smckenzie

On August 10th, after the market closes, the management team at entertainment giant The Walt Disney Company (NYSE:DIS) is due to report financial performance covering the third quarter of the company’s 2022 fiscal year. Heading into that time, there are a number of items that investors should be keeping a close eye on. Some of these are continued growth initiatives that have the potential to make or break the company’s near-term outlook. Others are aspects of the company that will gauge just how well the enterprise is recovering following the pandemic. In all, I personally view The Walt Disney Company as one of the most attractive opportunities on the market today, hence why it’s one of only six companies in my portfolio. But no firm is immune from changes, and this moment coming up, we’ll go a long way to determining whether my investment thesis plays out or whether some revision in it is ultimately needed.

All eyes on streaming

Beyond any doubt, the most watched for development regarding The Walt Disney Company will be its streaming operations. First and foremost, this involves the company’s hallmark streaming service known as Disney+. For a couple of years, this platform had been growing like a weed, but between difficult economic conditions, market saturation, and increased competition, concerns have mounted about whether or not streaming still remains a strong opportunity for growth moving forward. Keep in mind that the management team at The Walt Disney Company continues to push for between 230 million and 260 million global subscribers on Disney+ by the end of 2024.

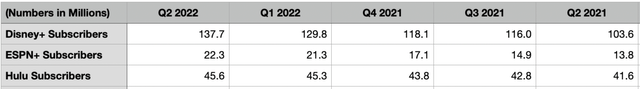

When the business reported results covering the second quarter of its 2022 fiscal year, it reported 137.7 million global subscribers on Disney+. This represented an increase of 32.9%, or 34.1 million, over the 103.6 million subscribers that were on the platform just one year earlier. It was also 7.9 million subscribers higher than just one quarter before, and it beat analysts’ expectations to the tune of 3.3 million. When it comes to the space as a whole, there is reason to be both optimistic and pessimistic about the future. On the pessimistic side, results for industry leader Netflix (NFLX) have not been particularly great. In the first quarter of this year, the company reported a loss in subscribers in the amount of 0.2 million, thanks in large part to losing 0.5 million subscribers because of its decision to stop operations in Russia because of the conflict involving Ukraine. But then, the management team at Netflix scared investors by saying that they forecasted another 2 million subscriber decline for the second quarter of the year. The actual number ended up being far better, with the company losing only 0.97 million. But at the same time, the subscribers ultimately lost were the high-value ones, while the ones they gained to help offset the losses were low-value in nature.

So far, The Walt Disney Company has bucked the pain experienced in this space. But there’s no guarantee that will continue. Of course, investors should also pay attention to subscriber numbers for both ESPN+ and Hulu. Hulu has been growing at a particularly slow pace recently, but that’s likely because its upside potential from here is not all that great. And ESPN+ has exhibited some weakness, with the 0.3 million subscriber gain it reported in the latest quarter coming in 1 million lower than analysts anticipated.

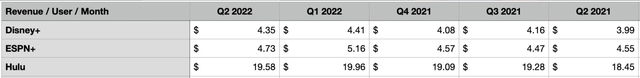

In addition to subscriber numbers, investors should also be paying attention to the pricing achieved by the company. Year over year in the second quarter, Disney+ saw average revenue per user per month actually increase by 9%. ESPN+ pricing grew by 4%, while Hulu pricing jumped by 6%. On the other hand, the numbers in the second quarter of the year were weaker than what the company reported for the first quarter. Though the dollar changes may not sound like much, they can have a significant impact on the company’s top and bottom line. A weighted average change in pricing across all three subscription platforms of just $0.30 per user per month can add $740.2 million in revenue to the firm’s top line over the course of one year based on current subscriber numbers.

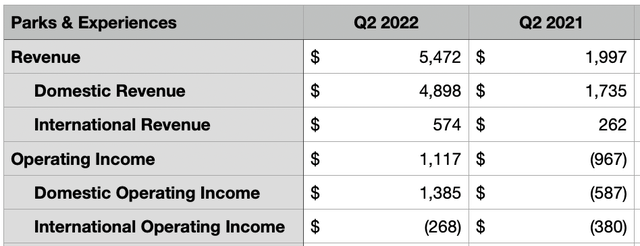

Pandemic weak spots

Although not as important as the streaming angle, I fully suspect that another important aspect that investors should keep a close eye on will be the parts of the company that were most impacted by the COVID-19 pandemic. At top of mind would be the Parks & Experiences portion of the business. The good news for investors is that, in the second quarter of this year, this particular portion of the firm performed exceptionally well. Revenue came in at $5.47 billion. That was almost triple the roughly $2 billion generated the same time one year earlier. Growth was particularly strong in the domestic market, with revenue skyrocketing from $1.74 billion to $4.90 billion. With this rise in revenue, we also saw operating income improve. The company went from generating a loss of $967 million in this category to generating an operating profit of $1.12 billion. Of course, the international side of things was still rather weak, with the loss narrowing from $380 million to $268 million. But any sort of improvement should be considered a win for investors.

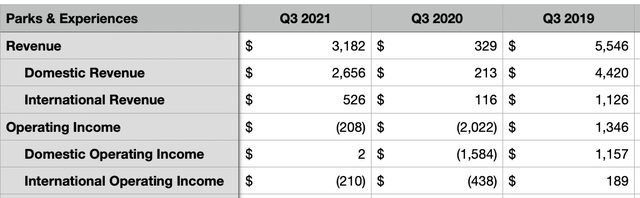

When it comes to the third quarter, things should get rather interesting. Consider how the past couple of years have been. In the third quarter of the company’s 2021 fiscal year, revenue across the Parks & Experiences unit totaled $3.18 billion. This was nearly ten times higher than the $329 million reported the same time one year earlier. At the same time, however, the 2021 figures paled in comparison to the $5.55 billion generated in the third quarter of 2019. Any sort of continued return to normalcy should have a big positive impact for shareholders. After all, in the third quarter of 2019, the operating income associated with these operations was $1.35 billion. This turned to a loss of $2.02 billion in 2020 before narrowing considerably to a loss of $208 million last year.

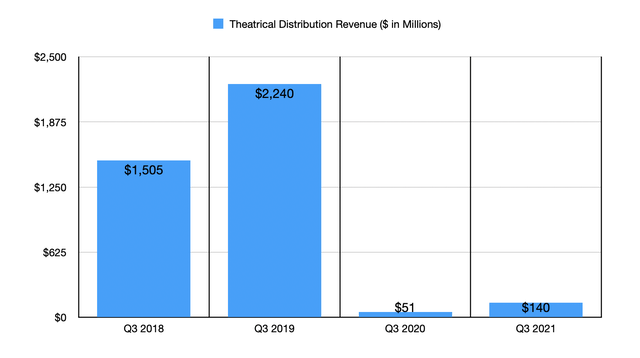

We should also be paying attention to how the theatrical distribution side of things goes. This has been the part of the company that has shown the slowest recovery from the pandemic as people have largely been afraid to go back to movie theaters and as firms like The Walt Disney Company have been afraid to invest heavily in content outside of what it intends to allocate toward their streaming services. But as I wrote in a prior article, this picture is starting to show signs of improvement. And while I fully expect a return to normalcy to take a while, that return could be very positive for shareholders. After all, in the third quarter of the company’s 2019 fiscal year, theatrical distribution revenue totaled $2.24 billion. That number plunged to just $51 million in the third quarter of 2020 and recovered only slightly to $140 million in the third quarter of last year. But with recent strong performance from both the Doctor Strange and Thor franchises, offset some by a weak showing from light-year, we could see something really great on this front.

Debt and cash flow

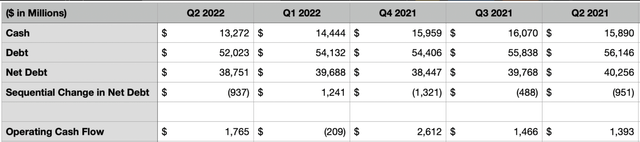

Naturally, investors in The Walt Disney Company should also continue to pay attention to developments regarding the company’s debt and its cash flow. To some degree, these two are heavily related to one another. In four of the past five quarters, the company saw its net debt decrease sequentially. And as of the end of the second quarter this year, net debt came in at $38.75 billion. This represented a quarter-over-quarter decline of $937 million. But of course, this can only be made possible when cash flow is robust. In the second quarter of this year, the company boasted operating cash flow of $1.77 billion. This was up from the $1.39 billion generated just one year earlier. In the third quarter of 2021, cash flow was $1.47 billion. So it will be interesting to see if the company can outperform that. Although the firm is investing heavily in content creation, any meaningful recovery associated with its Parks & Experiences, combined with the definite improvement we have seen in theatrical distribution, could help to push cash flow up to some degree. At the end of the day, the company does derive its value from cash flow. And until we get back to normal, there will still be some investors who are understandably bearish about the business.

Takeaway

At this point in time, I fully believe that The Walt Disney Company is one of the greatest opportunities on the market. Yes, the firm is taking some heat because of controversial political stances. But at the end of the day, that doesn’t mean anything. Consumers would gravitate toward high-quality content that serves the purpose of entertaining. And probably no company in the world is better at that than The Walt Disney Company. Absent some major and unexpected development in one or more of the areas that I discussed in this article, I fully expect the outlook for the enterprise to continue to be incredibly robust. And because of that, I have decided to retain my ‘strong buy’ rating on the company.

Be the first to comment