wildpixel

Vir Biotechnology, Inc. (NASDAQ:VIR) had in Q4 -2021 and Q1-2022 a particularly positive period in terms of revenue and profitability. This is thanks to the product placed on the market for the treatment of the advanced state of COVID-19. This period allows us to understand what the real potential of VIR could be.

At this time and for the next years, the company expects a fluctuating trend in revenue and also negative margins. The pipeline is very interesting and could lead to even higher levels of growth than in the past in the medium-long term.

The current assets plus the agreements signed with GSK plc (GSK) and BARDA allow the company to face the next quarters with absolute serenity from the financial point of view. A theoretical exercise tells us that the share price could reach much higher levels in the future and the comparison with the main peers highlights a very competitive company profile. With a high risk of maximum volatility, my rate is Buy.

Company Overview

Vir Biotechnology, Inc. defines itself as a ‘commercial-stage immunology company’ and bases its activity on infectious disease prevention. As we have seen in the last recent period with the presence of the COVID-19 pandemic (coronavirus disease 2019), infectious diseases are among the main causes of death worldwide and represent an element of certain interest on the part of all pharmaceutical companies.

The company strategy is based on analyzing the limits of the immune system in defeating certain pathogenic elements and subsequently identifying the vulnerable points of these pathogens and the reasons why treatments have failed. The consequence of this approach is the development of pharmacological technologies that can be used alone or with other drugs for the development of successful therapies.

Company milestones, acquisitions, and agreements

2016 – The company was incorporated and begin operations.

2016 – TomegaVax Acquisition (in several steps still open today): HBV (hepatitis B virus), HIV (human immunodeficiency virus, and tuberculosis platform for cytomegalovirus vector-based vaccine.

2017 – Humabs Acquisition: studies and development of monoclonal antibodies (‘mAbs’).

2020 – GSK plc (GSK) Agreement (expanded in 2021 and 2022). Starting from 2020 for 4 years, the companies have signed an agreement based on three platforms: Influenza/ Functional Genomics/ Selected Pathogens. VIR assumes responsibility for the research and development of antibody and vaccine programs while GSK assumes responsibility for the worldwide commercialization of the antibody program; the marketing and production of vaccines and the Genomic Program.

2022 – BARDA (Biomedical Advanced Research and Development Authority – part of HHS – the U.S. Department of Health and Human Services) and VIR signed an agreement based on the study and development of solutions for influenza and other infectious disease treatments. The total investment is up to $1 billion (to be received by VIR) and the initial investment is $55 million for VIR-2482 (a monoclonal antibody for influenza A). The BARDA Agreement will last until the beginning of 2026.

2022 – the birth of an owned subsidiary Vir Biotechnology International GmbH based in Switzerland for research and business development internationally.

The company has also some grant agreements with the Bill & Melinda Gates Foundation with a total support of $55.7 million for studies involved in HIV, tuberculosis, and malaria vaccine programs.

Pipeline and potential addressable market

With a team of experts in infectious diseases and immunology and also thanks to external collaborations and targeted acquisitions, the company has developed four development platforms based on: antibodies, T cells, siRNA (small interfering ribonucleic acid), and innate immunity.

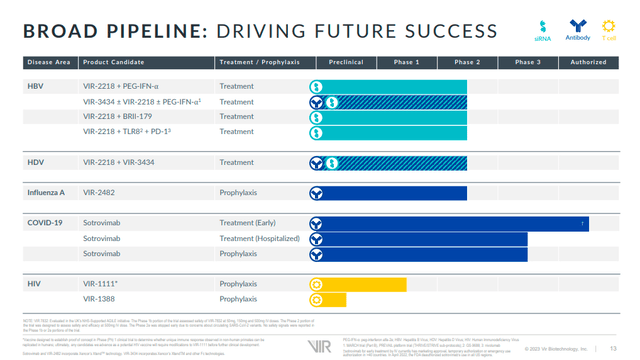

The 2023 pipeline is based on:

- sotrovimab targeting COVID-19

- HBV or hepatitis B virus

- HDV or hepatitis D virus

- influenza A virus

- HIV or human immunodeficiency virus

COVID-19

COVID-19 Sotrovimab is in Phase 3 or an Authorized product outside the US. In Q2 2022 due to certain omicron subvariants, FDA (Food and Drug Administration) inhibited the use of sotrovimab in all US. In Q3 2022 WHO (World Health Organization) strongly recommended the non-use of sotrovimab in patients with non-severe COVID-19 precisely because such therapy is not effective against the latest variants of the virus.

VIR and GSK do not currently plan to submit additional BLA (Biologics License Application) for the sotrovimab product to the FDA and this means that the suspension status of the product on the US market is currently confirmed for the next quarters.

In Q3 2022 Phase 3 Prophylaxis was initiated for patients at risk of COVID infection. In the meantime, VIR and GSK continue to implement tests and analysis on new variants with sotrovimab.

HBV and HDV

VIR-2218 and VIR-3434 are the two main products targeting siRNA (small interfering ribonucleic acid) and neutralizing mAb (monoclonal antibodies) for Hepatitis B and D Virus treatments.

In Q4 2022 VIR presentations have been included in the “Best of the Liver Meeting” by AASLD (American Association for the Study of Liver Diseases ) to underline the goodness of the ongoing studies on the treatment of hepatitis.

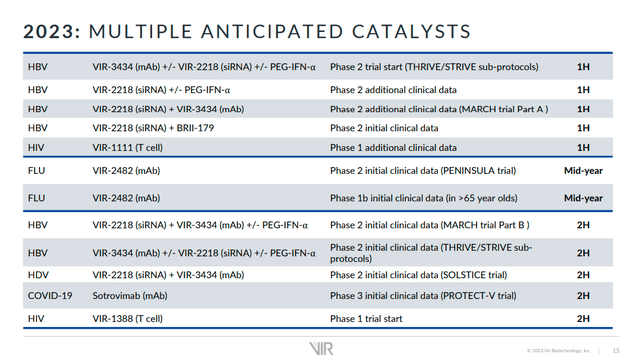

HBV and HDV are in Phase 2 of the development of the analyzes and it is expected that the start of the clinical data could take place partly in H1 and partly in H2 of 2023. It is also foreseen that a trial start could take place in H1 of 2023.

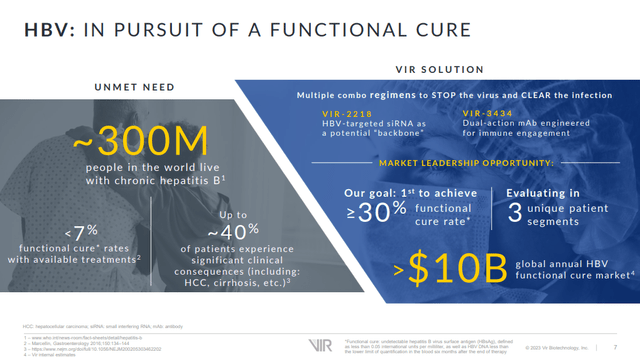

According to the World Health Organization, quite 300M people globally are affected by B chronic hepatitis and less than 7% represents the functional cure rate with available treatments. More than 40% of patients suffer from major clinical consequences.

VIR’s goal is to increase the functional cure rate to at least 30% through studies on VIR -2218 and VIR – 3434 products. According to the company, the potential target market could reach $10 billion on an annual basis.

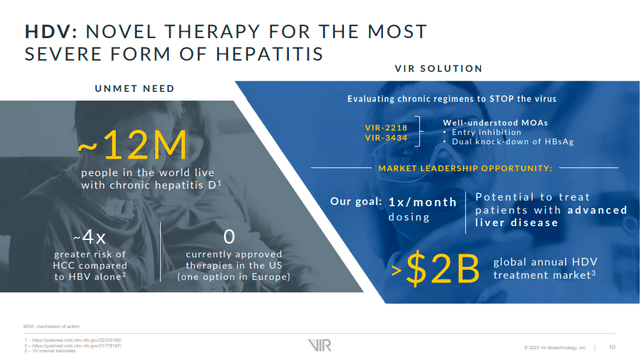

According to the World Health Organization, quite 12M people globally are affected by D chronic hepatitis and 4X represents the factor grade of greater risk of HCC (Hepatocellular carcinoma) if compared to B hepatitis only. There aren’t approved therapies in the US.

VIR’s goal is to reduce the risk factor to 1X with the potential to treat advanced liver disease. According to the company, the potential target market could reach $2 billion on an annual basis.

Influenza

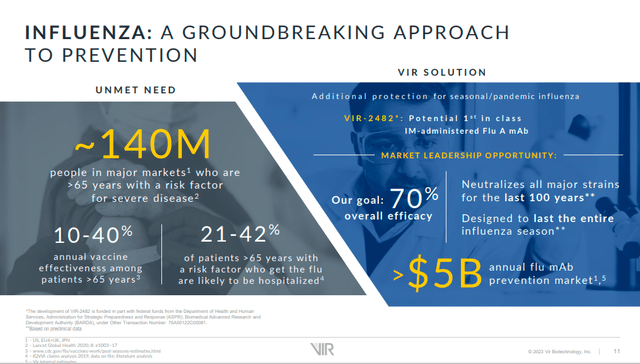

In Q4 2022 the Company has begun Phase 2 Prevention of Influenza A Illness to test the efficacy of VIR-2482 through two different intramuscular doses. This represents the first trial in evaluating the use of a monoclonal antibody in influenza prevention terms. Initial data results seems will be shown in the mid of 2023.

In Q3 2022 the Company has begun Phase 1b prophylaxis with people receiving the flu vaccine. The goal is to test the safety of VIR-2482 and the population is also representative of the next Phase 3. Initial data results seems will be shown in the mid of 2023.

According to the Centers for Disease Control and Prevention, the annual vaccine effectiveness among people older than 65 y is between 10% and 40%, and a great percentage of 21-42% of these patients have a risk factor to be hospitalized.

VIR’s goal is to increase efficacy to 70% and to design a vaccine that lasts all the influenza season. According to the company, the potential target market could reach $5 billion on an annual basis.

The following table shows all program timetables for 2023 and we can see how all Phase 2 are fully covered in 2023.

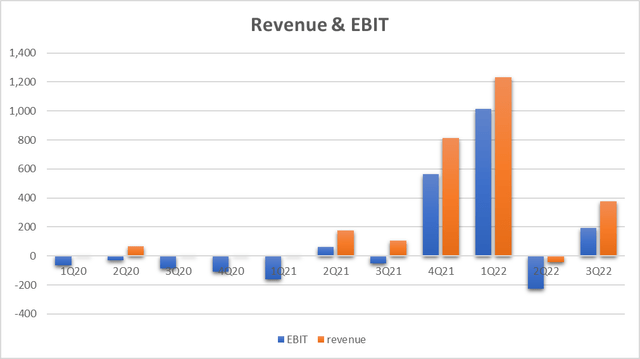

Revenue and Profitability

The graph shows the trend of revenue (orange bars) and EBIT (blue bars) since 2020. We can see how there have been high revenue peaks between 2021 and 2022 and this is mainly due to the marketing of the sotrovimab in the US. As FDA banned the drug in Q2 of 2022 revenue plummeted and bounced back in Q3 as 230,000 doses were sold in 40 countries outside the US. The negative revenue figure for Q3 – 2022 is due to an overproduction of sotrovimab by GSK which it assumes will not be sold and for which VIR has determined a reversal of revenue equal to $379.5 million.

EBIT closely follows the Revenue trend and this demonstrates that at the moment the company has practically only the fixed costs associated with the structures and personnel capable of carrying out the analyses. All part of the selling costs has currently been predominantly outsourced to GSK.

Although it can be seen that both in 2021 and 2022 the company produced profits (even high ones) the graph shows that there were many other quarters with significant losses in margins. There is no guarantee that these losses will not occur in the future and this is because sotrovimab (the only drug on the market) has been excluded from the US market and although it remains active in 40 countries outside the US, WHO has discouraged drug use in patients with non-severe COVID-19.

So what can we expect from sotrovimab in the US?

We can find the answer in the last 10-Q Form:

In light of these developments, we cannot predict whether (if at all) or to what extent sotrovimab may be reauthorized for use by the FDA in any U.S. region in the future. Furthermore, due to the evolving COVID-19 landscape and based on discussions with the FDA, we and GSK do not plan to file a BLA for sotrovimab at this time.

And about the other countries and other products revenue:

Although certain countries outside of the U.S., such as Canada and Japan, continue to maintain access to sotrovimab 500 mg IV while noting that it is unlikely to maintain efficacy against certain Omicron subvariants, we cannot predict whether countries will align with the WHO recommendation (if at all) and further limit the use of sotrovimab. We have not obtained regulatory approval for any other product candidates, and we do not expect to generate significant revenue from the sale of our other product candidates until we complete clinical development, submit regulatory filings, and receive approvals from the applicable regulatory bodies for such product candidates, if ever.

As we could see in the previous paragraph, the pipeline is quite rich and Phase 2 of many programs is expected in 2023. If the results are positive we can assume Phase 3 in 2024 and immediately mouse the BLA for placing on the market. from 2025 onwards we could expect to see new revenues on new products.

Related to profitability and future expenses the company says (Form 10-K):

we may continue to incur net operating losses for at least the next several years as the extent of future revenue remains uncertain. In particular, we expect our expenses and losses to increase as we continue our research and development efforts, advance our product candidates through preclinical and clinical development, seek regulatory approval, and prepare for commercialization, as well as hire additional personnel, protect our intellectual property and incur additional costs associated with being a public company. We also expect to increase the size of our administrative functions to support the growth of our business. Our net losses may fluctuate significantly from quarter-to-quarter and year-to-year, depending on the timing of our clinical trials and our expenditures on other research and development activities.

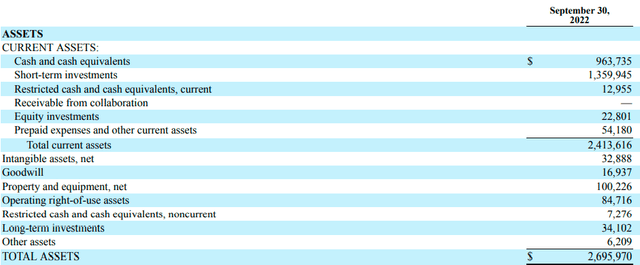

Asset and Capital

At the end of 2022, the company had approximately $2.4 billion in current assets and this implies a solid base of financial availability for the continuation of operations in the coming years. In addition, the company has an agreement with BARDA for up to a $1B grant for influenza studies in addition to more than $55M from the Bill & Melinda Gates Foundation on HIV.

Not to be forgotten is the consolidated agreement with GSK which could lead to new developments on the COVID-19 topic.

The above defines a decidedly high financial solidity and stability which allows the company to undertake the growth path for the next few years without particular concerns relating to the maintenance of current expenses.

VIR Valuation

Providing a truthful assessment of a company without revenue and earnings forecasts is an almost impossible task. In any case, if we want to ‘test’ the current market potential, we can use the method based on earnings power with 2022 data. This is a purely theoretical exercise but it gives us a picture of what the company value could be in the coming years in which it will be able to achieve the same margins as those recorded in the last year.

The method starts with EBIT. The second step is to add depreciation and amortization and then subtract stay-in-business CAPEX.

The result is the Cash Trading Profit.

I then subtract the taxes by calculating the amount using the actual tax rate that the company pays.

The result is the After-Tax Cash Trading Profit.

At least to calculate the total company enterprise value I divide the After-Tax Cash Profit by the interest Rate I define as fine for this kind of Company (VIR is a high-risk company so I decided to use 15%).

The result is the Total Company Earnings Power Value. Dividing the result by the total number of shares we find the value per single share.

The table below shows the calculation for VIR:

|

EBIT |

1,549.80 |

|

Dep & amort |

6.30 |

|

CAPEX |

-68.50 |

|

Cash Trading Profit |

1,487.60 |

|

TAX |

21.30% |

|

TAX |

-316.859 |

|

After TAX cash profit |

1,170.74 |

|

Interest Rate |

15% |

|

EPV |

7804.94 |

|

Share in issue |

133.1 |

|

EPV per share |

58.6 |

$58.6 represents the share price valuation using the EPV method. If we compare the data with the current market price ($26) we can get a snapshot of the price difference between today and tomorrow when the company can create $1.5 billion in EBIT again.

Peers Comparison

Moving on to peer comparison, I have selected the following company in Biotechnology Industry:

- Amicus Therapeutics, Inc. (FOLD)

- PTC Therapeutics, Inc. (PTCT)

- Vaxcyte, Inc. (PCVX)

- Abcam plc (ABCM)

- Intellia Therapeutics, Inc. (NTLA)

Using P/B value comparison:

|

VIR |

FOLD |

PTCT |

PCVX |

ABCM |

NTLA |

|

|

Price/Book Vale [TTM] |

1.62 |

26.32 |

NM |

7.57 |

4.22 |

3.44 |

We can see how VIR has the lowest value and this underlines that the price valuation at the moment could be seen as cheap if compared with peers.

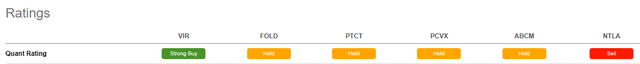

Using Seeking Alpha’s Quant Ratings we have, in confirmation with the P/B outlook, a ‘Strong Buy’ verdict related to the ‘Hold’ or ‘Sell’ rating of the others company.

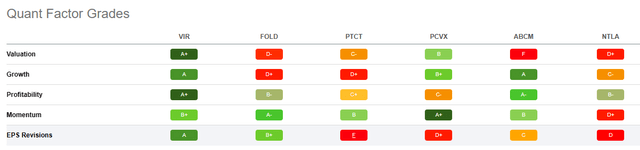

Under the Quant Factor Grades point of view, we can see how VIR is outstanding in Valuation and Profitability with an ‘A+’ rate. In Growth and EPS Revisions the Company has an ‘A’ rate and we can state that is preferable if compared with the peers. Only Momentum underlines that the company is slowing down and other companies have the best grades.

This comparison allows us to understand how at this moment VIR could be the best choice with quite all factor grades in his favor.

Timing for new revenue represents the main Risk

Although the company can be considered solid from the point of view of capitalization and financial capacity to meet current expenses for next year, the situation relating to the only marketed product is not entirely positive and this could jeopardize the partnership with GSK. But the aspect of greatest risk is, in my opinion, represented by the timing necessary to market the products for HBV and HDV, and Influenza A. There are currently no certainties and if the studies have a positive outcome, we can hypothesize, at best hypotheses, a lead time of approximately two years before being able to see new revenue. This is also commensurate with external factors such as FDA judgment and does not allow us to define a precise timeline and related costs.

Conclusion

Vir Biotechnology could go through a difficult period in terms of revenue and profitability. Its main product (as well as the only one marketed) has been excluded from the US market and severely penalized in foreign countries. Despite this, the company enjoys excellent financial health and a large pipeline. I think an investment in VIR could bring excellent results (albeit with the risk of high volatility) in the long run and my rate is Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment