metamorworks

A Quick Take On Verra Mobility

Verra Mobility (NASDAQ:VRRM) reported its Q2 2022 financial results on August 2, 2022, beating expected revenue and EPS estimates.

The company sells transportation safety systems and parking management solutions worldwide.

While VRRM’s government segment is growing well, I’m cautious about its other segment growth outlook given a slowing U.S. economy and consumer retrenchment.

I’m on Hold for VRRM in the near term.

Verra Mobility Overview

Mesa, Arizona-based Verra was founded in 2016 to provide smart mobility technologies to customers in the U.S., Europe, Canada and Australia.

The firm is headed by President and Chief Executive Officer David Roberts, who joined the firm in August 2014 and was previously CEO of BillingTree, an electronic payment company.

The company’s primary offerings include:

-

Commercial & Fleet Services

-

Government Solutions

-

Parking Solutions

The firm acquires customers through its direct sales and marketing teams as well as through partner referrals.

Verra Mobility’s Market & Competition

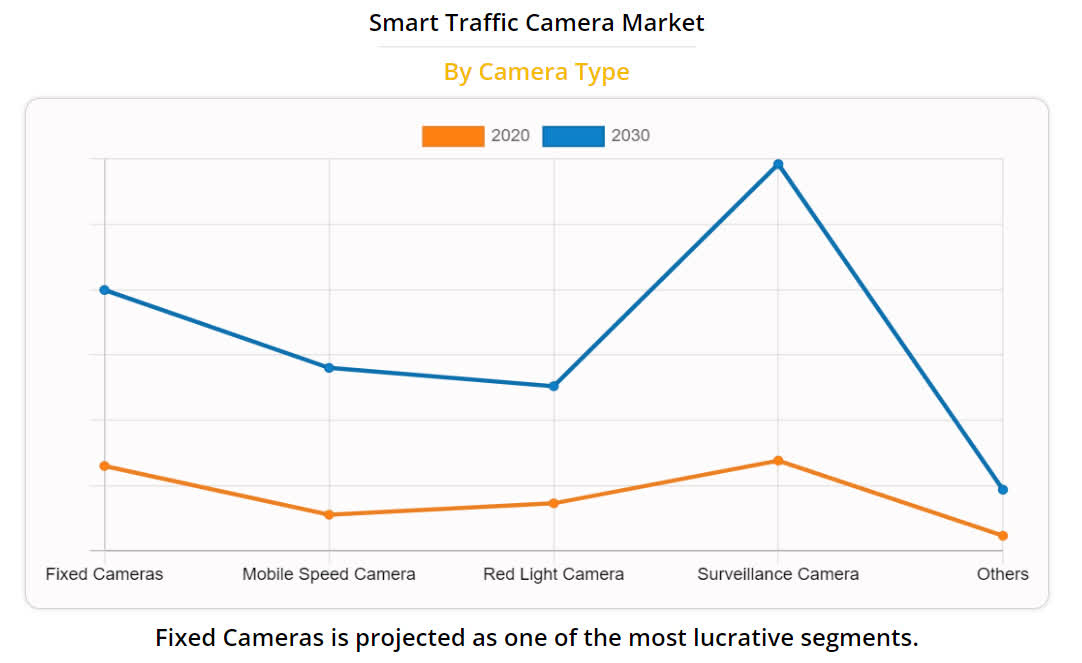

According to a 2021 market research report by Allied Market Research, the market for smart traffic camera technologies was an estimated $8.36 billion in 2020 and is forecast to reach $32.3 billion by 2030.

This represents a forecast CAGR of 14.6% from 2021 to 2030.

The main drivers for this expected growth are an increasing demand for higher efficiency transportation systems and growing urbanization in regions around the world.

Also, below is a chart showing the respective growth trajectories of the various elements of global smart traffic camera markets:

Smart Traffic Camera Market (Allied Market Research)

Notably, fixed cameras will likely represent the most profitable segment while the surveillance camera segment is forecast to see the highest market share.

Major competitive or other industry participants include:

-

Allied Vision

-

Axis Communications

-

E Com Systems

-

Jenoptik

-

Flir Systems

-

Hikvision

-

Tattile

-

Imperx

-

Teledyne Dalsa

-

Siemens

-

Idemia

-

Motorola Solutions

-

Redflex

-

Sensys Gatso Group Ab

-

Vitronic GmbH

The company operates in other smart mobility markets.

Verra Mobility’s Recent Financial Performance

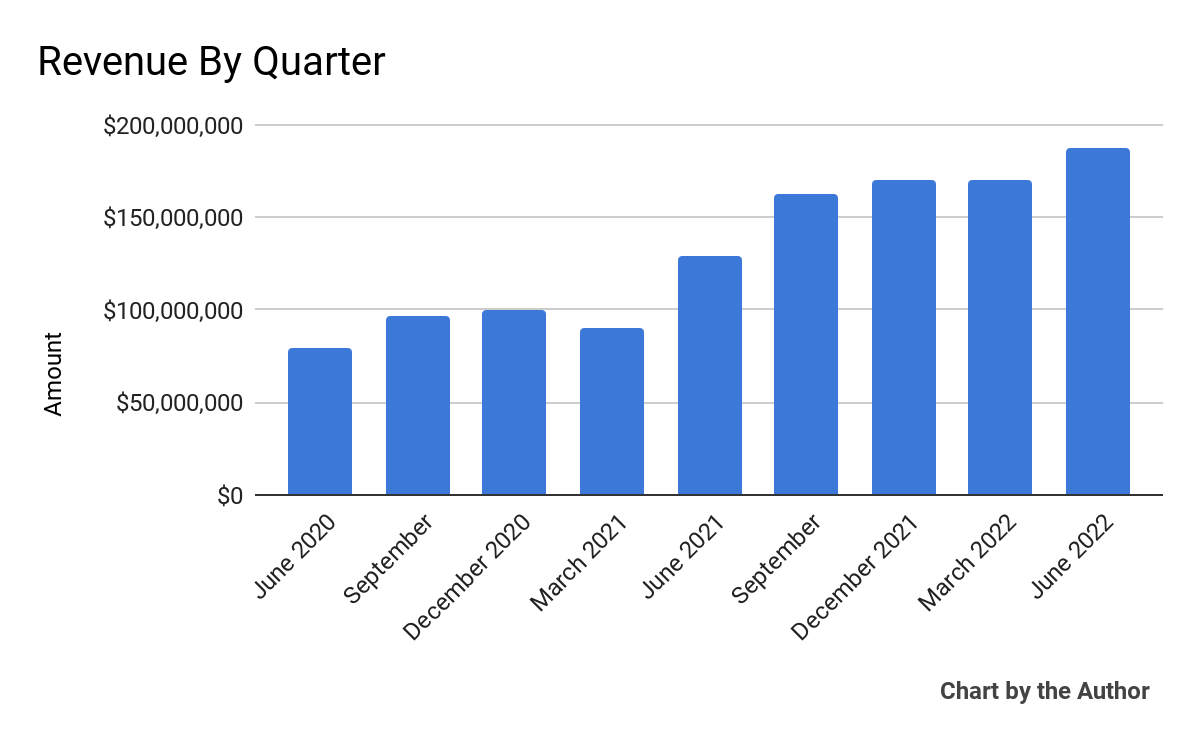

-

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

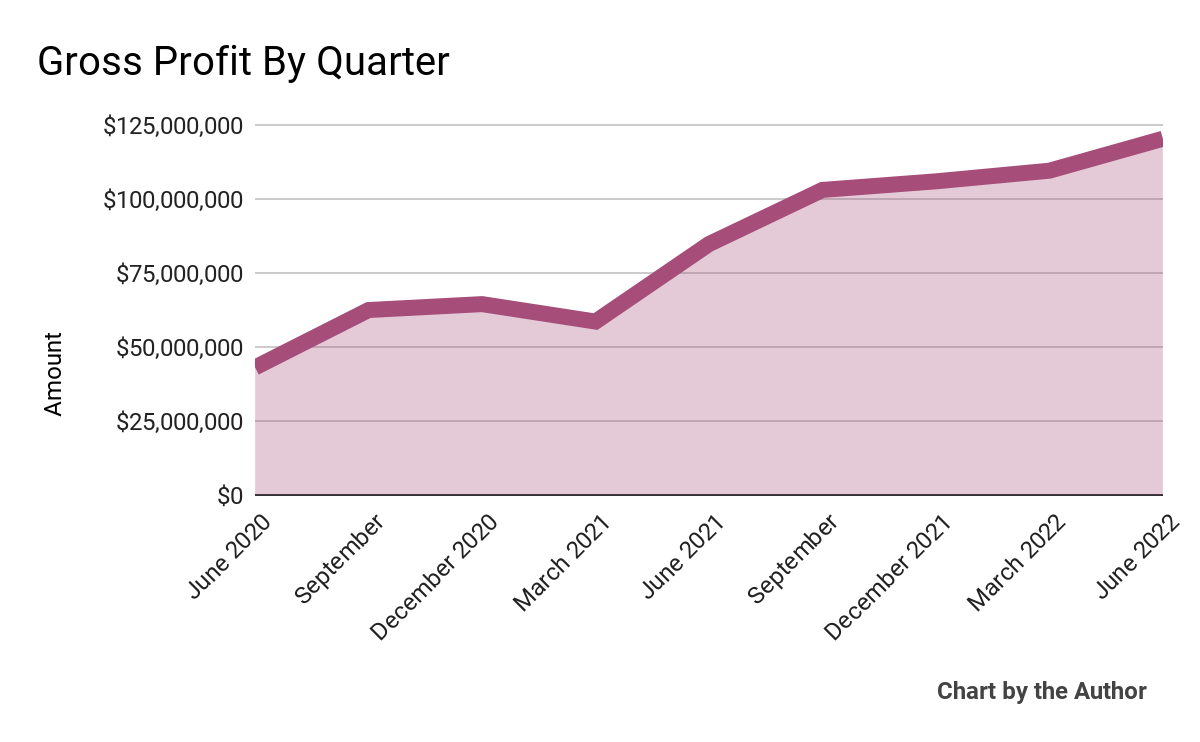

Gross profit by quarter has also grown accordingly:

9 Quarter Gross Profit (Seeking Alpha)

-

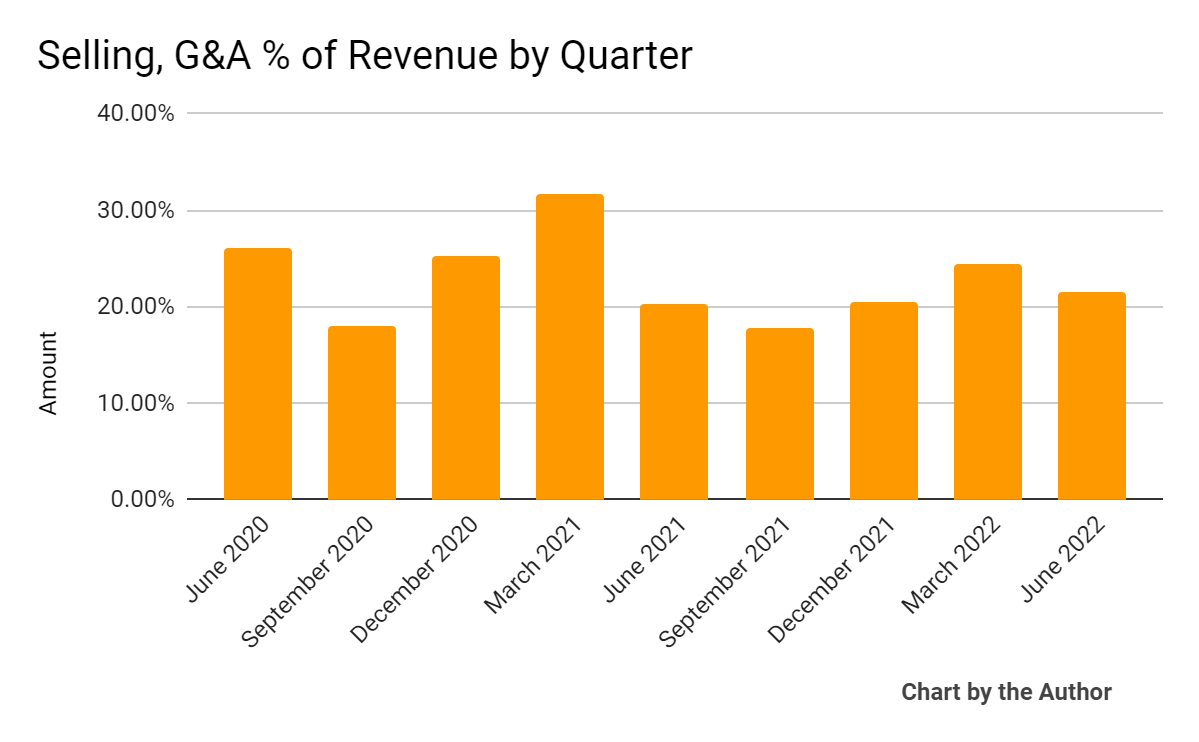

Selling, G&A expenses as a percentage of total revenue by quarter have remained in a narrow range in recent quarters:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

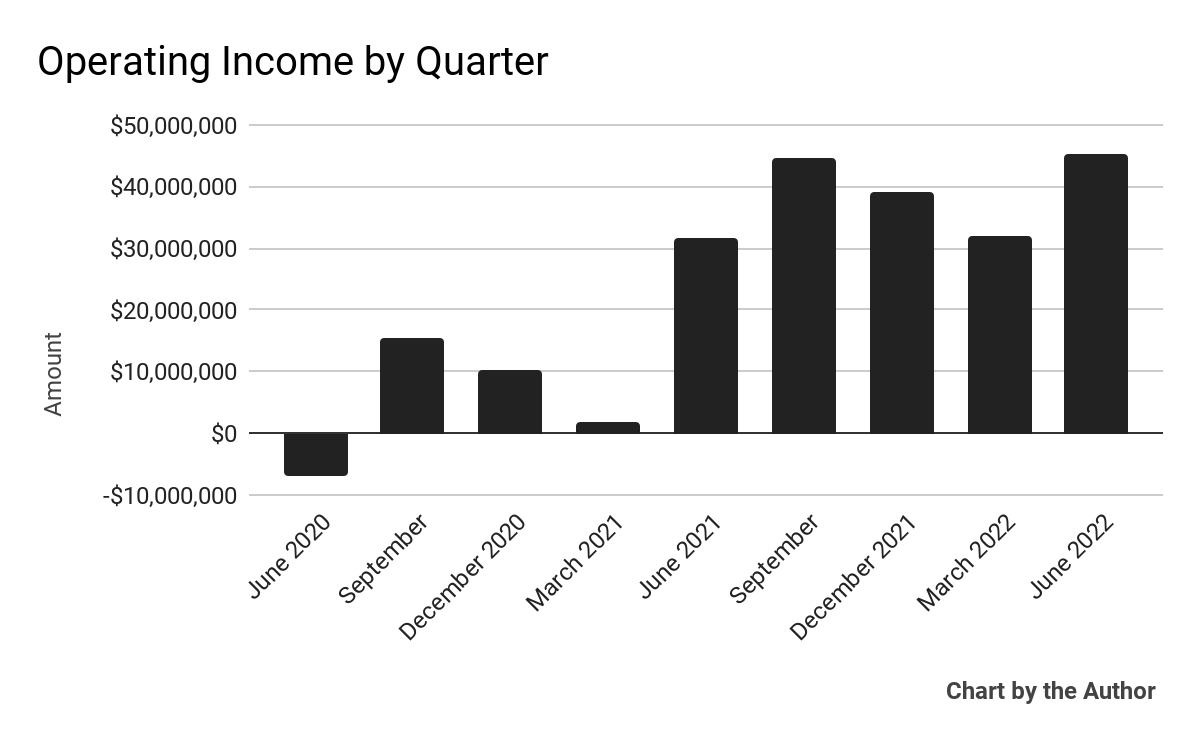

Operating income by quarter has grown substantially recently:

9 Quarter Operating Income (Seeking Alpha)

-

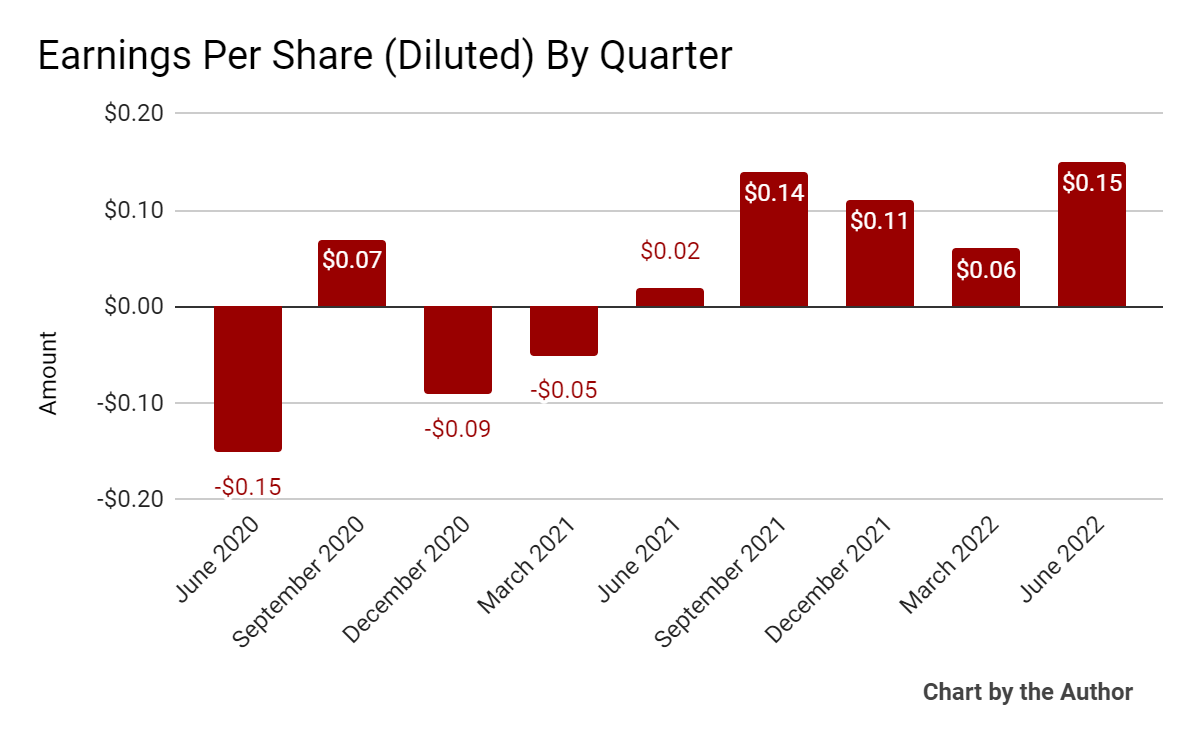

Earnings per share (Diluted) have been positive in the last five quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

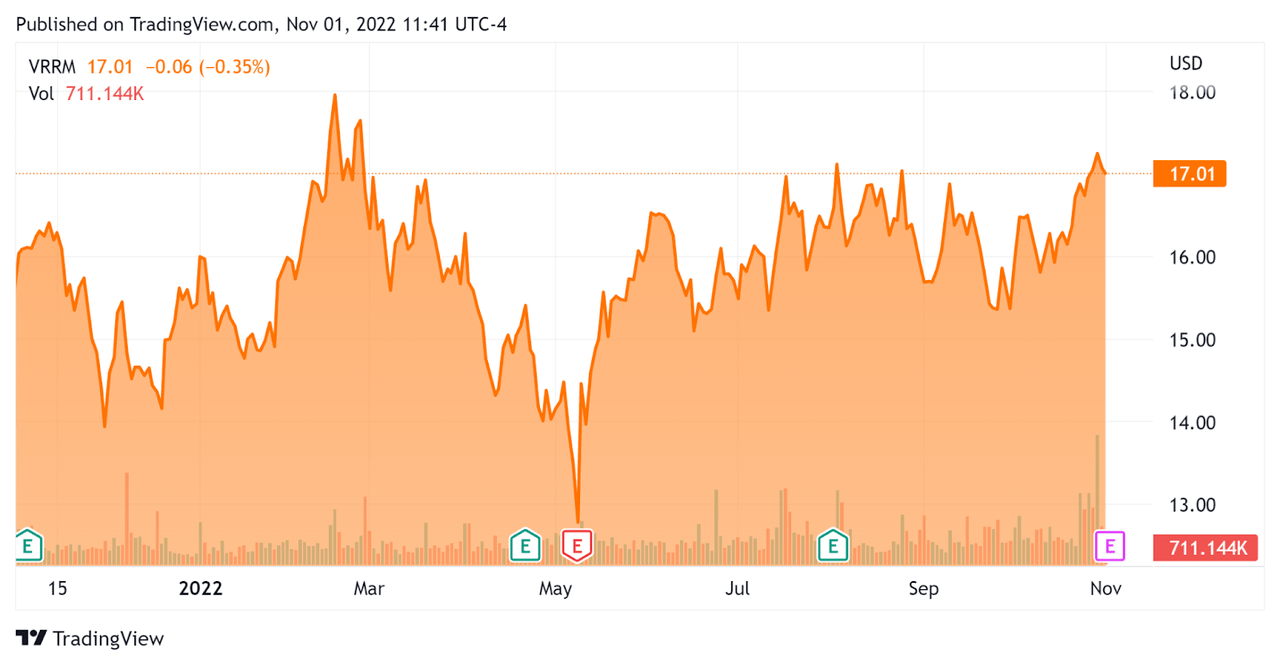

In the past 12 months, VRRM’s stock price has risen 8.5% vs. the U.S. S&P 500 index’s drop of around 16.6%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Verra Mobility

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

5.52 |

|

Revenue Growth Rate |

66.0% |

|

Net Income Margin |

12.5% |

|

GAAP EBITDA % |

42.8% |

|

Market Capitalization |

$2,640,000,000 |

|

Enterprise Value |

$3,810,000,000 |

|

Operating Cash Flow |

$252,070,000 |

|

Earnings Per Share (Fully Diluted) |

$0.46 |

(Source – Seeking Alpha)

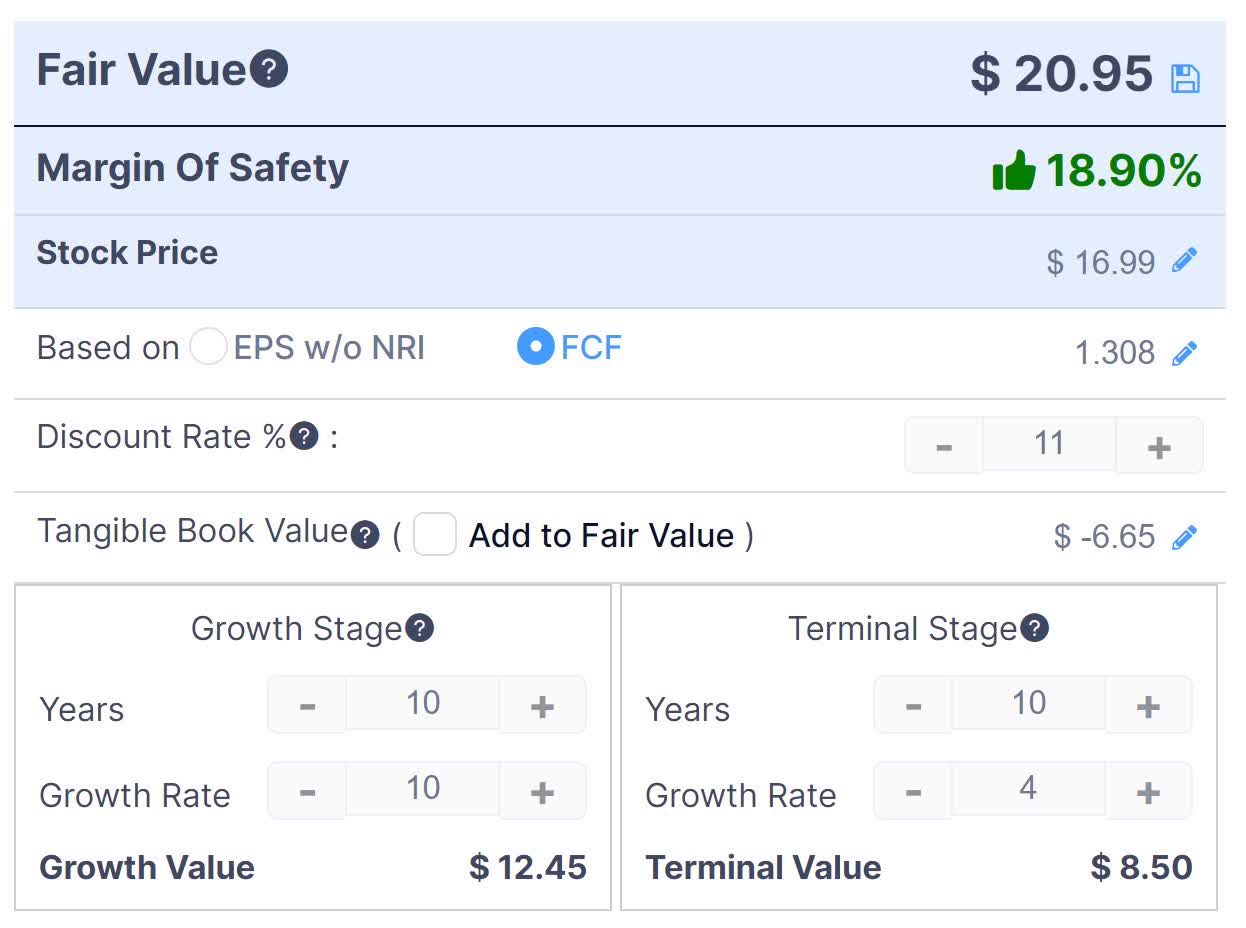

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Discounted Cash Flow – VRRM (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $20.95 versus the current price of $16.99, indicating they are potentially currently undervalued, with the given earnings, growth and discount rate assumptions of the DCF.

Commentary On Verra Mobility

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted a five-year contract extension with Hertz in the U.S. for its commercial segment.

Commercial is also seeing growth due to a ‘surge in travel demand across the U.S.’

The firm also saw growth in its Government Solutions segment, driven by a camera implementation with New York City school speed zone monitoring.

As to its financial results, revenue rose 46% year-over-year despite ‘rental car fleet volumes and TSA traveler throughput is below 2019 levels.’

Management did not disclose any customer retention rate information.

GAAP operating income was an impressive $45.2 million while EPS was $0.15, the best result in the past nine quarters.

For the balance sheet, the firm finished the quarter with $92.8 million in cash, equivalents and short-term investments and $1.2 billion in total debt.

Over the trailing twelve months, free cash flow was $212.6 million, with CapEx of $39.5 million.

Looking ahead, management increased forward revenue guidance for ‘modest sequential growth’ and expects net leverage to be ‘3.5 times or less by year-end 2022.’

The company believes it can generate 7% annual organic revenue growth at the midpoint through 2026 and expects to deploy its free cash flow for stock repurchases and potential M&A opportunities.

Regarding valuation, the market is currently valuing VRRM at an EV/Revenue multiple of 5.5x.

The primary risk to the company’s outlook is a slowing U.S. economy as consumers reduce spending in the face of persistent inflation and lowered travel volumes for the remainder of 2022 and into 2023.

While a discounted cash flow analysis indicates the stock may be attractively priced, I’m more cautious given worsening economic conditions and the firm’s exposure to dropping consumer activity.

So, I’m on Hold for VRRM in the near term.

Be the first to comment