AlexanderFord/E+ via Getty Images

It can be exciting to invest in cutting-edge industries. One great example would be the smart building space. As technology advances, the ability to integrate it into our homes and other buildings has opened up some interesting avenues to explore. However, this space is still rather risky and some players in it might not make sense to buy into at this time. One great example of a rather risky prospect is View, Inc. (NASDAQ:VIEW). In recent years, revenue growth from the company has been impressive. That trend looks set to continue this year. However, cash flow has been significantly negative and recent data shows little hope that this picture will change for the better. With even management saying during their last annual report that the company’s ability to survive is in doubt, investors would be wise to tread cautiously moving forward.

A niche smart building play

According to the management team at View, the company produces products centered around the smart building space. These particular products are centered around what management calls ‘smart glass’, which the firm has broken up, for the purpose of discussing the business opportunity, into three separate components. The first would be the insulating glass unit that the company sells. These are double or triple pane glass windows that utilize artificial intelligence to automatically adjust in response to the sun. This enables them to increase access to natural light and views while minimizing heat and glare. There are also other use cases for these windows. For instance, the company can use the glass to create immersive displays that transform smart glass into transparent, digital, and interactive surfaces that can enable video conferencing, content creation, entertainment, and more. Under the smart protect brand, the company offers a cloud-connected, software-based glass break detection system for customers who want it.

Of course, the glass itself is only one piece of the pie. It is true that the glass is special, since it has a micrometer semiconductor or electrochromic coating to it, depending on the desired use case. But there are other pieces of the pie required in order for the company’s technology to work. It also offers network infrastructure that consists of controllers, connectors, sensors, and cabling. This is the second of the three components I mentioned previously. And finally, there is the software component. This includes the predictive algorithms, artificial intelligence, remote management tools, and user-facing apps that help to control the tent of the glass in question.

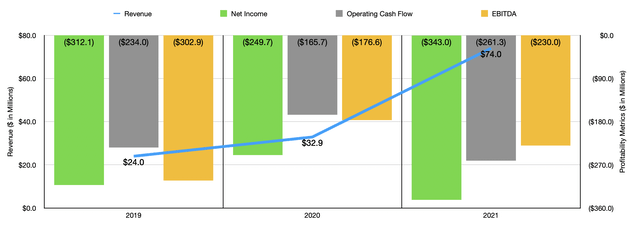

Over the past three years, the management team at View has done a really good job to grow the company. Revenue expanded from $24 million in 2019 to $74 million in 2021. Some of this revenue growth came from the 26.8% rise in revenue associated with its smart glass products. However, the company also saw $28.7 million, up from nothing a year earlier, associated with the smart building platform that it provides. It also enjoyed another $3.6 million in revenue associated with smart building technologies. For context, the smart building platform refers to the complete interrelated and integrated platform that the company produced that combines its smart glass with the fabrication and installation of the framing for the glass, as well as other related components, all in one.

Although the company did see a nice increase in revenue, profitability moved in the other direction. The company went from generating a net loss of $312.1 million in 2019 to a loss of $343 million last year. Operating cash flow followed a similar trajectory, going from negative $234 million to negative $261.3 million. Meanwhile, EBITDA improved only marginally, turning from a negative $302.9 million to a negative $230 million. The only thing that has proven somewhat helpful is the fact that the company currently has cash in excess of debt in the amount of $114.5 million. But that’s a fairly small amount of cash in the grand scheme of things.

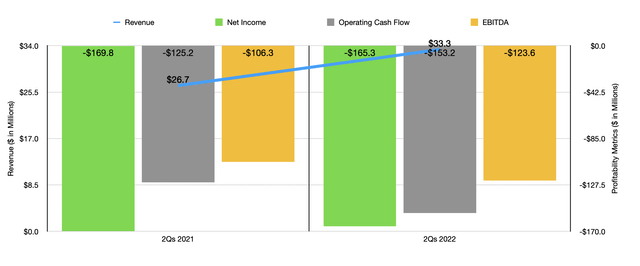

Unfortunately, the pain for the business has continued into the current fiscal year. Revenue of $33.3 million in the first half of the year translated to a year-over-year increase of 24.7% compared to the $26.7 million generated the same time last year. The net loss of the firm improved only slightly, turning from $169.8 million to $165.3 million. On the other hand, operating cash flow worsened from negative $125.2 million to negative $153.2 million. Even EBITDA continued to get worse, turning from negative $106.3 million to negative $123.6 million.

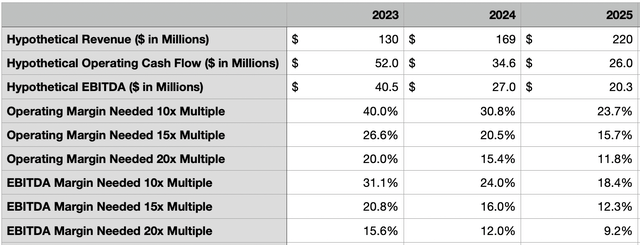

When it comes to the 2022 fiscal year as a whole, management expects growth to continue. The current expectation is revenue of between $100 million and $110 million. Unfortunately, we don’t know what profitability might look like. But more likely than not, it will be significantly negative. You also can’t really value a company based on negative fundamental results. But what you can do is ask what kind of profitability would be required in order to justify the company’s current valuation. To do this, I assumed that revenue would continue growing at a rate of 30% per year for the next three years. I also decided to look at fair value multiples for the price to operating cash flow approach and the EV to EBITDA approach of 10, 15, and 20.

What I found by taking this approach, as the tables here illustrate, is that investors have to be banking on a significant improvement in the company’s bottom line, with some scenarios illustrating margins as high as 40%. Naturally, this is unlikely. But some of the more aggressive pricing scenarios, such as a world in which growth has continued at a rate of 30% per year while the market accepts a trading multiple of 20 for both the price to operating cash flow approach and for the EV to EBITDA approach, could result in a favorable outcome for investors. But when you consider just how far apart this required profitability is from the kind of cash flow picture of the company today, such an outcome seems incredibly unlikely. At the very least, it’s almost certain investors could find a better opportunity with much lower risk elsewhere.

Takeaway

Based on the data provided, I will say that while I appreciate what View is working on, I do not think the company has any real upside potential for the foreseeable future. Though revenue will likely continue to grow, profits and cash flows are problematic. And at the end of the day, that’s ultimately what matters for investors. Overall, I feel comfortable rating the company a ‘sell’, reflecting my belief that it is very likely to underperform the market for the foreseeable future.

Be the first to comment