VioletaStoimenova/E+ via Getty Images

Co-produced with “Hidden Opportunities”

Mr. Market presents attractive deals every day. We have seen the market be tumultuous. This opens the door for great opportunities.

When markets are volatile and popular stocks drop big, it isn’t uncommon to see analysts issue buy ratings with a target price. We don’t know when and if those stocks will ever achieve those target prices.

At High Dividend Opportunities, we call our investment strategy “The Income Method.” We don’t try to chase stock prices up and down or predict their move in the next 3, 6, or 9 months. Instead, we look at the stock market as a place to shop for income. We pay the price and purchase a specific yield. A further drop in prices is an incentive to enable dividend reinvestments (‘DRIP’) or directly add more to our holdings. This materially increases our subsequent paycheck and improves our financial well-being.

This article discusses the spirit of High Dividend Opportunities – generating sustainable income for income investors and retirees through high-yielding stocks. We discuss how high dividend investing isn’t synonymous with chasing yield and we share the importance of distinguishing between treasure and trash for an income portfolio that allows you to ignore day-to-day market movements and lets you sleep well at night.

Dividends Are Easy To Love

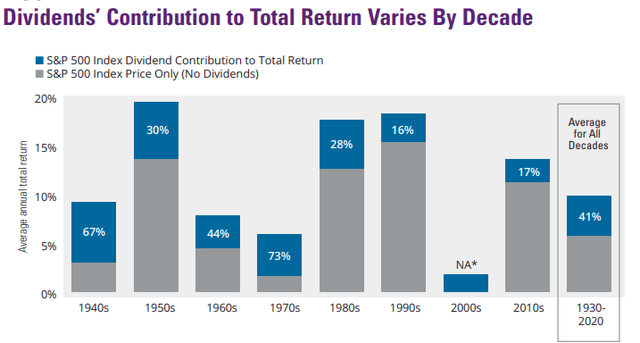

Dividends are the core component of HDO’s investment strategy. And it is easy because you can see your portfolio generate money periodically. Dividends have been instrumental for investors during wars, recessions, and other times of stress for governments and businesses. In the past 90 years, dividends have contributed to almost 41% of the total returns.

– Source: hartfordfunds.com

When markets are volatile, as they are today, dividends provide much-needed comfort. It is always nice to know that your next paycheck is right around the corner.

Why Do We Like High Yields?

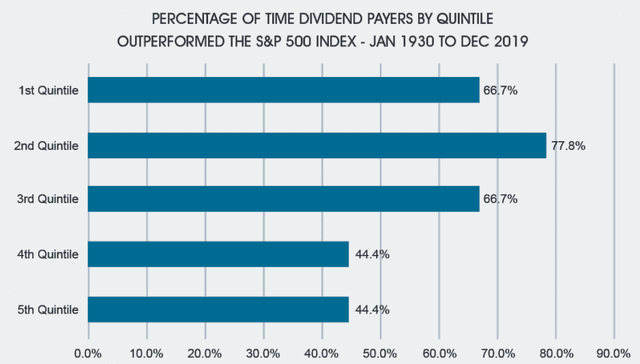

Companies can be divided into quintiles based on decreasing dividend payouts (i.e., the first quintile comprised the highest dividend payers while the bottom quintile comprised the lowest payers). Wellington Management conducted this study between 1930-2019 and found a clear correlation between higher dividends and the ability to beat the broader market.

Wellington Management and Hartford Funds

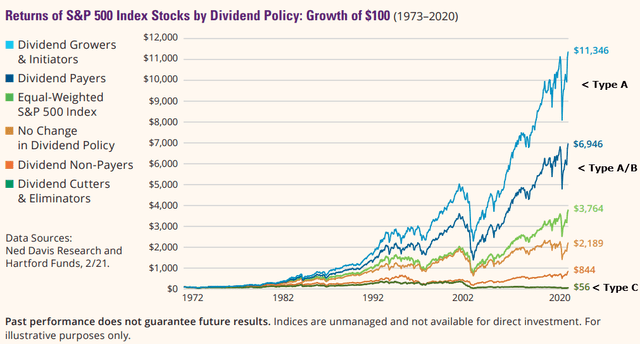

High-yield investing doesn’t mean using the stock screener to find the highest yields. In fact, this method could be counterproductive for your financial well-being. Please read ahead to find out more.

Where Do High Yields Come From?

There are three types of high yield opportunities:

Type A: Quality dividend companies that are temporarily mispriced:

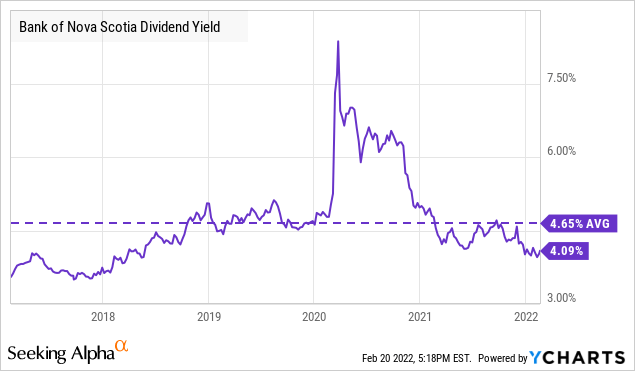

These companies aren’t true high yielders, but sometimes, during bear markets or periods of extreme volatility, you might find a high-quality company trading at a depressed level so that its yield may be considerably more than average. For example, Scotiabank (BNS) was yielding north of 6% for several months following the 2020 bear market, presenting a valuable opportunity for investors to lock in high yields from the 27th safest bank in the world.

As income investors, we don’t have a problem waiting for the misunderstanding to clear; we get paid to wait patiently.

Type B: Some securities are structurally designed to provide high yields due to regulatory requirements, and are popular securities that are must-haves in an income portfolio as an effective inflation hedge.

- REITs – Real Estate Investment Trusts

- MLPs – Master Limited Partnerships

- BDCs – Business Development Companies

- CEFs – Closed-End Funds

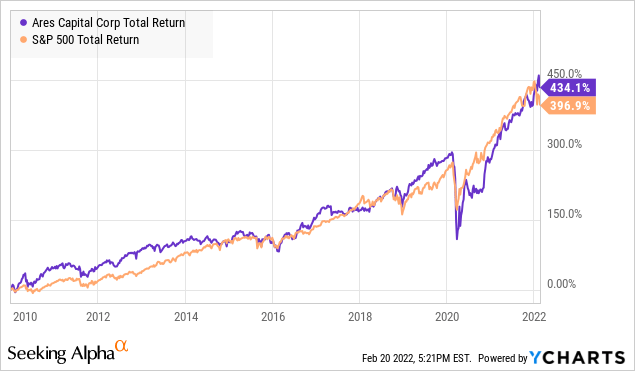

These structural high yielders have successfully outperformed the market in the long term. Look at our favorite blue-chip BDC Ares Capital (ARCC) handsomely beating the S&P 500 since January 2010 (without reinvesting dividends).

Type C: Distressed companies with (temporary) high yield

Struggling companies can have high yields too. Stock prices plunge when companies face significant headwinds, competitive/regulatory pressures, and other business challenges. Declining stock price raises the current yield, but these are not reliable dividend opportunities. It is critical to distinguish between irrational undervaluation and a struggling company.

Sometimes, Type A transforms into Type C when the macroeconomics shift out of favor for the company. This is why it is critical to pursue disciplined investing, regularly evaluate your holdings, and make prudent decisions to protect and grow your income.

Are High Yields Risky? Studies Show Otherwise

Word on the street is that high yields are risky. While there is a widely-accepted correlation between risk and commensurate compensation, not all high-yielding securities present high risks. As we discussed above, there can be multiple reasons why a security carries a high yield. The determination of risk on the basis of the business fundamentals would be more prudent.

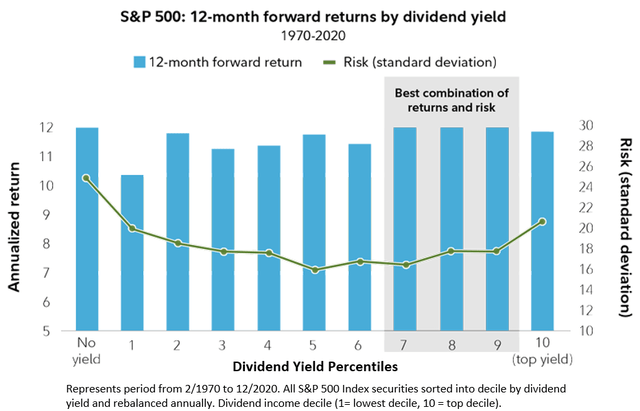

Fidelity studied yield levels, annual returns, and risk over the past 50 years. Their analysis shows that the securities in the 7th-9th dividend income deciles (high yield, but not the highest) provided the best combination of returns and risk. This implies that somewhere in the higher yield levels (maybe not the highest yield out there), there are attractive risk-reward combinations, and we aim to pursue these opportunities to build a sustainable income portfolio. These would largely represent Type A securities discussed above.

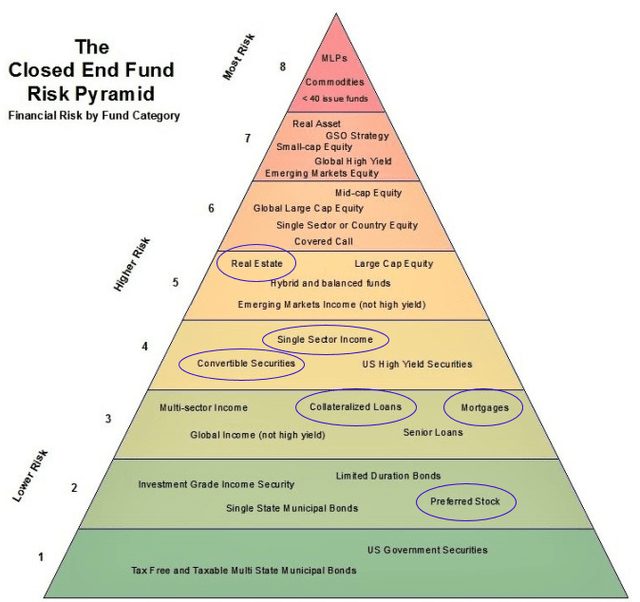

The S&P 500 studied in the chart above will not be highly representative of all high yield choices, so let’s also look at CEFs (closed-end funds), a popular vehicle for income investors that employ leverage to boost income capabilities. Not all CEFs are equal in risk, and the diagram below will demonstrate that.

The circled types of CEFs are a few of our favorite ones at this time and, as shown in the pyramid, present a relatively lower risk. Hence, it is possible to invest in Type B high yield securities while minimizing portfolio risk.

Don’t chase yield, they say, and we agree wholeheartedly. Going to the stock screener and searching for securities with the biggest yield without any other evaluation introduces significant risks to your portfolio, starting with dividend cuts, insolvency, bankruptcy, etc. Those are the Type C stocks we discussed in the previous section, and they have rightfully fallen to the bottom of the performance chart. For income investors, the moment you smell a Type C stock, you should get out before it does irreparable damage.

– Source: Hartford Funds

HDO’s income method is designed for retirees (and early retirees) to generate a dependable income stream to sustain their lifestyles. As such, our selections are carefully vetted for robust business fundamentals, quality management, and a proven track record of stable operations during good and bad market conditions. Only high-yield securities that pass a series of criteria we seek are added to our model portfolio.

Why Are High Yields Necessary?

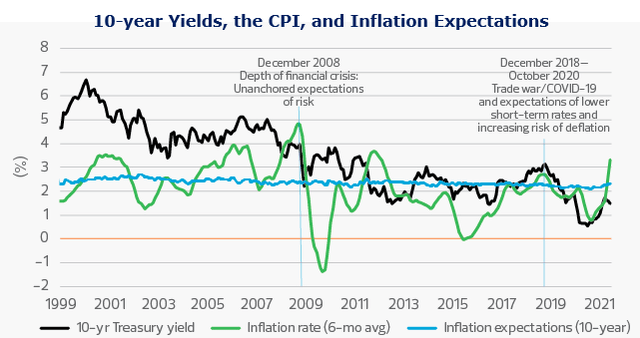

The 60/40 equity/bond portfolio, a strategy popularly recommended for years, is dying. During this past decade, treasury bonds have barely earned above inflation. The chart below shows the declining ability of T-bonds (the conventional fixed-income investment vehicle) to keep up with the rising cost of goods and services. Every time there is an economic crisis, the government steps up to save businesses by reducing borrowing costs. Consequently, we are left with a yieldless market for years, and your retirement portfolio is now losing out to inflation.

– Source: rsmus.com

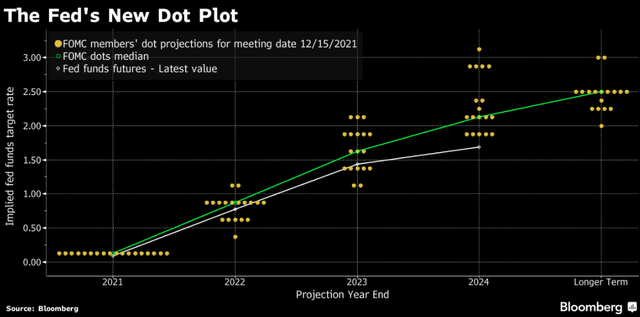

The Federal Reserve’s dot plot from December 2021 indicates a high possibility of rates staying at or below 2.5% beyond 2024. This still doesn’t cover the Fed’s projected inflation rate for the years ahead.

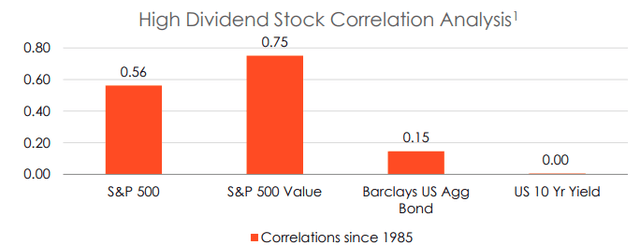

At HDO, we follow the 60%/40% allocation rule, except that our 40% comes from Preferred Stocks, high-yield bonds, and fixed income CEFs. Such high-yield fixed incomes are much less impacted by rising interest rates than other traded securities.

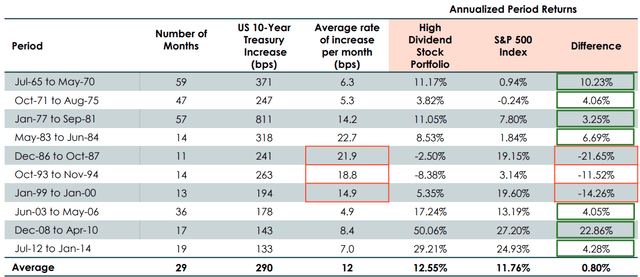

As a result, high yields have materially outperformed the S&P 500 in the past 7 out of ten rate hikes.

High Dividends vs S&P Rising Rates

This is a win-win situation. Not only are we protected from inflation with higher yields, but we are also protected from volatility due to rising rates.

The Importance of Discipline

Because we don’t manage these businesses, no matter how solid they are and how promising their management team operates, even as shareholders we only have a small voice in their pursuits and transactions. But we can routinely evaluate the health of our income prospects from the company and make investment decisions. Not unlike other investment strategies, our income method has rules.

-

Don’t get emotionally attached to our investments; if you sense trouble (for our income), move to a safer income opportunity.

-

Maintain strict portfolio allocation limits for each pick.

-

Diversify our income stream to secure economic tailwinds.

-

Regularly evaluate your portfolio constituents for their ability to earn and cover the dividend.

Conclusion

When it comes to investing, there is no one-size-fits-all. Based on the requirements of your personal situation, your commitments, your retirement timeline, and your geographic location, multiple strategies or combinations of techniques would work for you. Today, we highlight the essence of dividend investing with high yields, a method that has proven to be rewarding for investors seeking passive income.

This method is not only for retirement planning but applies to anyone who could use a parallel income stream. All it takes to do it right is discipline. This does not have to be as tricky as it sounds; HDO’s experienced team is here to help. We don’t buy high yields for the sake of it. We prudently evaluate our picks and follow a disciplined approach to making purchases.

At HDO, we are a large community of income investors at various stages of our lives, but with one goal – to earn growing paychecks from our investments. HDO maintains a model portfolio of over 100 securities targeting an average yield of 8% so you can sit back, collect dividends, and pursue a stress-free lifestyle. Stocks may go up and stocks may go down, but our income will go up forever.

You can achieve this yourself by becoming an income investor. You can unlock the true potential of your portfolio and thus unlock more opportunities and freedom from your retirement. Most savers when polled about retirement state they want “financial freedom” or “financial independence” in their retirements. Yet, so few know the steps of how to achieve this. Today, we aimed to arm you with more knowledge to achieve that goal. The next steps are up to you!

Be the first to comment