Green Energy Vehicles At 2022 Central China International Auto Show Getty Images

BYD Company (OTCPK:BYDDY) was one of Warren Buffett’s best bets over the last two decades. Having bought 225 million BYD shares for 8 Hong Kong dollars (US$1.02) in 2008, Buffett realized about a 4,900% gain when he started selling this year for around $50.

Buffett has made numerous high profile sales of BYD this year, and they’ve coincided with heavy selling of the stock. Many investors are nervous enough about China to begin with, the world’s most famous investor selling his one Chinese name can’t inspire confidence. However, Buffett’s selling might not be quite the bearish signal it appears to be. BYD has been a tenbagger several times over for Buffett, so his sales could just be profit taking.

Buffett’s sales notwithstanding, the current year is a great time for BYD Company. The firm is growing deliveries at 197%, it sells more cars than Tesla (TSLA), and it could benefit from China’s ongoing economic re-opening. Last week, China gave the strongest signals yet that it was putting Zero COVID behind it. On Wednesday, Guangzhou relaxed COVID control measures, despite the fact that it was in the midst of a major outbreak at the time. Furthermore, images of nucleic acid testing sites being torn down circulated on social media shortly after Guangzhou’s policy was announced, suggesting that China was preparing to scale back its COVID response.

These developments are bullish for all Chinese companies, but especially for EV makers like BYD. China’s Zero COVID policies hit EV companies hard, at one point shutting down a NIO (NIO) factory and causing disruptions to Tesla. EV manufacturing is a labor-intensive process: many tasks are automated, but building a car still requires a lot of onsite personnel. The fact that China is now easing its COVID policies bodes well for companies like BYD and NIO being able to hit their delivery targets.

But there’s more to BYD than just the COVID catalyst story. The company has phenomenal growth, is backed by many top investors, and has recurring revenue from government contracts. It’s a highly entrenched company that stands to gain immensely as countries transition to a low carbon future. If it executes well, it could reward shareholders handsomely in 2023 and beyond.

BYD is Primed for 2023

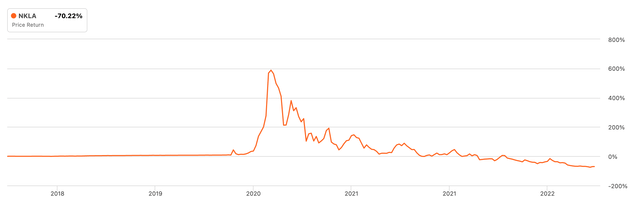

BYD Company stock has been a good buy at many points over the last decade. Since going public, it has risen several thousand percentage points, and made many investors wealthy in the process. It’s been a remarkable run, which is why the stock merits extra scrutiny now.

BYD: a remarkable run (Seeking Alpha Quant)

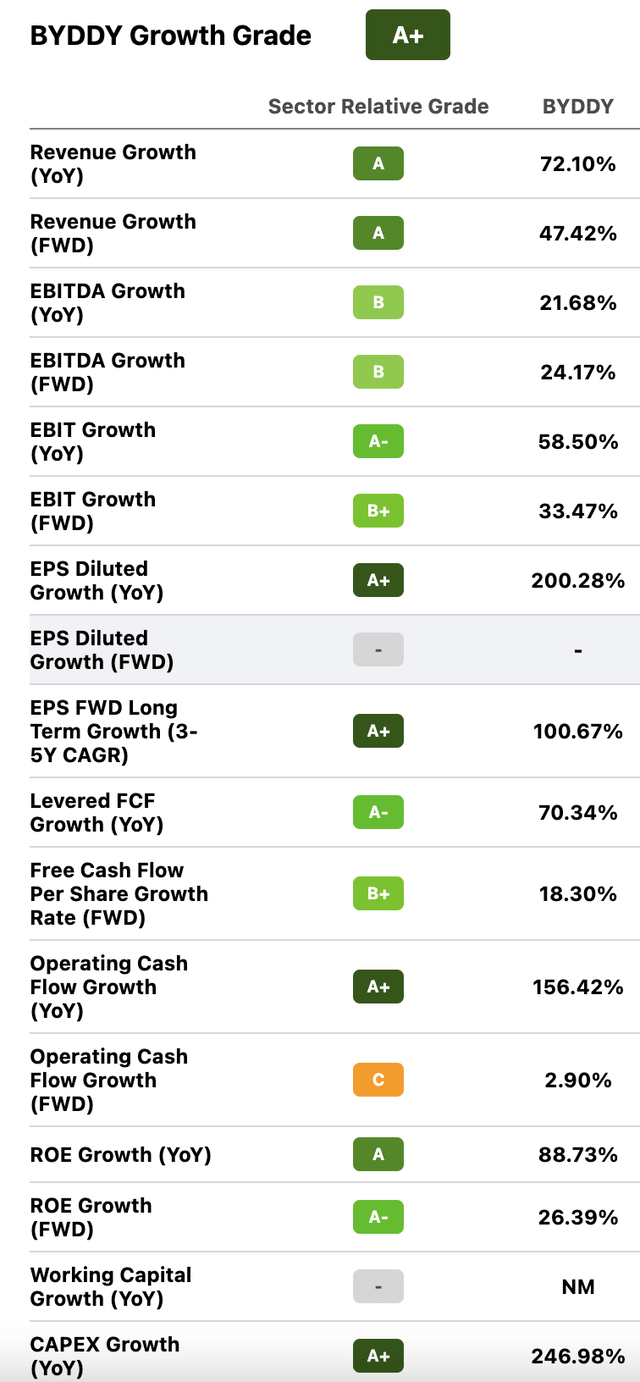

When you see a stock run up 5,000% in a few years, it’s natural to think that it’s a bubble. In BYD’s case, that suspicion is strengthened by the fact that many EV stock rallies have indeed been bubbles. For example, Nikola (NKLA) stock ran up 550% from its IPO to its 2020 peak, but lost all of the gains after its CEO Trevor Milton was charged with fraud (he was later convicted).

Nikola’s dramatic rise and fall (Seeking Alpha Quant)

The EV space has attracted a lot of skepticism, and in some cases the naysayers have been right, so we need to know what makes BYD different from industry norms. If we find proof that it is in fact different, then that strengthens the argument that its epic run has not been a bubble.

First things first, BYD’s business is quite different from that of other EV companies. It is in no small part a government contractor, it has a $1 billion contract selling buses to California, a $60 million Lithium production contract with Chile, and various procurement deals with local Chinese governments. So, it’s an entrenched manufacturer that collects recurring revenue from large institutions. This is a night and day difference from an EV startup that announces products and never delivers them–a common practice in the EV industry that has contributed to its bubble-like price moves.

In a YouTube video, tech reviewer Marques Brownlee cites at least three different EV companies that took customers’ money without sending them the cars they ordered. One of those companies was Tesla, which took pre-orders for the Cybertruck and never delivered–Brownlee himself pre-ordered the truck. If Brownlee is correct that these practices are an industry-wide problem, then BYD’s 343,000 quarterly deliveries demonstrate that it is not a typical EV company. It is delivering the cars it announces. So, we should not expect BYD to be yet another EV bubble story. It’s a company with real fundamentals whose stock price should correlate to one extent or another with its business performance.

Tech reviewer Marques Brownlee: EV startups fail to deliver (YouTube/Marques Brownlee)

It’s here that we start to see BYD’s potential as a 2023 pick. This year, BYD’s performance has been improving, while its stock price has been going down. In the trailing 12-month period, BYD has delivered:

-

$46 billion in revenue, up 72%.

-

$7.18 billion in gross profit.

-

$1.5 billion in operating income (“EBIT”), up 156%.

-

$1.39 billion in net income, up 190%.

-

$5.5 billion in levered free cash flow, up 70%.

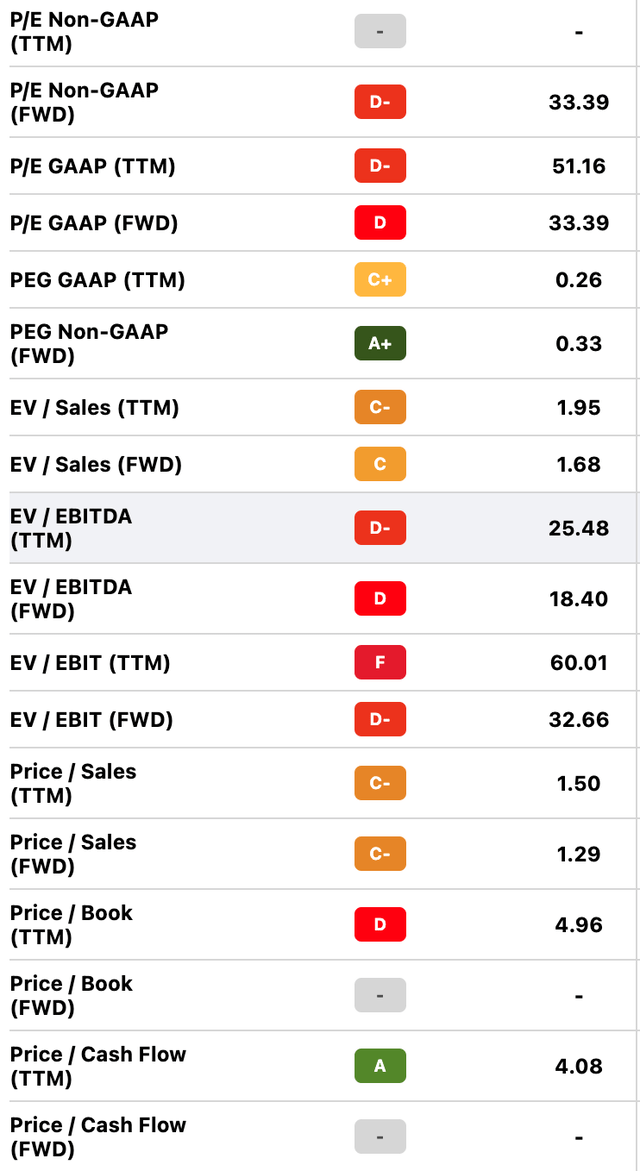

BYD – an ‘A+’ on growth (Seeking Alpha Quant)

The growth here is far above average, on par with that of Tesla, which trades at 7.4 times sales. A few of Tesla’s growth metrics, like EPS growth, are ahead of BYD’s, but BYD has faster revenue and FCF growth than Tesla does, and a mere 1.5 price/sales multiple! So we’ve got BYD with a relatively modest price/sales multiple AND the superior growth that gets investors excited in EVs in the first place. There’s a strong case to be made here that once China’s Zero COVID policy is over, interest in BYD Company stock will pick up. The company is already growing sales and cash flows at a rapid pace, while being reasonably cheap. It seems like the COVID overhang (and maybe Buffett’s sales) is what’s holding the stock back. Therefore, an end to China’s COVID policy could be the catalyst that takes BYD to new highs.

Valuation

As I showed in the previous section, BYD has a much lower sales multiple than Tesla does, despite having superior growth. It certainly looks like a promising opportunity at first glance. But we’re not done just yet. In order to truly know how BYD stacks up valuation-wise, we need to look at other multiples and perform a basic discounted cash flow (“DCF”) analysis.

We can start with multiples. In addition to the 1.5 price/sales multiple already mentioned, BYD trades at the following multiples (courtesy of Seeking Alpha Quant):

BYD Valuation (Seeking Alpha Quant)

As you can see, the earnings multiples are high (though lower than Tesla’s), yet the PEG ratio and operating cash flow multiple are at rock bottom levels. PEG is price/earnings, all divided by the growth rate. It tells you how expensive a company’s stock is if its historical earnings growth continues. Obviously, this ratio is not valid if future growth comes in below expectations, but BYD’s growth has been accelerating rather than decelerating, so the signs we’re seeing now look pretty good.

We get a similar picture if we do a basic DCF model for BYD. According to Seeking Alpha Quant, BYD has $2.12 in FCF per share and a 70% FCF growth rate. If we assume that BYD’s growth falls to 20% over the next year, then falls to 0% after five years, then we get a $59 price target using an 8% discount rate. So BYD has upside even if significant deceleration kicks in. If we discount at 4%, slightly higher than the current 10 year treasury yield, we even get a little upside assuming ZERO growth starting today! The math on that is shown below:

- Terminal value = $2.12 divided by 0.04 = $53.

BYD’s Technical Edge

BYD Company is growing fast and is cheap compared to its largest competitor. That looks enticing, but what’s even more incredible is that BYD has technical advantages that could help it maintain its growth. In my DCF model, I assumed extreme growth deceleration for the sake of being conservative. However, BYD’s battery tech provides some big advantages that could propel growth well into the future. BYD’s batteries are advanced enough that Tesla is now using BYD battery cells. Its blade battery was tested and found not to catch fire after being penetrated with a sharp object, reaching a temperature of only 30 degrees Celsius. An article by Tycorun Energy states that BYD batteries last 30 years, vs. 20-25 for Tesla batteries. Finally, BYD has Lithium mining rights in Chile, which provides advantages in procurement and supply chain management. This all suggests that BYD has a rock-solid edge in battery manufacturing, one of the crucial components of the EV supply chain.

Risks and Challenges

As we’ve seen, BYD is relatively cheap, it’s growing fast, and it is in possession of advanced battery technology. It looks like a winner. In my opinion, it is indeed a great stock, but there are several risks and challenges to be aware of, including:

-

Margins. BYD is one of the top EV companies in terms of sales, but it’s nowhere near Tesla in terms of profit. According to Seeking Alpha Quant, BYD has a 6.93% net margin and a 10.7% ROE. Tesla, by contrast, has a 15% net margin and a 33% ROE. BYD sells at a lower average price point than Tesla does, resulting in slimmer margins. As a result, it can’t take a big hit to revenue and still be profitable. It depends on high sales volume in order to generate profits.

-

Zero COVID. BYD is a Chinese company, and most of its factories are in China. China still officially follows a Zero COVID policy which, among other things, calls for quarantining factories that see significant COVID outbreaks on-site. This policy materially impacted NIO and Tesla this year. It could impact BYD as well.

-

U.S.-China tensions. BYD does a significant amount of business with U.S. customers. For example, it has a contract selling busses to California. Tensions between China and the U.S. are icy right now, we’ve seen several disputes over Taiwan and the addition of numerous Chinese names to the Holding Foreign Companies Accountable (“HFCAA”) list of stocks being considered for delisting. If U.S./China relations deteriorate further, BYD’s U.S. contracts could be at risk.

These risks are material, and merit being taken seriously. The U.S./China conflict issue is particularly serious: the SEC is so suspicious of China that it’s thinking about delisting Chinese names. Nevertheless, BYD, viewed as a company, is a big success. It’s growing fast, it has recurring revenue from government contracts, it’s supplying batteries to Tesla, and the list just goes on. If you have enough risk tolerance to manage volatility stemming from political disputes, BYD Company stock is worth considering in 2023.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment