tommaso79/iStock via Getty Images

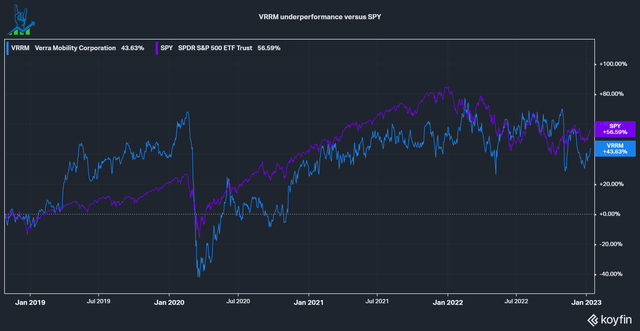

Verra Mobility (NASDAQ:VRRM) is a global leader in technology-enabled transportation solutions. The company’s innovative products and services help make roads safer, reduce congestion, and improve the overall transportation experience for drivers, municipalities, and other organizations like car fleets from companies like Hertz (HTZ). In this article, I will look closely at Verra Mobility’s business model, moat, and problems. So far, Verra has underperformed the S&P 500 since its IPO, partially due to the pandemic, but perhaps the future looks brighter.

VRRM underperformance versus SPY (Koyfin)

Business Model

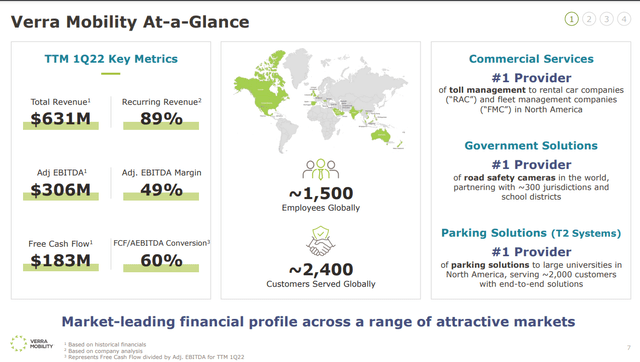

Verra operates in three major segments:

- Commercial Services account for 42% of revenues, including toll services, violation processing and registration automation.

- Government Solutions account for 46% of revenues, including red-light safety, transit bus lane enforcement and similar services.

- Parking Solutions account for 12% of revenues, including SaaS applications and services around the physical hardware, i.e., parking ticket machines.

We can see that the company has a diversified portfolio around a similar topic. Verra has built a strong moat in all its segments, which shows in its financials: 89% of revenues are recurring and the company has long-standing relationships with Universities, Municipalities and Cities, resulting in a 95%+ retention rate, with Government Solutions even at 98%. If we invert the retention rate, we get at least a 20-year customer relationship on average. Furthermore, the company has high margins due to the asset-light and scalable nature of the business and they manage to convert 60% of EBITDA into Free Cash Flow.

Verra Mobility at a glance (VRRM investor day)

What’s the moat?

Let’s find out what moat Verra has and why their business is so sticky. Local governments are incentivized to build out tolling stations as fuel taxes keep declining due to the shift to EV and fuel cost efficiencies. The company expects this to result in an 11% CAGR in toll revenue in the US. Verra offers a solution that automates these tolling stations and enables cashless payments, where Verra gets a transaction cut. Cashless tolls are currently at 64% versus 50% pre-pandemic, according to the company and every increase in cashless tolling gives the company 100% incremental revenue gains.

The company also automates police enforcement for things like speeding tickets, which saves up hundreds of hours of bureaucratic police work, that can be spent better, a no-brainer investment for local governments. The same applies to rental car fleets, where the company handles the registration of new cars and the toll payments, enabling the rental company to focus on what matters.

The business has a high barrier to entry due to the high amount of bureaucracy that is required. Over decades the company built relationships and gained the trust of the local municipalities and authorities that need to be integrated and maintained into the system. The regulatory landscape also isn’t fixed; on a local level, laws change constantly. A competitor would have a lot of work to do before being able to offer a similar solution. On the flip side, this also makes them vulnerable to regulations on a local level. For their Government solutions, they also have to install Cameras, which are the company’s primary source of Capital Expenditures. A competitor can’t just put their cameras next to Verra’s and would first need approval from local governments, which is unlikely and creates many regional monopolies for Verra Mobility.

Executive compensation

Executive compensation is a vital part of the incentive structure in a company, so let’s look at VRRM’s proxy.

Verra came public through a SPAC in 2018, so there are still funds owning stakes in the company; besides, the insiders own just 0.57% of the company, less than we’d want to see, especially for a small company like VRRM.

VRRM compensates its directors with a cash salary, an annual and long-term incentive programs vested over four years. 80% of the compensation is at-risk and depends on the company’s performance, aligning management and shareholder interests.

The annual incentive is split between revenue growth (20%), Adjusted EBITDA growth (50%) and individual performance goals (30%). Overall this is a fine structure, but I’d prefer if we used Free Cash Flow instead of adjusted EBITDA, a metric that can easily be abused. The long-term incentive is based on the total shareholder return of the stock compared to a peer group. I’d prefer if it would incorporate return on capital in any form, but this is a standard long-term incentive.

Overall, the incentive structure looks okay, but I’d have hoped for higher insider ownership and a better profitability metric like FCF.

Culture as a problem?

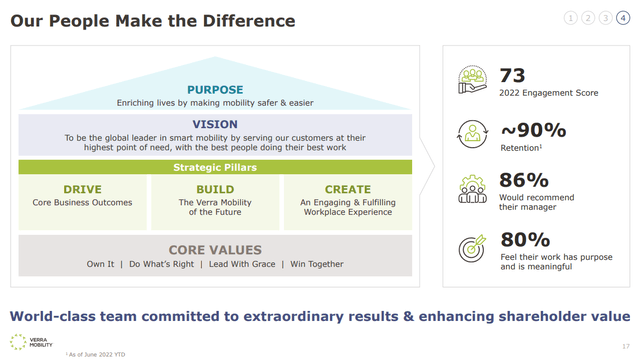

At its investor day, Verra pointed its culture out “to make the difference” with high retention and engagement scores; 86% of people would recommend their manager and 80% feel like their work is meaningful. It is hard to verify a company’s culture, but looking at the company’s Glassdoor is a good proxy in my opinion. The Glassdoor rating showed a very different picture: A total score of 3.4, with 56% recommending to a friend and 66% approving of the CEO, is average at best, in my opinion. Furthermore, the reviews show a lot of angry current and ex-employees that are unhappy about a toxic, discriminatory work environment. HR, in particular, is pointed out as a problem, with the Chief People Officer being pointed out as the problem in several reviews over many years. (Here are three examples of the kind of reviews I mean: Glassdoor Review 1, Glassdoor Review 2 and Glass Door Review 3.) Management is also often called short-sighted. This makes me doubt the excellent culture management claims to have, but this is hard to verify from the outside.

VRRM culture (VRRM investor day)

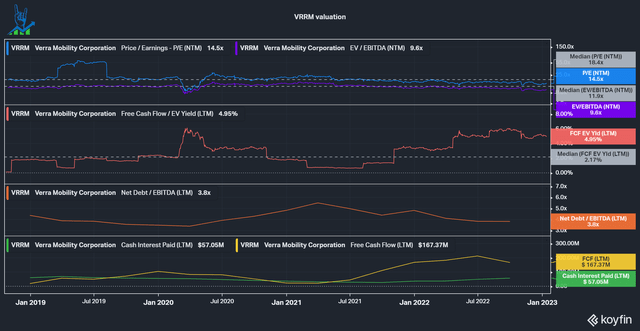

Valuation

Verra is trading at a cheap valuation based on historical multiples and EV/FCF yield, but the debt is a problem in my eyes. The company has aggressively pursued M&A over the last years during low-interest rates and took on $1200 million in debt, with $900 being flexible rates at LIBOR + 325 bps (right now, around 8% interest rate). This will significantly increase interest payments with rising rates and eat further into FCF. The company’s growth path relies heavily on aggressive share repurchases and opportunistic M&A (15% FCF/share growth was guided at the investor day), which gets increasingly more challenging if their FCF is being eaten away by interest payments. The company realized this issue last November and wants to bring debt down to 3.0x, an improvement but still too leveraged for me.

Risks

Verra Mobility has some risks that Investors have to consider:

- The company could face trouble from a regulatory point of view, due to its large government business. Especially in New York, the company has a large customer concentration.

- The commercial side of the business correlates with air travel because a lot of rental car demand is based in airports. Customer concentration is high between the three big rental car companies.

- Due to increasing interest payments, the large debt position and especially the $900 million in flexible debt pose a threat to the company’s ability to reinvest its free cash flow.

- The culture could be toxic if we can believe the Glassdoor reviews. This is very hard to verify, so take this point with a grain of salt.

Conclusion

Overall, I like Verra Mobility a lot, but the aforementioned risks keep me from buying. However, I will still rate it as a buy due to the valuation and fundamentals. As part of an extensive diversified portfolio, I could see a place for Verra, but there are too many question marks for my concentrated portfolio. I will continue to cover the company and maybe these question marks will resolve in the future. What do you think about Verra Mobility? Do you think it’s worth owning despite the risks? Let’s continue the discussion in the comments below.

Be the first to comment