jokuephotography/iStock Editorial via Getty Images

Admittedly, I am outside of my circle of competence when it comes to European telecommunications giant Vodafone Group Plc (NASDAQ:VOD). I’m an American investor, and my specialty is in real estate, not telecommunications.

But value is value, and I believe I’ve found value in VOD. The stock is dirt cheap, and it offers an ultra-high yield of 7.8% that looks fairly safe with a payout ratio of about 82% of adjusted earnings.

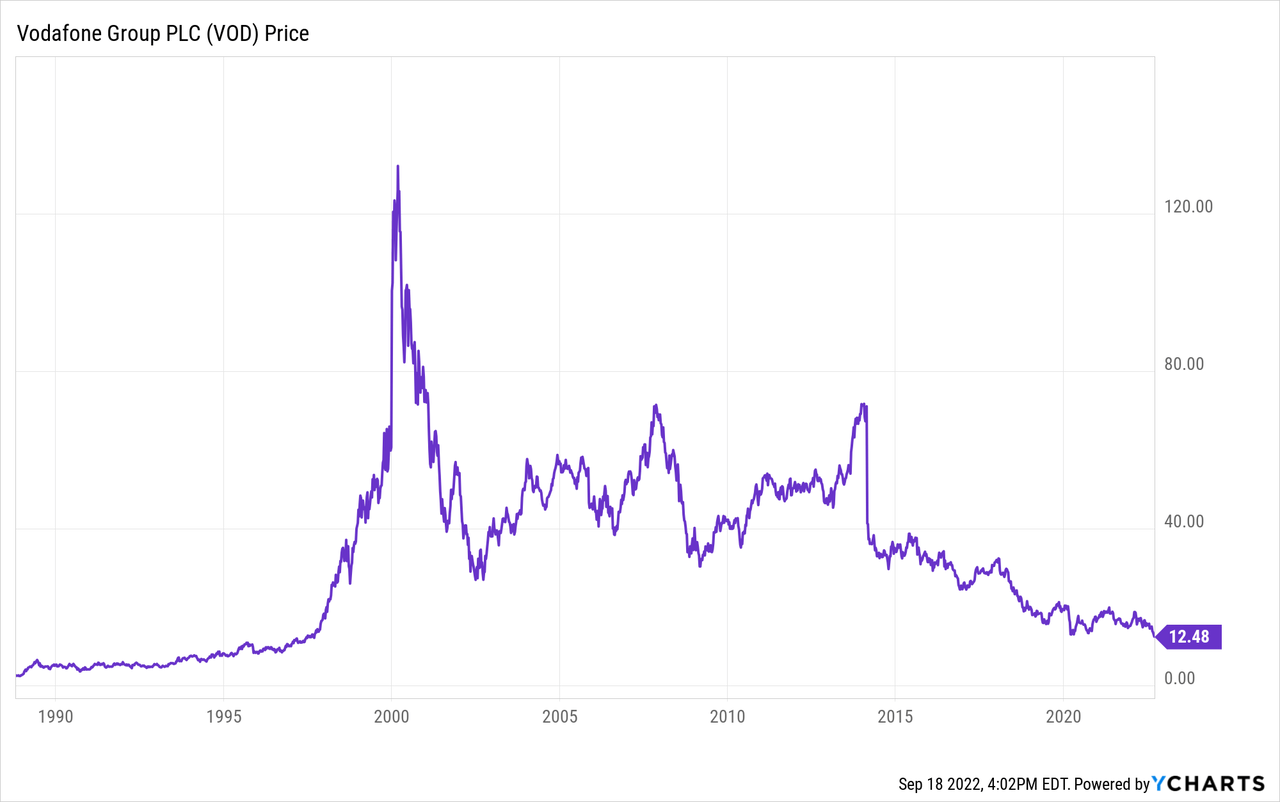

Plus, it bears mentioning that VOD’s ADR price has not traded this low since August 1997.

The strong dollar and European economic weakness are obviously weighing on the stock. Plus, heavily indebted telecoms have underperformed this year as interest rates have shot up. But all of this bad news and pessimism appears to be amply priced in.

What does not appear to be priced in are VOD’s strengths, namely:

- The Vantage Tower business, which is attracting potential buyers

- Nominal revenue growth in Africa

- Price increases in Europe, Turkey, and elsewhere

- An eventual end to the Ukraine war and the current level of acuity of Europe’s energy crisis

- Peer-leading levels of free cash flow generation

Let’s dive in for a midyear update on VOD, and then look at its valuation compared to peers.

Midyear Update On Vodafone

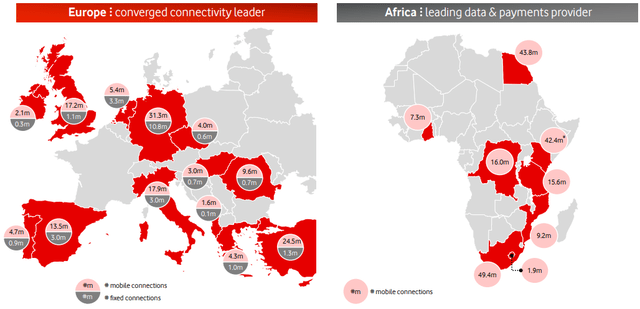

VOD is a multi-national, multi-continental telecommunications company mostly serving Europe but with irons in the fire across the African continent as well.

Normally, Europe is quite a stable environment in which to do business as a telecommunications provider, but recently, the situation there has destabilized. Germany passed a Telecommunications Act in December 2021 that has increased competition and weighted on VOD’s revenues. Hungary has taken steps to consolidate its telecommunications industry under government power. And, of course, the Ukraine war and its associated energy crisis has tightened consumer budgets.

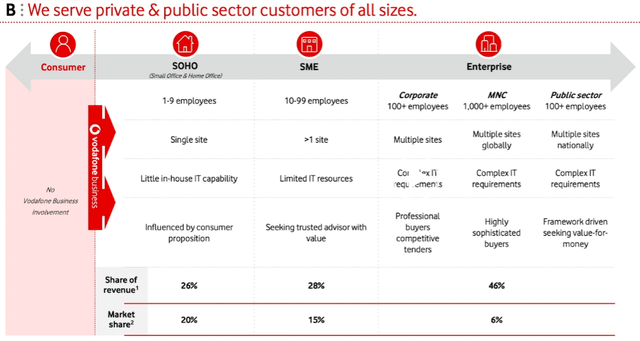

On the point about competition, though the US is more often known for its commitment to free-ish markets, Europe actually has greater degrees of competition in a number of industries. Telecommunications is one of them. As such, VOD’s relatively small market shares of various business sizes is pretty normal.

The good news for the long-term is that VOD has lots of exposure to the Internet of Things (“IoT”), which comes with high margins that should expand further with incremental additions of Internet-connected items. Europe, along with the US, will likely lead the way in the IoT revolution.

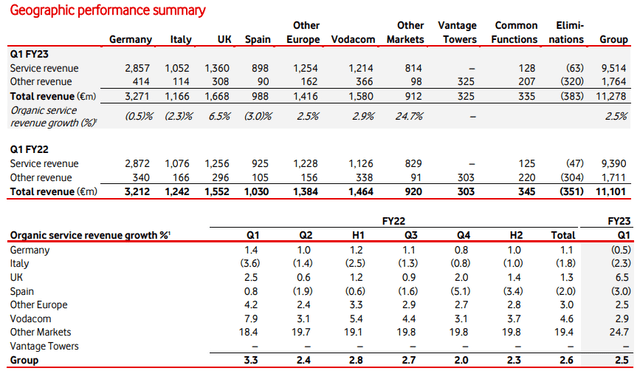

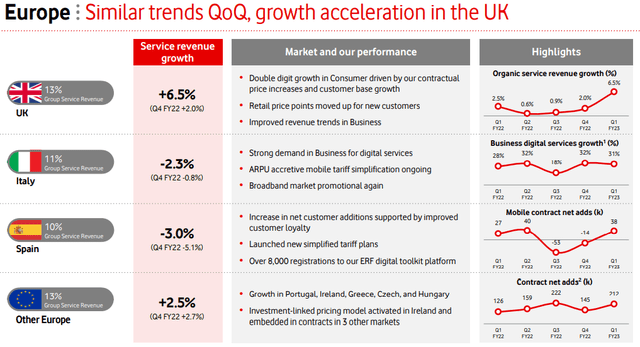

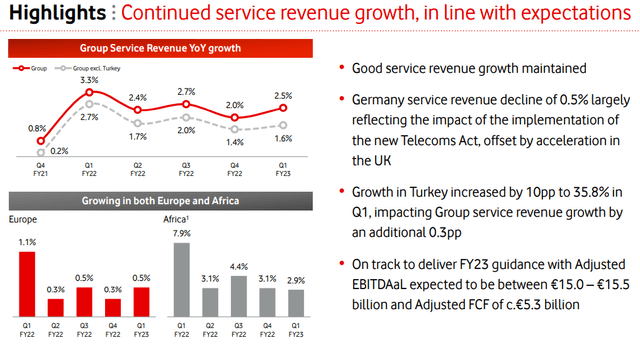

In the first quarter of fiscal 2023 (ending June 30th, 2022), VOD’s organic revenue rose 2.5%, mostly because of strength in the UK (due to price hikes) and non-European markets. Germany, Italy, and Spain suffered organic revenue declines.

Even in these markets, net additions of mobile customers typically remained positive, but pricing was stretched due to competition.

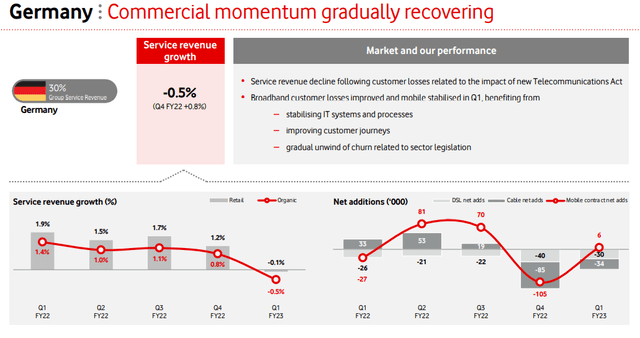

Though VOD is a UK-based company, Germany makes up the single largest country share of the company’s group service revenue at 30%. When Germany sneezes, Europe catches a cold. In this case, VOD catches a cold. Germany’s half-percent revenue decline dragged down overall growth.

As you can see above, Germans have mostly cut cable and DSL rather than their cell phone bills.

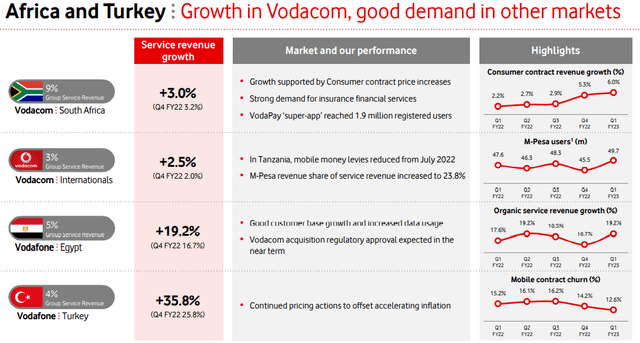

Meanwhile, in Africa and Turkey, nominal revenue growth remains robust because of high inflation in these countries.

It’s nice to see that M-Pesa, VOD’s mobile phone money transfer system, continues to gain users, now with nearly 50 million. This is one of the most exciting parts of the business for me, because uniting Africa onto one secure payment system remains a hurdle to the continent’s economic development.

Though nominal revenue growth remains positive in Europe, it’s much faster in Africa, both because of demographics and because Africa’s still-developing nature.

Meanwhile, pertaining to the balance sheet, debt has not come down, but it also isn’t growing much either. Here’s VOD’s net debt to adjusted EBITDA by fiscal year:

- 2022: 2.7x

- 2021: 2.8x

- 2020: 2.8x

While I would love to see net leverage come down, VOD has to continue investing in 5G infrastructure and other measures in order to remain competitive in Europe’s cutthroat telecom market, so I doubt this metric will fall anytime soon.

What will be more interesting to watch is how much rising interest expenses eat into earnings over time, if interest rates keep rising and remain elevated. That is certainly a legitimate concern.

Vodafone’s Undemanding Valuation

So, VOD has lots of issues to deal with. Europe is in economic shambles, and not to mention very competitive for the telecom industry. VOD’s non-European markets have severe inflation problems. The company has high debt, and interest rates are rising.

But all of this may already be priced in. That isn’t to say the price can’t drop further. There’s no limit on how low the price can go. But in terms of fundamental valuation of the good and the bad, the stock price does appear to amply weigh the bad stuff.

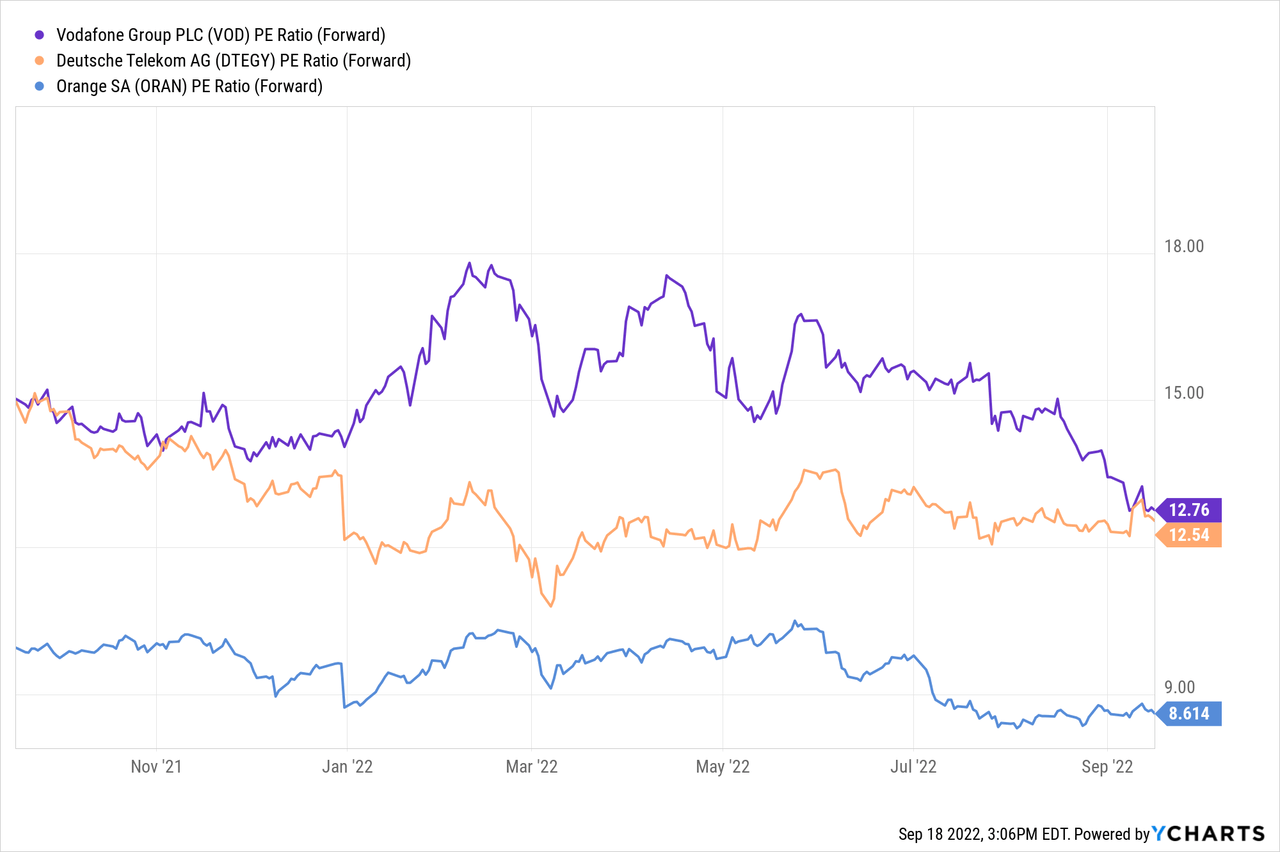

VOD’s price-to-earnings ratio has come down from over 15x for most of this Spring to about the same as its German telecom counterpart, Deutsche Telekom AG (OTCQX:DTEGY), though not as low as its French telecom peer Orange S.A. (ORAN):

Then again, there are a lot of accounting gimmicks going on with GAAP and IFRS earnings, so this may not be that useful.

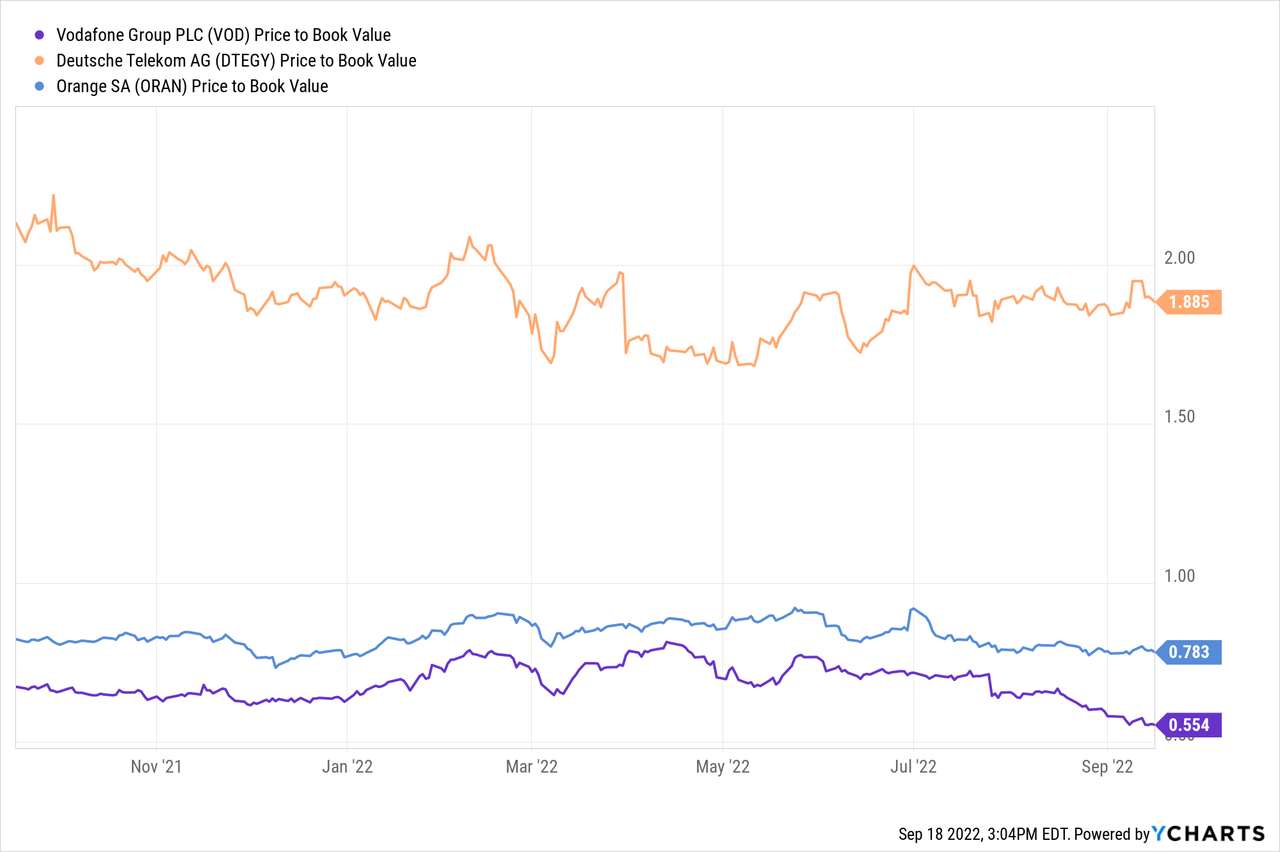

Let’s try price to book value, which also may not be that useful because of variations between accounting practices but is better than nothing. Here we find that VOD is the cheapest among peers:

Though VOD never trades at 100% of book value according to this measurement, its current 55% of book value level is historically low.

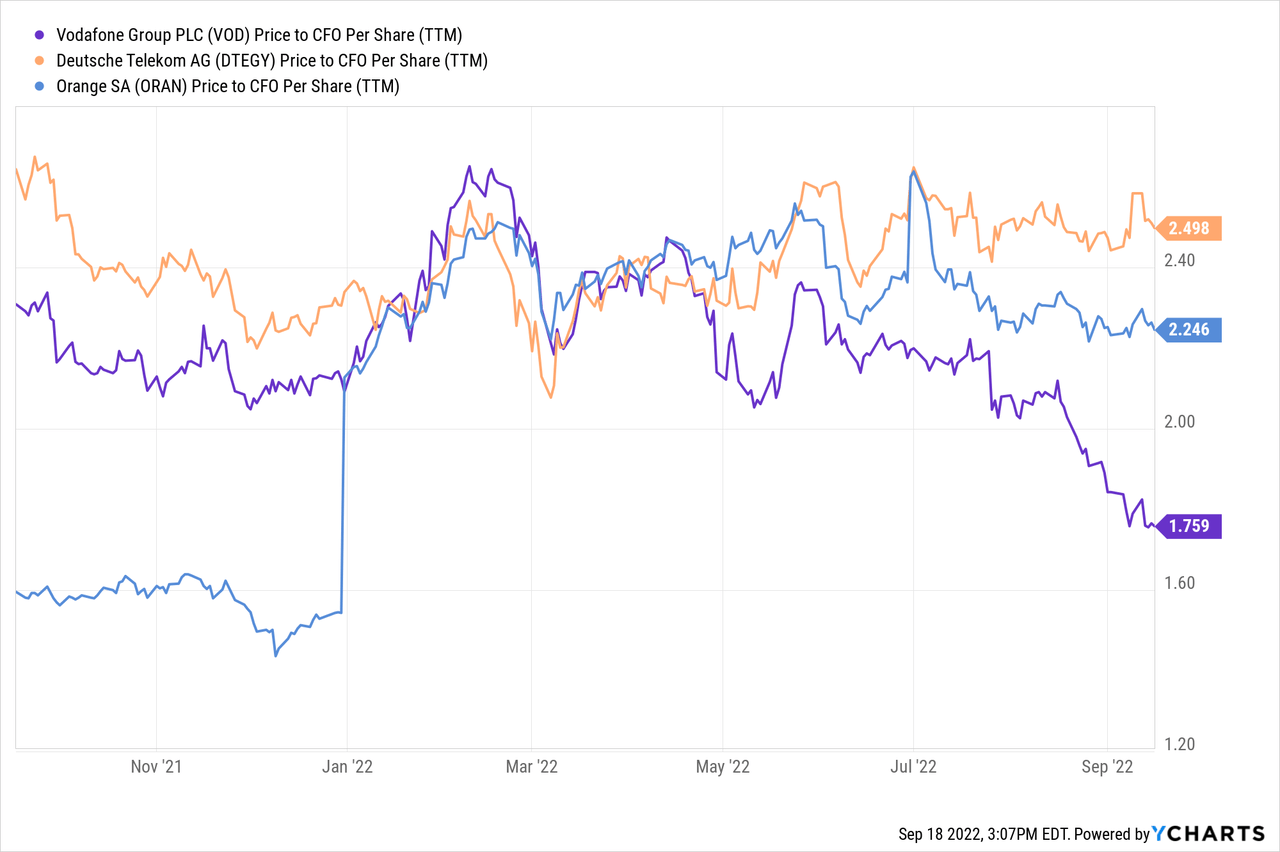

So also is its price to cash from operations of about 1.8x, which is well below Deutsche Telekom’s 2.5x and Orange’s 2.25x.

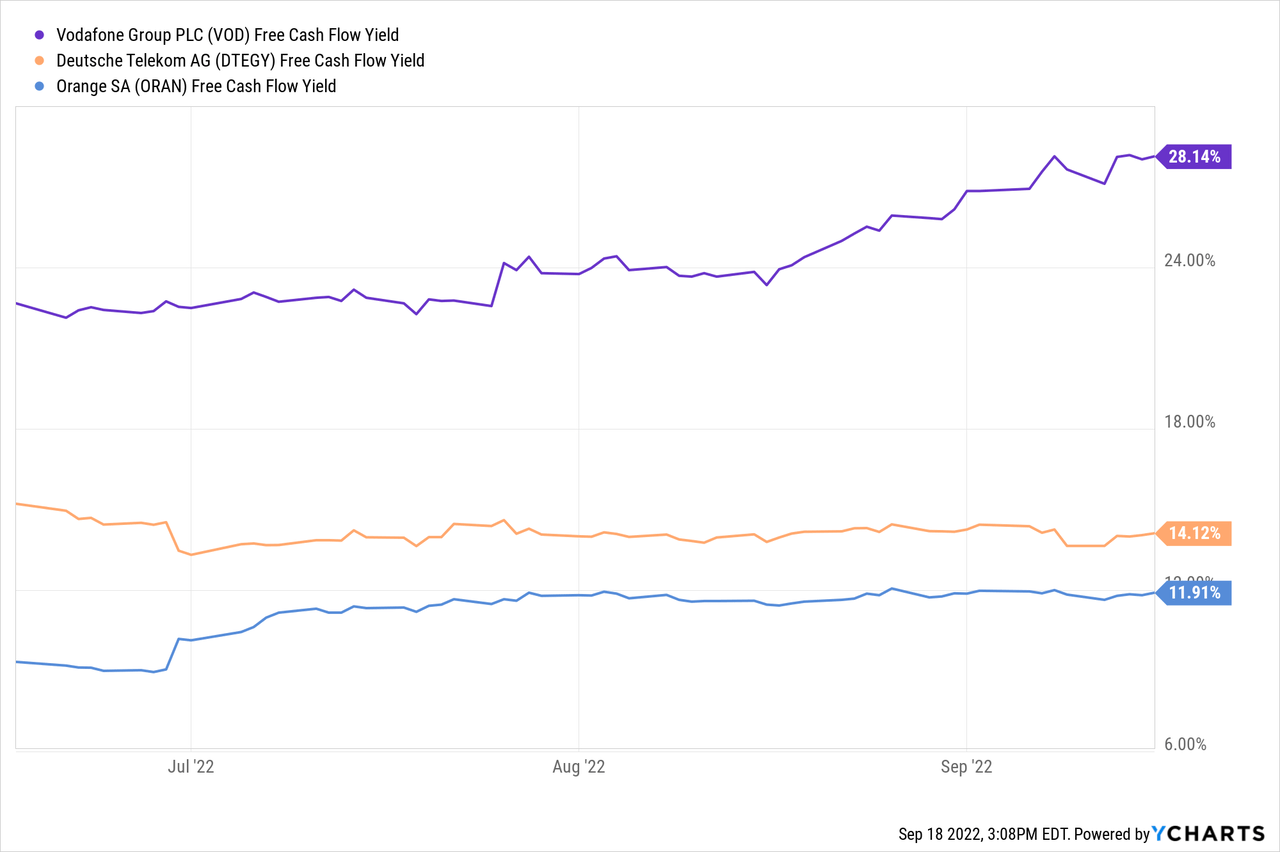

VOD generates a lot of operating cash flow, and it translates a decent amount of that into free cash flow. In fact, its FCF yield is significantly higher than peers’.

Now, to be fair, VOD’s true FCF yield is not that sky-high. When I compare management’s expectation of €5.3 billion in adjusted FCF for fiscal 2023 to the current market cap of €35 billion, I get a FCF yield of about 15%. Even so, 15% is higher than VOD’s peers and certainly higher than the vast majority of other publicly traded companies!

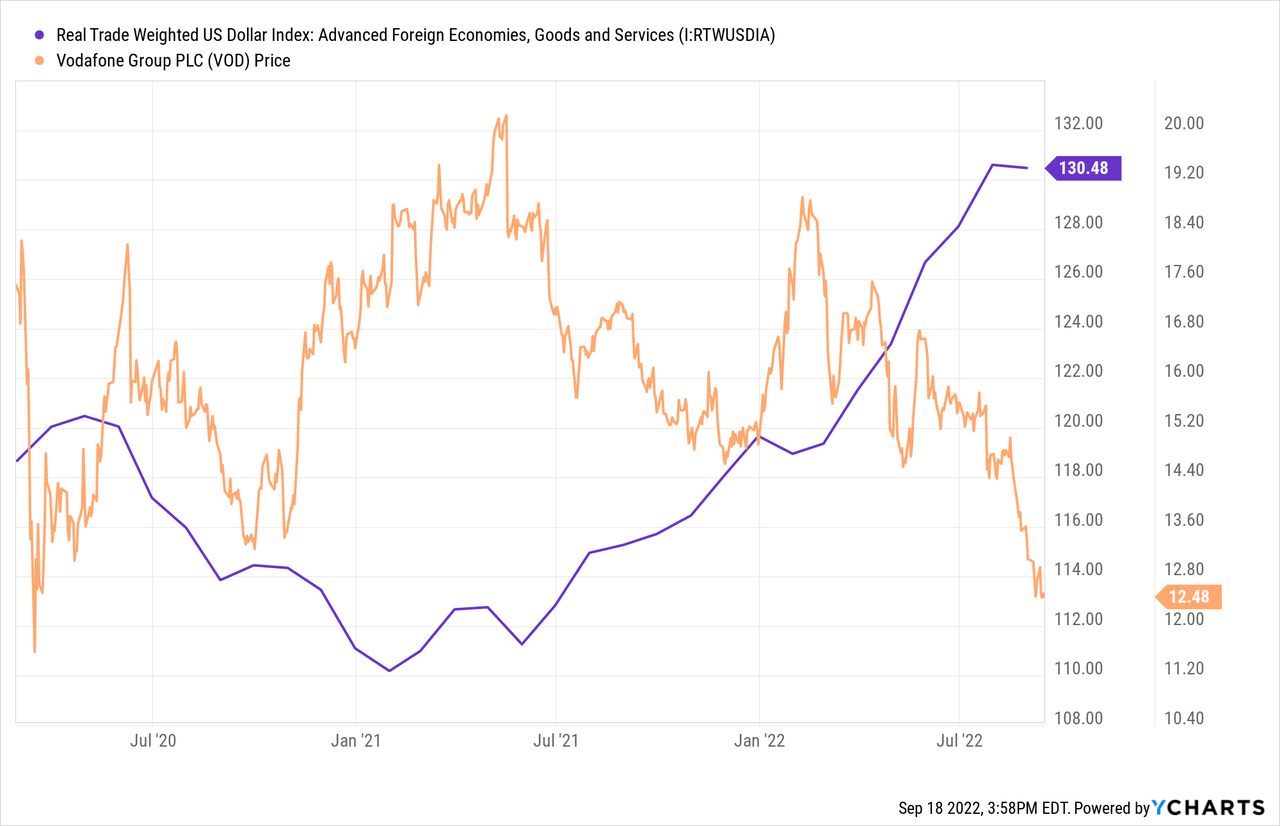

Of course, one of the biggest headwinds to VOD this year has been the strong dollar. Notice that VOD’s stock price performed best when the dollar was weakest in the first half of 2021 and has since zagged downward as the dollar has gotten stronger and stronger.

Since a majority of VOD’s revenues are priced in currencies other than dollars (which have been weakening against the dollar), this has caused VOD’s ADR to perform even worse.

Reversion to the mean is one of the most ironclad laws of economics, and if it eventually proves true for the USD (that is, if the USD reverts to the mean by going back down from its current high level), then VOD’s stock price should find some relief and get a nice bounce.

Bottom Line

There is certainly risk to the “it’ll all work out” thesis (I wouldn’t even call it a “bull” thesis) for VOD. A deeper than expected recession in Europe could derail even the company’s modest revenue growth this year, which could lead to a dividend cut.

But VOD just looks so darn cheap, it’s hard not to think that all of these risks are priced in already.

If and when the USD reverts to the mean, interest rates flatten or decline, the war in Ukraine ends, and the energy crisis stops pinching Europeans’ budgets quite as much as it’s doing now, VOD should enjoy a modest rebound.

I think that rebound will come, eventually. In the meantime, I’ll sit back and enjoy VOD’s 7.8% dividend yield.

Be the first to comment