Olga Tsareva

Village Farms International (NASDAQ:VFF) is one of the strongest choices in the Canadian marijuana market, due in no small part to its amazing management team. As I learned about investing as a young man, I heard constantly about how management matters when choosing an investment. I ignored that advice for too many of my early investing days, but Village Farms, as I hope to illustrate through this article, is a case study in why it’s so important.

Village Farms Early History (Pre-Marijuana)

Village Farms has deep roots in the “gold rush” to build out greenhouses in North America to mirror those successfully deployed in the Netherlands. Growing flowers and vegetables and selling them all season was a profitable business of the time, but massive flows of investor capital led to overbuilding and fierce competitive pressures. After decades of brutal competition, Village Farms managed to become the only modern greenhouse operator to stay on the public markets, after all of its competition was taken private, amalgamated, fled South or went under.

During that time VFF developed a long history of modern greenhouse operations, developing many increasingly modern greenhouses, collected historical growing/weather data, partnered with low-cost Mexican producers, developed retail partnerships, tuck-in acquisitions of power production, and sat on valuable assets. VFF’s stock price floundered during this time, with most of the interest coming from deep value investors like myself, interested in the small capitalization value stock it represented.

VFF had assets of tremendous value, worth several multiples of the market capitalization, but with no effective way to unlock that value. Having operated their most modern greenhouses for many years they continued operating with cash flow but little net profit (as most asset-heavy ventures with large depreciation expenses tend to do). Vegetable profits were low and no crop was going to be priced strongly enough to allow sufficient growth for an increasingly growth-oriented market.

They continued to build out their capacity with partners in Mexico, offering their expertise in modern greenhouse production, cultivation, pesticides and retail experience/partnerships to create value. They continued growing their scale through these ventures while awaiting what all deep value companies await: a new opportunity.

Suddenly a new use for greenhouses arrived: marijuana. A new way to unlock the tremendous value of its assets that they carried at on their balance sheet. They had the assets, the staff, the data, and the retail partners to make a go of it. They found a dangerously optimistic and inexperienced partner – and they got to work.

Village Farms Marijuana Entry (Finding Emerald Health)

VFF’s management team had a lot of experience in overexuberant markets filled with inexperienced players, and they had some predictions of what was likely to occur:

- Overcapacity would plague the industry. There was no reason for anyone to be building greenhouses without utilizing experienced partners, they existed all over the country just needing updates as there was an overcapacity in greenhouse production of vegetables and flowers. Retooling existing greenhouses was the obvious solution, so any company custom-building greenhouse assets illustrated the naivety of their competitors, and would lead to overcapacity issues.

- No major players would meet their production targets. Growing in a greenhouse is serious business, and almost none of the major players were partnering with any of the (now private) competitors that VFF had been fighting with for market-share for over three decades. Without more experienced hands “on the ground,” marijuana flower production would be lower than projected.

- Retail prices would collapse within a couple years. Due to how this type of market would work, prices would not be able to be sustained. Companies would get desperate for cash flow and would sink their prices to try to get any sustaining cash they could get their hands on. Overbuilding of assets would mean no one would be able to unlock the value of their greenhouse assets, which would make up the majority of investor-destroyed capital.

- Prices will not recover until that production is taken offline permanently. The industry will need to be capable of sustaining itself through a long period of low prices as companies are very good at keeping themselves in a business they should have exited a long time ago. Only low-cost producers with a decent product will be able to hold out to price recovery.

- Taking market share from the illicit market is the only path forward. VFF recognized early on that the only way industry players would survive is to ensure they focused on their real competitors: The illicit market. If you can build a company that could face off against the illicit market through quality and pricing, then that company will survive whatever the incompetent, but well-funded, competition will come up with.

Faced with all of this, they had a clear strategy. They needed a partner to get their hands on the capital needed for the renovations to modernize their greenhouses to meet the best practices for the marijuana industry. They needed a partner with the marijuana intellectual property (IP) VFF sorely lacked access to. Ideally, they could use a partner whose management team did not agree with this strategic vision. They found everything they could have asked for in Emerald Health Therapeutics (OTCQX:EMHTF).

The Risky Partnership with Emerald Health (The Work Begins)

Although it took some time, VFF finally found a partner that would give them everything they needed. Emerald Health was willing to give them the capital, the staff, and the IP. The deal most investor paid attention to was simple enough.

Emerald Health gives the capital funding and VFF gives the greenhouses. They would use the funds to renovate and update the greenhouse assets to meet the latest best-practice for greenhouses and ensure an ideal environment for marijuana. Once the partnership began producing, Emerald would purchase what it could sell at $2 per gram to the medical market it had already entered (giving it the equity prices needed for funding rounds), and the rest would be sold on the open market to take advantage of the comically high prices of the day (~$10+ per gram wholesale at the time).

The funding from Emerald and the equipment/people/buildings from Village Farms would be placed into a 50-50 partnership, Pure Sunfarms.

The key was not the initial press release part of the deal, which was well documented at the time. The real key was how the partnership was structured to allow each partner to buy out the other, which only became clear as it unfolded.

Emerald Case

Effectively if prices remained high ($5 per gram or more) Emerald would accumulate the needed capital to exercise the options to expand production and eventually purchase the entire greenhouse partnership, Pure Sunfarms, should it want to. Emerald, should this occur, would then perhaps purchase all of VFF’s shares in a hostile takeover to get access to the Texas assets (as VFF’s business would trade at a discount due to its legacy produce business), if another deal could not be reached in the future. The higher the price for wholesale, medical and retail flower, the faster the process.

Emeralds entire business case was built around the belief that a plant that had existed alongside humanity for a thousand years had some unlocked health potential that Emerald would be able to find. They painted a picture for investors that this future would be capitalized on by research and development, and high prices would allow for a future where Emerald would license these magical properties out to health companies if it did not just do all of it itself. Emerald management had its hands in so many “promising” ventures that if they succeeded in a single one, all their publicly traded properties would benefit. This case was evidently exciting enough to bring in the investor capital necessary to fund this venture alongside many others, as rising investor exuberance lifted all boats even tangentially related to the marijuana industry.

Village Farms Case

If prices dropped to VFF management’s expected range of sub $2 per gram, Village Farms would be able to sustain itself and await the necessary drop in Emerald share price to purchase the Sunfarms assets. Eventually, should Emerald’s price drop low enough, purchasing the rest of the IP and medical cannabis parts of Emerald by purchasing the company outright. Emerald was building out an incredibly expensive infrastructure and R&D department that would sink it if they could not get a premium price for their marijuana. They needed a premium product to charge premium prices, but VFF had a feeling that premium prices would fetch mediocre prices, so that is what its strategy relied on.

Village Farms was positioning itself to be able to save every penny that was thrown off of Pure Sunfarms, combined with the fact its own greenhouses were producing cash-flow to sustain themselves, the partnership should throw off enough cash to grow while providing funds to VFF to allow it to do whatever it wished. They initially planned to utilize that cash to expand further into Mexico to protect its retail partnerships it would need later, and to fund expansion into CBD markets.

Partners in Name Only (Emerald Proves Management Matters by Showcasing Poor Management)

Initially things went well, the partnership Pure Sunfarms had some initial wins, including coming online on schedule and getting good pricing on the wholesale market due to the quality of its product. But prices began to come down not long after production started. Emerald began to see the writing on the wall, that their leveraged bet into a market that did not exist might cause it to collapse, but VFF managed to convince them to fund the first major expansion. Pure Sunfarms started picking up some strong management hires to complement the strong business model. Its experience in dealing with retailers ensured it knew who to recruit to build the business, and that experience shined as results came in each quarter.

Business picked up, even as the retail and wholesale price of marijuana was falling, and VFF wanted to expand again. Although risky, Pure Sunfarms low cost production was likely to find buyers and pay for the expansion if they got online soon enough. Emerald refused to participate, not because the outlook was bad, but because they were burning investors capital and their market price was reflecting it. No matter how successful Pure Sunfarms was, if prices remained “low” (as in, lower than Emerald had anticipated in its overly optimistic projections) Emerald would run out of cash. Pure Sunfarms was ready for expansion, but even the sustaining capital Pure Sunfarms already demanded meant it could not issue dividends to the two owners faster than Emerald could destroy any cash it received. The partnership was stuck in a holding pattern waiting to see what Emerald would do. Emerald was desperate for prices to improve, or for investor sentiment to return so they could go for an equity raise. Otherwise, Emerald was doomed.

As prices began to more actively collapse, Emerald started to showcase why the market was punishing VFF for choosing to partner with them. Emerald started to refuse to purchase the minimum contractual amount of Pure Sunfarms production at the agreed upon price (estimated at $2 per gram) while prices floated around $1. They purchased what they needed from the wholesale market and refused to honor their contract with Pure Sunfarms. VFF initially used this as a pretense to increase their ownership stake in Pure Sunfarms. Then, as it got even worse for Emerald, VFF enter negotiations to increase their stake again.

This all eventually culminated in VFF getting full control of Pure Sunfarms in exchange for releasing Emerald from their contractual obligations and paying them effectively the entire market capitalization of Emerald Health in cash. Net of all the cash Village Farms was able to get out of Emerald before it collapsed on itself, Village Farms essentially got all of the components it was missing (marijuana growing experts, marijuana IP, $40 million in greenhouse renovations, and a year of growth) for about $20 million net (author’s informal estimate). They also finally dropped the dead weight of a partner who refused to contribute to growing the partnership (or even living up to its signed agreements), allowing it to make the best decisions for growth based on the information available without waiting on a partner.

The issue was that it was too late, investor overexuberance was gone, the wholesale market no longer priced high enough to justify an expansion on its own without expanding branded sales. The market only cared about the products each company could sell as a stand-alone entity, and VFF needed to show it could grow the branded part of its business without relying on the wholesale market. It was alone now, but producing cash flow to fund expansion plans.

Village Farms Going It Alone (Mistakes Are Part of Growth)

A lot had happened with Pure Sunfarms as Emerald collapsed, but there was more to be done. Village Farms built up their management team, and built up its ability to expand internationally should the opportunity arise. This led to one of the two major blunders the management team had made in its foray into this new market.

Mistake One: The Netherlands Lottery

Village Farms paid a seemingly fair price to get a shot at entering the European market. Although it would just be a first-mover advantage and only allow it to sell out of one location, it would allow VFF to build the infrastructure and partners it needed to enter the broader European market once it received GMP certification. There was only one issue – the competition was not based on the strength of the company/strategy, as Village Farms management had been led to believe, it was literally a lottery. They would not be allocated one (or preferably many) locations to sell their products based on the strength of their product and the strength of their partners. They were placed on a list, and simply needed to hope their company was drawn. They did not get drawn, so the price they paid was for nothing but a spot on a waiting list.

Village Farms wrote off the investment and eventually purchased a stake in one of the winners.

Mistake Two: CBD Farming Is Tough

Village Farms entered into agreements with farmers around the United States to grow CBD outdoors in a unique farming relationship. Farmers who agreed to enter an agreement with VFF were given a laundry list of support (including financial guarantees) to take the risk of growing this new crop. It was a promising model, giving VFF access to a lot of low-cost production and would give it the experience it needed to enter the CBD market in a bigger way each growing season. The experiment was relatively inexpensive to start, but would lay the foundation to allow for big expansions should it work. Unfortunately, CBD prices did not stay unreasonably high, farmers had trouble during a difficult growing season, and several crops were lost in severe weather. Between the guarantees and upfront cost, what marginal amounts of CBD could be processed and sold did not justify continuing the experiment.

Village Farms wrote off the investment and decided to save its capital for the future expansion into the Texas CBD or marijuana market, whichever happens first. They continued their foray into the CBD market by purchasing Balanced Health Botanicals.

Village Farms learned from these errors and entered a number of new partnerships, doing its best to not enter any more equal partnerships to avoid the situation with Emerald where a partner refused to do what was best for the business due to its own internal issues. They entered the Asia-Pacific market (partial ownership with options to increase), entered Quebec (full acquisition of ROSE Lifesciences), and entered the online CBD market (full acquisition of Balanced Health Botanicals) to give avenues for growth. Village Farms has always heralded their Texas assets as the true optionality value for VFF, but Texas (being Texas) has had difficulty doing what is best for its citizens and businesses for political reasons. Village Farms committed itself to only moving forward with its plans in Texas once they had some success in lobbying for the changes necessary to avoid running afoul of any laws. Only once it was crystal clear would VFF take the risk of expanding its Texas assets.

Village Farm’s Bright Future (Optionality is the Name of the Game)

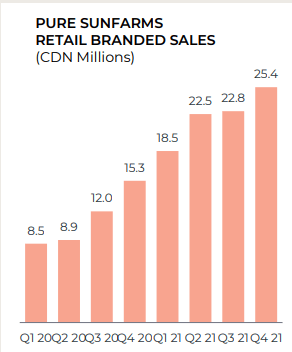

Increasing Retail Branded Sales (Village Farms Investors Presentation)

As it stands, Village Farms has done a remarkable job of expanding into the Canadian market quickly and successfully. They have some of the most popular individual products on the market, they have launched some of the most innovative pricing for products, they have current access (in one form or the other) to most of the major markets in the world (Europe, East Asia, Canada, United States), and have the option of further expanding into all of them as the political environment continues to evolve. Village Farms have done all of this while generating positive EBITDA since Pure Sunfarms began selling its products. They have managed cash burn well due to a struggling green-house vegetable business, and equity raises have been on a necessity basis only.

Village Farms is currently dealing with soft pricing in the Canadian marketplace as competition floods the market with poor quality product to shore up awful balance sheets. Investor sentiment is fickle, and appears to be solely focused on the United States getting its act together regarding legalization. Competition is actively saving each other (Tilray (TLRY), the largest future producer, needlessly saving HEXO (HEXO), the current production leader) rather than allowing companies that took the worst risks to dissolve. Canopy Growth’s (CGC) major investor Constellation Brands (STZ) has even allowed its bonds to be turned into a further diluting equity investment, rather than use its creditor position to turn the company around, buying current management some breathing room. Expansion into the United States has been held up for political reasons, with few reasons to believe the Democrats would legalize without asking for reparations to all those impacted by the war on drugs, or Republicans allowing it to pass as their ancient sitting senators, responsible for the war on drugs and its impacts, would allow the embarrassment of legalizing something they have spent a career needlessly demonizing.

There remains much hope, however. Village Farms has seen enough success to justify expanding production. Sales have remained strong and margins have been able to sustain themselves despite the terrible market conditions. Village Farms continues to climb the list of largest producers, inserting themselves into the conversation through production results and strategic acquisition of retail opportunities instead of just rampant acquisition of production. GMP certification opens the door to Germany, and combined with the Netherlands acquisition, serve to keep the doors open to building the partners, capacity and knowledge for continued expansion in Europe. They continue to expand their ownership of the Asian-Pacific retailer with hopes of developing that market. The recent expansion into the United States CBD retail side keeps more doors open for them as the United States eventually comes around on legalization of their primary product. There has been slow, but increasing uptake in generation 2 and 3 products from Pure Sunfarms, and Village Farms still has Canadian assets to mobilize should the market demand it. Retail sales in Canada have been strong enough to grow their production, as wholesale pricing for Pure Sunfarms premium quality at mid-market-prices strategy has appeared to have sufficient demand to take up any additional production. Texas also stands as a largest opportunity for VFF to meaningfully expand production to service the world market. CBD is also always on the radar of the VFF team, should they choose to make another foray into that market now that they have the ability to sell direct through several of their retail acquisitions.

Village Farms also has the vegetable business, which has maintained their retail partnerships that Pure Sunfarms will rely upon when the American CBD market matures (management hopes to sell CBD white-label products to the same major grocery and pharmacy operators that it currently sells produce to). Partnerships with Mexican private greenhouse operators has maintained production numbers as Village Farms has continued to expand owned-assets to marijuana. High inflationary pressures have also slowly improved margins and prices for their legacy produce business, as pricing agreements slowly renew.

Fundamental Analysis Discussion

Although the article focuses on the management team, their predictions and strengths, the company itself is a solid contender in the space based on its fundamentals. The company has separated out its investments in marijuana and the vegetable marketplace, making analysis easier. It is important to remember the wider picture of the company as it is today (vegetable grower and marijuana grower) and the future of the company compared to others in its growth industry (marijuana).

Produce Greenhouse Business

One of the most difficult aspects of comparing this part of the business is that no adequate comparisons exist. There are companies aggressively pursuing this industry with aggressive targets via SPAC’s like Appharvest (APPH), but that business model involves trying to keep up with Village Farms best-in-class growing numbers without the retail partners, environmental data or low-cost workers. They are trying to win a battle with both hands tied behind their backs and without shoes, but they are also the only other publicly listed vegetable grower. APPH is attempting to build a massive network of facilities from scratch that should, when completed, rival Village Farms pre-marijuana capacity in the vegetable space, only with higher costs and no network to leverage. There are other companies supplying marijuana growers, and nursery companies, but they all operate completely differently compared to Village Farms with incomparable business models and strategies.

Keep in mind that Appharvest, should it manage to raise enough capital, is aggressively attempting to grow to become approximately double the size of Village Farm’s vegetable business (if we do not include VFF’s Mexican and Canadian partner assets) and attempting to develop the retailer network VFF has already developed. On the plus side, Appharvest is hoping to have a better, more profitable business model with great control of the growing environment (who needs regional growing patterns when you are in total control of the environment) and have aggressive projections of possible growth and yield. This is theoretically possible as their facilities are brand new, but they have thus far failed to live up to what Village Farms is capable of since Village Farms has been building greenhouses with completely controlled environments for a very long time, and even they acknowledge that you need the right people and right data to get the growing conditions perfected. That takes time, but Appharvest is hoping to raise enough funds to make a play.

Appharvest trades at a 7.589 EV/sales (adjusted to expected 2022 run-rate sales). This is based on them reaching a size comparable to Village Farms square footage and with sales approximately one-fifth of Village Farms.

Assuming Village Farm’s produce business was discounted sufficiently to match this valuation, it would trade at a valuation of $874 million USD. As we can see, that is an essentially impossible valuation for the greenhouse business side on its own. If Village Farms re-committed into an aggressive greenhouse growth strategy, perhaps they too could leverage their tremendous experience to rival Appharvest’s valuation for that part of the business, but as I mentioned in comment sections while reading about Appharvest, that valuation is likely anchoring bias from SPAC investors who got caught up in the promising story without realizing there is a better, less expensive alternative in VFF.

A more common way to value the business is at 1x Sales, used by another author. That would value the produce business at $165.60M USD today, and approximately $200M USD if assets producing marijuana today needed to convert back to vegetables.

Marijuana Business Valuation

To get to the marijuana business valuation, I thought I would use two companies. Tilray, which is the best-in-class operator Village Farms is working to match, and HEXO the fallen from grace operator that Tilray extended a lifeline to.

- Tilray EV/EBITDA: 54.21

- Tilray EV/Sales: 3.60

- HEXO EV/EBITDA: N/A

- HEXO EV/Sales: 1.532

Generally, values for EV/EBITDA of 10 or lower are seen as healthy for companies growing at the pace of the market, so that will serve as our worst-case. EV/EBITDA of 20 for a growing company for our base-case and EV/EBITDA for those opportunities available to Village Farms should they manage to capitalize on it we will use 40 for our best-case.

Sales should be normalized at $35 million per quarter, as $28.8 million sold in Q1 represents the slowest quarter for Village Farm’s marijuana segment. Any growth past that number will be part of the higher valuation assigned to the base and best-case scenario.

EBITDA should be normalized at $3.18 million per quarter, for the same reason as mentioned above as to why they should be higher than the current quarter would indicate.

Village Farm’s Marijuana Valuation

Worst Case:

- EV/Sales at 1: $140M USD

- EV/EBITDA at 10: $127M USD

- Marijuana valuation at worst case: $133.5M

Base Case:

- EV/Sales at 1.532: $214.48M USD

- EV/EBITDA at 20: $254.4M USD

- Marijuana segment valuation at base case: $234.4M

Best Case:

- EV/Sales at 3.6: $504M USD

- EV/EBITDA at 40: $508.8USD

- Marijuana segment valuation at best case: $506.4M

Combined Valuation and Expected Returns

Worst Case:

- Growth commensurate with the market, likely the company has been limited to the Canadian marketplace and their growth plans internationally are stalled.

- $299.10M USD or $3.38 per share

- Expected Return: 17.36%

Base Case:

- Growth matches what is expected within the industry and includes expansion into international markets with some limited success in the United States through their CBD platform.

- $400M USD or $4.52 per share

- Expected Return: 56.94%

Best Case:

- The United States and other major European markets legalize marijuana fairly quickly, and Village Farms is able to capitalize on their position in each major market.

- $672M USD or $7.59 per share

- Expected Return: 164%

Note: These valuations are what the company is worth today, meaning that the current valuation assumes no growth internationally or within the United States markets outside CBD. I believe that the base case is possible just with the platform they have today, and we would expect moderate EBITDA growth moving forward until legalization in the United States. Once there are a number of world markets open to marijuana, Village Farms has a platform to capitalize and be worth several multiples of where it trades today. Mr. Market disagrees, which is what makes investing so interesting.

Risks

Marijuana business remains limited to Canada: Village Farms has made expansion plans in Europe and in the Asia-Pacific region, along with ownership in a CBD sales in the US, should legalization in the rest of the world be delayed for any reason the growth that is required to maintain the valuations depicted might not be possible. They also need to capitalize on growing market presence outside of Canada, which can be a difficult game.

Inflation continues to hurt the business: Inflation is just a fancy word for higher prices but Village Farms lacks pricing power in their vegetable business, and competition in marijuana is fierce as larger competitors die a death by a thousand cuts. Village Farms requires natural gas, employees and supplies to run its business, and needs to be able to increase sales or prices to match. If inflation continues to affect their costs but competition prevents increasing their prices enough to compensate, we will continue to see share price pressure.

Zombie competitors: If companies like HEXO and Canopy Growth continued to get bailed out instead of being allowed to shutter their operations, prices will continue to be too low within the Canadian market. Smaller companies should continue to be amalgamated and closed down as the market matures, but these larger companies have nearly unlimited capital to keep them shuffling along until the US market is decriminalized.

Product and IP expansion slows: Part of the reason Village Farms has the business it does is that they have a good product portfolio and have been a leader in pricing and quality products. Continued innovation in all categories will be required to survive this difficult market, and there is no guarantee Village Farms will be able to manage it.

Wholesale market weakness: Village Farms is finding (and creating) a market for its goods in Canada, and part of that strategy is getting premium wholesale pricing for its products due to their high quality and Village Farms reputation in the industry. If those they supply are building out their own capacity, wholesale weakness will not soak up the extra supply that Village Farms is bringing online.

Conclusion

American multi-state operators (MSOs) are solid operations delivering in a market with one arm tied behind their back. Once legalization occurs there will be a tremendous push from the Canadian super-majors as they all try desperately not to fail before the legalization tide improves their prospects. MSO’s require legalization to begin participating fully in the equity market and banking industry, and the Canadian super-majors require the American market just to soak up all of their irresponsible production.

There is one name that has the door open to every market, including recently adding retail CBD services in the United States, that can operate without any hands tied behind its back, and is priced reasonable enough to allow investors to get in without the risk of a collapse should the U.S. stay a backwater developed nation in the marijuana market. Expansion internationally while continuing to take market share from failing super-majors and the illicit market alike within their home market. Approval for expansion overseas, as well as ownership stakes in companies in Europe and East Asia. In my opinion, the only operator in Canada worth a single investor penny is Village Farms International.

Be the first to comment