Paul Morigi/Getty Images Entertainment

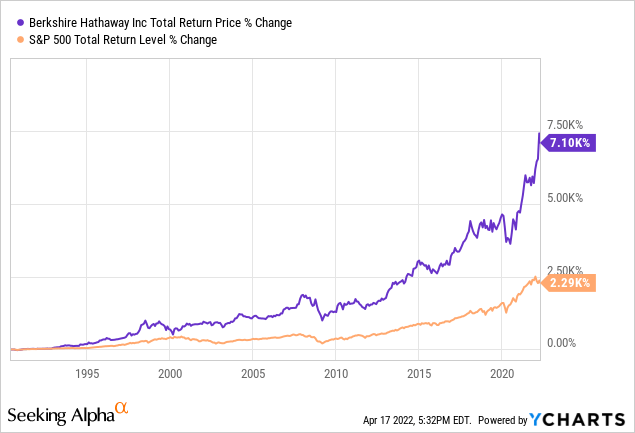

Warren Buffett is widely regarded as one of the most successful investors in history, with an incredible long-term track record of steering Berkshire Hathaway (BRK.A) (BRK.B) on a run of remarkable outperformance of the stock market (SPY):

This outperformance is not by accident. One does not steer such a large company to such massive outperformance over many decades by dumb luck. In today’s article we will be looking at five of the key traits that Mr. Buffett looks for in companies that have enabled him to experience such substantial long-term outperformance.

Trait #1: Flexible & Innovative

The first four traits we will look at today come from the Berkshire Hathaway annual meeting in 1989, where Warren Buffett said:

Rationality frequently wilts when the institutional imperative comes into play. For example: (1) As if governed by Newton’s First Law of Motion, an institution will resist any change in its current direction; (2) just as work expands to fill available time, corporate projects or acquisitions will materialize to soak up available funds; (3) any business craving of the leader, however foolish, will be quickly supported by detailed rate-of-return and strategic studies prepared by his troops; and (4) the behavior of peer companies, whether they are expanding, acquiring, setting executive compensation or whatever, will be mindlessly imitated.

Mr. Buffett’s first trait is essentially that the typical business will naturally become inflexible and that those that do learn how to strategically flex and innovate are the exception rather than the norm. In reality, for a business to survive and thrive as a long-term compounder of shareholder wealth, it must be flexible enough to adapt and innovate in a rapidly-changing environment. A company that fails to ever change course is bound to lose its competitive advantage and eventually go the way of the dinosaur.

As Amazon’s (AMZN) famous and wildly successful founder has stated:

I’ve made billions of dollars of failures at Amazon.com… None of those things are fun, but they don’t matter. What really matters is that companies that don’t continue to experiment – companies that don’t embrace failure – they eventually get in a desperate position, where the only thing they can do is make a ‘Hail Mary’ bet at the very end.

While there are plenty of highly innovative tech stocks out there that I like at current prices – such as Palantir Technologies (PLTR), Coinbase (COIN), and NVIDIA (NVDA) – there are also some higher yielding dividend stocks that I like here that have also proven to be innovative in their own right. Conagra Brands (CAG), Hanesbrands (HBI), and Coca-Cola FEMSA (KOF) are three consumer products companies that have had spotty pasts, but in recent years have found new life through management teams that have focused on innovating within their brands driven by consumer data. As a result, all three are capturing market share and offering customers better and better products.

Trait #2: Shareholder-Friendly Capital Allocation

Here Buffett is essentially warning against businesses that have a propensity to empire build. When a company retains far more cash than what its high incremental returning reinvestment opportunities require, it is likely to find other uses for the capital that generate less-than-attractive returns for shareholders.

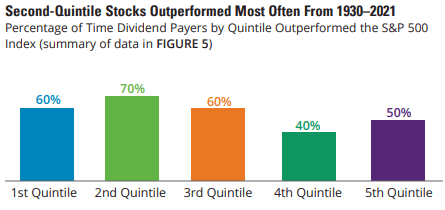

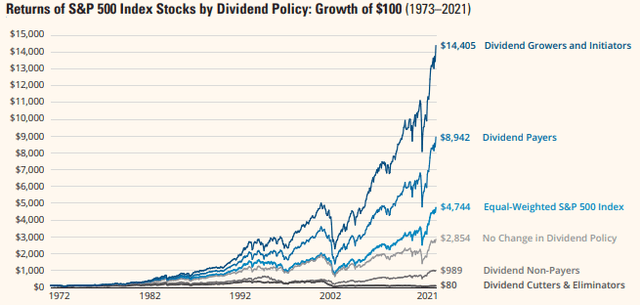

This is really the secret that has driven the long-term outperformance of high yielding securities: when a company pays out a significant dividend to investors, it only retains a limited portion of its profits. This then forces management to high grade investments which helps improve capital allocation discipline and ultimately leads to superior long-term investment performance.

As a result, it is unsurprising that high yielding stocks and dividend stocks in general have outperformed the market on average over time:

High Yield Stocks Outperform (Hartford Funds) Dividend Stocks Outperform (Hartford Funds)

Our entire portfolio is filled with these kinds of companies and this is why we invest in high yielding stocks.

Trait #3: Disciplined M&A

Along a similar line of reasoning as that offered in trait #2, management teams that have an unquenchable desire to “empire build” often wind up destroying shareholder value. It is virtually universal practice for management teams to supply an endless stream of facts and figures supporting acquisitions with rosy projections of accretion to shareholders. As the saying goes: you can make numbers say anything you want.

However, while it is easy to lie with numbers when drumming up shareholder support for an acquisition, in the long run the bottom line numbers don’t lie. Unfortunately, all to often those numbers tell a very different story from what management told when selling the acquisition to investors.

Truly exceptional long-term compounders are very disciplined with M&A and make such decisions based off of very conservative assumptions rather than deciding to acquire an asset or business and then massaging the numbers to make it look good to investors.

Some great examples of this type of business in our portfolio include Virtu Financial (VIRT), Patria Investments (PAX), Leggett & Platt (LEG), and Compass Diversified Holdings (CODI). All four have a significant and impressive track record of acquiring businesses and generating strong returns on them. It is not without coincidence in our view that all four also return significant capital to shareholders on a regular basis. This commitment to shareholders helps them to remain very disciplined in their investment process.

Trait #4: Independent Thinking

Another rare trait, but one that is essential for long-term compounders, are companies that are willing to break from the herd and operate on logic and common business sense rather than simply copy whatever is popular at the time. Long-term outperformance requires at least a certain degree of contrarianism, which is by definition difficult to find. When you find a business that has proven to be an intelligent contrarian, it is very likely also going to be an outperformer.

EPD is a clear example of this. As Morningstar has said:

While many other midstream operators are playing checkers, Enterprise Products Partners is a chess master.

EPD has refused to climb aboard the buyback bandwagon that so many in its industry – like Magellan Midstream (MMP) and ONEOK (OKE) – are plunging headlong into. Instead, management is prioritizing distributions as a more tax-efficient means of returning capital to unitholders. As it said on its Q2 earnings call:

…as far as distributions versus buybacks, we’re an MLP. The most tax-efficient way to return capital and cash to your partners is through distributions. And that’s what we’ve done… So distributions are really our first go-to.

EPD has also continued to invest aggressively in high returning incremental growth projects at a time when so many of its peers are slashing growth capital investing. While this might be intelligent for some businesses that lack attractive opportunities to invest in growth opportunities, it is not the case with EPD. This leads us to our fifth trait…

Trait #5: High Returns On Incremental Capital

Last, but not least, a truly wonderful business is one which has very attractive opportunities for allocating retained earnings. As Warren Buffett said in his 1992 Berkshire Shareholder Letter:

Leaving the question of price aside, the best business to own is one that, over an extended period, can employ large amounts of incremental capital at very high rates of return. The worst business to own is one that must, or will, do the opposite-that is, consistently employ ever-greater amounts of capital at very low rates of return.

While we love our dividends at High Yield Investor, we also like businesses that invest capital at high incremental returns on capital. In fact, we see these two traits as complementary rather than contradictory, and so does Buffett. In fact, his largest stock holdings – such as Apple (AAPL), Coca-Cola (KO), Bank of America (BAC), Verizon (VZ), American Express (AXP), and Kraft Heinz (KHC) – pay dividends.

Our ideal business – as is Buffett’s – is one which pays out a strong dividend and then invests the remainder of its earnings into high incremental returning opportunities. This results in shareholder wealth compounding at high rates over time while also typically leading to steadily growing dividends per share and therefore an increasingly attractive income stream for us as shareholders.

EPD is a great example of this. The company recently purchased Navitas Midstream which is expected to generate a 14% DCF yield on invested capital. Given EPD’s proven track record of highly disciplined M&A and high returns on invested capital, we are inclined to believe management’s projections here. Furthermore, with EPD’s DCF yield at 11.8% at current unit prices, investing capital in Navitas Midstream and similar growth projects is a much better use of incremental capital beyond the distribution.

Investor Takeaway

Warren Buffett has become one of world’s greatest investors by patiently selecting investments with great discipline and then buying them on a value basis. By following these five traits of outperformers provided by the Oracle of Omaha, we believe that we can continue outperforming the market and generate an attractive combination of attractive yields alongside outsized total returns.

Be the first to comment