supergenijalac

Introduction

It is earnings season and here we are, once again, looking at how our companies are performing. One of the first projects I published on Seeking Alpha was a full-coverage of the main truck manufacturers. At the end, I picked as my favorite companies Volvo Group (OTCPK:VOLAF; OTCPK:VLVLY) and Paccar (PCAR).

For those interested in reading the first step of my research, it is possible to find it here: Volvo Group: Best In Class And Undervalued.

Not only this company is among the most reliable in its industry, with very strong financials and a good management that was able to anticipate the problems inflation would cause to manufacturing companies, but also it is the one I like the most when I look at the developing electric truck industry.

This is why, rather than investing in Nikola (NKLA), I chose Volvo Group, as I explained in this article: Why I Prefer Volvo Group Over Nikola.

Volvo Group

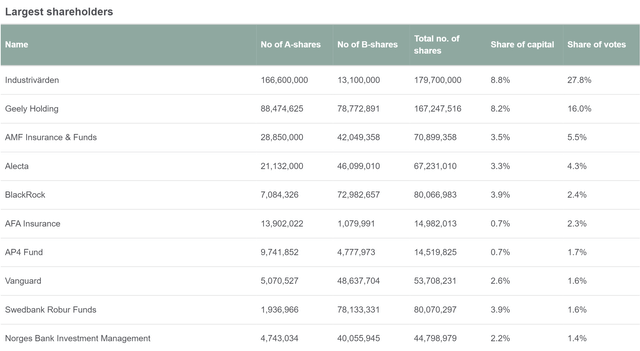

I feel it is important to review once again Volvo Group’s shareholder structure. In fact, this company is sometimes confused with the car manufacturer and it is seen as of Chinese ownership. In reality, the ownership of Volvo Group is a bit more complex. Unlike the car manufacturer, Volvo Group sees the participation of only one Chinese holding, Geely (OTCPK:GELYF), that has 8.2% of shares which account for 16% of voting rights. However, the major owner is a Swedish holding investment fund, Industrivarden, which aims at investing into the best Swedish companies. The other shareholders all belong to Scandinavia or North America as we can see from the table below.

Volvo Group Investor Relations Webpage

Q3 Earnings Highlights

Volvo has proven itself as a company able to defend its margins better than most of its peers. It has done this by introducing a restrictive order slotting policy to manage order book quality and cost inflation. Volvo was one of the first to adopt this policy and I have outlined before how this shows both the strength of a company that is not focused only on volumes and the quality of its management, that was able to foresee in advance the upcoming economic conditions. Thus, the company was able to offset inflation not only by raising prices, but by keeping under control its whole order inflow while managing its production chain. This is a well-thought-out strategy which has enabled Volvo to keep its margins in the low double-digits.

Volvo Group just released its Q3 earnings. There are two main things I wanted to look at in this report:

- how the company is managing its margins and its order book

- how EVs are performing

A caveat, Volvo Group reports earnings in Swedish krona (SEK), which, at the moment of writing this article, is equal to $0,09. This means that $1=11.2 SEK. I will use this ratio to convert Volvo’s financials into USD.

Volvo Group’s results

Now, before we get to margins, we have to consider anyway how the business as a whole is performing.

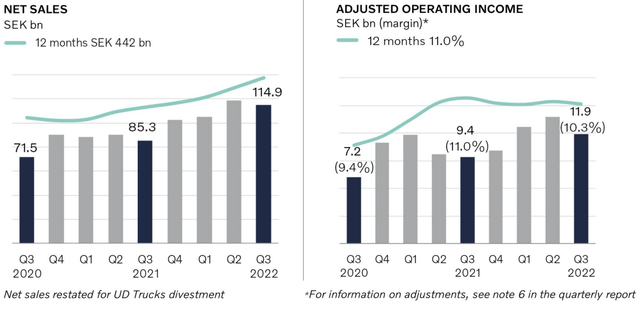

Volvo’s net sales, as we can see from the graphs below, increased 21% (FX adjusted) to $10.26 billion.

Volvo Group Q3 Earnings Presentation

This overall result saw all of Volvo’s division report increasing sales with trucks up 11%, construction up 3%, buses up 28%, Volvo Penta up 7% and Volvo Financial up 15%.

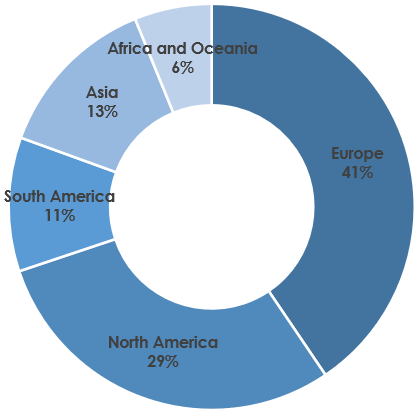

Clearly, the most important division for the company is trucks, which grossed $19.93 billion in the first nine months of the year of the $29.42 billion. This is equal to 67.7% of total revenues. Trucks net sales per geographical region are split in the following way, showing how reliant Volvo is on high margin markets such as Europe and North America.

Author, with data from Volvo Group data

As shown in the graph above, together with an increase in net sales, Volvo published a growing operating income YoY which reached $1.06 billion which is equal to an adj. operating margin of 10.3%. Even though the operating margin increased, on a percentage basis, it decreased from 11% to 10.3%. Still, this is a really good result in an environment where Volvo Group’s competitors have seen worse drops.

Thanks to a growth in revenues and a good results in terms of operating margin, the bottom line was pleasant to see: the income for the quarter increased to $775 million, an 18% increase YoY. EPS, too, moved up from $0.31 to $0.38.

What can we expect in the future?

First of all, orders are still strong because many fleets have been utilized a lot and aged in recent years as an effect of supply chain bottlenecks. This has created a lot of pent-up demand to replace aging vehicles while creating an increased need for spare parts and devices. In addition, the record harvests in Brazil is pushing South American order intake up by 25%, underlining once again the strong performance this continent has seen throughout the whole year.

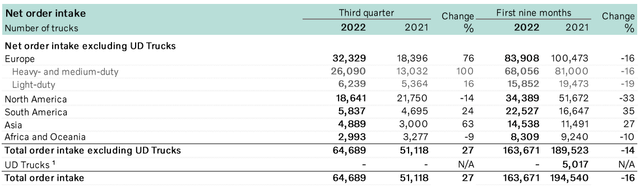

Another thing to notice that is important for the future outlook is the net order intake. If we observe the table below, we see that in the first nine month the total order intake is down 14% YoY. This, as we have already said, is due to the restrictive slotting strategy that helped Volvo protect its margins. However, if we look at the third quarter, we see a reversal in this trend, with orders up 27% YoY. This means that the company feels now more confident in taking more orders as supply chain constraints are easing up and inflation seems to be tackled by increasing interest rates. For investors in Volvo Group, this table below shows bright quarters ahead which could even make the company go through a mild recession without being hurt that much.

Overall, I judge these results very solid. But the thing I like most about Volvo is this last metric: ROCE. Volvo reported once again a very high result at 27.4% versus last year’s 25.6%. We have heard it over and over, return on capital employed is one of the hidden metrics that are able to compound year over year and make the stock deliver very good returns over a long-term horizon.

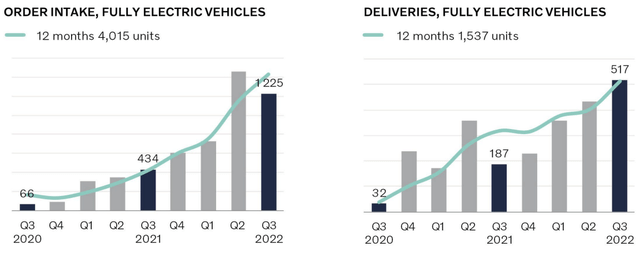

Electric Vehicles

Volvo is quickly ramping up its EV business. In just two years it went from an order intake of 66 units to 1,225 in the past quarter. This goes along with a similar trend in deliveries which were just 32 in 2020 and reached 517 units in Q3.

Volvo Group Q3 Earnings Presentation

But, while this trend may be nothing new for investors who are already pricing in this market trend, Volvo Group announced a very important news during in the earnings call.

The company has in fact started series production of electric heavy-duty 44-tonne trucks and it will supply 20 of them to Amazon. At the same time, Renault Trucks electric heavy-duty trucks are now available for pre-order. This makes me expect and even further growth of the EV business for Volvo, that now has six electric truck models in series production. It is important to know that the Group’s electric trucks are produced on the same lines as the conventional trucks, which gives high production flexibility and efficiency gains.

Over the past quarters, I have come to appreciate quite a bit how rapidly Volvo is progressing on this side of its business in an industry that, unlike it happened for cars, there is no such player as Tesla.

Valuation

Let’s get to the valuation. Volvo’s quant rating valuation grade is an A. The company trades at a fwd PE of 10.56, a fwd EV/EBITDA of 7.32. The company is clearly not that expensive. In addition, within its industry, I would price at a premium Volvo Group’s reliability and quality in management. In my previous article I showed the results I got by plugging the following parameters into my discounted cash flow model discount rate of 8%, perpetual growth rate of 2%, margins at 9%. The output was that in a base case scenario Volvo Group’s shares are worth around $33. The stock has traded down around 10% since then and this makes the investment even more interesting as the stock trades now around $16.50. Let’s take a margin of safety and slash by 30% the target price we would reach $23 which gives us at least a 40% possible upside.

I am invested in Volvo and I am confident this company will deliver reliable results for a long period of time.

Be the first to comment