Aubrey Lao/iStock Editorial via Getty Images

Recently I had an exhausting fight with my wife regarding vacation destinations. I wanted to go to Croatia, while she wanted to go to Italy. Granted, both countries are enclosing the Adriatic sea, but as you know, the devil always lies in the details… and Adriatic scarpa tastes differently on the opposite seashores.

In the breaks between our fierce arguments, I imagined which powerful car would drive us to the to the shady seaside. But sometimes car dreams should remain just dreams, especially when you see how much a hotel room costs in August, the busy season in Europe. In the end, I opted for a budget electric vehicle (“EV”). All in all, who said the car should be powerful when traveling with a family? As Keynesians used to say, “demand creates its supply.”

I do not know if the guys in Volkswagen AG (OTCPK:VLKAF) are Keynesians, but they anticipate consumer trends well. Volkswagen’s array of affordable $40,000-55,000 electric products really caught my attention. Therefore, I decided to have a look at the stock itself.

Volkswagen is one of the world’s largest car producers, selling 8.6 million vehicles worldwide. Its broad product range and early entry into the electric vehicle race allowed it to become an unreachable market leader in Europe with over 50% market share by revenue. Its 7% share of electric vehicles is one of the highest among traditional car makers. However, if you google Volkswagen, you are swamped with negative media coverage about software issues and data leakage, followed by the CEO’s resignation.

Having looked behind the “news curtain,” I cannot say I saw a beautiful company over there. But I did notice a fair company at a wonderful price providing attractive returns for value investors.

A setback in the software battle is not a loss in a car race.

In late July, famous VW CEO Herbert Diess announced his intention to step down. His resignation followed a chain of tensions with trade unions and a recently leaked McKinsey report. The report showed that Volkswagen has had serious issues with its software development pipeline. It’s quite curious indeed how the leakage preceded Herbert Diess’ resignation and the appointment of Oliver Blume as the new CEO. For the record, Blume is also known as CEO of Porsche (OTCPK:POAHY), VW’s premium brand that is expected to spin off in late 2022 and attract financing for EV transition.

Before we discuss any potential conflict of interest stemming from the dual-CEO role, I’d like to go deeper into the software issue mentioned. Let me take a step back and show you the background behind the importance of software.

Currently, design, brand image, and performance are the key factors in your decision to buy a combustion engine car. However, when you purchase an EV vehicle, the battery capacity and vehicle range also play an essential role in decision-making. To achieve a solid mileage, it’s not just enough to put different car body patties on the buns of mechatronics known as skateboard platforms. It needs the right software sauce consisting of the proper data ingredients.

Thanks to your driving data, a car producer can learn how quickly you accelerate and how gently you press on the brakes. You cannot hide how stressed you are in the traffic jam and how relaxed you feel in the countryside. Algorithms analyze the driving behavior of you and all other drivers then use the data to optimize battery usage and durability. The gathered information allows engineers to design road assistance functions that help you park, cruise, and avert crashes.

However, software roll-out for vehicles is an extremely challenging and costly task. Herbert Diess formulated it well in his interview with the Verge:

The car today is already ten times more complex than a smartphone. It has ten times more lines of code than a smartphone. The criteria are incredibly different. The real-time environments are really difficult: if you think about braking or steering, you have to build in redundancies, and then you have to make the whole thing communicate to each other.

To optimize IT costs, Volkswagen created a particular unit, CARIAD. It’s a division affecting the subsidiaries of VW, united to create a monster that can tear all the rivals’ attempts to compete with VW. Imagine such a mind-blowing cooperation: VW, Porsche, Audi (OTC:AUDVF), Seat, Skoda, Bentley, MAN.

VW’s presentation

But… there’s where the root of the evil lies. The fact that so many brands huddle under one roof creates serious problems. The budding idea sounded like the “Creation of CARIAD to produce software in-house and increase business profitability rather than buying IT solutions externally and paying license fees.” This is, in fact, a Labor of Hercules. Not cooperating with global software providers like Google is potentially a good approach. The more you outsource, the less you are aware of the processes and data circulating in your production.

However, this well-devised strategy struggled from operating inefficiencies by CARIAD that led to belated roll-outs and software updates. The “one size fits all” concept was not applicable for the company uniting so many subsidiaries. Let me name just a few examples cited in a recent leakage. At Bentley, VW’s subsidiary located in Great Britain, the transformation into a purely EV manufacturer was postponed until 2030, when the premium EV niche can already be occupied by competitors. VW faces further problems in a less premium segment. The release of the Audi Q6 E-Tron and Porsche Macan, scheduled for 2023, is likely to be delayed too, due to software inefficiencies.

Some commentators are ready to bury Volkswagen due to its IT struggles. I think the battle is far from over, as VW has several ways to cope with the situation. For one VW can potentially change the buy/make software mix in favor of licensed IT solutions. Under the previous CEO, its target was to produce 60% of the software in-house. Indeed, the more you produce in-house, the higher profitability you can achieve. But having a partnership with an established IT player can accelerate the roll-out pipeline, make the internal structure leaner, and possibly achieve in-house cost savings. Alternatively, a strong credit profile allows VW to consider M&A opportunities in the IT field.

I believe it’s not the time to stop believing in VW’s initiatives yet. If we analyze other carmakers, we can see their ups and downs in software development.

Take the “almighty” Tesla (TSLA), for instance. If we search diligently, we can find many skeletons in its closet. Look at the latest news about the release of the untested Model S. The company delivered insufficiently safety-tested vehicles as an experiment with the incentive “deliver now, fix later.” Here is what went wrong at Tesla.

The new technology was implemented into the so-called “ankle catcher” model, a newly developed front bumper carrier structure. There had been several crash tests run before the launch, but they didn’t show the required results. Despite that, the Model S was put on sale “raw” and improperly tested. Thus, the company put drivers in potential danger. Even if the approval after delivery was intended, the automobile is not the thing to be checked this way, as it directly influences the customers’ lives.

A similar example refers to BMW (OTCPK:BMWYY) and their software developer Topalsson, the company from Munchen. In 2019, BMW decided to outsource its software development and signed a contract with Topalsson for several years. But in 2020, Rolls-Royce, BMW’s subsidiary, terminated the deal one-sided, which led to lawsuits from Topalsson demanding compensation for the partnership. However, the tricky episode came out in the wash. It appeared that after the termination, BMW and Rolls-Royce allegedly continued delivering Topalsson’s software to car dealerships illegally. Both companies are accused of commercial copyright infringement and commercial classified information violation. Unfortunately, my Bavarian neighbors seem to be not always as “ordentlich” as perceived.

Now the decision of VW to walk their thorny path of in-house development doesn’t seem so senseless.

New CEO and Porsche’s carve-out

At the recent quarterly call, the potential conflict of interest arising from Oliver Blume’s dual CEO role in Volkswagen and Porsche was one of the main questions for American investment banks. The management assured investments banks with the following statement:

Yes. And in terms of the potential topic of interest or conflict of interest, first and foremost, as said before, we are still working on the IPO of Porsche. It still absolutely makes sense and is still in both companies’ interest. So it’s in the interest of Porsche. They will get more entrepreneurial freedom, and Volkswagen would get more flexibility in financing the transformation. So it’s absolutely in the interest of both companies.

And there are a lot of synergies that we will see. And if it comes to specific questions where there might be a potential interest, we established really robust processes to avoid conflict of interest, and there are external advisers involved. But we think or we believe these questions where it’s — really we have different interests are very rare and we will handle that with great care.

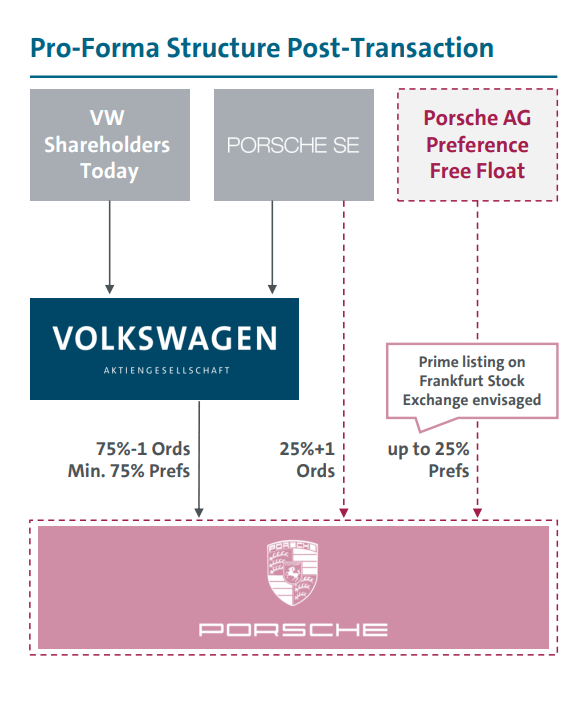

I would agree with the management that the interests of both companies are aligned. Volkswagen sees Porsche’s IPO as a source of financing for its EV transition and is interested in the most successful carve-out. In 2021, Porsche produced about 300,000 vehicles that generated $30 billion revenue and $5 billion EBIT with a 16.5% margin. It’s almost double compared to the roughly 7.7% margin of the entire Volkswagen group. If we apply VW’s EV to an EBIT multiple of 4.0x, Porsche is valued at approximately $20 billion… However, given Porsche’s accelerated transition to EV, 13% of the vehicles Porsche sold in the first half of 2022 were electric while only about 7% by Volkswagen core brands — Porsche could achieve a higher valuation. Recent Seeking Alpha article indicated a valuation of between $60 billion and $85 billion reflecting about 14x EV to EBIT multiple.

Given a limited anticipated free float, we speak at about $15-20 billion proceeds for Volkswagen, as about 25% of shares are allocated to the Porsche family and general public.

VW’s presentation

Despite a limited free float, the Porsche family will remain behind two entities as only preferred shares will be sold to the street. In Europe, there are two types of shares: ordinary and preferred shares. Ordinary shares give you economical and voting rights, while preferred shares only provide the owners economical rights. It means owners of preferred stock are entitled only to dividend payments and do not have voting rights.

The fact that the Porsche family stays behind two entities minimizes a potential conflict of interest arising from the dual CEO function. Furthermore, it’s expected that the new CEO will harmonize the relationship with the trade unions and achieve more aligned corporate governance. The previous CEO had tensions with trade unions that are extremely powerful in Europe. As Reuters recently put it:

Hoping to return the group to calmer waters after the turmoil of the Diess years.

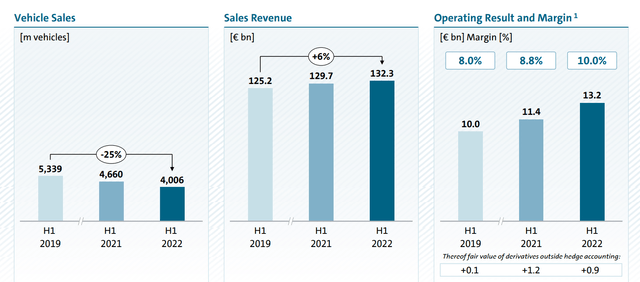

Finally, it’s important to note that Porsche is one of the best-performing assets in the group. VW’s revenue in 2021 was at the same level as in 2018, but Porsche’s revenue increased by 30% over the period and its share in total VW’s automotive profits increased to 13%. The EBIT level contributed even more due to the high marginality of premium vehicles. It’s definitely a strong argument for the new CEO’s credibility.

Valuation

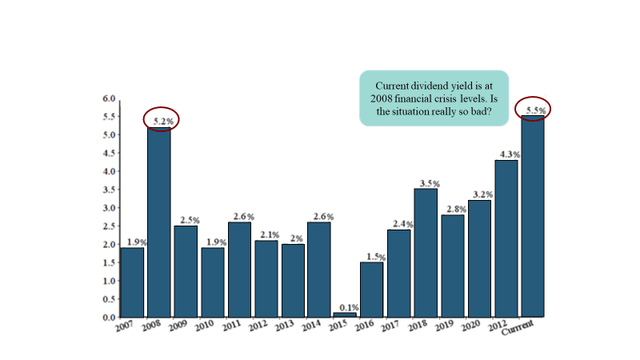

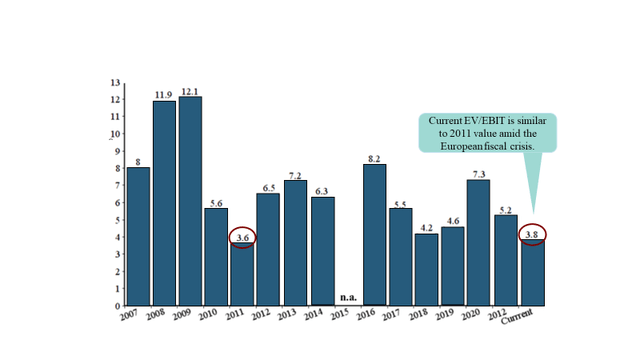

I am eager to benchmark Volkswagen against its historic valuation based on two classical metrics: Dividend yield and EV/EBIT.

Dividend Yield

The dividend yield for preferred shares is at 5.5%, which is almost double compared with an average value over 2007-21. The critical question here is whether the dividends are sustainable or will be reduced to finance the EV transition. I believe that the current dividend levels are sustainable. The payout ratio is only about 25%, and cash flow generation is vital; in 2021, it was around $15bn, despite the acquisition of Europcar.

EV/EBIT

The current EV/EBIT of 3.8x is significantly below the historical average of 6.9x. As I described in the article about Ford, electric vehicles currently contribute negative or low EBIT margins. Therefore, an increasing EV share should have a downward pressure on margins. However, Volkswagen managed to increase its EBIT despite a growing EV share. The chart below illustrates how Volkswagen managed to increase profitability and focus on high-margin products over the last years. It makes me believe that the current EBIT is at sustainable levels and that low EV/EBIT provides significant upside potential. Please note that sales decrease was driven mainly by supply-side bottlenecks and not demand-side factors. EV sales showed a continuous growth.

Risks

Issues in the software division bear considerable risks for Volkswagen’s development. If the management fails to restructure the IT division, it will delay vehicle roll-out even further and may have a negative effect on the market share. Given the increasing importance of software compared with hardware, the IT problems will prevent multiple increase to the average historical levels.

The second major risk lies in the geopolitical field, as Russia has weaponized its gas export to Europe, jeopardizing European economic growth. Insufficient gas deliveries will lead to higher energy prices and potentially even gas rationing. This may result in a stagflation scenario for European economies. An especially strong impact can be felt in Eastern Europe due to its high energy dependence on Russia. It would have a negative effect on Volkswagen’s suppliers. You can learn more about the topic in a fascinating UBS podcast.

Conclusion

Recent challenges with the software, a potential conflict of interest due to dual CEO functions, and high geopolitical risks decreased Volkswagen’s valuation. However, Volkswagen remains a fundamentally solid player in the EV field and therefore offers a substantial opportunity for value investors. I would invest gradually in VW over the next three quarters, as I believe that not all geopolitical risks are factored in the current prices.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment