J. Michael Jones

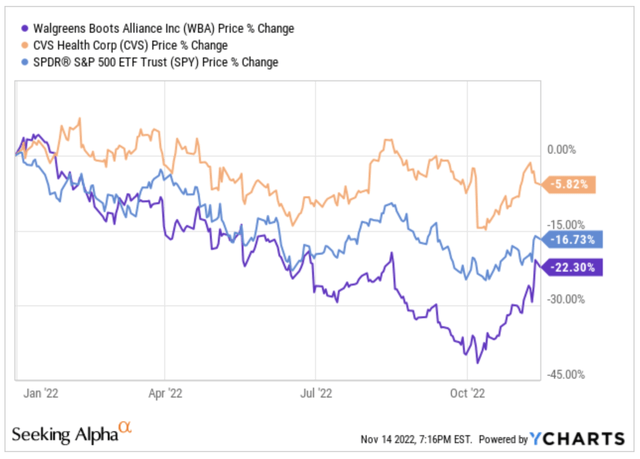

The stock market has not been kind to investors in 2022 for the most part, and that is no different for Walgreens Boots Alliance, Inc. (NASDAQ:WBA) which has seen its shares fall over 22% on the year, well behind the S&P 500 (SPY) and their closest competitor, CVS Health Corp (CVS).

Given that WBA shares have fallen so much in 2022, new investors can now receive a dividend yield of 4.6%, which is quite juicy.

WBA Is Enduring An Exciting Turnaround

Walgreens Boots Alliance is a leading retail pharmacy, with Walgreens locations here in the U.S. and Boots store locations in Europe and Asia. The company started back in 1901 as a small store in Chicago, Illinois.

Currently, WBA has a market cap of $35.7 billion, trailing CVS, which has a market cap of $128.2 billion.

CEO Roz Brewer took the helm back in March 2021, coming over as a successful executive at Starbucks (SBUX). In fact, many pointed to her as a potential successor to Kevin Johnson, but she was offered a position at WBA that she could not pass up.

While operating as the COO of SBUX and during her stint as CEO of Sam’s Club, Roz Brewer was touted for her strong leadership as well as her ability to innovate.

Innovation is exactly what she is trying to do, both from a digital standpoint as well as trying to refocus the company to be more health-care focused.

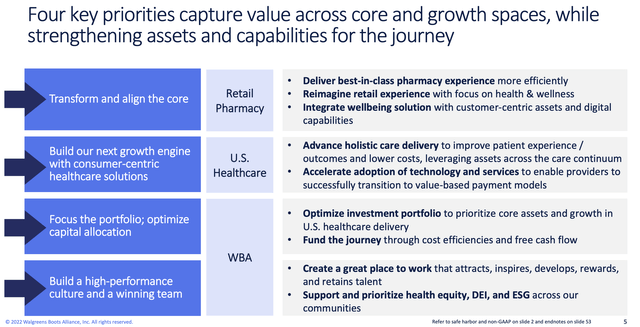

Here are the four key priorities Ms. Brewer laid out in the company’s Q4 investor presentation.

- Transform

- Growth

- Focus

- Culture

Transform the business to align it with its goals, focusing on health and wellness. Building the next growth driver will come via the adoption of technology and services both in the front of the store as well as back of the store, including within the supply chain. Focus on how to strengthen the portfolio by utilizing capital assets strategically. Finally, focus on building a winning culture, something Ms. Brewer has been praised for at her most recent stops.

All of these things are already starting to take some sort of shape, but there is a lot of work left to do. The turnaround reminds me very much of what is happening over at Lowe’s (LOW) with CEO Marvin Ellison. Lowe’s is second fiddle to Home Depot (HD) in their respective industry, very similar to the position WBA is in with CVS.

Tough Comparison To 2021 Due To Vaccinations

The company has a tough comp year in 2022, as 2021 was a huge year in terms of COVID vaccines and they are enduring a raging dollar, putting even more pressure on 2022 results.

Here’s what the company reported for their fiscal Q4 2022 results in October as compared to analyst expectations:

- Earnings per share: 80 cents, adjusted, vs. 77 cents expected

- Revenue:$32.45 billion vs. $32.09 billion expected.

Sales for the quarter were down 3.2% on a constant currency to $32.4 billion, and adjusted net income of $694 million was down 30.2% on a constant dollar figure as well.

Sales of $132.7 billion for the year were up 1.2% for the entire 12-month period with net income coming in at $4.4 billion, up 3.3% on a constant currency figure.

Walgreens continues to poor money into their turnaround plan to transform the company away from being just another drugstore and more to being a large health-care company.

This started in the fall of 2021, when the company invested $52 billion in VillageMD, bringing their ownership up to 63%. The investment is to advance their position in the delivery of value-based primary care.

According to Walgreens, the partnership with VillageMD makes the company the first national pharmacy chain to offer full-service primary care practices with primary care physicians and pharmacists co-located at its stores all under one roof at a large scale.

The company has a calendar year 2022 goal to open 160+ co-located clinics, and through September 30th, they have opened 152. They stated in the Q4 slides that they are on track for 200 by the end of 2022. VillageMD as a whole has opened 334 doctor offices, which include the 152 I mentioned above that are connected to a Walgreens store.

Walgreens health care strategy has been driven by investments in not only VillageMD, but also by their investments of CareCentrix and Shields Health Solutions. CareCentrix coordinates care and benefits for at-home care and Shields Health Solutions is a specialty pharmacy.

This area of the business is and continues to be a major growth driver for future success. The company is upbeat, and in their Q4 earnings release, management increased their long-term 2025 guidance from $11 billion in sales to now guiding $12 billion in sales for the health-care division.

Investor Takeaway

Walgreens has a lot of potential growth drivers, especially when it comes to their health-care division. Roz Brewer certainly has her fingerprints all over this company as she tries to refocus and transform Walgreens into a health-care player within the industry.

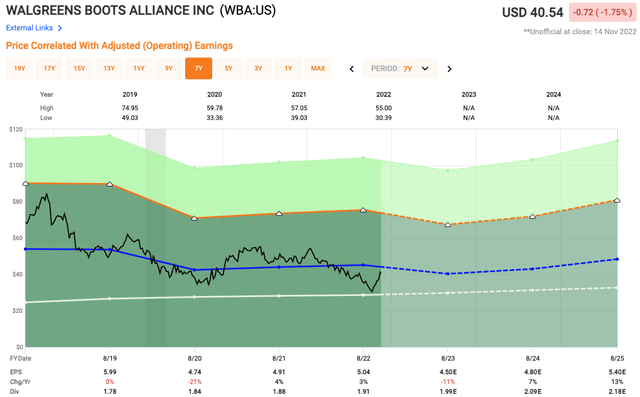

On the year, WBA generated adjusted EPS of $5.04, meaning shares currently trade at an earnings multiple of just 8x. Over the course of the past five years, shares have traded at an average of 9x earnings, meaning shares appear slightly undervalued based on recent history.

2023 is expected to be a year of growth for WBA, as analysts expect the company to continue reinvesting in the business, and earnings are expected to fall. Management gave a range of $4.45 to $4.65, meaning the middle of the range would pin shares at a forward P/E of 9x, right in-line with their average over the past five years.

As such, shares do not look all that appealing from that perspective, but yesterday’s Walgreens is not the Walgreens of the future, at least if Roz Brewer has anything to do with it. If, and that is a big if, but if her plans for more of a healthcare-focused company come to fruition, Walgreens shareholders could be in for some major gains. I would not expect only sales to grow, but margins to increase nicely, leading to further margin expansion. That is where the opportunity for Walgreens lies, but you need to be willing to wait it out.

In doing so, WBA pays an annual dividend of $1.92, which equates to a dividend yield of 4.65%. The company has a low payout ratio of only 38% and they have increased the dividend for 30 consecutive years and counting, making them a Dividend Aristocrat.

Let me know down in the comment section if you are a believer in the turnaround taking place at WBA.

Be the first to comment