FG Trade

Veru Inc. (NASDAQ:NASDAQ:VERU) has an interesting business profile due to its combination of a relatively stable sexual health division and growth opportunities in oncology and Covid-19 treatment, but this seems to be reflected in its valuation while risks of disappointment should not be overlooked.

Veru – An Overview

I’ve covered this company many years ago, when it was named Female Health Company and only focused on the FC2 female condom. In 2016, the Female Health Company acquired the unlisted company Aspen Park, forming the current Veru HealthCare.

Business combination (Veru)

The Female Health Company was a profitable, debt free and cash flow generating company, even though of a small size, while Aspen Park had a strong pipeline of products under development in the men’s health and oncology segments. However, the Female Health Company was a single product company selling the FC2 female condom, and management wanted to further diversify the business and the purchase made sense, as it increased its upside potential over the long term.

This means that after the merger, Veru was a combination of a relatively stable business plus the potential of several drugs under development that required significant investments (research & development expenses) that could be financed from the FC2 segment, making the combined Veru Healthcare more attractive for shareholders.

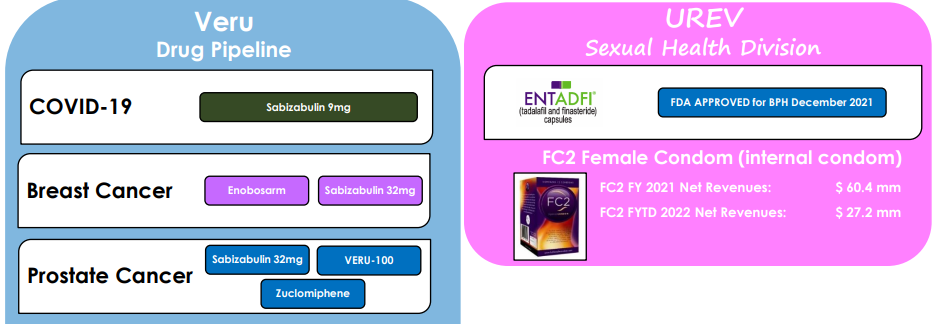

Nowadays, Veru is a biopharmaceutical company with two major segments, namely the Sexual Health Division, which includes its legacy FC2 female condom business, and its Drug Pipeline segment. Veru continues to be focused on developing drugs for cancer, but also has expanded to Covid-19 treatments as shown in the next graph.

Business Profile (Veru)

Even though Veru is still a relatively small company, its current market value is close to $1.3 billion, a much larger value than when I previously covered the company as the Female Health Company (around $250 million), showing that its strategy of changing its business profile has been recognized by the market as having more value over the long term.

Business Profile & Growth

Despite the company’s efforts to change its business profile, Veru is still financially very dependent on its Sexual Health Division to generate revenue and cash flow. This cash flow is then used to fund the clinical development of its drug pipeline, which is targeted for much larger market opportunities.

Even though, historically, Veru remained heavily exposed to the FC2 female condom, this profile is expected to change gradually over the coming years. Indeed, in the Sexual Health Division Veru has now two products, after the approval in December 2021 of its drug ENTADFI, a new treatment for benign prostatic hyperplasia. This is a great milestone for the company, and a positive signal that its strategy of investing revenue generated in its Sexual Health Division in other drugs is working, allowing Veru to internally finance, at least in part, its R&D requirements without relying only on raising additional cash from shareholders.

In the Sexual Health Division, Veru sells its FC2 female condom, an FDA-approved product, around the world for the protection against unplanned pregnancy and the transmission of sexually transmitted infections. The vast majority of its customers are in the public sector and this business has been profitable since 2006, which bodes well for future revenue and cash flow generation.

Regarding its growth prospects, these are mainly related to Veru’s drug pipeline, which is mainly focused on developing drugs for two of the most prevalent cancers, namely breast and prostate cancers. In this area, the company has several drugs in late-stage clinical pipeline, which potentially may come to the market over the next two to three years.

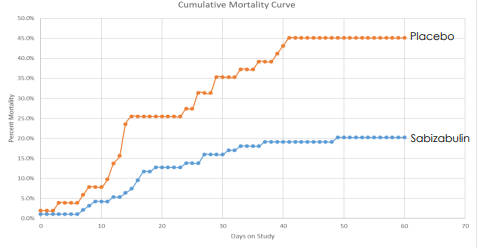

Beyond cancer, Veru is also using its anticancer drug (sabizabulin) for the potential treatment of hospitalized Covid-19 patients, which have a high risk of developing acute respiratory distress syndrome (ARDS). Sabizabulin has dual antiviral and anti-inflammatory effects and has provided good indications of its efficiency, reducing the mortality rate considerably compared to patients treated with placebo.

Mortality data (Veru)

This means that it may have a good chance of being approved in the U.S. and abroad for treatment of Covid-19 patients in hospitalization, which may happen in the coming months. However, there are some concerns about the data used in the approval process for sabizabulin, and the FDA has recently scheduled an Advisory Committee meeting for next October, thus it is not certain that Veru’s therapy for Covid-19 treatment will be approved.

Financial Overview

Regarding its financial performance, Veru has delivered a growing revenue path over the past few years, with revenue increasing from $18 million in fiscal year (FY) 2018, to a record amount in FY 2021 of $61.3 million. This strong increase in revenue was mainly justified by higher revenue in the U.S., which accounted for only about 9% of total revenue in 2017, but increased to close to 80% in FY 2021. This is explained by the company’s strategy in 2017 to make the FC2 available by prescription, and to move its offering to telemedicine partners instead of having its own marketing and sales program.

Moreover, beyond growing revenue, Veru was also able to report a net profit in the last fiscal year, of about $7.4 million. While this is a small profit, it shows that Veru’s business model and strategy are sound, given that it was also able to increase its R&D expenses ($32 million in FY 2021 vs. $16.9 million in the previous year) and report a profit at the same time.

Nevertheless, at this time, Veru remains focused on generating revenue to fund its R&D expenses rather than seeking to increase its profitability, a strategy that makes sense on a long term perspective. This also means that, despite reporting a positive bottom line, Veru did not pay dividends and is not expected to change this policy in the near term.

During the first nine months of FY 2022 (October 2021 to June 30, 2022), Veru reported revenue of $36.8 million, representing a decrease of 19% YoY, as sales were hurt by a business slowdown in telemedicine customers. Despite that, R&D expenses increased to $43.8 million, compared to $24.4 million in the first nine months of FY 2021, which led to a net loss of $42 million during the period. At the end of June, the company had about $100 million in cash, which seems sound for the next few quarters.

Going forward, Veru expects to start generating revenue from the launch of ENTADFI, which is now commercially available, in the coming quarters, which will allow it to grow revenue and have a more diversified revenue and cash flow stream. Management expects this product to have some $200 million annual sales potential, but at this time it is difficult to quantify how much revenue Veru will generate from this product over the next few years.

Nevertheless, according to analysts’ estimates, Veru should increase its revenue from $48 million in FY 2022, to $110 million in 2023, $277 million in 2024 and about $450 million by 2025. These are impressive growth rates, but investors shouldn’t be too excited given that these estimates are dependent on product approvals, that are always unpredictable.

Conclusion

Veru has changed its business profile significantly since my previous coverage many years ago. I like its strategy of having a relatively stable and profitable business as a funding source for its R&D expenses in areas with higher potential, namely oncology and Covid-19 treatment.

The fact that Veru received approval of a second product is a great step forward in its growth path, but its current valuation seems to be too high for its current financial and risk profile, considering that there is a significant risk that sabizabulin may not be approved for Covid-19 treatment. Therefore, I think investors should remain on the sidelines on Veru for the time being, at least until there is more certainty about the prospects of sabizabulin as an effective Covid-19 treatment.

Be the first to comment