sharrocks

Overview

The Vanguard FTSE Europe ETF (NYSEARCA:VGK) provides diversified exposure to European companies. The fund seeks to track the performance of the FTSE Developed Europe All Cap Index.

As of 10/31/2022, the fund was invested in 1361 different holdings which includes popular names such as Nestlé SA (OTCPK:NSRGF)(OTCPK:NSRGY) and Roche Holding AG (OTCQX:RHHBY)(OTCQX:RHHBF).

The fund has an expense ratio of 0.08% per annum which is remarkably cheap and a hallmark of Vanguard ETFs.

Fund performance

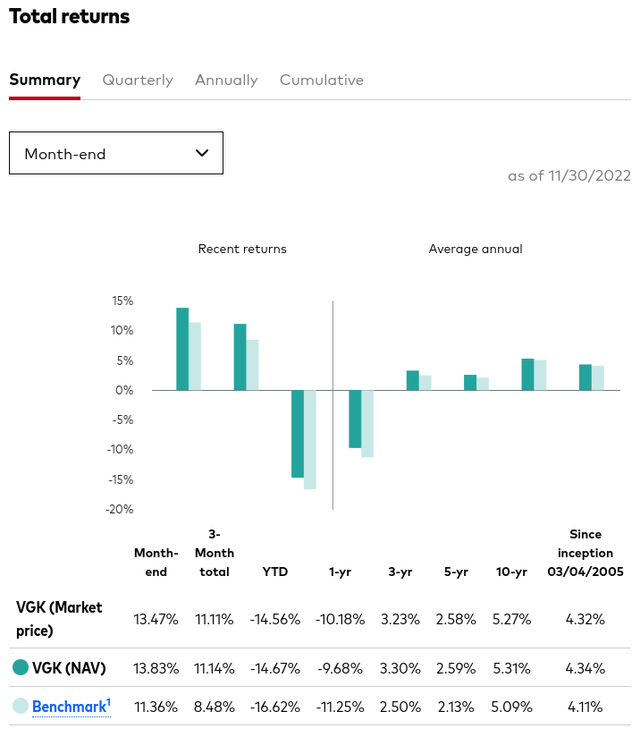

The VGK fund has returned 4.32% per annum since its inception in 2005, slightly outperforming its benchmark by 0.21%.

Overall, the return has been quite poor compared with the S&P 500 average return of 11.88% per annum since 1957. Investors have not been compensated for the higher risk involved with a foreign investment.

The fund’s performance can be seen below:

Vanguard

Portfolio

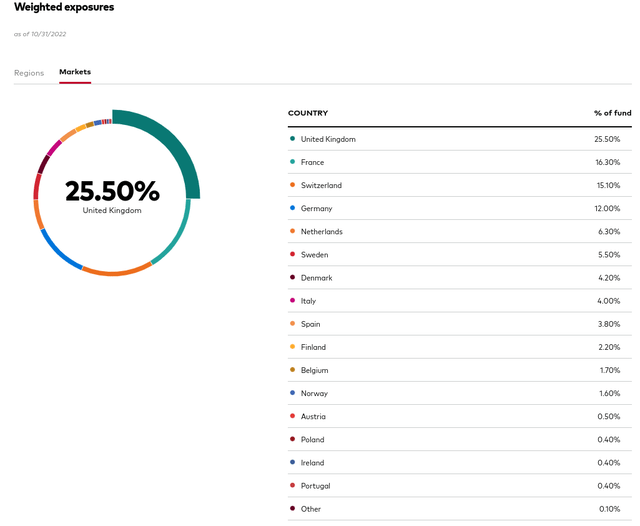

The VGK fund is regionally diversified across multiple countries in Europe. The fund is heavily weighted towards the United Kingdom which constitutes 25.5% of the portfolio exposures.

Combined with France (16.3%), Switzerland (15.1%) and Germany (12.0%), these 4 countries represent nearly 70% of the portfolio.

On the other hand, the fund has less than 1% exposure to Portugal and Ireland combined.

The fund’s regional exposure breakdown can be seen below:

Vanguard

European Economic Outlook

The Russian invasion of Ukraine has destabilized European economies. The region is suffering from a severe energy crisis which has caused high and persistent inflationary pressures.

Central banks have been tightening monetary policy to bring inflation down in line with their objectives and targets.

A mixture of high inflation and rising borrowing costs have depressed household real incomes. Against this backdrop, the European economic outlook has worsened considerably.

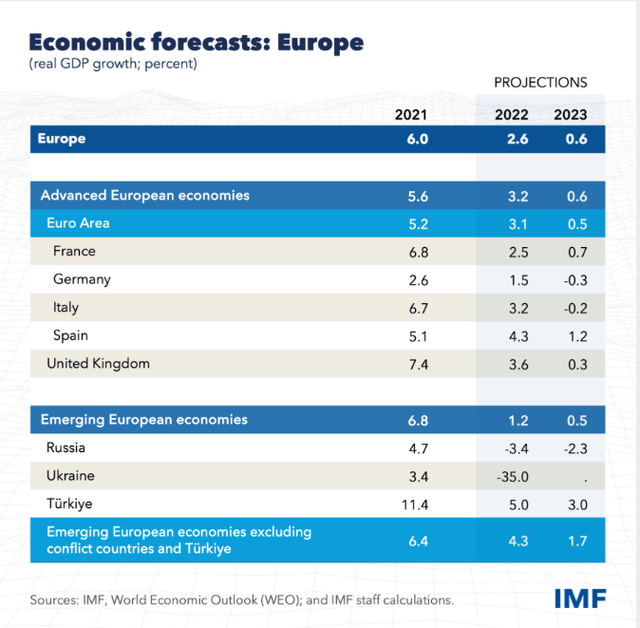

According to the IMF, real GDP growth in advanced and emerging European countries is forecast to fall to 0.6% and 1.7% in 2023 respectively.

IMF

Inflation risks

The IMF expects inflation to decline to 6% and 12% next year in advanced and emerging European economies respectively.

However, the IMF highlights two risks to their forecasts. The first being a potential de-anchoring of medium-term inflation expectations and second, a wage-price spiral.

The first scenario can occur if the ECB loses credibility in its ability or determination to quench inflation.

If people lose confidence in the central bank, it can cause a re-adjustment of inflation expectations and prolong the inflationary period.

In the second scenario, a wage-price spiral occurs when inflation is high and workers demand higher wages, which can create a self-reinforcing loop which sustains inflation.

A wage-price spiral is a massive risk to financial stability and can be very difficult to stop.

Case study: Signs of a wage-price spiral in the United Kingdom

The United Kingdom is the fund’s largest regional exposure. The country has been going through one of the worst cost-of-living crises, deepened by the loss of its biggest trading partner from Brexit.

The UK faces the largest wave of industrial action from trade unions since the 1980s. Strike Map, a campaign group, has mapped nearly 6,000 strikes this year.

Industrial action is expected to create a massive disruption to the UK economy.

This week the RMT rail union, one of the fastest growing trade unions in the UK covering the transport sector, announced a series of rail strikes for December after rejecting a 9% pay offer from the UK government.

The risk in such a scenario is that if workers and firms start setting wages based on current inflation rather than central bank targets, it might cause a wage-price spiral.

Central banks are worried about a wage-price spiral as it will only increase the eventual cost of bringing down inflation, which will cause more harm to workers in the long term.

Conclusion

An examination of wage dynamics in the UK suggests there are clear signs of a potential wage-price spiral.

Other European economies, like the UK, are suffering from a similar toxic mix of high inflation and slowing growth which suggests that a wage-price spiral remains a risk for Europe.

Investors should monitor the risk of a wage-price spiral carefully as it creates upside risks to inflation forecasts and is a potential disruption to financial stability.

Considering the risks of a potential wage-price spiral, I would suggest a Hold rating for the VGK fund at the moment.

Be the first to comment