BCFC/iStock Editorial via Getty Images

Investment Thesis

Waste Management, Inc. (NYSE:WM) is a market leader in the ‘Waste Management’ or Garbage industry. Most of the largest landfills in the US are owned by 2 of the largest players in the industry and WM is one of them, effectively giving it a duopoly status in the market.

The acquisition of Advanced Disposal (the fourth-largest publicly traded waste management Company in the United States.) further cemented WM’s already huge market dominance.

WM’s overall financial performance is observed to have fared just modestly compared to peers. However, as a leading player in the industry, this should still be enough to maintain its current leadership in the market.

The current share price is currently overvalued which means investors should keep this company on the watch list for now and invest only when it becomes undervalued.

Company Overview

WM provides comprehensive waste management environmental services in North America. Based on the company’s latest Q1 2022 earnings report, it serves customers from the residential, commercial, industrial, and municipal sectors. Some of its services include:

- Providing collection, transfer, disposal, and recycling and resource recovery services.

- Through the company’s subsidiaries and WM Renewable Energy business, WM is also a leading developer, operator, and owner of landfill gas-to-energy facilities in the U.S. that produce renewable natural gas, which is a significant source of fuel for our natural gas fleet

WM is a leader in the waste management industry. The company owns or operates the largest network of landfills, giving it a clear competitive advantage over larger smaller players.

The latest Q1 2022 financial figures saw the company reporting mostly positive results on the top and bottom lines, based on a year-on-year comparison between 2021 and 2022:

- Operating revenues increased from 4,112M to 4,661M.

- Net Income increased from 421M to 513M.

- Net cash provided by operating activities increased from 1,120M to 1,258M.

During the latest earnings call, this is what the management has to say about such ‘sustainability growth investments’:

We see the opportunity to further our sustainability leadership by expanding recycling capacity, automating recycling processing and increasing the renewable energy generated from our landfill network. We opened a new recycling facility in the first quarter and we’re on track to bring online another fully retrofitted MRF in the second quarter, along with the next WM-built renewable natural gas plant. These projects are expected to generate excellent returns that are superior to those of solid waste acquisitions.

In the long run, WM is trying to pivot its business from mainly “solid waste management” to a leader in providing environmental sustainability solutions.

A Duopoly of the Garbage Industry

According to CNBC, “Two private companies, Waste Management and Republic Services lead the solid waste management sector. Together they own about 480 landfills out of the 2,627 landfills across the United States”. Quantitatively, this implies WM and Republic service collectively owns just 18% of the landfills in the US. But if we focus on the ownership of only the largest landfills, we can observe how the 2 companies lead the industry.

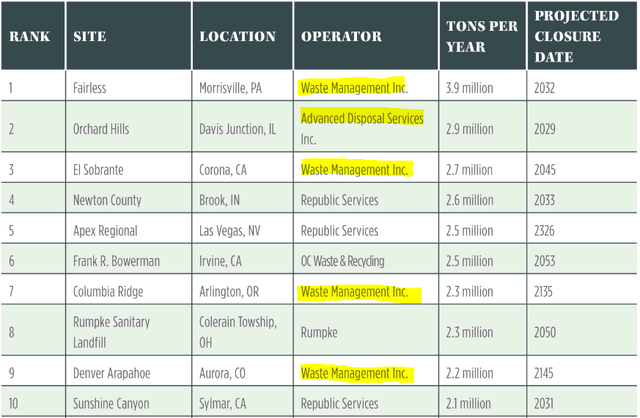

According to this article, which “ranks the largest 30 landfills in the U.S.”, WM is observed to operate 5 (or half) of the top 10 on the ranked list:

- Collectively, from these 5 WM-operated landfills, WM managed 11.9 tons of waste per year.

- Republic Service owns 3 of the top 10 landfills and manages 7.2 tons of waste per year.

- ‘OC Waste & Recycling’ and ‘Rumpke’ managed just 2.5 tons and 2.3 tons of waste per year, respectively.

Largest Landfills List (Waste Today Magazine)

As mentioned in the same CNBC article, the existence of landfills is undergoing a trend, and “the trend has been to go larger and larger so the small neighborhood dump can’t exist because of the regulations and the sophistication of the design”.

This implies a very high barrier to entry for the Waste Management industry.

Acquisition of Advanced Disposal

Prior to the acquisition by WM, Advanced Disposal was the fourth-largest player in the industry. After the acquisition was completed in Oct 2020, it further strengthens WM’s already huge market dominance. As mentioned in the same article, the management claimed that this acquisition expands “Waste Management’s reach and positions us for significant earnings and cash flow growth.”

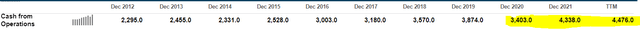

Net Income (Seeking Alpha) Cash From Operations (Seeking Alpha)

Indeed, if we look at the increased earnings and cash flow from operations after the acquisition, it appears the company has achieved these objectives.

Financial Comparison with Competitors

We will compare the financials with some of WM’s peers:

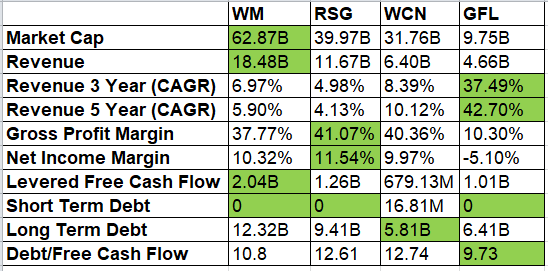

Financial Comparison (Seeking Alpha)

- We can observe that WM is obviously the largest player in the comparison list by market capitalization.

- In terms of absolute revenue value, WM is also the highest, although it is not having the fastest growth. Since WM has already captured a dominant market share in the industry, I think it can afford to have a smaller growth rate and still maintain its competitiveness.

- As we drill down to the gross and net income margins, the largest 3 players in the comparison list have roughly the same value of about 40% and 10% respectively.

- Looking at the free cash flow (“FCF”) and debt profiles WM has both the highest FCF and debt (both short-term and long-term combined). Overall, if we compare the debt with respect to its FCF for each of the peers in the comparison list, there are no significant differences. All the peers on the list have a Debt/FCF in the range of 9 to 13. WM has a value of 10.8 which is at the ‘lower end’ of this estimated range.

Overall, I think WM’s financial profile is significantly better only in terms of top-line revenue and free cash flow. Other bottom-line figures appear to be just on par with the largest 3 players in the comparison list. But having attained a dominant market share as one of the duopolies in the industry, WM is likely to maintain such market leadership even with this relatively ‘modest’ financial profile.

Valuation

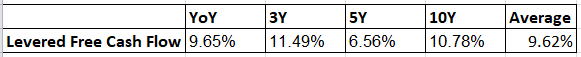

From Seeking Alpha‘s observation of “Compound Annual Growth Rates (TTM)”, these are the different growth figures for Levered Free Cash Flow for different timeframes:

Levered Free Cash Flow (Seeking Alpha)

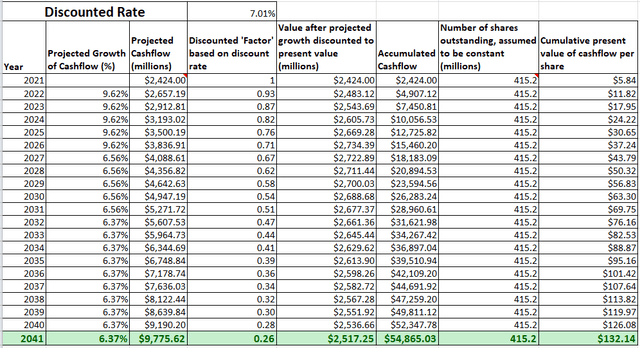

We will make the following assumption when evaluating the intrinsic value of the company using the discounted free cash flow model:

- We will assume WM will grow its free cash flow at this average rate of 9.62% for the next 5 years.

- The smallest growth recorded in point 1 is 6.56%. We will assume WM tapers in growth to this rate from year 6 to year 10.

- WM matures in growth from year 11 to year 20, growing at 6.37%, which is the ‘mean value’ of the US GDP growth rate.

- The value of free cash flow to be projected is $ 2,424 million, taken from the TTM period.

- The discount rate is estimated to be 7.01%.

- I assume WM may not exist beyond 20 years. As such, Terminal Value will not be included in the calculation of intrinsic value.

Present Value of Projected Free Cash Flow (Author’s Calculation)

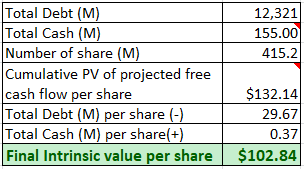

Based on the above inputs, the present value (“PV”) of projected free cash flow per share for WM is $132.14.

Intrinsic Value (Author’s Calculation)

Taking into account the total debt and cash that the company is holding, the final intrinsic value is $102.84.

The current price of around $151 implied the stock is currently overvalued.

Investment Risks

Generally, most waste management companies in our comparison list discussed earlier incurs a significant level of debt. In the current environment where interest rates are increasing, companies with high levels of debt will hurt more due to the need to incur higher interest expenses. Right now, WM is having 353M in interest expense and 4,476M in operating cash flow. That means the interest expense is 7.9% of its operating cash flow, which, in my opinion, it’s considered low. Investors should monitor and ensure that this percentage does not go up to more than 30%.

Conclusions and Key Takeaway for Investors

As discussed earlier, as one of the duopolies in the industry, WM has a business model with a wide moat, as attested even by Morningstar analyst, as of this writing:

Morningstar Analysis Headline (Morningstar)

Its moat was further strengthened with its acquisition of Advanced Disposal.

However, it is currently overvalued and investors should hold and wait for the price to retrace to at least the fair value of around $102 before taking an investment position.

Be the first to comment