Getty Images

Investment Thesis

On September 29th Volkswagen (OTCPK:VWAGY) launched the Porsche (OTCPK:POAHY) IPO. At the time that I am writing this, the stock has a market capitalization of $82 billion. The IPO was successful and the biggest IPO in European history. Volkswagen still holds 75% minus one share of ordinary shares of Porsche, the other 25% plus one share is owned by Porsche holding SE. Porsche Holding SE has full operational control over Porsche AG and Volkswagen still owns most of the shares. The whole IPO did earn Volkswagen $9.4 billion for the 25% of non-voting shares being traded publicly. A very good deal for Volkswagen. Half of these earnings will be invested into the electrification process and the other half will be distributed to Volkswagen shareholders through a special dividend. This IPO once more shows the criminal undervaluation of Volkswagen AG.

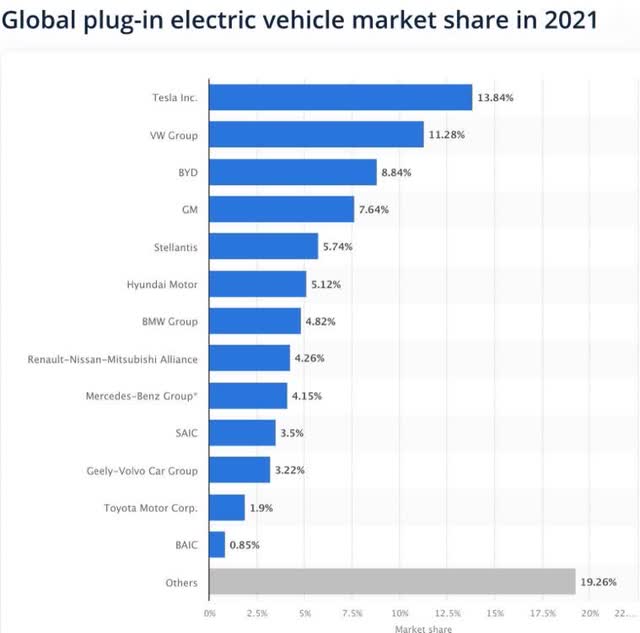

I already own Volkswagen shares for a long time, and I still believe in the long-term potential of Volkswagen. Volkswagen has a strong position in the EV market, and I believe it will soon overtake Tesla (TSLA) in Europe as the biggest EV manufacturer. In this article, I want to take you through the business and show you why Volkswagen is a buy at current prices. The long-term potential remains strong thanks to strong innovation and heavy investments in the future of automotive.

Volkswagen

Volkswagen Group is a German multinational car manufacturer with its headquarters in Wolfsburg, Germany. The group sells under 10 brands consisting of Volkswagen, Volkswagen commercial vehicles, Audi, Porsche, Skoda, Seat, Cupra, Bentley, Lamborghini, and Ducati. Besides its brands, the Volkswagen group also offers financial services like Dealerships, leasing, customer financing, insurance, and fleet management. Volkswagen operates 120 production plants all over the world with most of those in Europe. The company has 662,575 employees worldwide. The Volkswagen Group sells its vehicles in 153 countries. Volkswagen is also heavily invested in its electrification and carbon neutrality by 2050. This is what Volkswagen says on its website:

Under the vision “Mobility for generations to come.” the Volkswagen Group with its sharpened NEW AUTO Group strategy 2030 provides answers to the challenges of today and tomorrow. Our goal is to sustainably shape mobility for present and future generations. Our promise: With electric drives, digital connectivity and autonomous driving, we are making automobiles cleaner, quieter, more intelligent and safer. At the same time, our core product becomes even more emotional and offers a completely new driving experience. In this way, the car can continue to be a cornerstone of contemporary, individual and affordable mobility in the future. In addition, we are committed to the Paris Agreement on climate protection and are one of the first companies in our industry to commit ourselves to becoming a carbon-neutral company by 2050. This includes our vehicles, plants and processes.

The group does €250 billion in yearly revenue and €19.3 billion in operating profits. In 2021 the company produced a little over 8 million cars. This makes the Volkswagen group the most valuable European car manufacturer and the second largest worldwide (in production numbers), only behind Toyota. In 2021 Volkswagen had a market share of 12.9% of all cars sold worldwide.

There are a lot of car manufacturers worldwide and a lot of them produce very high-quality cars which compete with Volkswagen. The automotive sector is not an easy sector to invest in. Margins are generally very low, and the industry is very capital-intensive, as shown by the high debt burdens of most car manufacturers. So why invest in the automotive sector and why specifically in Volkswagen? I have one very short answer to this and this is “electrification”.

I believe the automotive sector is more interesting than ever and is going through a significant change that started a few years ago and will continue over the coming decade. The move I’m talking about here is the move to go electric and leave diesel and petrol engines in the past. We could probably state that Tesla gave a real boost to this trend and showed all the skeptic old-fashioned car manufacturers that it is possible and highly profitable. Tesla has way higher profit margins than most of the legacy carmakers. Of course, this is partly due to the more high-class vehicles Tesla builds. More expensive cars, almost always have higher margins. Good examples of this are Porsche within the Volkswagen Group and Ferrari (RACE). These two have margins between 15%-25% compared to the few percentages Toyota (TM) and Volkswagen make on their cheap mass-production cars. But it is not just the high pricing. It is also the expensive ICE (Internal combustion engine) being replaced by batteries. These batteries exist of way fewer parts and are therefore way cheaper than ICE. Using cheaper components means having higher margins on your product. Do not get me wrong here, the batteries are still the most expensive part of any EV. We should also not forget that batteries don’t need as much maintenance and are way less susceptible to problems later on thanks to fewer moving parts. This is good news for car manufacturers and consumers.

So, we have higher margins on electric vehicles and fewer maintenance and problems. This new way of building cars will boost profitability in the future for Volkswagen group, but of course also for all other legacy car manufacturers.

There is one more point why I started to like the automotive sector again. This is the potential for autonomous driving. For now, this plays a way smaller role in my choice though. These innovations will mean a real change in the sector and change always creates possibilities to excel (or fail) as a company. If car manufacturers play into these innovations, they might be able to set themselves apart from the competition just as Tesla did. Autonomous driving is one of those opportunities. If you are looking for a car manufacturer playing into this area very well, you should have a look at Mercedes-Benz (OTCPK:MBGAF). They are cooperating with both Nvidia (NVDA) and QUALCOMM (QCOM) for their autonomous driving software.

One question remains for now, why Volkswagen? Well, I see great potential, as I described above, in electric vehicles and the advantages for the manufacturers. For me, Tesla is too high valued. This is not a discussion for now. After I did my research, my conclusion was that Volkswagen seemed to be best prepared (of the legacy carmakers) and heavily invested in electric vehicles. Volkswagen is already one of the biggest manufacturers of electric vehicles and has a lot of new models in their pipeline. Just last quarter, during their earnings call, the company reported they delivered 217,000 electric vehicles during the first half of the year. This was 27% more compared to one year earlier.

Volkswagen said to increase Capex for the development of e-mobility by almost 50%. This brings the total investments for the next 5 years to $179 billion. Besides replacing its CEO, the company announced another big decision by deciding to electrify more European plants to achieve its goal of becoming the global market leader in electric mobility by 2025. This shows the real commitment of Volkswagen to the electrification of their cars. To end this part of the story: Volkswagen states that it wants 100% of all its cars in the world’s core markets to be climate neutral by 2050. A strong goal to aim for.

Volkswagen is even more ambitious in other parts of the business. I am referring to the next statement from Volkswagen:

In order to accelerate the market success of e-mobility, Volkswagen is investing in the development of an open fast-charging network worldwide like no other mobility company. By 2025, around 45,000 High Power Charging points are planned in Europe, China and the USA together with partners. The product range also includes the entire range of charging solutions for private customers and companies – from the company’s own wallbox and flexible fast charging station to charging services and innovative, smart green electricity tariffs. In the next step, Volkswagen will develop the EV as a mobile power bank and ensure that EVs become part of the energy system in the future and, for example, can use green electricity from the region for charging.

This is a very ambitious plan by Volkswagen, and I doubt whether they can achieve this goal. I do appreciate the commitment to the plan and the ambition in the “e-car”. I think Volkswagen is trying to play a more important role in the future of the automotive sector. This innovation allows Volkswagen to put itself on top of everybody else, and it sure looks like Volkswagen is doing so with some very ambitious plans. I do think they should stay aware of their spending.

Volkswagen also has plans in place to play into the opportunity of autonomous vehicles, an innovation I already mentioned before. This is what Volkswagen says about it:

Mobility as a Service and Transport as a Service, fully autonomous, will be an integral component of NEW AUTO. By 2030, Volkswagen Group will be offering integrated mobility and transportation solutions to cover all customer needs on a central platform. The value chain consists of four levels: the driverless system, its integration in vehicles, fleet management, and a mobility platform for customers.

Yet again, Volkswagen seems very ambitious with its goals. I am very glad to see that Volkswagen is aware of the potential new industries to diversify its revenue stream. Volkswagen wants to provide its first autonomous mobility service in Europe. The company sees a TAM of $70 billion for mobility as a service for Europe alone.

One last point I want to discuss is software. Volkswagen believes almost one-third of sales revenue in the global mobility market will come from software-based services, on par with EVs and ICEs. For this reason, they want to keep the software creation in-house by using strategic partnerships to gain more knowledge and expertise. This is what Volkswagen states about its software plans:

Over the coming years, the Group’s own software and technology company CARIAD will develop the new E3 2.0 software platform for all Group vehicles and thus exploit synergy effects across all the brands. This single software stack will form the technical foundation for data-based business models, new mobility services and autonomous driving (level 4) for the Volkswagen Group and its brands.

The new software architecture enables a complete ecosystem, which will offer customers a host of software-based services throughout the full product life cycle. By 2030, the Volkswagen Group will put up to 40 million of its cars based on the new software stack on the streets of this world. The Group will have the largest amount of real-time data in the whole industry – and continuously improve its products on this basis.

This sounds like a very good idea and a strong part of its business if it can realize its goals. I have just one problem with this plan, and that is the threats it brings with it. The software will play a crucial role in the cars of the future. Cars will turn into driving supercomputers over the next few years. If Volkswagen cannot get its software to work, this will bring risks of having to push forward car releases and having to put extra cash to work. These software problems are already causing a drag on Volkswagen right now. Volkswagen sees the software business as one of its biggest opportunities but has seen multiple problems and bugs within its software. The Register reported that these problems were the reason for the delay of the launches of multiple cars of the Porsche, Audi, and Bentley brands. These were also the reason for the delay of the Volkswagen ID models.

The software problems are also a threat to the company’s reputation if Volkswagen decides to deliver cars when the software is not yet ready for prime time. This report noted the following problems with the ID.3:

In-car cameras going dark, navigation bugs, keyless entry problems, pop-ups telling the driver to go to a dealer, these were just a smattering of issues early ID.3 owners faced. VW told reporters that buyers were told they could wait for software updates coming in January 2021 but chose to take deliveries sooner.

These are serious issues and Volkswagen might have to consider outsourcing the software if they can’t get the issues solved. Multiple brands already had to push launches from 2024 to 2027 and this is not a good sign. I hope Volkswagen can get on top of this and get the software working without further delay.

Volkswagen is using Snapdragon chips from Qualcomm to power its software applications and autonomous driving ambition. I think this is one of the best in the business, so this gives me a little hope.

Results

In July Volkswagen reported its H1 earnings. Total deliveries fell by 22% during the first half of the year to 3.9 million vehicles. All-electric vehicles grew to 5.6% of total deliveries. The group reported revenues of €132.3 billion; with 2% growth YoY. Higher prices and stronger margins resulted in higher revenue despite the drop in total deliveries. The operating result came in at €12.8 billion and a profit of €10.6 billion.

Volkswagen reported strong results for the first half of 2022 and grew its revenue and profits. Deliveries dropped during H1 compared to one year earlier, mostly because of supply chain issues. If demand stays strong, despite less consumer spending, and supply chain problems get resolved, more earnings growth might be possible over the next few quarters.

Valuation and balance sheet

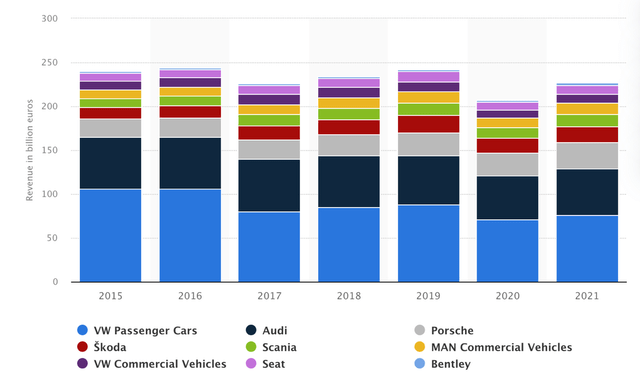

Volkswagen is currently valued at a forward P/E of 3.8, which is over 70% lower than the sector median. The company receives an A rating from seeking Alpha Quant. The recent valuation of Porsche stock shows us that investors currently value Volkswagen without Porsche at $16 billion. This is a crazy valuation since Porsche only accounts for a very small part of the total group revenue. The graph below shows this.

Revenue split (Volkswagen Group)

We already knew Volkswagen was undervalued, but the IPO of Porsche proved this fact.

Volkswagen ended the latest quarter with $42.82 billion in total cash and a massive $207.75 billion in debt. This is a drag on the Volkswagen stock but is not a problem yet. Most car manufacturers have high debt burdens, so this is not Volkswagen-specific. Volkswagen’s burden of debt is inflated partially by its car financing division. This division finances cars for its buyers so they can pay off the car over 3/4/5 years. By doing this, Volkswagen takes on the debt of financing. Volkswagen also uses the money to heavily invest and stay a leader in innovation. Volkswagen has its debt under control, so I am not too worried about this.

Volkswagen pays a strong dividend of 4.95%. This is 85% higher than the sector median and receives an A from Seeking Alpha Quant. The payout ratio is 25.69% and so the dividend is well supported. It is important to note that Volkswagen cut its dividend completely in 2020, because of the covid-19 impact on car sales. Volkswagen did reinstate its dividend one year later and increased its dividend compared to 2019. I would still not value the dividend too much, because I do see a lot of risk of a dividend cut in the coming year. I will discuss why in the threats section.

Threats

There are some risks you need to be aware of when investing in Volkswagen group. The main and most important threat is a recession. 2022 has been a horrific year so far and the S&P 500 is down over 25% YTD. This is all thanks to extremely high inflation. Germany has inflation above 10% and this puts pressure on all German industrials, including Volkswagen. This inflation is mostly thanks to extreme energy prices, which are a significant drag on the German economy. There is the real threat that the energy crisis gets so bad in Europe, and Germany in particular, that big factories will need to shut down because of an energy shortage. Germany is highly dependent on Russian gas and the explosions in the Nord Stream pipeline mean Germany is not getting any gas from Russia anytime soon. This means Volkswagen factories in Europe are at risk of experiencing temporary shutdowns, which would have serious consequences on the total production of the Volkswagen Group. Most Volkswagen factories are located in Europe.

There is another threat regarding high inflation, and this is the rate hikes by central banks, which might cause the economy to tumble into a recession. A recession would mean way less consumer spending. During the great financial crisis, Volkswagen’s margins turned negative, and the company had to take on a lot of debt to stay alive. During periods of high inflation combined with a recession, people are going to be spending less, first dropping unnecessary investments like buying cars. I am worried about the dividend payout of Volkswagen if the economy would head into a recession. For now, I would advise not to buy Volkswagen for its dividend.

One more threat is staying on top of new trends. Volkswagen needs to stay on top of new trends and innovations to make sure it can offer the best products. The sector is changing rapidly. If Volkswagen would act too late in any future switch in the automotive sector, the company could get overtaken by its peers. Also, the company needs to get on top of its software issues discussed before. I will not get into this again, but I want to note this could be a significant drag on new releases for Volkswagen.

Conclusion

I continue to believe in the Volkswagen Group. I think the company has its priorities in order and is playing into all innovations. At current valuations, most of the downside risks mentioned above have already been priced in and so I do not see much downside for the stock. I rate Volkswagen a buy on strong future potential. In my opinion, Volkswagen will overtake Tesla soon to become the biggest EV manufacturer.

Be the first to comment