Jon Kopaloff

Introduction

My thesis is that Warner Bros. Discovery (NASDAQ:WBD) faces challenges given the information we received after the 2Q22 period closed.

Projections Were Too Optimistic

Management is struggling to meet past projections. Back on June 4th, I tweeted that I didn’t understand how management could show an adjusted EBITDA slide in one part of the May 2021 “Discovery and WarnerMedia to Combine” presentation but then say the following in another part of the same presentation:

Adjusted EBITDA estimates depend on future levels of revenues & expenses which are not reasonably estimable at this time. Accordingly, we are not able to provide a reconciliation between adjusted EBITDA and the most comparable GAAP metric without unreasonable effort.

This is unbelievable! They were able to make the slide and boldly present it, but they then said it requires “unreasonable effort” to explain the numbers in the slide:

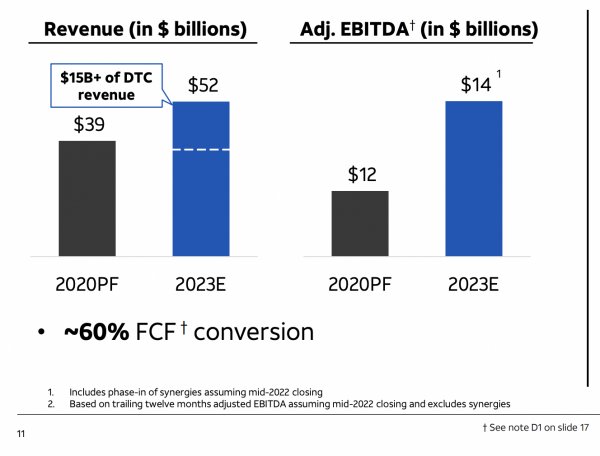

WBD EBITDA, FCF & Revenue (May 2021 “Discovery and WarnerMedia to Combine” presentation)

In the 2Q22 call, management confirmed that the $14 billion adjusted EBITDA number for 2023 in the above slide is wrong:

Based on the full year impact of our 2022 corrective actions and $2 billion to $3 billion of synergy realization in 2023, we expect adjusted EBITDA to be at least $12 billion.

The 60% FCF conversion figure in the above slide is also unrealistic until after 2023. This is what management said about it in the 2Q22 call:

We expect to convert approximately 1/3 to half of our adjusted EBITDA into free cash flow in 2023 as we make progress towards our long-term target of approximately 60%.

This is a prodigious difference for FCF in 2023. The slide above says $14 billion in adjusted EBITDA with a 60% FCF conversion, meaning about $8.4 billion in FCF. The 2Q22 call says $12 billion in adjusted EBITDA with a 1/3rd to 1/2 FCF conversion, meaning FCF of about $4 billion to $6 billion.

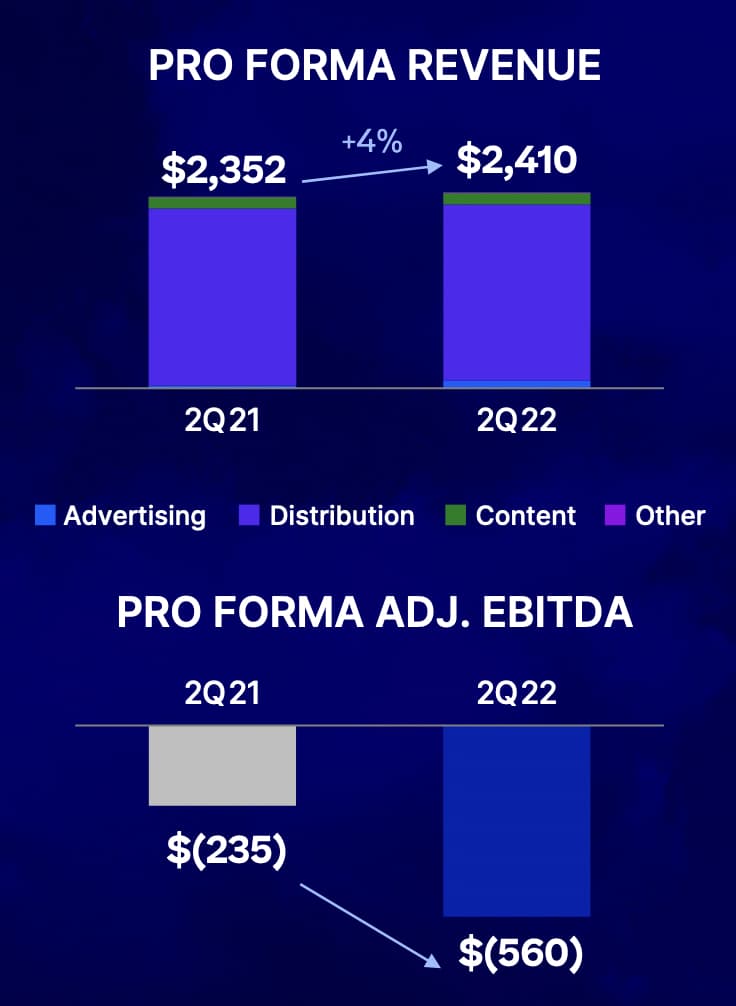

Like everything else in the slide, the revenue number is wrong too. The slide shows $52 billion in overall revenue, with $15 billion or more coming from DTC. The 2Q22 presentation shows that year-over-year revenue growth for DTC was only 4% from $2,352 million in 2Q21 to $2,410 million in 2Q22. Annualizing the 2Q22 figures gives us $9,640 million, and it is not realistic for this to jump to $15 billion or more for 2023:

WBD Revenue and Adjusted EBITDA (2Q22 presentation)

Debt

Unlike competitors such as Netflix (NFLX), WBD has significant debt, such that their enterprise value (“EV”) is much higher than their market cap. Looking at the 2Q22 10-Q, we have $51,388 million long-term debt plus $1,097 million short-term debt plus $328 million redeemable noncontrolling interests plus $1,236 million noncontrolling interests. This is partially offset by $2,575 million cash, such that the enterprise value for WBD is around$51.5 billion higher than the market cap.

Debt is much lighter at Netflix such that their enterprise value is only about$8.4 billion more than their market cap due to $14.2 billion in long-term debt that is partially offset by $5.8 billion in cash

Innovator’s Dilemma

In the 2Q22 call, CEO David Zaslav explained that WBD has 4 to 6 “cash registers” or revenue sources:

We effectively have four, five or six cash registers. If there is a cash register where a consumer can come in and either watch or pay for a piece of content, we have every platform in the ecosystem. And in a world where things are changing, and there is a lot of uncertainty and there is a lot of disruption, that’s a lot more stable and a lot better than having one cash register.

Having multiple cash registers in a changing world can be both a blessing and a curse depending on factors like durability. The DTC streaming cash register continues to grow in importance, and The Innovator’s Dilemma by Clayton Christensen explains that having multiple cash registers can be problematic because the non-streaming cash registers can prevent management from focusing on the DTC streaming cash register. One hint of this focus dilemma was the comment management made in the 2Q22 call regarding the release of direct-to-streaming films:

As films move from one window to the next, their overall value is elevated, elevated, elevated. We saw this clearly demonstrated with the Batman and Elvis. We have a different view on the wisdom of releasing direct-to-streaming films, and we have taken some aggressive steps to course correct the previous strategy.

In the 2Q22 call, management made more comments about windowing that could hurt their DTC streaming product:

For decades, our industry has embraced changing technology and consumer demand by evolving a very successful windowing approach to exploiting content. However, in recent years, a strategy has emerged that suggests the video business will be better off collapsing all windows into streaming, overpaying for and overinvesting in content and offering it all at the same time for a low price. We don’t believe in this strategy.

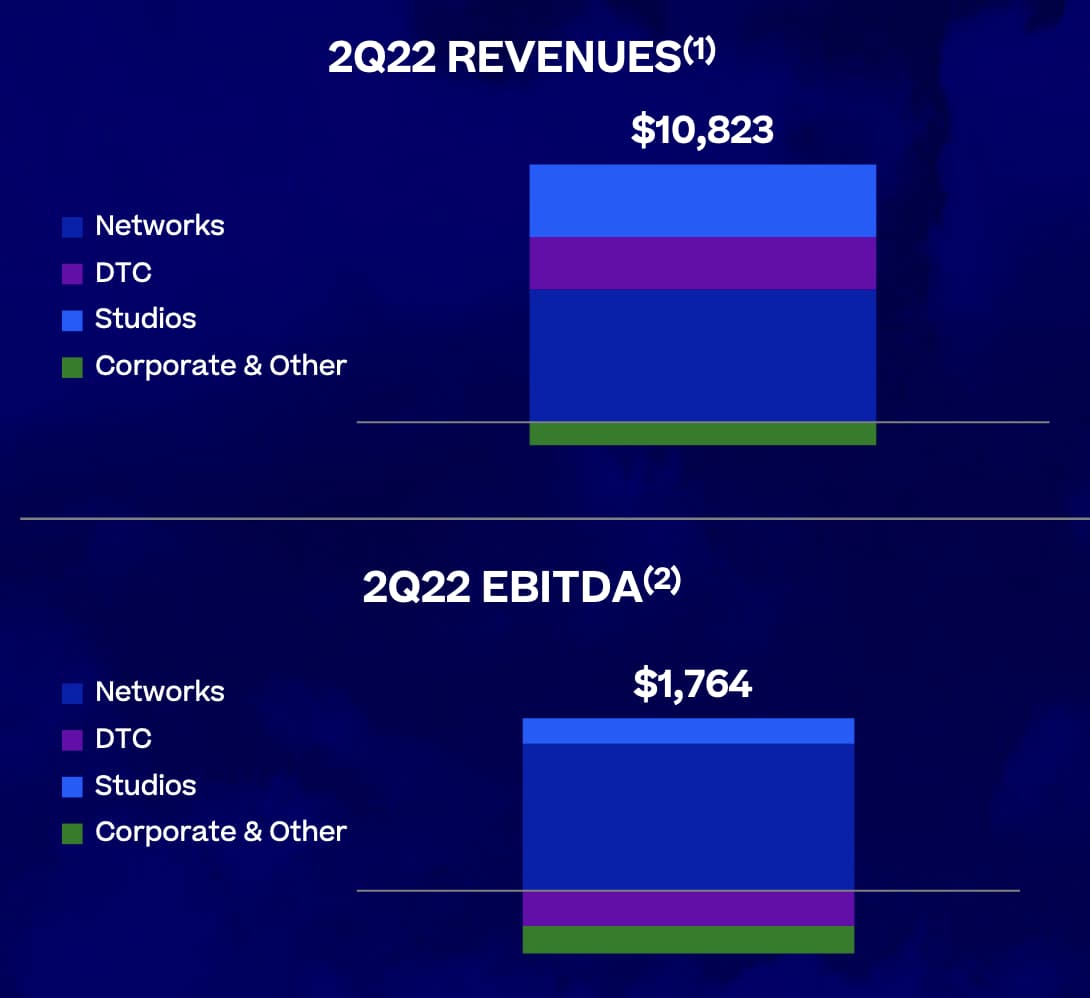

The legacy networks register is by far the biggest contributor to EBITDA, and one danger is that management will focus too much on this cash cow and not give the DTC streaming business the attention it needs:

WBD Revenue and EBITDA by segment (2Q22 presentation)

Having just one cash register, Netflix is galvanized to get streaming right. WBD can get it right as well, but they may face struggles with respect to focus.

Streaming Economics

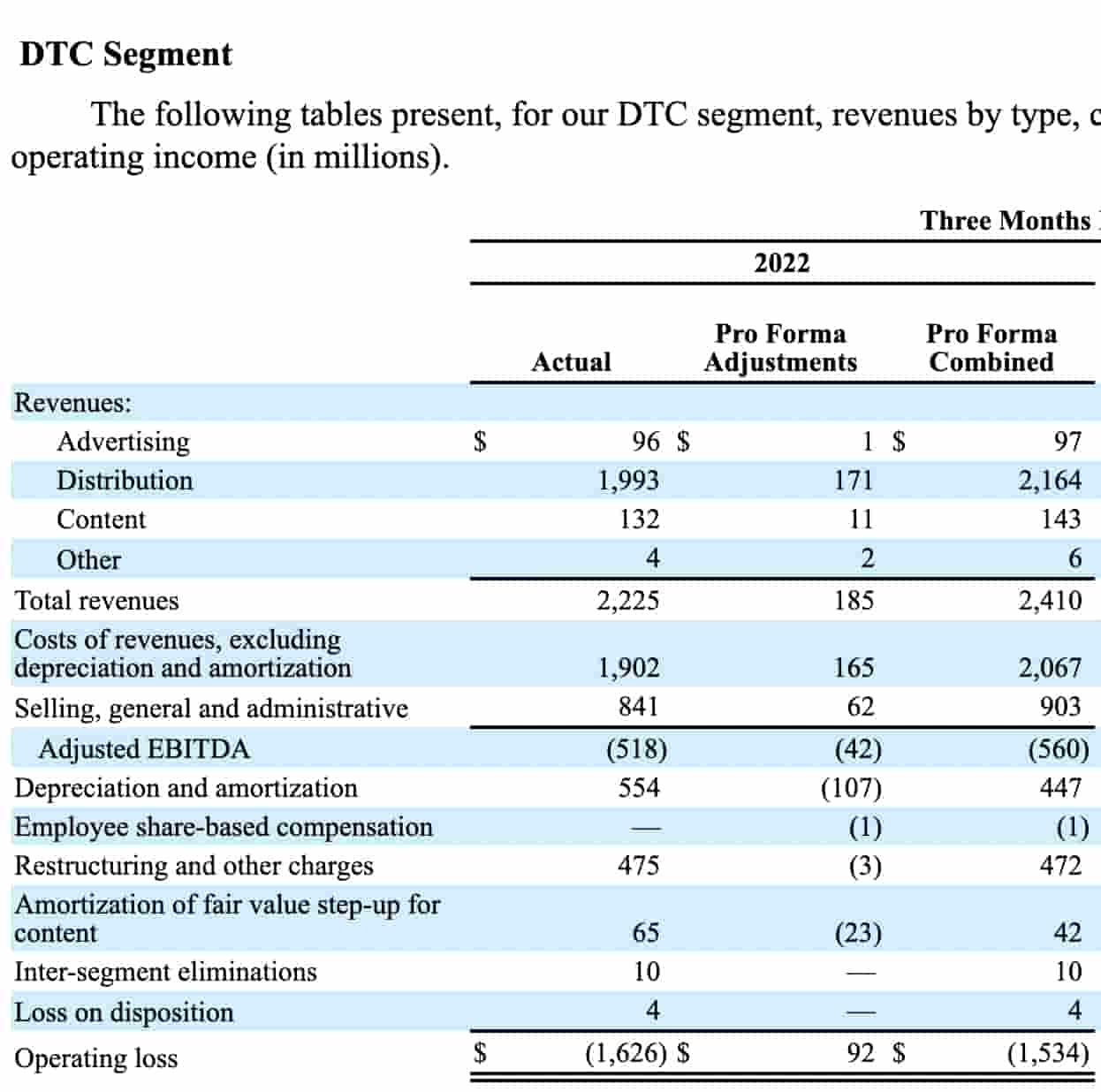

Per the 2Q22 10-Q, the streaming business had a quarterly pro forma operating loss of $(1,534) million. I don’t think the $472 million restructuring charges represent future economics, so I think of the operating loss as being closer to $(1,062) million in practical terms. The 10-Q also shows the same figures we saw in the 2Q22 presentation slide above – quarterly DTC adjusted EBITDA of $(560) million on quarterly DTC revenue of $2,410 million:

DTC Segment (2Q22 10-Q)

Here are the new streaming parameters from the 2Q22 presentation:

Key Streaming Metrics (2Q22 presentation)

In the 2Q22 call, CEO Zaslav focused on the U.S. DTC break even expectation for 2024 and the $1 billion global DTC EBITDA for 2025:

But the number — the number on the corner of JB’s desk and mine is the breakeven and the $1 billion. If we do that – I don’t really care what the [subscriber] number is. We’re not in the business of trying to pick up every sub. We want to make sure we get paid. We get paid fairly. We have very high-quality content in many markets, we should be paid more because we’re providing dramatically better content and more robust content and higher quality content. If the [sub] number is 122 and we’re making over $1 billion, that is the number for us. We’re going to grow subs significantly, but we want to run – we want to drive profitability and free cash flow.

Today’s quarterly DTC revenue figure of $2.4 billion is a far cry from Netflix’s 2Q22 quarterly revenue of $8 billion. Part of this is because Netflix has better monthly average revenue per user (“ARPU”). The Netflix 2Q22 letter shows ARPU of $15.95 for the U.S. and Canada, $11.17 for Europe, the Middle East and Africa, $8.67 for Latin America and $8.83 for Asia Pacific. Meanwhile, Discovery International CEO Jean-Briac Perrette explained in the 2Q22 call that the WBD ARPU figures are lower:

Turning to ARPU. As we just reported, our current ARPU is almost $8 globally, comprised of nearly $11 domestically and almost $4 internationally.

It will be difficult for WBD management to keep up with the breadth of content we see at Netflix without the benefit of the volume of streaming revenue we see from Netflix. In the 2Q22 WBD call, EVP of Global Investor Strategy Andrew Slabin explained this need of having a breadth of content in order to keep churn under control:

And ultimately, the breadth of the offering matters to get the churn down so that there’s something for everyone in the household, everyone in the family. And we’ve seen it across all our data points where the more people you have in a household, using the service, the stickier it is, the lower your churn is the more viable our businesses. And so at the end of the day, putting all the content together was really the only option we saw to making this a viable business.

Valuation

Looking at the 2Q22 presentation, adjusted quarterly EBITDA is $1,764 million, which comes to $7,056 million annualized. This excludes interest on debt so I think in terms of enterprise value instead of just market cap when looking at this metric. Given the growth expectations, I wouldn’t be surprised if some investors think the enterprise value should be 10 to 12 times this annualized figure, or $70.6 billion to $84.7 billion.

If we switch over to FCF, then interest on debt is included, so we can hone in on market cap. Eventually management hopes to convert 1/3rd to 1/2 of adjusted EBITDA to FCF so that hopeful FCF figure is $588 million to $882 million quarterly and $2,352 million to $3,528 million annualized. I think some investors would want to see WBD’s market cap at about 10 times this annualized range, or $23.5 billion to $35.3 billion.

Per the 2Q22 10-Q, there were 2,427,592,861 shares as of July 21st, and we multiply this by the August 10th share price of $13.10 to get the market cap of $31.8 billion. As we explained above, the enterprise value is significantly higher than the market cap, coming in at $83.3 billion for a difference of $51.5 billion.

The market cap and enterprise value are in the range many would expect. Given the uncertainty from the way management has changed numbers recently, I’m fairly neutral and I don’t have a strong feeling in support of or against Mr. Market at this time. Technically I’m long because I bought a single share, but I’m neutral from a practical perspective as I continue to learn more about this business and think about if and when I should build a real position.

Be the first to comment