DKosig

Author’s note: This article was released to CEF/ETF Income Laboratory members on August 25th, 2022.

I recently wrote about the Vanguard International High Dividend Yield ETF (VYMI), a diversified index ETF focusing on international stocks with above-average dividend yields. The Vanguard International Dividend Appreciation ETF (NASDAQ:VIGI) is a similar fund, focusing on international stocks with long dividend growth track-records instead of yields.

Both funds are broadly similar choices, with similar fundamental characteristics and investment theses, but a couple of differences. VYMI is more diversified and yields more, with a 5.4% yield versus 2.1% for VIGI. VIGI’s dividends have grown quite a bit faster since inception, with a 13% dividend CAGR, versus 10% for VYMI. In my opinion, both VIGI and VYMI are buys, but VYMI is a slightly superior choice, due to its higher yield and greater diversification.

VIGI – Basics

- Sponsor: Vanguard

- Underlying Index: S&P Global Ex-U.S. Dividend Growers Index

- Dividend Yield: 2.1%

- Expense Ratio: 0.2%

- Total Returns CAGR (Inception): 7.4%

VIGI – Overview

VIGI is an international equity dividend growth index ETF. It tracks the S&P Global Ex-U.S. Dividend Growers Index, an index of these same securities. It is a relatively simple index, investing in all relevant international stocks with at least 7 consecutive years of dividend growth, subject to a basic set of inclusion criteria. It is a market-capitalization weighted index, although weights are capped at 4.0% to ensure a modicum of diversification.

In general terms, the fund’s underlying index is sound, simple, and quite broad, but somewhat out of sync with international equity market norms and fundamentals. There are comparatively few international companies with long, consistent dividend growth track-records, and these are less important in some foreign markets, for historical and governance reasons.

International companies are, sometimes, less able and willing to sustain their dividends through downturns when compared to U.S. companies. Dividend cuts are somewhat common, which means fewer holdings, lower diversification, and higher turnover rates, all negatives for the fund and its shareholders.

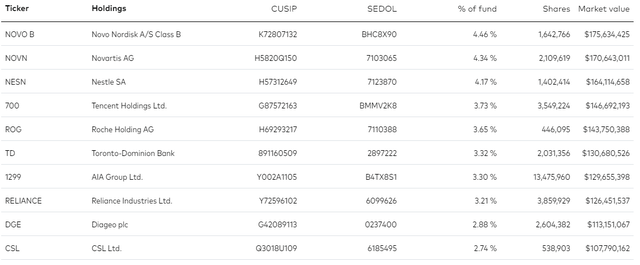

VIGI is a reasonably well-diversified fund, with investments in over one hundred securities from dozens of countries, and from all relevant industry segments. VIGI’s holdings tend to be well-known blue-chip international stocks, as these tend to be the only companies with the capacity and desire for consistent dividend payments. These include Novartis (NVS), Nestle (OTCPK:NSRGY), and Roche (OTCQX:RHHBY). Largest holdings are as follows.

VIGI

VIGI is somewhat overweight established developed markets like Canada, Switzerland and Japan, as these account for a relatively large proportion of more mature companies with longer dividend growth track-records. Canada also shares the same culture / governance around dividend payments as the U.S. Most Canadian companies try to grow, or at least sustain, their dividends through time.

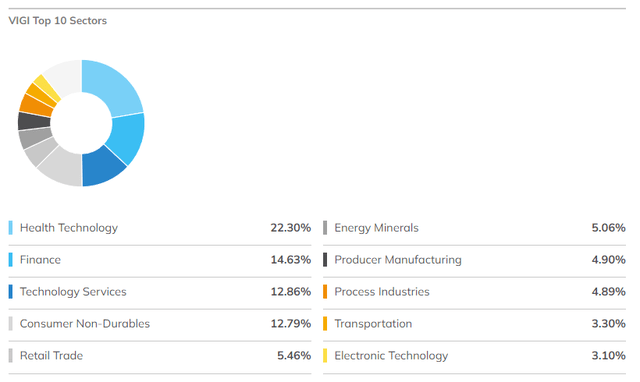

VIGI is somewhat overweight certain old-economy industries, including healthcare and financials, as these industries house most mature companies with long dividend growth histories. Conversely, the fund is underweight tech, as there are comparatively few tech companies with long dividend growth histories. VIGI’s industry exposures are quite similar to those of most dividend equity funds, although the fund’s healthcare exposure is somewhat higher than average. From what I’ve seen, this is simply because Novartis and Roche are relatively large healthcare companies which meet all relevant inclusion criteria.

ETF.com

VIGI’s diversified holdings provide investors with sufficient exposure to international stocks, although the fund is definitely materially less diversified than some of its peers, including VYMI, and the Vanguard Total International Stock ETF (VXUS). Investing only in companies with at least seven consecutive years of dividend payments means excluding many stocks, leading to less diversification. In my opinion, VIGI is still sufficiently diversified, but some investors might prefer funds with a greater number of holdings.

VIGI’s diversification also somewhat reduces the possible negative impact from excessive turnover. The fund simply invests in too many securities, industries, and countries for a single dividend cut and forced asset sale to have a significant impact on the fund’s performance.

VIGI – Dividend Analysis

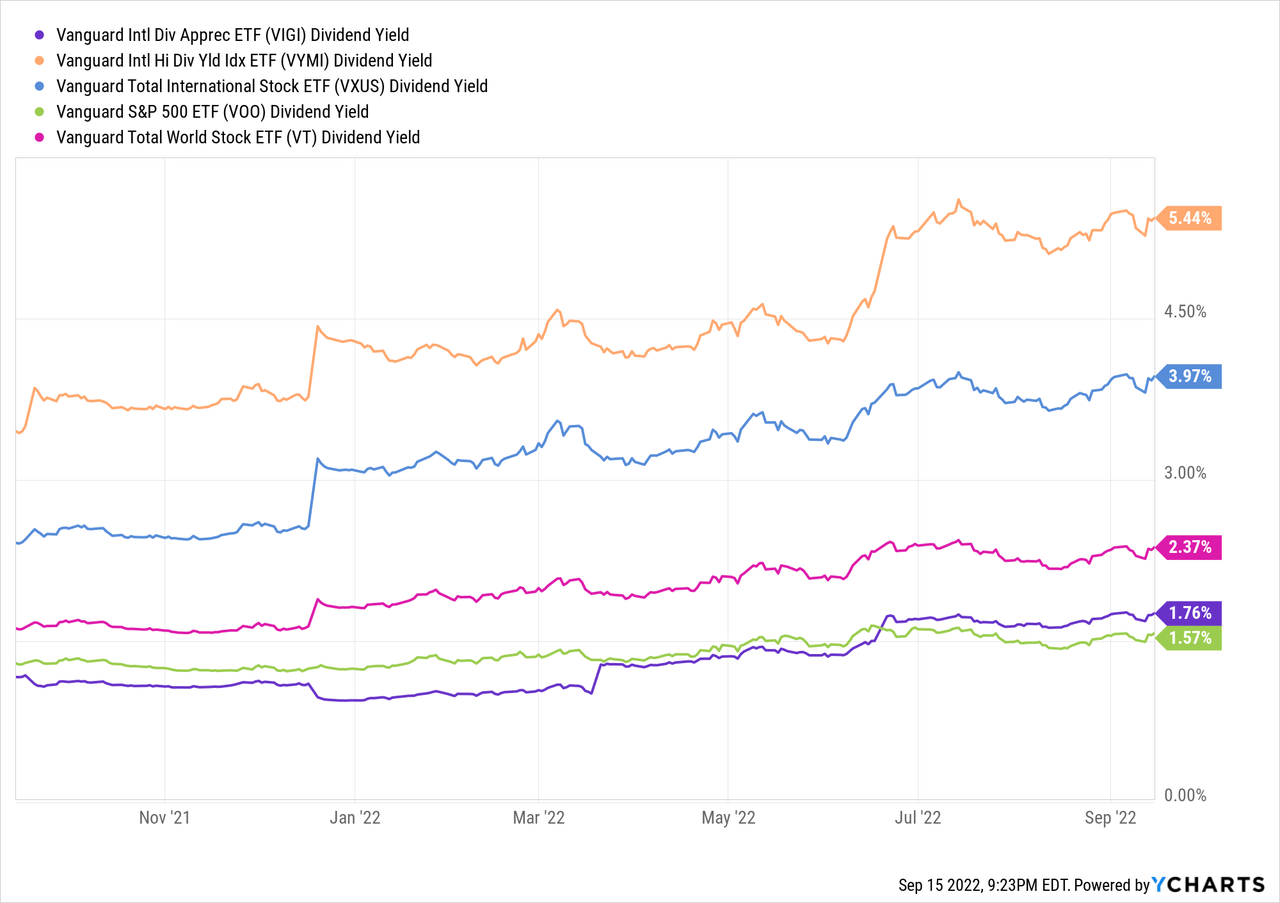

VIGI currently offers investors a 2.1% dividend yield, excluding a special distribution in late 2021. It is not a particularly strong yield, is slightly lower than average for an international equity fund, and quite a bit lower than VYMI’s 5.4% yield. It is slightly higher than that of most U.S. equity index funds, but the difference is quite small.

VIGI’s dividend growth track-record is stronger than average. From what I’ve seen, most equity and dividend equity ETFs see growth rates in the high single-digits. Low double-digit rates do sometimes occur, but rarely, and usually not for long. Only fund with a comparable dividend growth track-record is the Schwab U.S. Dividend Equity ETF (SCHD), which has seen annual dividend growth of 13% these past five years, matching VIGI. SCHD is an incredibly strong fund, with one of the strongest dividend growth track-records in the market, but VIGI matches said record, one of the few funds which does so.

VIGI’s dividend growth track-record is strong, amongst the best in its peer group, and a benefit for the fund and its shareholders. The fund’s low yield does significantly blunt the benefits of said growth, as it would take many years for the fund’s meager 2.0% yield to grow

VIGI – Performance Analysis

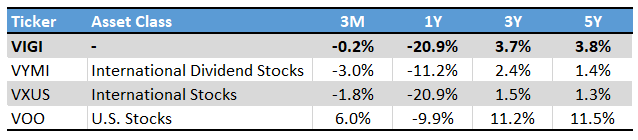

VIGI’s performance track-record is reasonably good, for an international equity fund, at least. VIGI has outperformed relative to its peers since inception, and for most relevant time periods. Outperformance was due to focusing on comparatively high-quality companies like Novartis and Roche, which outperformed relative to international equity indexes, and due to fewer investments in smaller, underperforming companies. VIGI’s performance was particularly strong between 2019 and 2020, in the run-up and aftermath of the coronavirus pandemic.

On a more negative note, the fund has underperformed relative to U.S. equity indexes since inception, and for most relevant time periods. U.S. equities have outperformed international equities and equity funds for quite a few years now, and VIGI was no exception.

VIGI’s performance is as follows.

ETF.com -Chart by author

Although the table above is accurate, I believe it somewhat exaggerates the fund’s relative performance, due to timing issues. International equity performance looks particularly mediocre for these past five years, less so if you contract or expand the time period analyzed.

VIGI – Valuation Analysis

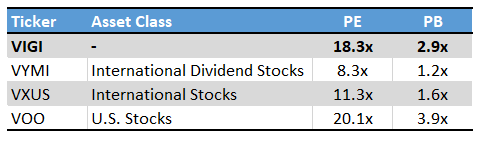

VIGI currently sports a P/E ratio of 18.3x, and a P/B ratio of 2.9x. Both are relatively average, normal figures on an absolute basis, although significantly higher than average for an international equity fund. On the other hand, the fund’s valuation is slightly cheaper than that of most U.S. equity indexes, including the S&P 500.

Vanguard – Chart by author

Other international equity funds trade with cheap valuations, and so offer investors strong potential capital gains. This is not the case for VIGI, an important disadvantage of the fund relative to its peers.

Conclusion

VIGI offers investors diversified exposure to international equities with strong dividend growth track-records. Although the fund is a reasonable investment opportunity and a buy, VYMI is a slightly superior alternative, due to the latter’s higher yield, greater diversification, and lower turnover rate.

Be the first to comment