Justin Sullivan/Getty Images News

Fast Background

If you’re an investor in Walmart (NYSE:WMT) then you’ve probably already seen the bad news. CNBC captured it simply:

Walmart on Monday cut its quarterly and full-year profit guidance, saying inflation is causing shoppers to spend more on necessities such as food and less on items like clothing and electronics.

That shift in spending has left more items on store shelves and warehouses – forcing the big-box retailer to aggressively mark down items that customers don’t want.

And, in terms of actual numbers, CNBC continues:

Walmart said it now anticipates adjusted earnings per share for the second quarter and full year to decline around 8% to 9% and 11% to 13%, respectively. It had previously expected them to be flat to up slightly for the second quarter and to drop by about 1% for the full year.

Previously, WMT expected lukewarm earnings:

EPS expected to be flat to up slightly for Q2; EPS expected to decrease about 1% for FY; excluding divestitures, EPS expected to be flat for FY.

The main bad news for WMT is that the company is shifting from a neutral outlook to a rather bearish one. The main culprit? In a word: inflation.

Keep in mind that WMT actually expects same-store sales to rise by about 6% in Q2 2022. That’s 4-5% higher than previously expected. Sounds good, until you realize it means customers are pouring more money into food, and less on higher margin discretionary items, such as electronics.

Finally, as WMT says, spending is shifting, and prices are being slashed in certain areas – not previously expected, or planned:

Food inflation is double digits and higher than at the end of Q1. This is affecting customers’ ability to spend on general merchandise categories and requiring more markdowns to move through the inventory, particularly apparel.

Inflation

OK, fine, so inflation is a big problem for WMT. But, this ignores a few things. Let’s explore a bit deeper.

This isn’t just a problem for WMT. Inflation is impacting nearly every business, in some way or another, from shortages to supply chain issues to customer anger. In other words, inflation itself isn’t the biggest problem for WMT. It’s merely applying pressure.

If we spin this around, look at how inflation benefits WMT. As a low-cost provider, it’s going to benefit. Here’s just one example:

During the quarter, the company made progress reducing inventory, managing prices to reflect certain supply chain costs and inflation, and reducing storage costs associated with a backlog of shipping containers. Customers are choosing Walmart to save money during this inflationary period, and this is reflected in the company’s continued market share gains in grocery. [Emphasis: Author]

WMT has a strong history of superior inventory management, supply chain management and driving down costs. Here, inflation is likely to hurt other players more than WMT, because WMT is built for exactly this kind of stress.

More importantly, as emphasized above, WMT is going to benefit. That’s not because WMT is going to make a ton more profit – that’s not it at all. Instead, it’s about relativity. Competitors are going to suffer far more. In short, as WMT leadership suggests, WMT will gain market share. Ultimately, this is going to benefit WMT. Maybe not in the short term, but in the medium to long term, this is potentially a net benefit. We’ll see.

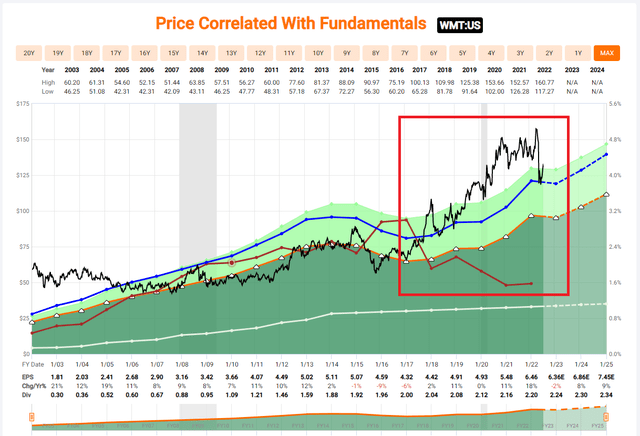

The Chart That Matters

Taken as a whole, the story appears to be that inflation is doing damage to WMT. It’s hurting margins, profits, earnings and whatnot. Of course, as I’ve explained, it’s not really hurting topline sales:

The company maintains its expectations for Walmart U.S. comp sales growth, excluding fuel, of about 3% in the back half of the year.

Inflation is being treated like the main cause of WMT’s stock price decline. Well, the logic chain is that inflation is hurting margins and profits, and therefore WMT is expecting less, so the market is expecting less. Therefore, the stock price drops.

This is the wrong narrative in my opinion. I see inflation as an excuse. I also see the impact of inflation as another excuse. Let that sink in for a minute. I’m saying that there is a bigger problem and that inflation, and its impact, is a catalyst but not the deep cause.

Now, we shift and see the real problem in one chart.

Walmart Overvaluation (FASTgraphs)

Investors have been very optimistic about WMT. Back in October 2015, WMT was trading at a P/E of about 13. In early 2017, the P/E was about 15. Since the middle of 2018, WMT’s been trading at a P/E over 18. And in April 2022, the blended P/E reached as high as 24. Putting it together, WMT’s P/E has been expanding like a balloon.

Now, for perspective, the Adjusted Operating Earnings Growth Rate over 20 years has been just under 6%. But, over 15 years, it’s been under 5%. And, over 10 years, it drops down again to under 4%. This isn’t a growth machine, yet factors such as low interest rates and the pandemic have contributed to the good feelings about this slow-to-moderate growth retail company.

Unlike say, Amazon (AMZN), it’s not like WMT has any incredible new technology, or new large-scale capability. It’s a grocery story. It’s a retailer. It’s really not anything special in terms of growth, even with economies of scale, supply chain prowess, and low prices. There’s not an amazing, deep growth catalyst here.

So, over the last 10 years, the normal P/E ratio for WMT has been a pinch over 20. That’s the average. Target (TGT) has a 10-year average of just over 16. And whereas WMT’s growth over 10 years is under 4% as noted above, TGT’s growth over 10 years is well over 14%. Hopefully, the point is clear – that WMT has been valued at a premium.

Wrap Up

WMT has almost been treated like a growth stock. Given what it does, and what it offers, I’m not seeing the special value at this point. Inflation is hurting WMT, yes, and profits are going to be hurt. But, more importantly, I think the current news – especially the downward revisions – has exposed WMT’s weakness. Namely, that WMT’s growth has been punched in the face.

We’re told that consensus EPS for WMT’s FY is $6.39 right now. As I’m typing this up for you, I see a price of just over $122. So, the rough P/E is around 19. So, you can own WMT with a P/E of 19, or you can instead own Alphabet (GOOGL) (GOOG) with a P/E of just over 19. Obviously, they are not peers. I’m talking about comparing valuation versus valuation. WMT is a hold at best. That’s where I land. WMT is still burning off overvaluation, and that’s that.

Be the first to comment