is a hold, in my view, as the valuations are just too rich, but the moat is amazing. It is certainly not a stock worth dumping if you already own it.

Doubling down on trash

Bill Gates has a similar waste holding all for himself:

Gates, a co-founder of Microsoft (MSFT), paid $117 million from Feb. 18 through Feb. 24 2022 for a million more Republic shares, at a per-share average price of $116.95, according to filings with the Securities and Exchange Commission. He made the purchase through his investment vehicle, Cascade Investment, which now owns 110 million Republic Services shares, a stake of more than 34%.

One of Waste Management’s competitors, Republic Services (RSG), is held in a holding company that principally manages Bill Gates’ net worth. So, on the one hand, the Bill & Melinda Gates Foundation is heavily into Waste Management, and on the other, Bill Gates hedges his bet in the personal portfolio with its main competitor. Bill Gates certainly is long this sector. He has advocated heavily for sanitation and water services in underdeveloped areas of the world as well.

What Waste Management does

Waste Management falls under the industrials sector and provides waste pick-up and environmental services for residential, industrial, municipal, and commercial clients throughout North America. The company has over 21 million customers throughout the U.S. and Canada. On top of the waste trucks you see daily, they also own and operate 340 transfer stations, 260 landfills (which include hazardous waste landfills), and 96 recycling plants. The company also owns 144 beneficial-use landfill gas projects, which I will cover in potential catalysts.

Waste Management has the largest fleet of natural gas vehicles in this industry, with 6,536 natural gas collection trucks operating in North America.

This is a massive empire of trash collection and real estate.

Low beta stock

One of the first positives I will note about Waste Management is that it is a low beta stock, currently at .76.

WM 52 Week Performance (Yahoo Finance)

We can see that the 52-week performance is +10% versus a negative -12% for the market. One of the key components for well-run charitable foundations certainly has to be a stock’s volatility. The foundation needs reliable preservation of capital to liquidate from time to time to deploy into charitable causes.

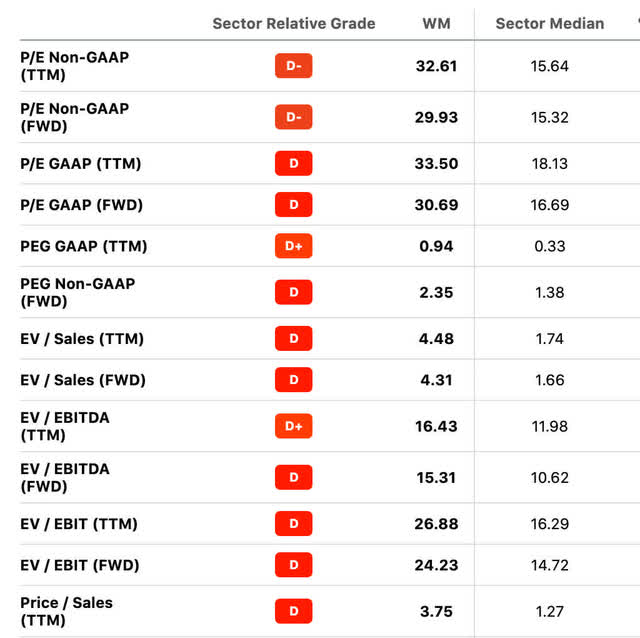

Valuation

As we can see above, Waste Management trades significantly higher than any of its peers in the industrial sector. But we will also see later that it trades on par with peers solely in waste collection. For industrial sector companies, I sometimes like to use price target formulas that incorporate the book value of the assets, but with Waste Management trading at nearly 10x book value, this is far more similar to a tech company. The most logical ratio to evaluate the price in my mind would be an altered PEG ratio substituting EBITDA for earnings.

For those unfamiliar with the PEG ratio, it was popularized by Peter Lynch during his reign at the Magellan Fund and divides the price/earnings ratio (“p/e”) of a company by the trailing 3-5 year compound annual growth rate of earnings. If a stock is trading at 25x and the growth rate in earnings is 25%, you simply drop the percent sign and divide it into the p/e. A value of 1 or lower is considered a bargain.

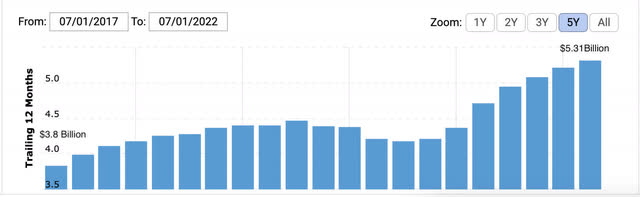

5 Year EBITDA WM (macrotrends.net)

The 5-year EBITDA has grown from $3.8 Billion to $5.31 Billion, a CAGR of 6.75%. Another practice Lynch incorporated was to add the dividend to the final CAGR to come up with the multiple. In this case, WM’s dividend is 1.52%. That would make the final multiple 6.75+1.52=8.27. The amount of EBITDA per share is $5.31 Billion / 413 million shares outstanding, equal to $12.85 EBITDA per share. Using our multiplier of 8.27 times the multiplicand of $12.85 we have a price target of $106.32. This is showing the stock as 37% overvalued according to this metric.

If we were to use EBIT instead of EBITDA, the overvaluation would seem more dramatic. Using earnings or free cash flow would make it even worse. In this situation, EBITDA is appropriate because it is a typical ratio for buying a whole business. With a virtual monopoly in many markets, this would be an attractive company to take private.

The dividend

Waste Management has paid a dividend every year from 1998 to the current, 25 years without a cut. The annual growth rate, with increases over the past 15 years, has averaged 6% per year over the past 5 years. Normally, I would run a 10-year dividend reinvestment analysis at this point, with the dividend reinvested and growing at the average stated rate. However, I only like to run these if I’m buying a stock at fair value, as the downside is more likely to eat up my compounding dividend returns than enhance them.

Competitors and their valuations

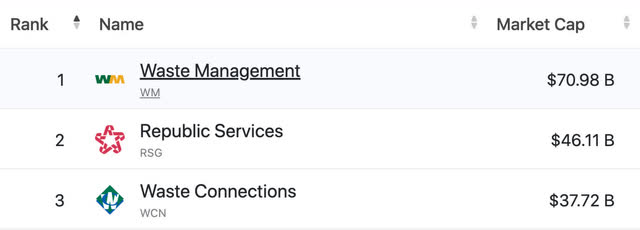

WM’s two next-largest competitors are Republic Services and Waste Connections (WCN).

WM Competition (companiesmarketcap.com)

Republic Services is currently trading at 16.4x EBITDA, while Waste Connections is trading at 21x EBITDA. On a trailing basis, Waste Management is trading at basically the same valuation as Republic Services at 16.43x EBITDA. This is a very expensive industry, to say the least, there doesn’t seem to be a deal anywhere in sight.

As mentioned previously, Gates through his foundation and holdings company is heavily invested in both Waste Management and Republic Services.

Debt

With debt of $14.28 Billion, this company is heavily leveraged. Most of this is long-term debt as Waste Management has a current ratio of 1.07. With higher rates on the horizon, this could be troubling if Waste Management needs to roll over any of this debt in future years.

Headwinds for the industry

Commodities prices, namely oil and natural gas, are a big factor in the cost of operations for these companies. With Waste Management building and converting much of its fleet to natural gas, this could be an even bigger problem for Waste Management, as the price of natural gas has accelerated upwards even faster than oil. But, interestingly enough, Waste Management also has a renewable energy technology to create natural gas.

Catalysts

WM Renewables Profile (wm.com)

In 2021, Waste Management started some interesting renewable projects. The one that caught my eye the most was being able to capture natural gas from landfills to fuel their trucks. Having an integrated business of both landfills and trucks plus this added technology could give Waste Management a competitive advantage in the cost of operating their fleet. A similar technology is also shared by Republic Services.

The renewables program is also turning landfills into solar farms and selling excess gas to power plants used to produce electricity. Especially with a shortage of natural gas in the world, this could be an amazing opportunity if they can harness this into an efficient business.

Conclusion

Waste Management and its peers are just too overpriced at the moment. Even using an enterprise value to EBITDA methodology, which is more liberal than earnings or free cash flow multiples, most of these stocks seem about 30% overvalued. The debt, while covered this year, could become an issue if debt maturities beyond the next 12 months need to be refinanced and rates continue to rise. That being said, Bill Gates certainly is of the mindset that population growth is inevitable and more waste will be created every year. This will provide a steady trajectory of earnings and cash flow growth. The dividend growth rate of the company is solid as well. Bill Gates wants to be in this sector, and that has my attention.

Waste Management is a quality operation with a lot of potential to add on more revenue-generating businesses. It is worth holding in the long run if you already own it and aren’t worried about its debt. If you don’t, I would wait to see prices around $106 a share based on my analysis. Reiterate hold.

Be the first to comment